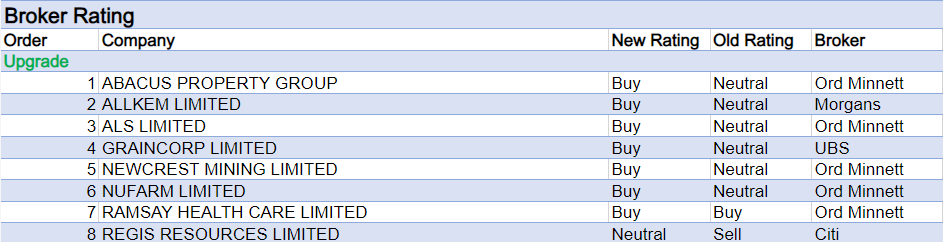

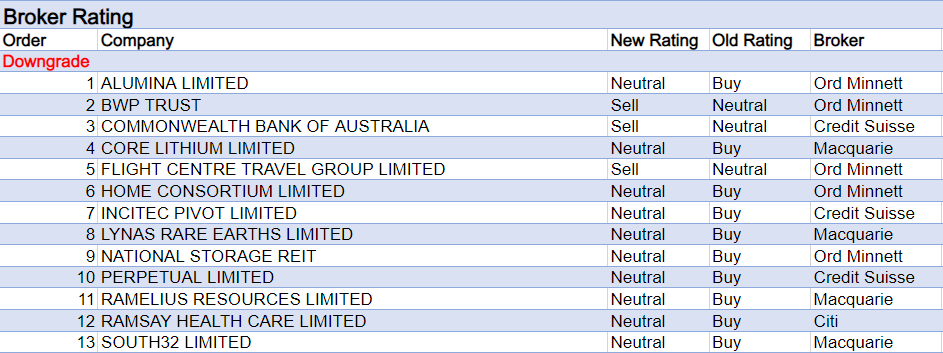

For the week ending Friday November 18 there were eight upgrades and thirteen downgrades to ASX-listed companies covered by brokers in the FNArena database.

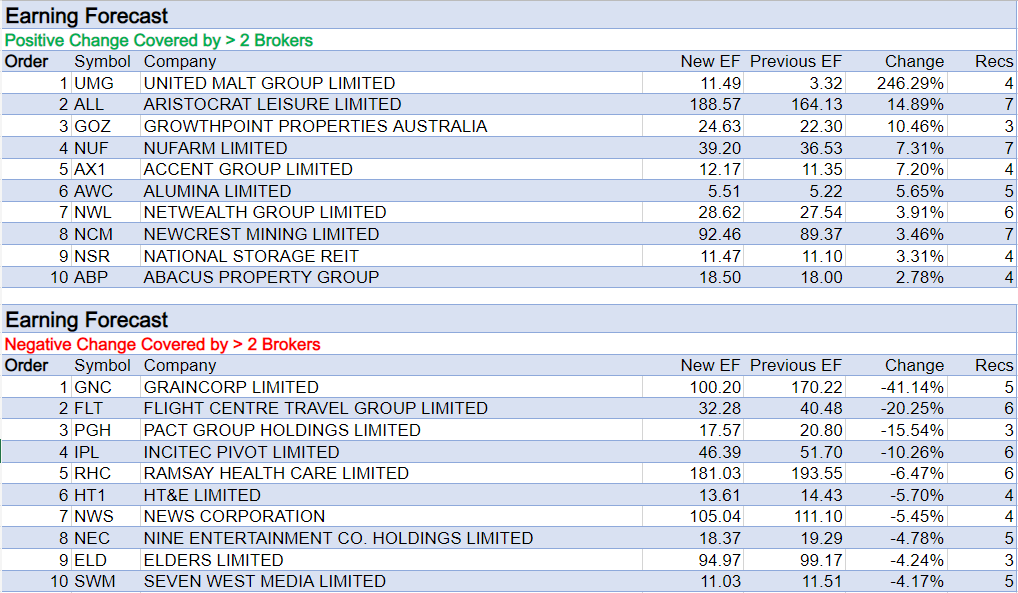

In the case of United Malt Group, the average of target prices set by three brokers in the FNArena database rose to $3.92 from $3.78.

According to Morgans, FY22 earnings [post software-as-a-service (SaaS) costs] were in line with guidance, while management’s FY23 guidance was revised marginally lower for higher SaaS costs.

Higher net interest and tax forecasts led the broker to make material profit forecast downgrades, and its target fell to $3.67 from $3.84.

On the other hand, UBS raised its target to $3.70 from $3.50 and felt the company performed to the broker’s recently upgraded expectations, which were underpinned by easing supply-side headwinds and ongoing beer demand.

Risks around high-end craft beer demand and the potential for an equity raise to deleverage the business faster were mentioned by UBS, though Macquarie felt gearing will naturally revert to the company’s target range by FY23 and envisaged a credible path to an earnings recovery in FY23 and beyond.

Due to a few one-off items, GrainCorp’s overall result came in slightly weaker than Morgans’ forecast and at the bottom-end of the guidance range.

The broker observed financial years don’t get much better than FY22 for this company and FY23 earnings are unlikely to exceed FY22, especially with wet weather creating some uncertainty. A smaller crop and lower marketing margins and crush margins are also set to weigh.

UBS agreed with Morgans that FY22 likely represents an earnings peak. However, strong visibility into FY24 and upside risk potential from favourable weather and macro conditions prompted this broker to raise its rating to Buy from Neutral.

Outperform-rated Macquarie noted commentary from the Agricultural Bureau suggests a third consecutive above-average crop is anticipated in 2022-2023, though management pointed out flooding has delayed the harvest and impacted yield and quality.

The average target price in the FNArena database for GrainCorp fell to $9.59 from $9.71.

The average target price for Incitec Pivot moved in the other direction and increased to $4.34 from $4.18, despite appearing in the table below for broker forecast downgrades due to the FY22 forecast rollover effect mentioned above.

FY22 results revealed earnings beat the consensus forecast and Morgan Stanley noted the focus will now likely be on the decision to delay the demerger of Pivot Fertilisers and Dyno Nobel, and to pursue a “strategic review” of the US ammonia manufacturing business.

A fully franked final dividend of 17cps was declared and a $400m buyback (5.2% of issued capital) boosted Morgans FY23-25 EPS forecasts.

Brokers’ earnings forecasts for Flight Centre Travel declined last week after a trading update for the first four months of FY23 came in -20% adrift of consensus forecasts. Ord Minnett downgraded its rating to Lighten from Hold following weaker-than-expected first half guidance.

Despite the increasing demand for bricks and mortar travel advice, the company’s network is now around -50% smaller than pre-pandemic.

More positively, Neutral-rated Citi pointed to an improving underlying operational performance, with volumes back to pre-covid levels and revenue at 95%.

Two brokers in the FNArena database refreshed research for Pact Group last week following a disappointing first quarter trading update. First half guidance was softer than either Ord Minnett or Macquarie had expected.

The analyst at Ord Minnett was sceptical of management’s “slight EBIT growth” for FY23 and pointed out that for FY23 guidance to be achieved the group requires a half year earnings result only experienced in three of the past ten half yearly periods.

The average target price in the database fell to $2.23 from $2.76.

Total Buy recommendations comprise 55.93% of the total, versus 36.53% on Neutral/Hold, while Sell ratings account for the remaining 7.53%.

In the good books

ABACUS PROPERTY GROUP (ABP) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 2/2/0

Ord Minnett has lifted its cost of capital used for valuation models for the third time in 2022, taking the risk-free rate up by a further 25 basis points to 3.75% after starting the calendar year at 3.0%. The broker has also increased capitalisation rate, floating debt cost and inflation assumptions. This results in a -5% average cut to property sector price targets, or -15% total in 2022. The sector is now trading at a -10% discount to revised targets. Abacus Property upgraded to Accumulate from Hold. Target falls to $3.10 from $3.30.

ALLKEM LIMITED (AKE) was upgraded to Add from Hold by Morgans, B/H/S: 5/1/1

Morgans disagrees with recent market views of pending oversupply of lithium and expects demand will remain strong for the next 12 months. The broker’s forecasts for realised lithium prices in FY23 -24 have increased, given the continued strength of the spot market. As a result, Morgans lifts its rating for Allkem to Add from Hold and raises its target to $15.70 from $15.00. At the same time, a note of caution is added regarding highly volatile share prices in the sector.

GRAINCORP LIMITED (GNC) was upgraded to Buy from Neutral by UBS, B/H/S: 3/2/0

GrainCorp delivered, as expected, a strong full year result according to UBS, supported by a bumper crop and high supply chain margins. The broker warns FY22 likely represents an earnings peak but likes the strong visibility into FY24 and upside risk potential from favourable weather and macro conditions. Recent flooding has delayed winter harvests, and could impact on final crop size, but UBS suggests this is more likely to limit potential upside rather than create downside. The rating is upgraded to Buy from Neutral and the target price increases to $8.65 from $8.60.

NUFARM LIMITED (NUF) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 5/2/0

Nufarm’s result met forecasts, with North America a highlight and Asia-Pacific solid, Ord Minnett notes. Europe was more muted. FY23 outlook commentary for “modest underlying EBITDA growth” on a constant-currency basis was positive, the broker suggests, underpinned by favourable conditions and a strong outlook for soft commodity prices. European regulatory headwinds seem to be abating, but management otherwise believes it can offset through organic growth and new products. Upgrade to Accumulate from Hold, target rises to $6.40 from $6.10.

REGIS RESOURCES LIMITED (RRL) was upgrade to Neutral from Sell by Citi, B/H/S: 2/3/1

While further approvals are still outstanding (and a final feasibility study) for Regis Resources’ McPhillamys project, Citi recognises the importance of a DPE approval by raising its rating to Neutral from Sell. DPE stands for the NSW Department of Planning & Environment. The target is increased to $1.85 from $1.50 after the analyst reduces the risk weighting on the project.

In the not-so-good books

ALUMINA LIMITED (AWC) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 3/1/1

Alumina shares have rallied around 30% when the index has managed 7%, Ord Minnett notes, despite alumina prices remaining flat. The key driver have been lower gas prices in Spain, which have settled at half the price of that in February. Spanish gas prices have been the main drag on earnings this year, Ord Minnett points out, along with lower alumina prices, leading the San Ciprian refinery to generate significant cash losses. The next catalyst would need to be improved alumina prices, and the broker does not see that happening near term. Downgrade to Hold from Buy, target unchanged at $1.50.

BWP TRUST (BWP) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 0/1/2

Ord Minnett has lifted its cost of capital used for valuation models for the third time in 2022, taking the risk-free rate up by a further 25 basis points to 3.75% after starting the calendar year at 3.0%. The broker has also increased capitalisation rate, floating debt cost and inflation assumptions. This results in a -5% average cut to property sector price targets, or -15% total in 2022. The sector is now trading at a -10% discount to revised targets. BWP Trust downgraded to Lighten from Hold. Target falls to $4.00 from $4.20.

HOME CONSORTIUM LIMITED (HMC) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 1/5/0

Ord Minnett has lifted its cost of capital used for valuation models for the third time in 2022 (see BWP above). Home Consortium downgraded to Hold from Buy. Target falls to $5.60 from $6.60.

NATIONAL STORAGE REIT (NSR) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 0/2/2

Ord Minnett has lifted its cost of capital used for valuation models for the third time in 2022 (see BWP above). National Storage REIT downgraded to Hold from Buy. Target falls to $2.60 from $2.70.

PERPETUAL LIMITED (PPT) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 3/2/0

Credit Suisse expects the Perpetual and Pendal Group ((PDL)) merger is likely to complete following a ruling from the New South Wales Supreme Court that Perpetual could be liable for further remedies beyond the -$23m break fee if the company does not proceed, making it difficult to pursue alternatives. Updated merger financials will see the deal close for $1.65 cash and one Perpetual share for every seven Pendal Group shares, increased scrip 5%. The reduced target price reflects the broker’s sum of the parts valuation for the merged entity. The rating is downgraded to Neutral from Outperform and the target price decreases to $27.50 from $29.00.

SOUTH32 LIMITED (S32) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 5/2/0

South32 has been downgraded by Macquarie to Neutral from Outperform with unchanged price target of $4.40. The broker is anticipating emerging headwinds for the miner’s earnings. Illawarra Coal is expected to slow down over the near term due to soft coking coal prices and weak output. The broker thinks alumina and aluminium operations are facing rising costs and subdued prices. It is noted the shares have performed strongly recently.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.