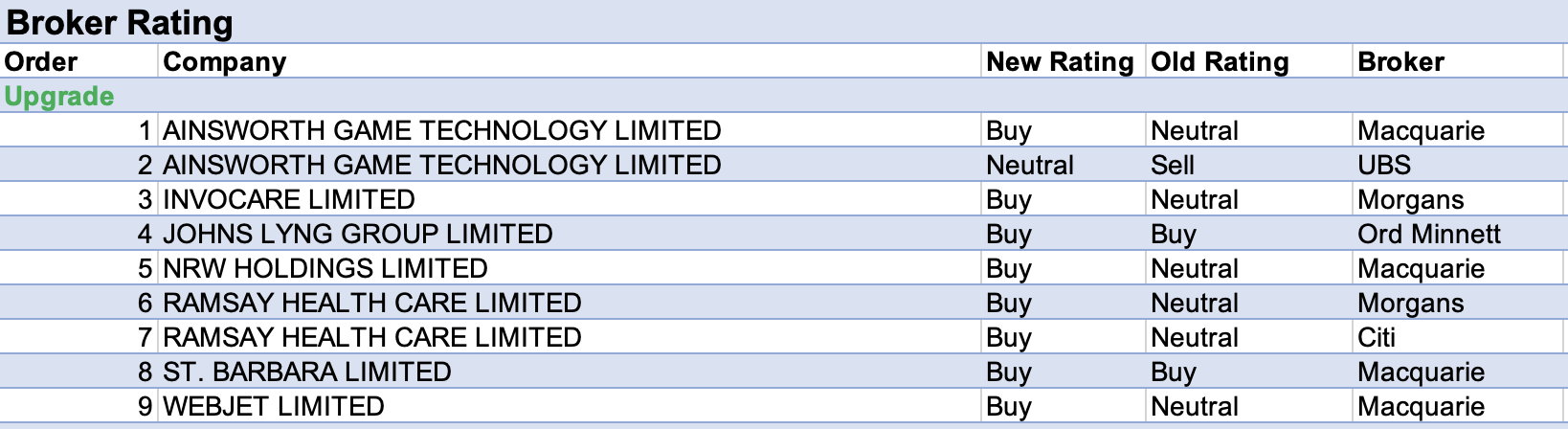

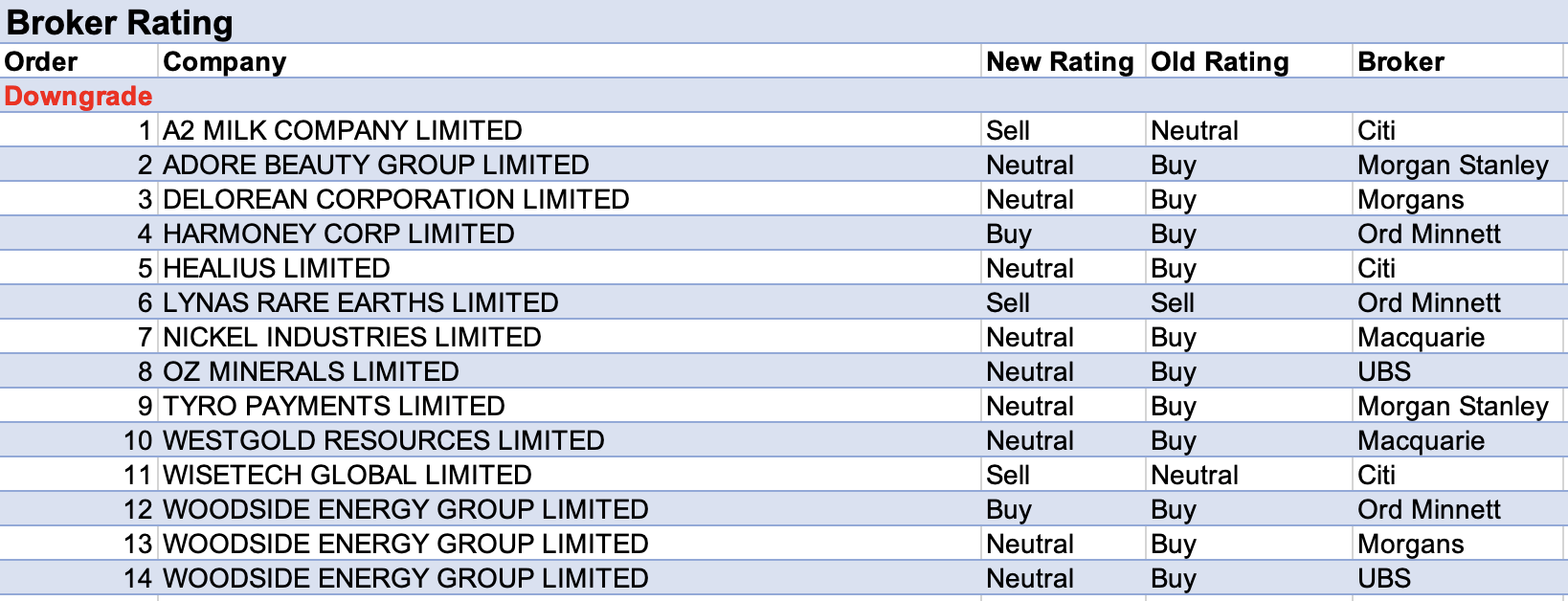

For the week ending Friday September 2 there were 9 upgrades and 14 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Three brokers decided to downgrade their ratings for Woodside Energy — two to Hold or equivalent and Ord Minnett to Accumulate from Buy — on valuation grounds following first-half results that either met or beat expectations.

Ord Minnett noted additional capital management does not appear to be imminent, with management taking a more conservative view of the balance sheet. Morgans also felt the dividend payout ratio could be cut in the near term due to higher planned Capex in the second half.

UBS supported Woodside’s focus on balancing sustainable returns with investment in growth and energy transition Capex, but also noted investors will have to moderate former capital management expectations.

While FY22 results for Tyro Payments generally beat expectations, the company received the largest percentage decrease in target price set by brokers in the FNArena database.

This anomaly may be explained by the actions of Morgan Stanley, which had a $4.70 target in place prior to results, more than double that set by each of the other four covering brokers in the database.

Following the results, the broker slashed its target to $1.40, acknowledged its prior Overweight rating was the wrong call and downgraded it to Equal-weight. The speed and magnitude of the de-rating of payments stocks, in general, came as a surprise.

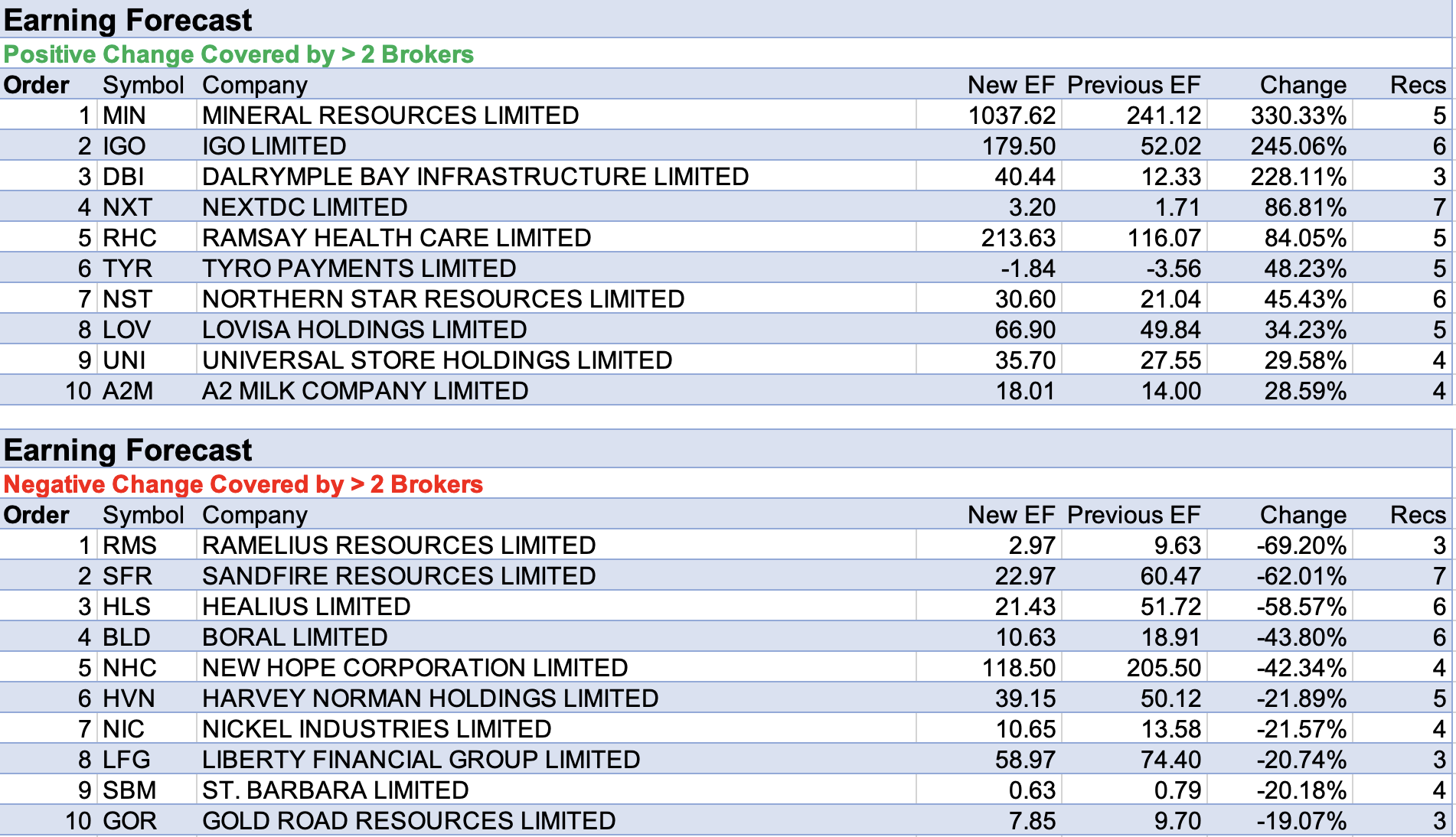

With the advent of a new financial year, overall earnings forecasts for some companies like Mineral Resources and IGO have received a material boost as FY22 forecasts rolled off broker financial models.

Mineral Resources was atop the table for the largest percentage upgrade to forecast earnings last week. Macquarie found FY22 results were mixed but generally in line with forecasts. While underlying net profit missed the UBS forecast by -11-12%, a better-than-expected 100cps final dividend provided an offset.

The big news was the approval of the Onslow Iron project from the Red Hill Iron (RHI) joint venture partners. Mineral Resources plans to increase its stake to 60.3% from 40% and will build, fund, own and operate all infrastructure.

Next on the table was IGO. FY22 results were in line with underweight-rated Morgan Stanley’s expectations though the dividend was lower than anticipated. The broker had expected a higher payout given strong cash generation into FY23.

Ord Minnett maintained its Lighten rating (target $8.40) for IGO on concerns around project execution at both Kwinana and Cosmos, while Buy-rated UBS kept the company as its top battery-raw-materials pick and increased its target to $16.00 from $15.85.

While FY22 results for NextDC were in line with broker forecasts, average forecast earnings for the first year of the forecast period almost doubled (on small numbers), once FY22 broker forecasts rolled off financial models. The same near doubling also occurred for Ramsay Health Care, despite a miss versus broker expectations for FY22 results.

For Ramsay Health Care, Morgans maintained a takeover premium in its valuation and upgraded its rating to Add from Hold. The broker lowered FY23-24 underlying earnings forecasts on a challenging operating environment, though management expects a “gradual recovery” through FY23 and more “normalised” conditions from FY24 onwards.

Citi believes there is a greater than 50% chance of a formal bid still occurring and upgraded its rating to Buy from Neutral after the KKR-led consortium withdrew its indicative proposal of $88 a share and made an alternative offer that was rejected by the board.

Despite in-line FY22 results at the underlying level, Ramelius Resource received the largest percentage downgrade to forecast earnings last week. Results were impacted by impairments and higher D&A costs, and Hold-rated Ord Minnett now awaits September quarter results to re-examine cost expectations and the ramp-up of the key Penny gold mining operation in Western Australia.

Sandfire Resources also garnered lower earnings forecasts from brokers following full-year results that missed most expectations. Underlying profit of $111m for FY22 came in well below the $171m forecast by Ord Minnett, largely due to higher depreciation charges, while the FY22 dividend of 3 cents (no final dividend) was adrift of the anticipated 8 cents.

While FY22 results for Healius were in line with consensus forecasts thanks to strong demand for covid testing, Citi lowered its FY24 earnings forecasts by -21% to reflect lower base business revenue forecasts, after management said it expects a period of catch-up before trade normalises.

The broker downgraded its rating to Neutral from Buy and suggested all pathology companies will find it difficult to outpace expectations given earnings are forecast to more than halve in the next one to two years unless a more severe covid variant appears.

Total Buy recommendations take up 55.43% of the total, versus 36.67% on Neutral/Hold, while Sell ratings account for the remaining 7.90%.

In the good books

AINSWORTH GAME TECHNOLOGY LIMITED (AGI) was upgraded to Neutral from Sell by UBS and Outperform from Neutral by Macquarie, B/H/S: 1/1/0

Ainsworth Game Technology’s result outpaced UBS forecasts and profits rose sharply half on half, thanks to a strong performance from the North Americas, which are recovering faster than other divisions.

UBS expects other divisions will start to catch up over FY23 further boosting earnings this financial year.

No guidance was provided but the broker expects better revenue will still translate to flat margins given supply-chain challenges.

The company has finalised the restructuring of its balance sheet and has completely paid down its debt, exiting the year with $50m in net cash. UBS says this positions the company well for investing in product – the No.1 priority in the broker’s mind.

Earnings rise 5% to 7% across FY23 to FY25.

Neutral rating and $1 target price retained.

Ainsworth Game Technology posted a $27m FY22 profit, which was a turnaround of $44m from FY21 and ahead of Macquarie. Ainsworth has returned to sustainable profitability, the broker notes, and is also increasing investment in products through R&D which could see upside to forecasts.

With improved earnings quality, Macquarie is starting to gain better visibility on the trajectory with more than 35% of revenues now coming through gaming operations and digital.

The stock is cheap, the broker notes, based on historical PE. Upgrade to Outperform from Neutral. Target rises to $1.25 from $1.20.

NRW HOLDINGS LIMITED (NWH) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/0/0

Macquarie has adjusted its valuation methodology for mining services companies to come into line with metrics reported by the industry.

This results in the broker’s earnings forecasts for NRW Holdings to be increased 9% for the medium term to reflect higher margins, given commentary of margin recovery and sustained contracting strength.

Target rises to $2.50 from $2.10, upgrade to Outperform from Neutral.

St. BARBARA LIMITED (SBM) was upgraded to Outperform from Neutral by Macquarie,B/H/S: 1/3/0

St. Barbara reported a much larger loss than Macquarie expected driven by an impairment at Atlantic, primarily driven by past permitting delays. Underlying earnings were nevertheless stronger on lower operating expenses.

Macquarie continues to view a potential sale of Simberi as a key near-term positive catalyst, given the prospect of reducing group

capital requirements and providing proceeds that can be diverted to other growth projects.

On recent share price weakness, the broker upgrades to Outperform from Neutral. Target unchanged at $1.10.

WEBJET LIMITED (WEB) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 5/1/0

The guidance provided at Webjet’s AGM suggests FY24 earnings will exceed those of pre-covid FY19.

Profitability ahead of expectations increases Macquarie’s confidence that Webjet will deliver and sustain a structurally lower cost base.

Despite some macro risks on the horizon, the medium-term growth outlook is favourable and underpinned by market share gains, ongoing tech investment, and a full recovery in travel markets, the broker notes.

Upgrade to Outperform from Neutral, target rises to $6.15 from $5.50.

In the not-so-good books

DELOREAN CORPORATION LIMITED (DEL) was downgraded to Hold from Speculative Buy by Morgans, B/H/S: 0/1/0

Morgans expects share price weakness will continue for Delorean Corp and downgrades its rating to Hold from Speculative Buy and reduces its target to $0.095 from $0.215.

Losses continued in the 2H from the engineering, procurement, and construction (EPC) businesses, notes the analyst, and FY22 results revealed a net loss after tax of -$10.9m.

Management pointed to one-off impacts including timing and covid impacts to the Ecogas project and BLM project.

The broker’s lower target price results from several factors including the introduction of a 25% risk weighting on the EPC business, given troublesome project execution since the company was listed.

HARMONEY CORP LIMITED (HMY) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 1/0/0

Ord Minnett saw Harmoney Corp releasing FY22 financials largely in line. Cash flow milestones have been reached during H2 and the broker is banking on further cash flow improvements.

Also, now that the loan book has reached a greater point of scale in Australia, Ord Minnett is forecasting operating costs as a share of revenues to fall to circa 20%, adding: this should support adjusted profit growth.

As investors are anticipating further rate rises, multiples for the sector are de-rating, with the broker pulling back its target for Harmoney to $1.02 from $2.19 (not a typo).

The stock has been downgraded to Accumulate from Buy. Note: the broker publishes “normalised EPS” forecasts which are better-looking than the reported financials.

NICKEL INDUSTRIES LIMITED (NIC) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/2/0

Nickel Industries’ first half profit was -6% below Macquarie and earnings missed slightly. Nickel price realisation rates have been falling this year, down to 70% currently from 85% in 2021, the broker notes. The dividend was in line.

Softening stainless steel demand in China has been a headwind to price realisation rates so far in 2022. Further weakness in the stainless-steel market could further impact earnings, Macquarie warns.

This has led to a cut in earnings forecasts, a cut in target to $1.00 from $1.40, and a downgrade to Neutral from Outperform.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.