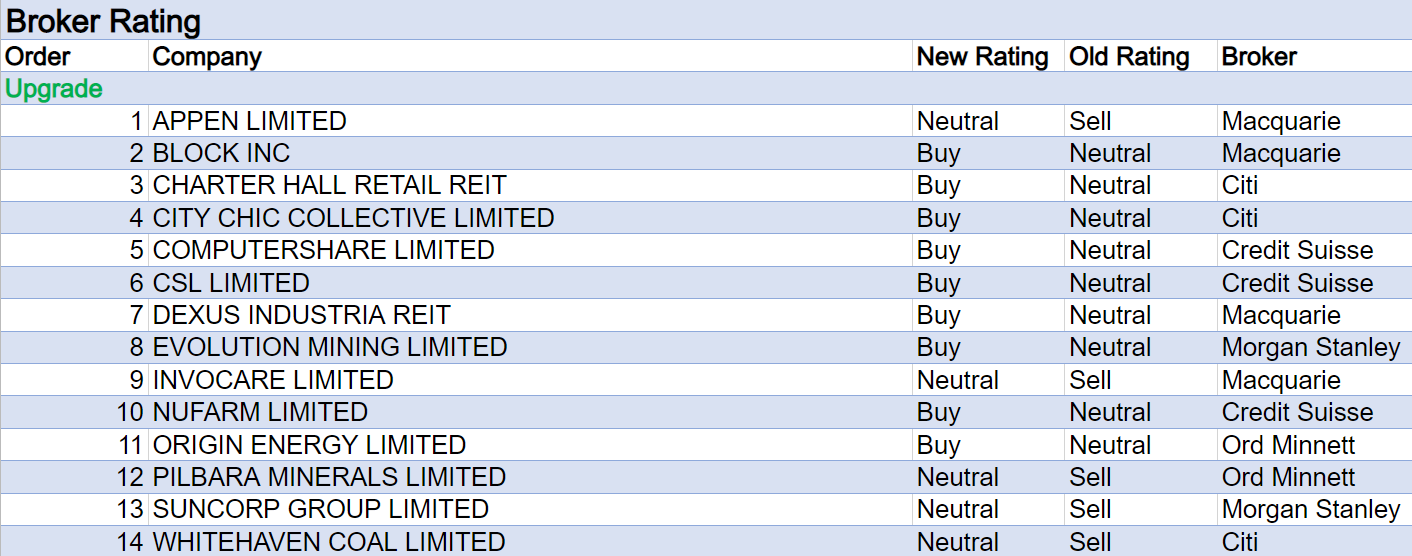

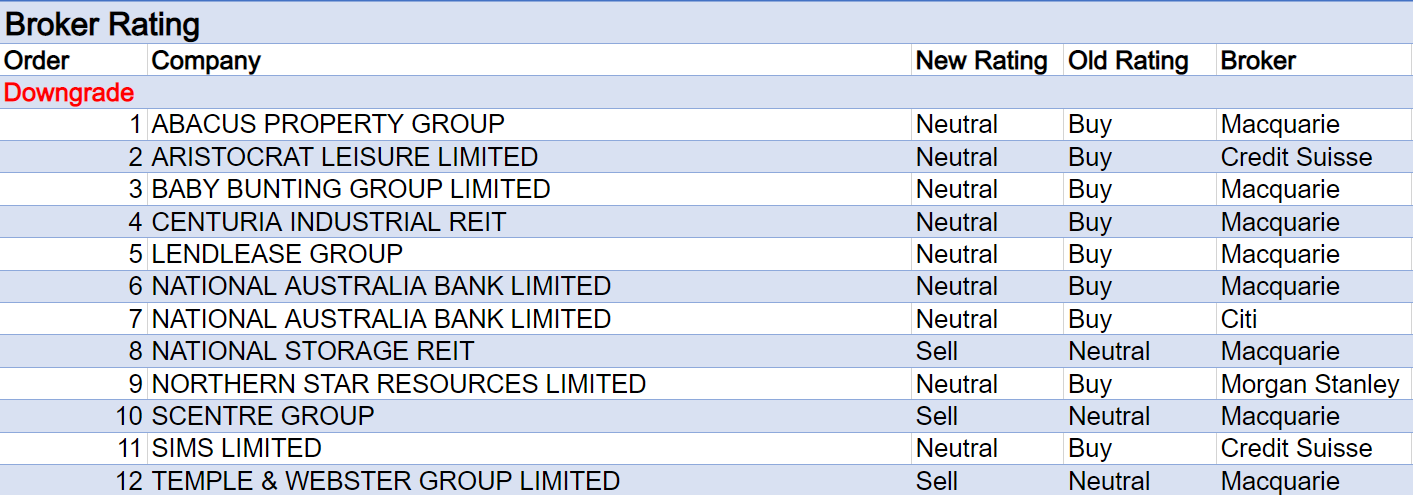

For the week ending Friday November 11 there were fourteen upgrades and twelve downgrades to ASX-listed companies covered by brokers in the FNArena database.

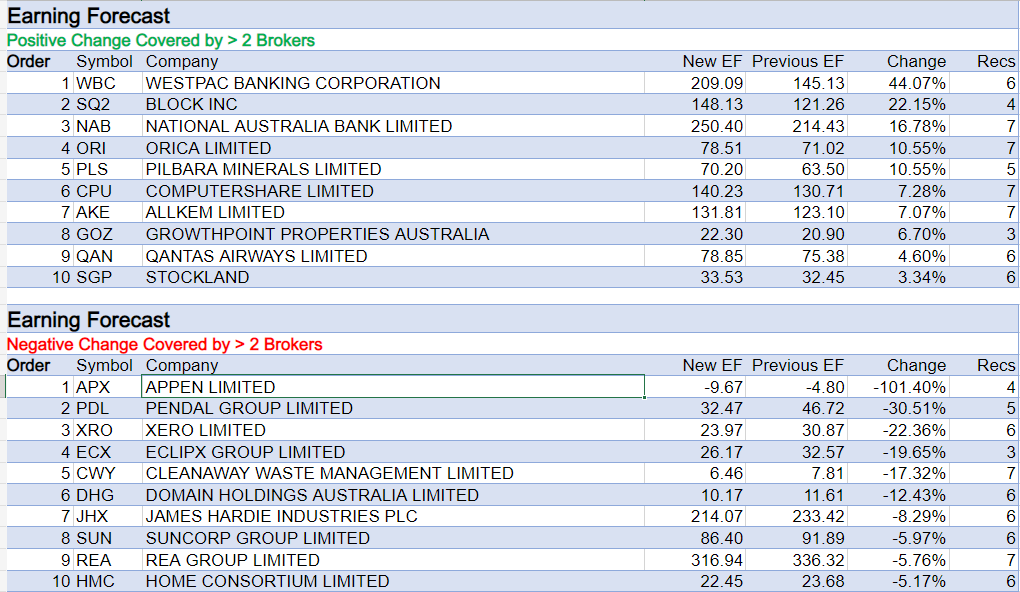

Westpac, National Australia Bank and Orica appear among the top four in the table for largest percentage increase in forecast earnings last week because of the roll-off of FY22 forecasts and replacement with FY23 forecasts..

Westpac target price set by brokers in the FNArena database fell to $25.87 from $26.00,.Morgans assessed the bank’s result met or exceeded expectations and the 64cps fully franked second half dividend was a beat by 3cps. However, management’s cost target increased to $8.6bn from $8bn due to higher inflation, a later timing of business exits and longer phasing of regulatory costs.

This broker lowered its FY23-25 cash EPS forecasts by around -2-8%, while dividend forecasts suffered larger percentage falls on a lower assumed payout ratio due to the economic backdrop.

NAB received a rating downgrade to Neutral by two separate brokers. Macquarie felt there is limited scope for a further re-rating for both the sector and NAB, while Citi noted FY22 results delivered few surprises.

Accumulate-rated Ord Minnett noted NAB’s net interest margin result failed to deliver upside, while FY22 margins for Westpac and ANZ Bank exceeded expectations.

For Orica, Citi noted FY22 results exceeded the consensus forecast by 6%.

Given the macroeconomic conditions, the broker considered management’s FY23 outlook commentary was surprisingly constructive, with FY23 earnings expected to be ahead of FY22 on growth in global commodities demand.

Management stated inflation pressures, particularly from energy, are an ongoing challenge and cost-reduction initiatives will be introduced. The average target price for Orica in the database only increased to $16.18 from $15.96, following the full year results.

It was also a positive week for broker earnings forecasts for Pilbara Minerals after Ord Minnett raised spodumene forecasts to US$6,500/t for 2023 and US$5,700/t for 2024, increases of 44% and 66%, respectively. As a result, the broker’s rating was upgraded to Hold from Lighten and the target increased to $5.10 from $4.20.

Also, Macquarie made material upgrades to its earnings forecasts for lithium miners and developers under its coverage, despite near-term headwinds from economic slowdowns and covid lockdowns in China.

The broker maintained an Outperform rating and increased its target price to $7.50 from $5.60 for Pilbara Minerals, the preferred Lithium sector exposure (along with IGO) on the ASX.

Pilbara Minerals and Block also came second and third on the table for the largest percentage increase in average target price, while Origin Energy received the largest increase.

Ord Minnett increased its target for Origin Energy to $9.00 from $6.00 and upgraded its rating to Buy from Hold following a $9.00/share non-binding takeover bid from a consortium. It’s felt the full bid price will likely rule out bids by other players.

Regulatory issues may hinder the bid as the Federal government may not desire privatisation in light of ongoing scrutiny around elevated energy prices, suggested the broker. On the flipside, a $20bn commitment by the consortium to expand the company’s renewable power generation may appeal to the government.

Baby Bunting received the only materially negative adjustment to average target price last week following first quarter results. Citi (unchanged $3.32 target) noted margin headwinds are likely to continue into the second quarter due to pressures from its loyalty program and increased input costs (diesel prices and currency).

This margin pressure prompted Macquarie to lower its rating to Neutral from Outperform and slash its target to $2.80 from $4.95. Also, the Playgear category is considered a key concern, being high margin discretionary. Sales expectations were nevertheless unchanged, and the analyst remained positive on revenue growth execution.

In terms of earnings, Appen received the highest percentage downgrade after Macquarie waited a month to react to latest guidance by management, which showed global services revenue is being impacted by large market-share loss from its major customers.

Appen’s de-rating may have now largely played out, according to the broker, but a material recovery is not forecast until 2025 at the earliest. On limited further downside, the rating was upgraded to Neutral from Underperform, while the target fell to $2.70 from $3.30.

Pendal Group was next on the table for earnings downgrades after releasing FY22 results, though as explained above, the roll-off of FY22 forecasts from broker financial models has the capacity to distort.

Brokers’ earnings forecasts for Zero were lowered after September-half earnings fell -12% short of consensus. While subscriber growth was slower than Morgans forecast, pricing power was evident, and a weaker New Zealand dollar assisted. Revenue grew by 30% year-on-year in constant currency terms.

Morgan Stanley (Overweight) lowered its target to $95 from $130, though felt the company has a meaningful opportunity to create value should it pivot to profitability by reducing its expense base and/or capex levels.

Total Buy recommendations comprise 56.09% of the total, versus 36.51% on Neutral/Hold, while Sell ratings account for the remaining 7.40%.

In the good books

CSL LIMITED (CSL) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 6/0/0

Credit Suisse examines the September-quarter results for CSL’s offshore comps and finds Seqirus and Behring to have improved marginally but Vifor remains weak. The broker upgrades CSL’s EPS forecasts 1% to 2% accordingly. Target price rises to $310 from $305. Rating upgraded to Outperform from Neutral, the broker expecting the market will focus in on Behring’s strong growth in plasma collections.

DEXUS INDUSTRIA REIT (DXI) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/0/0

Dexus Industria REIT has divested of its Rhodes business park at a -15% discount to book value. Macquarie estimates this is -9% dilutive to earnings going forward. However, the balance sheet has been strengthened, and additional capacity can now be used to fund the development pipeline, the broker notes. The REIT is now some 88% industrial. Dexus Industria is currently implying a -20% fall in asset values, which in Macquarie’s view is overly aggressive in light of the strong rental growth being achieved in industrial.

Meanwhile, Macquarie downgrades its outlook for Australian Real Estate Investment Trusts, expecting the rising cost of capital could combine with a recession-induced fall in bond yields, to pressure weaker balance sheets. The broker says most covenants appear safe but investors will need to keep a keen eye to weaker players. Falling asset valuations means balance sheet capacity is likely to moderate notes the broker, the upshot being development pipelines will need to be reduced or funded through asset sales (not an easy task in a rising rate environment). Macquarie considers the balance sheet to be among the less attractive among peers but after the Rhodes divestment considers the position to be more positive. Rating upgraded to Outperform from Neutral. Target price falls to $2.89 from $3.08 to reflect the dilution.

EVOLUTION MINING LIMITED (EVN) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 4/3/0

Morgan Stanley believes execution risks for Evolution Mining are easing at Red Lake and upgrades its rating to Overweight from Equal-weight. The target is increased to $3.10 from $2.55. Industry View: Attractive. The company is now Morgan Stanley’s preferred sector exposure from among stocks under its research coverage. The broker sees potential at Red Lake for more throughput and higher reserve grades, which could lift group production by around 9%. Potential mine life extension at Ernest Henry also supports the analyst’s investment thesis Separately, Morgan Stanley sees upside for the gold price from a potential slowing in rate hikes and a peaking of the US dollar index (DXY). Undemanding valuations are noted in the Gold sector and multiples for stocks are expected to increase.

INVOCARE LIMITED (IVC) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 1/5/0

Looking to US and UK data, Macquarie finds year to date death rates remain elevated despite both countries recording materially elevated deaths in 2020 and 2021, primarily due to covid. This suggests Australian deaths may remain elevated longer than prior expectations. Industry volumes should be stronger over 2023 than previously thought, Macquarie notes, creating upside risk for InvoCare earnings if management successfully executes its expansion strategy. Upgrade to Neutral from Underperform. Target rises to $11.40 from $10.75.

NUFARM LIMITED (NUF) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/3/0

Credit Suisse expects Nufarm should be able to deliver a result towards the top end of consensus, underpinned by strong crop fundamentals improvement to costs and margins. The broker continues to consider Nufarm a compelling long-term growth story, driven by expansion of its omega-3 canola oil, carinata and convention seeds businesses. In particular, Credit Suisse finds fundamentals for canola to be increasingly attractive. The rating is upgraded to Outperform from Neutral and the target price decreases to $6.85 from $6.96.

ORIGIN ENERGY LIMITED (ORG) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 3/3/0

Ord Minnett increases its target for Origin Energy to $9.00 from $6.00 following a non-binding takeover bid from a consortium. It’s felt the full price will likely rule out bids by other players. The rating is upgraded to Buy from Hold. The broker suggests regulatory issues may hinder the bid as the Federal government may not desire privatisation in light of ongoing scrutiny around elevated energy prices. On the flipside, the government may like the $20bn commitment by the consortium to expand the company’s renewable power generation, explains the analyst. Ord Minnett sees positive implications for AGL Energy as the Origin bid implies an equity value of $13-14/share.

WHITEHAVEN COAL LIMITED (WHC) was upgraded to Neutral from Sell by Citi, B/H/S: 6/1/0

Despite downgraded guidance by Whitehaven Coal for open cut mine production, Citi notes the value on offer now that shares have fallen by around -15% this week, and upgrades to a Neutral rating from Sell. The target slips to $8.00 from $8.50. The lower run-of-mine (ROM) Coal production guidance falls to 19.0-20.4mt from 20.0-22.0mt, due to current and forecast weather impacts and ongoing labour constraints, explains the analyst. Also, guidance for unit costs of coal rises to $95-102/t from $89-96/t.

In the not-so-good books

ABACUS PROPERTY GROUP (ABP) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/3/0

Macquarie has reviewed the broader REIT sector, and sees downside risk to demand in self storage and office. Abacus Property has a 51% exposure to self storage and 37% to office, with both asset classes particularly sensitive to changes in the macro-economy. In self storage, typical lease terms of 6 weeks mean reduced income certainty, the broker notes, with peer updates showing occupancy has started to moderate. Macquarie remains attracted to self storage longer term, but near term the cycle is slowing.

Macquarie also downgrades its outlook for Australian Real Estate Investment Trusts to reflect its rising deck for bank bill swap rates, expecting the rising cost of capital could combine with a recession-induced fall in bond yields, to pressure weaker balance sheets. The broker says most covenants appear safe but investors will need to keep a close eye on weaker players. Falling asset valuations means balance sheet capacity is likely to moderate notes the broker, the upshot being development pipelines will need to be reduced or funded through asset sales (not an easy task in a rising rate environment). Macquarie observes fundamentals are shifting for Abacus Property, which has benefited from strong consumer sentiment in recent years, and that gearing appears toppy. EPS forecasts ease -0.8% for FY23; -1.3% for FY24; and -3.1% for FY25. Rating downgraded to Neutral from Outperform. Target price falls -25% to $2.64 from $3.53 as the broker shifts to a net asset value assessment from a discounted cash flow valuation. The stock still offers an attractive forward yield of 6.8%, the broker notes.

ARISTOCRAT LEISURE LIMITED (ALL) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 6/1/0

Aristocrat Leisure’s September-quarter results suggest a strong close for the company according to the Eilers survey but Credit Suisse’s survey of Aristocrat’s revenue sources suggest October digital trends softened. EPS forecasts rise 0.5% to 9% across FY22 to FY25, thanks to expansion of US revenue share installed base, currency windfalls; likely improved margins in digital and the $500m share buyback. Credit Suisse sits below consensus by 1% to 3%. Rating downgraded to Neutral from Outperform to reflect recent share-price strength but the broker continues to consider the company to be a core holding. Target price rises to $37.20 from $36.00.

CENTURIA INDUSTRIAL REIT (CIP) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/3/0

Macquarie has reviewed the broader REIT sector, and sees strong direct market fundamentals for Centuria Industrial REIT offset by interest costs. Solid rent growth industrial and execution of the development pipeline provides for stronger revenues, but a low level of interest rate hedging will lead to a subdued earnings growth outlook. Property devaluations may also result in more limited funding capacity, the broker notes.

Macquarie downgrades its outlook for Australian Real Estate Investment Trusts to reflect its rising deck for bank bill swap rates, expecting the rising cost of capital could combine with a recession-induced fall in bond yields, to pressure weaker balance sheets. The broker says most covenants appear safe but investors will need to keep a keen eye to weaker players. Falling asset valuations means balance sheet capacity is likely to moderate notes the broker, the upshot being development pipelines will need to be reduced or funded through asset sales (not an easy task in a rising rate environment). The broker notes Centuria Industrial REIT’s gearing is looking toppy and applies a -2% discount to net asset value. Downgrade to Neutral from Outperform to reflect rising rates and the affect of falling asset values on the group’s funding capacity. Target price falls to $3.02 from $3.69.

LENDLEASE GROUP (LLC) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 4/2/0

Macquarie downgrades Lendlease Group to Neutral from Outperform after the company advised returns would fall at the lower end of divisional targets for FY23. Macquarie says the lower end of FY24 return forecasts are not de-risked and will rely on good commencements and leasing outcomes. The broker notes the company is leaning towards more third-party capital for developments but expects this might be a tough ask in the current environment.

Meanwhile, Macquarie downgrades its outlook for Australian Real Estate Investment Trusts, expecting the rising cost of capital could combine with a recession-induced fall in bond yields, to pressure weaker balance sheets. The broker says most covenants appear safe but investors will need to keep a keen eye to weaker players. Falling asset valuations means balance sheet capacity is likely to moderate notes the broker, the upshot being development pipelines will need to be reduced or funded through asset sales (not an easy task in a rising rate environment). Target price falls to $8.74 from $13.33.

NATIONAL AUSTRALIA BANK LIMITED (NAB) was downgraded to Neutral from Outperform by Macquarie and to Neutral from Buy by Citi, B/H/S: 1/6/0

National Australia Bank delivered another good result, Macquarie suggests, underpinned by solid performances in the Business Bank and NZ franchise. Interest rate leverage started to come through in the second half, albeit below expectations. It was also below that delivered by peers, the broker notes, reducing the potential upside risk to margins in the first half FY23. With limited upside risk to FY23 earnings and likely downside risk to consensus in FY24, coupled with NAB trading significant premiums to peers bar Commonwealth Bank ((CBA)), Macquarie sees limited scope for further re-rating for both the sector and NAB. Downgrade to Neutral from Outperform. Target unchanged at $32.25.

As the National Australia Bank share price has rallied since Citi upgraded to a Buy rating in September, the rating now falls back to Neutral, following yesterday’s FY22 result that delivered few surprises. The $32.75 target is unchanged. In yesterday’s research, Citi noted cash earnings of $7,104m were in line with it’s own forecast and that of consensus. The 2H22 net interest margin (NIM) of 1.67% was also considered in line. The analyst felt material cost revisions by the market are unlikely, as consensus is already factoring in around -5% cost worsening in FY23. The broker pointed out business lending has been a key point of differentiation for National Australia Bank versus peers, but macro forecasts indicate a sharp slowdown. So, despite a strong result, it’s felt this factor may be uppermost in investor’s minds. Citi placed the FY22 result in context, by suggesting it lands between Westpac ((WBC)) (targeting cost reductions) and ANZ Bank ((ANZ)) (accelerating investment spend) for FY23.

NATIONAL STORAGE REIT (NSR) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 1/1/2

Macquarie downgrades its outlook for Australian Real Estate Investment Trusts to reflect its rising deck for bank bill swap rates, expecting the rising cost of capital could combine with a recession-induced fall in bond yields, to pressure weaker balance sheets. The broker says most covenants appear safe but investors will need to keep a close eye on weaker players. Falling asset valuations means balance sheet capacity is likely to moderate notes the broker, the upshot being development pipelines will need to be reduced or funded through asset sales (not an easy task in a rising rate environment).

EPS forecasts for National Storage REIT fall -1.2% in FY23; rise 1.7% in FY24; and rise 2.6% in FY25. Macquarie observes the REIT has benefited from strong consumer sentiment and high house turnovers in recent years but expects these trends to moderate. Rating downgraded to Underperform from Neutral, the broker anticipating a downturn in self-storage fundamentals as weaker demand hits higher supply and observes the group is still trading at a premium to peers. Target price falls -17.3% to reflect the broker’s switch from a discounted-cash-flow valuation to a net-asset-value calculation (which results in an expansion to the cap rate).

NORTHERN STAR RESOURCES LIMITED (NST) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 5/1/0

Morgan Stanley sees upside for the gold price from a potential slowing in rate hikes and a peaking of the US dollar index (DXY). Undemanding valuations are noted in the Gold sector and multiples for stocks are expected to increase. While the target for Northern Star Resources rises to 10.80 from $9.25, the broker downgrades its rating to Equal-weight from Overweight on valuation after outperforming peers year-to-date.

SCENTRE GROUP (SCG) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 2/3/1

Macquarie downgrades its outlook for Australian Real Estate Investment Trusts, expecting the rising cost of capital could combine with a recession-induced fall in bond yields, to pressure weaker balance sheets. The broker says most covenants appear safe but investors will need to keep a keen eye to weaker players. Falling asset valuations means balance sheet capacity is likely to moderate notes the broker, the upshot being development pipelines will need to be reduced or funded through asset sales (not an easy task in a rising rate environment). Macquarie considers Scentre Group to be one of the more vulnerable REITs, expecting expanded cap rates will raise leverage to 48%, which the broker considers to be unsustainable given the company’s future capital expenditure bill. This is likely to leave Scentre Group in a position where it needs to sell assets or raise capital (unlikely says the broker), to return leverage to 35%, explains Macquarie. Rating downgraded to Underperform from Neutral. Target price falls to $2.54 from $2.79.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.