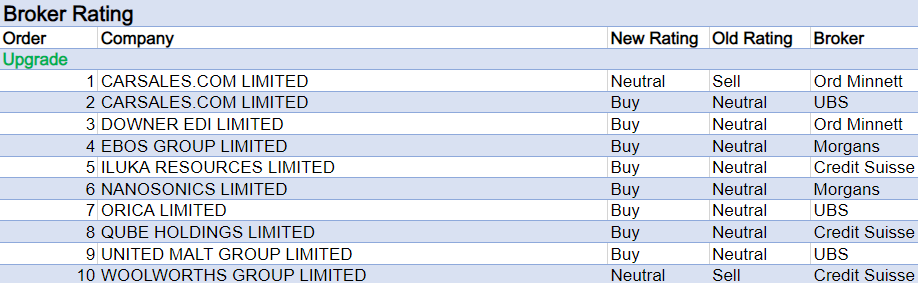

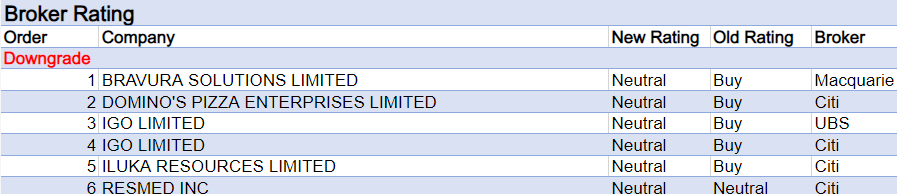

For the week ending Friday November 4 there were ten upgrades and six downgrades to ASX-listed companies covered by brokers in the FNArena database.

Despite first quarter results showing a downward trend for traffic and lead volumes, Carsales received an upgraded rating from UBS and Ord Minnett due to recent share price weakness.

Before becoming more upbeat than a Hold rating (up from Lighten) Ord Minnett would like to see improving indicators for both consumer confidence and dealership trends.

More positively, UBS noted the least cyclical of the online classifieds categories is automotive and Carsales’ current trading conditions indicate momentum across its businesses. The broker raised its rating to Buy from Neutral.

On the flipside, UBS and Credit Suisse downgraded IGO to Neutral from Buy on valuation. However, after six covering brokers in the FNArena database adjusted forecasts following September quarter results for IGO, the new average target price of $15.05 was barely changed.

While Citi noted Greenbushes (lithium) more than doubled underlying earnings from the June quarter, a larger than forecast capital expenditure bill at Cosmos (nickel) disappointed brokers.

Coronado Global Resources had the largest percentage fall in target price last week, after third quarter production and sales missed consensus forecasts.

Despite these near-term negatives, brokers generally remained positive and increased earnings forecasts. An out-of-season special dividend of US13.4cps was declared and Credit Suisse expects the dividend bonanza to continue.

Domino’s Pizza Enterprises had the second-largest percentage fall in target price and the second-largest percentage fall in earnings forecasts last week.

While first quarter results disappointed, both Ord Minnett and Morgans agreed October signalled an inflection point for Domino’s sales. Citi also noted the company’s scale should see it outperform smaller competitors in what remains a challenging operational environment.

Citi is further enthused that Domino’s remains one of the best long-duration growth companies under its research coverage though still downgraded its rating to Neutral from Buy.

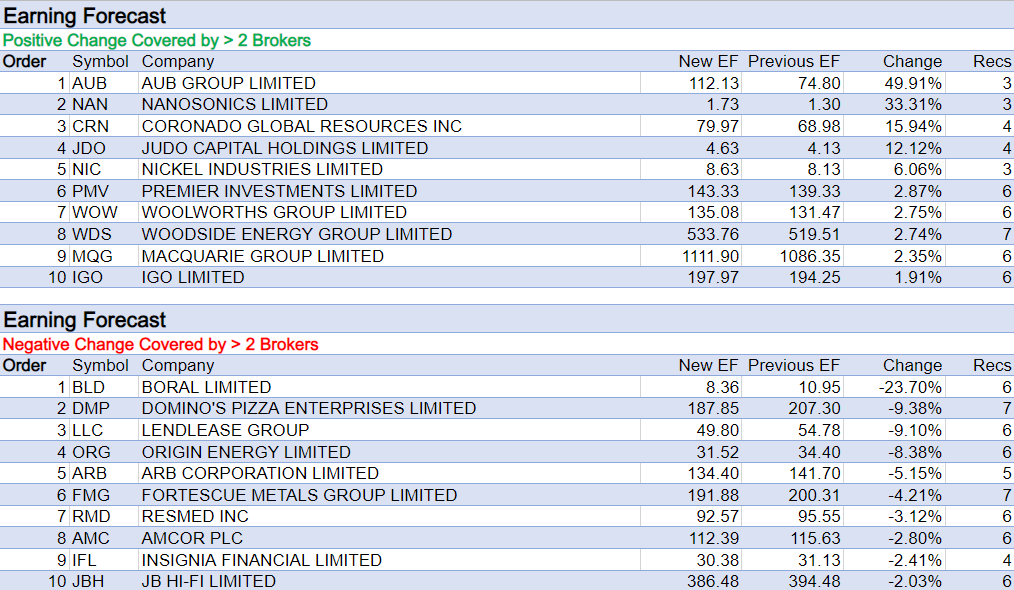

The largest percentage fall in broker forecast earnings went to Boral after AGM commentary indicated price rises and operational leverage may be unable to deliver the margin expansion previously anticipated, amid ongoing and significant inflation.

Earnings forecasts also fell for Lendlease after a downgrade to FY23 profit guidance. All targets for return on invested capital (ROIC) and margin were pushed to the lower-end of ranges provided in August, driven by a combination of the macro environment and asset-specific delays, according to Macquarie.

In addition, the payout ratio for dividends will be lowered to 30-50% from 40-60%, which confirmed Morgan Stanley’s previous commentary regarding a tight balance sheet position. More positively, it’s thought FY24 is on-track to meet return targets for each of the three company segments.

AUB Group featured atop the table for the largest percentage increase in forecast earnings last week.

The group lifted its net profit guidance to $90-92.0m from $86.5-91m, or $107.5-115m if one includes initial guidance for the Tysers acquisition. Ord Minnett raised its forecasts to allow for higher interest rates and the earlier close of that acquisition.

Nanosonics was next on the table after Morgans increased its FY23 revenue forecast to allow for a lower Australian dollar. After also taking into account recent share price weakness, the rating was raised to Add from Hold.

Judo Capital also received earnings upgrades by brokers last week after first quarter profit of $23m came in ahead of Credit Suisse’s $17m estimate. Management guidance for FY23 also beat consensus forecasts, particularly around the underlying net interest margin.

According to Ord Minnett, the loan book is currently showing few signs of stress in the current macroeconomic environment and the businesses is on a sound financial footing.

Total Buy recommendations comprise 56.28% of the total, versus 36.38% on Neutral/Hold, while Sell ratings account for the remaining 7.35%.

In the good books

DOWNER EDI LIMITED (DOW) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 5/0/0

Downer EDI reiterated FY23 guidance for 10-20% growth in net profit at its AGM with “strategies to realise value for shareholders” also to be articulated in 2023. Ord Minnett notes a 2H outlook will be provided at February’s interim results. On valuation grounds, the broker upgrades its rating to Buy from Accumulate and trims its target to $5.90 from $6.10 after reducing its FY23 profit growth forecast to 15% from 23% year-on-year. The latter change results from softer assumptions for Transport and Utilities. Ord Minnett remains positive on Downer’s longer-term prospects.

ORICA LIMITED (ORI) was upgraded to Buy from Neutral by UBS, B/H/S: 3/4/0

UBS believes Orica’s upcoming FY22 result has been de-risked by a previous trading update. The broker upgrades its rating to Buy from Neutral on valuation and after raising FY23 and FY24 EPS forecasts by 4% and 11%, respectively. The analyst points out global ammonium nitrate prices have increased significantly over the past 12 months and looks forward to evidence of increasing contract prices during the company’s upcoming earnings update. The target rises to $18.00 from $17.00.

WOOLWORTHS GROUP LIMITED (WOW) was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 1/4/0

Woolworths Group delivered below-market sales growth in the first quarter, with Credit Suisse acknowledging the market was too optimistic on market share retention. The broker notes Woolworths Group appears to have ceded the 60 basis point share gain from the first quarter lockdown of FY22 as market share normalised. The broker also found profit guidance for New Zealand operations of NZ$100-130m to be lower than anticipated, and expects the profit reset to have some permanence. A less demanding share price to valuation sees the broker increase its rating to Neutral from Underperform and the target price increases to $33.01 from $32.84.

In the not-so-good books

BRAVURA SOLUTIONS LIMITED (BVS) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 1/1/0

Bravura Solutions issued FY23 guidance significantly below Macquarie’s expectations due mostly to far higher costs. The broker’s revised forecasts for cost inflation materially reduce outer year earnings. Client inactivity has been an issue since covid and given the economic outlook, the risk is the issue continues, Macquarie suggests. The balance sheet is not at risk at this point, but the broker will monitor. Switching to a price/earnings valuation from discounted cash flow, target falls to 66c from $2.00. Downgrade to Neutral from Outperform.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.