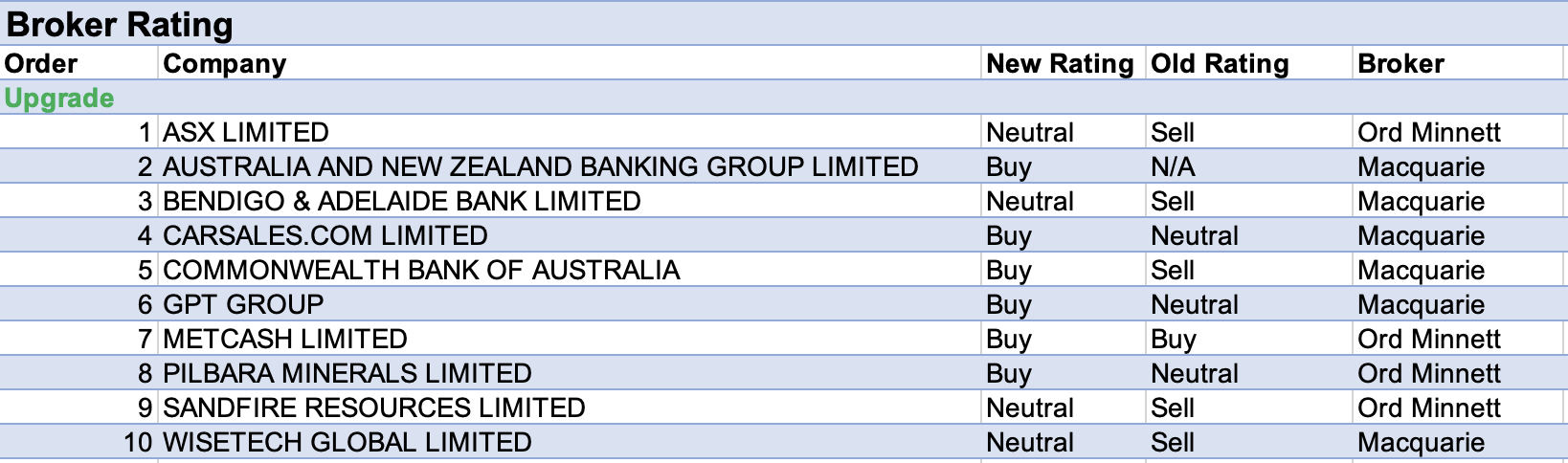

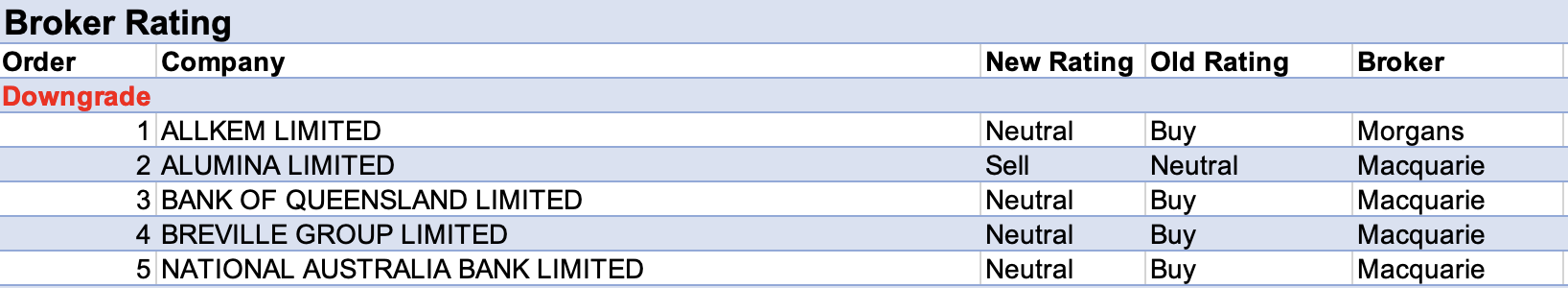

For the week ending Friday September 9 there were 10 upgrades and 5 downgrades to ASX-listed companies covered by brokers in the FNArena database.

After an avalanche of analysis during the August reporting season, broker research was in short supply last week.

In looking at the upgrades and downgrades, the Banks featured heavily due to a review of the sector by Macquarie. Upside is expected in the next six months, driven by benefits from rising rates and lagging term-deposit pricing, but the benefits aren’t likely to last.

The broker’s earnings forecasts remain well below consensus expectations for FY24 and beyond, given potential credit quality concerns, demanding pre-provision valuations, and elevated multiples relative to global peers.

Macquarie prefers ANZ Bank to Neutral-rated Westpac Bank within the value category and upgraded its rating to Outperform from Neutral following ongoing share-price weakness.

While CommBank is expensive at current levels, there is no obvious catalyst for underperformance and likely near-term upside risk to earnings, and the broker upgraded its rating to Neutral from Underperform, while the rating for National Australia Bank was lowered to Neutral from Outperform on valuation.

For regional banks, Macquarie noted Bendigo & Adelaide is set to benefit from highly accretive term deposit spreads in the near term and upgraded to Neutral from Underperform. The rating for Bank of Queensland was downgraded to Neutral from Outperform on lower-than-peer margin benefits due to high exposure to the intensely competitive mortgage market and lower interest rate sensitivity.

There were no material changes to target prices set by brokers during the week.

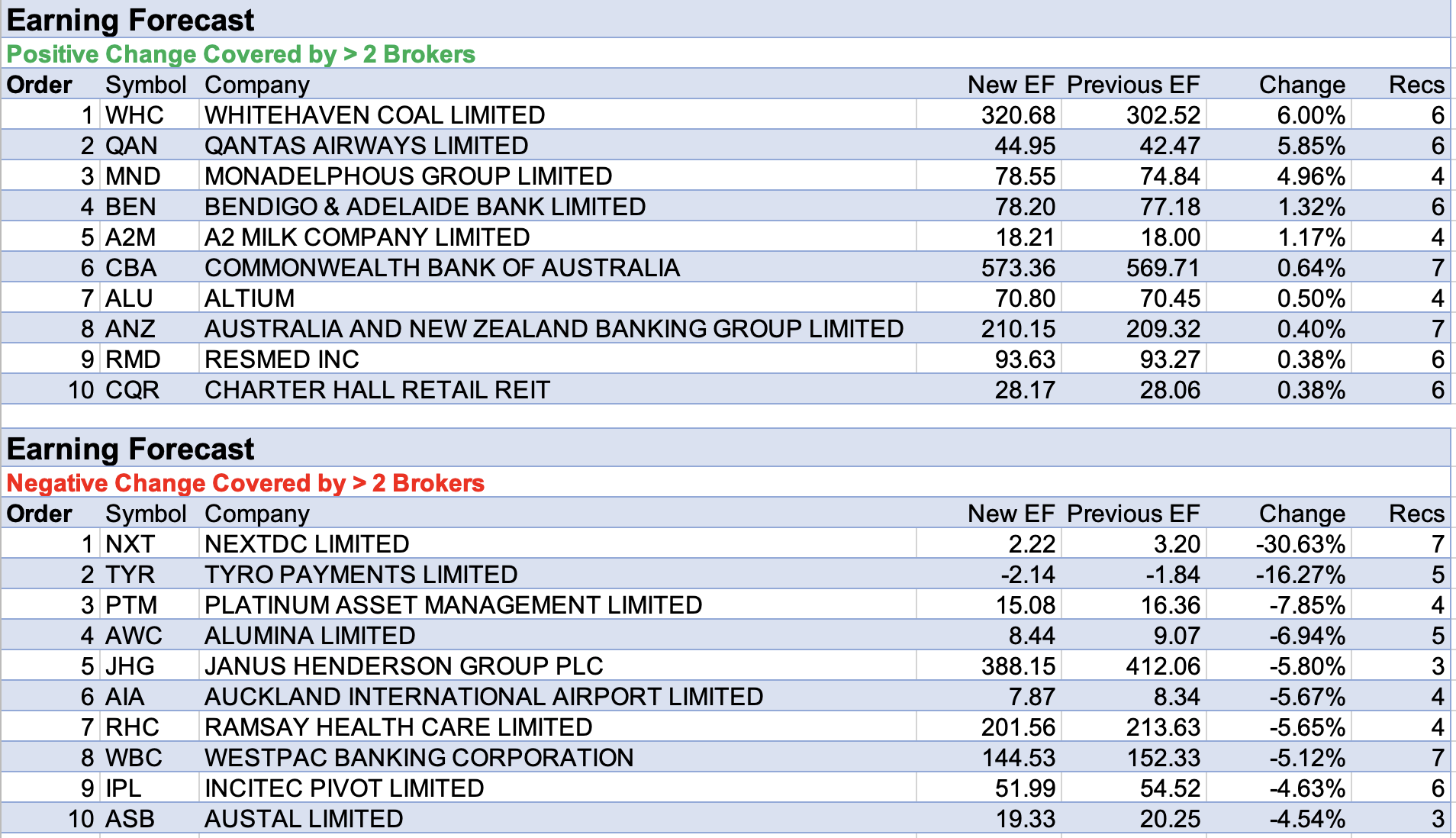

NEXTDC received the largest percentage fall in forecast earnings after a review by Morgan Stanley into the energy-intensive undertaking of running data centres.

Despite lowering its target price to $14 from $15, the broker concluded costs are manageable, as about 80-90% of the forecast energy cost increase for FY23 (a 100% rise from FY22) can be passed through to customers.

Should energy prices rise a further 100% in FY23 and FY24, the risk to NEXTDC’s earnings is about -2-3%, and the impact on Morgan Stanley’s valuation is about -15cps.

Tyro Payments also received reduced forecast earnings by brokers, after several announcements. Only a minor change in forecasts led to a material percentage change, given only small forecast numbers were involved.

The week began with a trading update, which revealed a transaction value of $3.5bn, up 69% on the same period last year. According to Ord Minnett, the update was in line with the $40-42bn guidance range provided at FY22 results.

In generally positive commentary, the analyst noted statistics from downloads and engagement with Tyro’s mobile app, showing ongoing merchant acquisition and retention.

Towards the end of the week, the board of Tyro Payments announced and rejected a conditional bid of $1.27/share by a private equity consortium led by Potentia. This announcement validated recent Morgan Stanley research highlighting the global trend of consolidation in the merchant acquiring space.

The broker retained its Equal-weight rating and 12-month target price of $1.40.

Buy-rated UBS kept its $1.80 target unchanged and noted 12.5% shareholder Grok Ventures is willing to accept the takeover bid or vote in favour of a scheme of arrangement proposed by Potentia at the offer price, subject to certain conditions.

The broker further explained Grok can’t act under a competing proposal unless the proposal is valued 25c higher than the most recent Potentia bid. It’s noted Grok has an option to remain a private investor under private equity and the current proposal.

Total Buy recommendations take up 55.51% of the total, versus 36.86% on Neutral/Hold, while Sell ratings account for the remaining 7.63%.

In the good books

METCASH LIMITED (MTS) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 3/2/0

Following an AGM trading update by Metcash, Ord Minnett raises its rating to Buy from Accumulate and lifts its target to $5.00 from $4.80, after the last ten weeks have shown ongoing sales momentum.

In general, independent supermarkets are proving resilient, according to the analyst.

In addition, Mitre 10 has seen a further sales growth acceleration via strong demand in the trade channel and general inflationary gains, while Total Tools is also benefiting from store rollouts, explains the broker.

Ord Minnett increases its FY23-25 EPS forecasts by 1-2%.

WISETECH GLOBAL LIMITED (WTC) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 2/1/1

Reflecting on WiseTech Global’s existing CargoWise One business and upcoming CargoWise Neo platform, Macquarie forecasts the company to achieve a 21% revenue compound annual growth rate over the next three years.

The broker notes launch of CargoWise Neo could be as soon as six months, but that the platform remains 1-2 years from delivering revenue. Macquarie estimates CargoWise Neo, as a standalone, to contribute $12.90 per share to the company’s valuation.

The rating is upgraded to Neutral from Underperform and the target price increases to $55.00 from $46.00.

In the not-so-good books

ALLKEM LIMITED (AKE) was downgraded to Hold from Add by Morgans, B/H/S: 4/2/1

Morgans lowers its rating to Hold from Add following a 26% share price rally in the last month (8% yesterday) which leaves the price just shy of the broker’s 12-month target price of $15.40.

The likelihood of substantial contract price increases for carbonate is becoming less likely (though possible) and the analyst expects prices to moderate over the next one to two years.

Morgans still rates Allkem as one of the best lithium pure plays on the market.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.