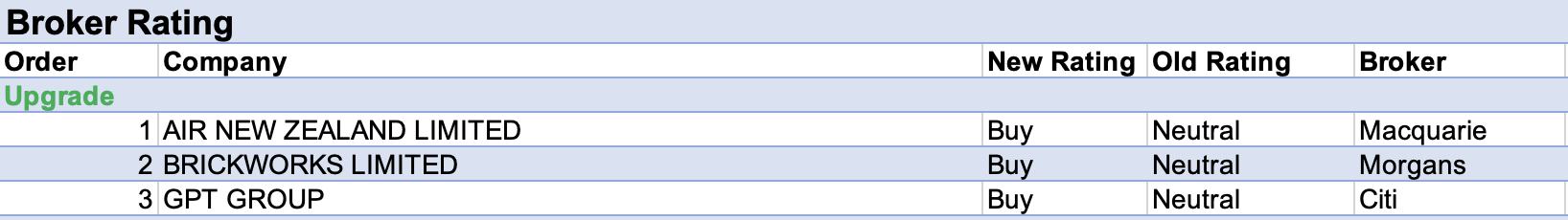

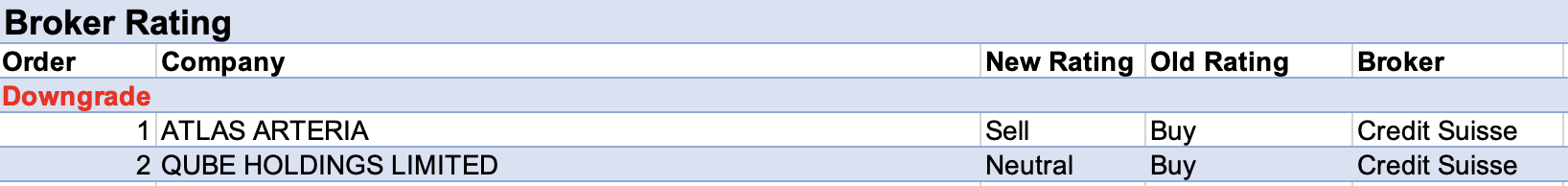

For the week ending Friday September 23 there were three upgrades and two downgrades to ASX-listed companies covered by brokers in the FNArena database.

Some public holidays across Australia and relative calm following the end of the August financial reporting period resulted in lower percentage moves for broker target prices and earnings forecasts.

Atlas Arteria received the only material change to target price after Credit Suisse downgraded its rating to Underperform from Neutral and reduced its target to $6.30 from $7.55, while Morgans lowered its target to $6.46 from $7.76.

The brokers made these changes in reaction to the acquisition of a majority interest in the Chicago Skyway toll bridge for $2.95bn and a $3.1bn capital raising to fund the purchase, with shares issued at $6.30.

Morgans felt these transactions were value-destructive though recommended investors take up entitlements under the capital raise, while Credit Suisse believed Atlas Arteria paid too much for the asset.

The purchase is the first of several acquisitions and capital raisings believe Credit Suisse, to help offset the APRR (French tollway) expiry. While the shift in focus from managing existing assets may lead to higher growth, there are now considered to be greater risks from overpayment and/or lack of execution.

Credit Suisse cut its 2023 and 2024 dividend forecast by -10% and -19%, respectively, and noted a full takeover for Atlas Arteria by 20% equity owner IFM Investors now looks less likely.

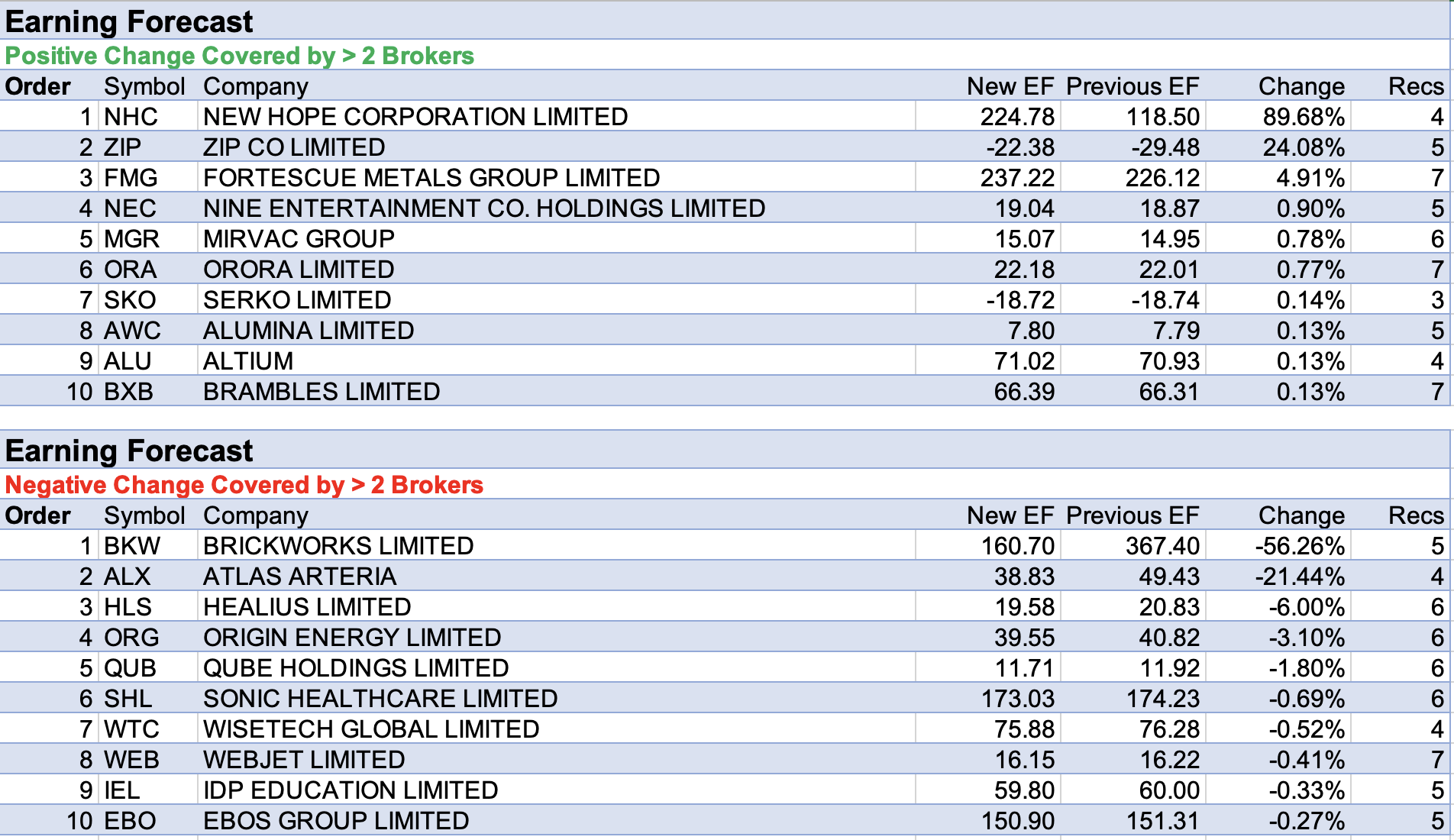

Atlas Arteria was only headed by Brickworks on the list for the largest percentage downgrades to forecast earnings by brokers in the FNArena database last week.

With the advent of a new July-ending financial year, overall earnings forecasts for Brickworks fell as FY22 forecasts rolled off broker financial models.

While the company delivered a better-than-expected full-year result, according to Macquarie, the outlook for Building Products is getting murkier, with front-end residential sales weakening and dragging on operations in both Australia and North America.

As a result, the broker’s EPS forecasts were lowered, the target price fell to $22.80 from $22.90 and the Neutral rating was retained.

Despite these changes by Macquarie, most brokers’ commentary was generally upbeat after the FY22 beat compared to expectations. Add-rated Morgans reiterated the opportunity for investors to buy the company’s quality businesses well below replacement value and increased its target price to $24 from $23.

Citi also increased its target to $28 from $26 on both near-term and longer-term potential upside to the outlook and reiterated its Buy rating.

In an opposite scenario to Brickworks, the new financial year for New HopeCorp heralded increased overall broker earnings forecasts for New Hope as July-ending FY22 forecasts were consigned to history.

In addition, analysts generally raised respective target prices in response to the company’s FY22 results and outlook.

As a result, New Hope received the largest percentage upgrade to forecast earnings by brokers last week.

Fourth quarter earnings were a 6% beat compared to Morgans forecast as coal prices continue to surprise to the upside. It’s thought shares can drive higher once the market grasps the scope of current cash flows and the potential for increased dividends.

While Citi acknowledged the potential for higher-for-longer coal prices from an ongoing EU gas crisis, the rating was lowered to Sell from Neutral. Buy-rated Whitehaven Coal is preferred for its thermal coal exposure.

The broker’s rating decision followed a 98% share price rally in six months as thermal coal prices breached new highs.

Zip Co was next after Citi raised its earnings forecasts as part of a general sector update on the local Technology sector. The target was increased to 80c from 70c previously.

The broker assessed the August reporting season for the sector was better than expected from a top-line perspective, with most companies not seeing a slowdown from the softening macroeconomic environment.

Total Buy recommendations comprise 55.77% of the total, versus 36.61% on Neutral/Hold, while Sell ratings account for the remaining 7.62%.

In the good books

AIR NEW ZEALAND LIMITED (AIZ) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/0/0

Air New Zealand has suggested a strong first-half return to profitability, guiding to profit before tax of NZ$200-275m. Macquarie’s previous estimate had the airline delivering NZ$46m for the period, but strong forward sales in the first three months of the year underpin company guidance.

Guidance assumes jet fuel price of US$130 per barrel, with pricing currently US$115 per barrel, but Macquarie highlights pricing volatility does pose a threat to recovery. The broker expects high fuel costs to drive more rigid ticket pricing and predicts a 70% full-year skew to the first half as a result.

Earnings per share forecasts are increased 299% and 1% for FY23 and FY24. The rating is upgraded to Outperform from Neutral and the target price decreases to NZ81c from NZ86c.

BRICKWORKS LIMITED (BKW) was upgraded to Add from Hold by Morgans, B/H/S: 3/2/0

As Brickworks shares are currently trading at an around -30% discount to the last disclosed net tangible assets (NTA) metric, Morgans upgrades its rating to Add from Hold. Investors can now buy a quality business well below replacement value, notes the analyst.

While the business is correlated to both the US and domestic housing markets, the broker points out cyclicality is partially offset by earnings stability from the investment in WH Soul Pattinson (SOL). A 50% share in two long-lease property trusts provides a further offset.

The target price falls to $23 from $26.10. Morgans believes Brickworks can maintain the trend, in place since 1976, of maintaining or increasing its normal dividend.

GPT GROUP (GPT) was upgraded to Buy from Neutral by Citi, B/H/S: 3/1/1

After recent share price falls for GPT Group, Citi now sees a reasonable safety margin from a -35% discount to net tangible assets (NTA) and upgrades its rating to Buy from Neutral. The $4.90 target price is unchanged.

The broker feels NTA substantially excludes the value of the funds’ management business and future profitability of the development pipeline.

Investors have been wary of the group’s low level of interest rate hedging; the analyst points out the level has increased to 65% in 2022 from around 50% at June 2021.

In the not-so-good books

ATLAS ARTERIA (ALX) was downgraded to Underperform from Outperform by Credit Suisse, B/H/S: 0/3/1

Credit Suisse has adopted the view that Atlas Arteria is preparing to go out on an acquisition journey, to offset the expiry of the APRR concession.

Acquiring a 67% stake in the Chicago Skyway is but the first step in this process. Credit Suisse believes investors should re-adjust their perception of the overall risk profile for Atlas Arteria; it’ll be faster growth but also higher risks from here onwards.

The broker nevertheless models a -75% decline in dividends in the mid-2030s (long way out, still). Also, a full take-over by 20% equity owner IFM is now seen as a reduced chance of succeeding.

Dividend forecasts have been cut. Target price declines to $6.30. Downgrade to Underperform.

QUBE HOLDINGS LIMITED (QUB) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 2/4/0

The Productivity Commission has recommended regulation of container terminal operators to ensure they only collect terminal access charges from shipping lines, which Credit Suisse expects could drastically increase competition between container terminal operators to attract shipping lines.

Melbourne’s Patrick terminal, in which Qube holds a 50% stake, lifted terminal access charges from almost nil in 2017 to more than $150m, and Credit Suisse estimates charges accounting for over a third of the terminal’s unit revenue in FY22.

The rating is downgraded to Neutral from Outperform and the target price decreases to $2.80 from $3.55.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.