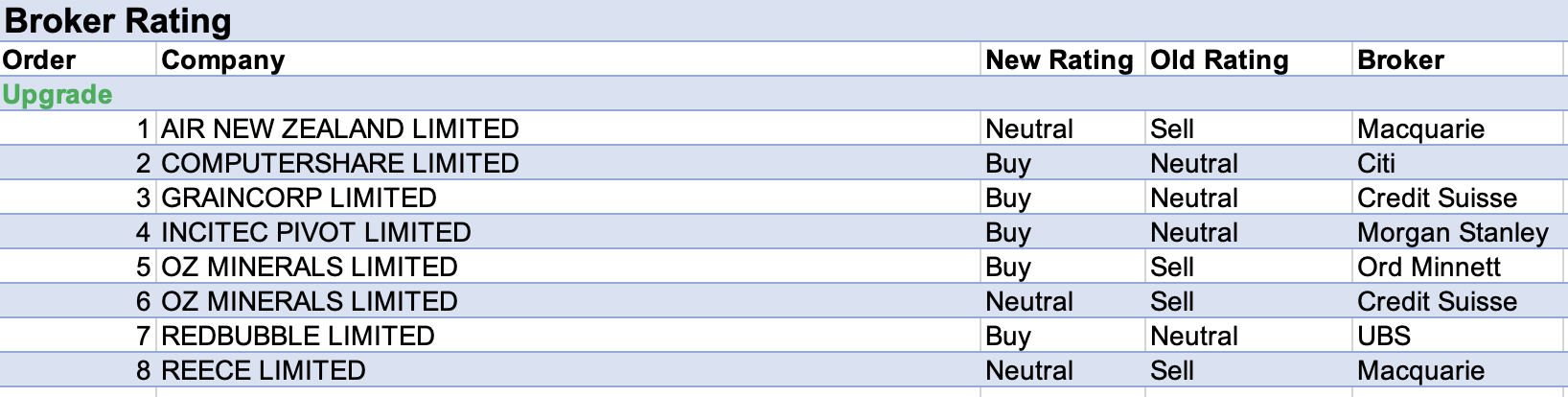

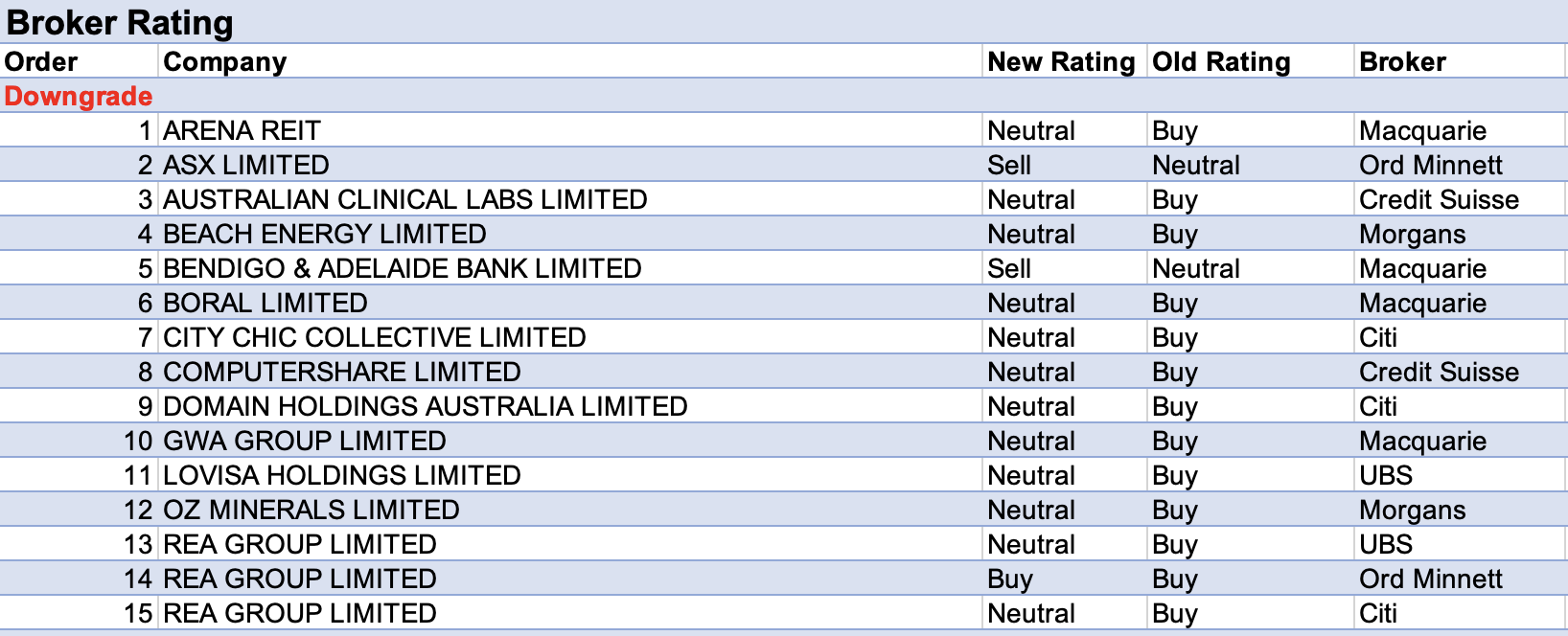

For the week ending Friday August 12 there were 8 upgrades and 15 downgrades to ASX-listed companies covered by brokers in the FNArena database. REA Group featured prominently, picking up three separate broker rating downgrades.

Considering a forecast near halving of house lending over the next two years, along with double-digit house price declines, Citi felt consensus growth expectations for FY23 and FY24 were too optimistic and lowered its target to $133.05 from $153.50.

Ord Minnett noted some emerging cost pressures though retained its $140 target, while UBS set a $142.60 target, up from $130, despite lowering earnings forecasts by -5%. Strategists at the broker see the potential for house price declines of -10-15% peak to trough by around the second half of 2023, at which point inflation should peak.

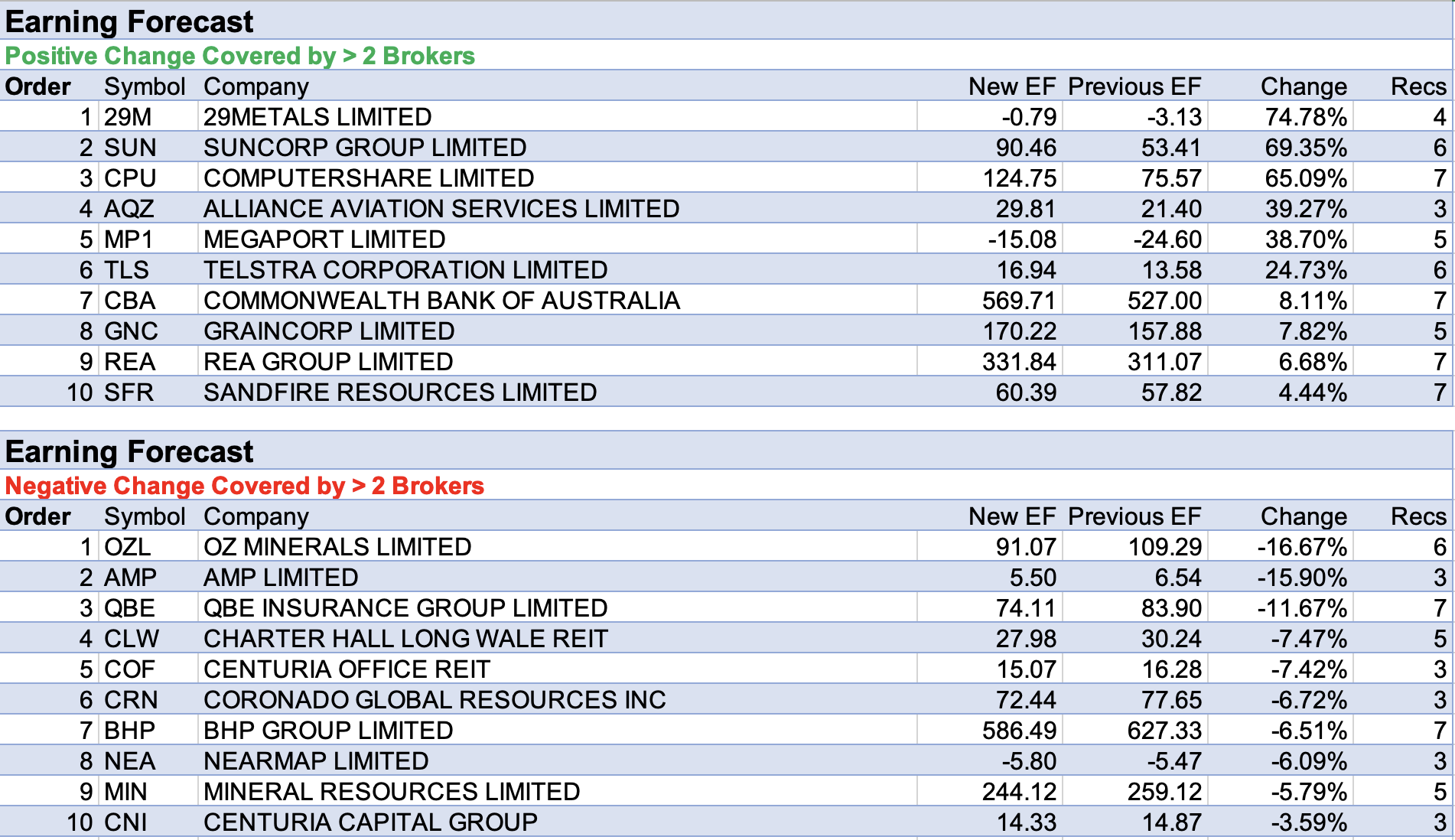

OZ Minerals had the largest percentage fall in forecast earnings in the FNArena database last week, as well as the second largest increase in average target price set by brokers.

Morgans agreed with the company’s board that the $25/share takeover bid by BHP Group undervalues the company and is highly opportunistic. OZ Minerals shares had corrected by around -35% from a 12-month high above $29.

In reaction to the bid, Ord Minnett increased its rating to Accumulate from Hold (target to $27,40, up from $16.00) and Credit Suisse upgraded to Neutral from Outperform and nearly doubled its target to $28.00 from $14.50.

Morgans did the reverse and downgraded its rating to Hold from Add after a share price rally following the announcement was adjudged to incorporate most of the potential upside.

Morgans’ 12-month target price was increased to $25.40 from $23.20 after also allowing for second quarter production that trailed its expectation by -10%, partly due to higher unit costs. The broker also incorporated lower near-term in-house copper forecasts.

29Metals had the largest percentage rise in forecast earnings by brokers last week after Credit Suisse adjusted both net interest expenses and income tax expenses over the forecast period. An absence of major capital expenditure commitments in the coming two years was noted, as was more balance sheet flexibility than peers, though an Underperform rating was retained.

Next up was Suncorp Group. Following FY22 results, Macquarie lifted EPS forecasts for FY23 and FY24 by 5.3% and 6.6%, respectively, due to higher gross written premiums and bank lending growth.

UBS felt the core general insurance franchise remains in good shape and noted the group appears to have navigated home claims inflation well, with claim severity rising only 1-2% in the second half, while the industry rose closer to 10%.

All seven brokers in the FNArena database reviewed Computershare’s FY22 results and earnings forecast were increased on average. Any short-term concerns for Morgans were trumped by interest rate leverage as suggested by FY23 guidance for over 55% growth. FY23 EPS guidance was estimated to be around 5% above the consensus forecast.

The company’s margins, costs and leverage all impressed Macquarie though corporate activity was considered weak. Credit Suisse was a dissenting voice and downgraded its rating to Neutral from Outperform. The earnings upgrade cycle is thought to be coming to an end, as interest rate cuts from FY24-26 begin to be priced in to fixed income markets.

A reporting season wouldn’t be complete without deep analysis of the widely held Telstra and its all-important dividend, which rose to 8.5cps in the second half from 8cps in the first half. On average, brokers increased earnings forecasts though commentary was mixed.

On one hand, Morgans felt the company had comfortably turned the corner, Morgan Stanley anticipated shares would outperform in uncertain markets and Ord Minnett recommended shares to investors for the outlook on mobile and the monetisation of InfraCo.

On the other hand, Neutral-rated UBS noted lower FY23 guidance partly implies near-term impacts from rising inflationary pressures, while Macquarie forecast softer NBN margins and increased competition in enterprise fibre, and lowered its target by -7% to $3.80, while its Neutral rating was retained.

Macquarie wasn’t getting too carried away after the increased dividend either, with no further increase anticipated until FY25.

Total Buy recommendations take up 58.43% of the total, versus 34.21% on Neutral/Hold, while Sell ratings account for the remaining 7.37%.

In the good books

AIR NEW ZEALAND LIMITED (AIZ) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 0/1/0

Macquarie reviews Air New Zealand’s capacity for FY23 and finds first-half capacity should land at 67% of pre-covid levels before rising to 84% in the second half.

Strong demand is allowing ticket prices to recoup fuel costs, for now, notes the broker, but remains cautious given the likelihood of a spending slowdown.

Rating is upgraded to Neutral from Underperform. Target price is NZ65c.

COMPUTERSHARE LIMITED (CPU) was upgraded to Buy from Neutral by Citi, B/H/S: 6/1/0

Even though Computershare flagged the significance of margin income, Citi concludes from the FY22 results that the company is even more heavily reliant on the movement in interest rates, both up and down.

The margin income was a significant earnings driver in FY22 and more than operational earnings.

Looking to FY23, Citi views the company will benefit from a further notable increase in margin income with the peak expected to be down the track.

The company’s balance sheet revealed a strong improvement post the CCT acquisition with net debt to EBITDA at 1.64x and within the target range.

The broker’s earnings forecasts are raised by 4% and 3% for FY23 and FY24, respectively and changes from the Canadian transfer pricing mean there will be zero franking soon.

The price target is adjusted for the earnings forecasts and valuation to $28.20 from $26.90 and the rating is upgraded to Buy from Neutral.

See downgrade below

GRAINCORP LIMITED (GNC) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/3/0

With GrainCorp upgrading its FY22 guidance and providing increased visibility as to earnings through to FY24, Credit Suisse has upgraded its own full-year FY22 earnings forecast to 7.5% and FY24 earnings forecast to 185%.

The broker highlights the guidance upgrade for FY22 is a product of the company’s strong export program execution, supported by a positive trading environment that the broker anticipates will continue into FY23. Credit Suisse also notes the company expects an above-average winter crop, driving the broker to lift its production forecast to 26m tonnes from 21m tonnes.

The rating is upgraded to Outperform from Neutral and the target price increases to $9.14 from $8.79.

OZ MINERALS LIMITED (OZL) was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 3/3/0

OZ Minerals has been offered a $25 per share takeover bid by BHP Group (BHP), an offer that Credit Suisse notes represents 12x 2023 expected earnings and values OZ Minerals at a level far superior to any copper peers.

With both of OZ Minerals’ copper mines at growth stages, the broker expects BHP would require key personnel to be retained to oversee integration of copper assets to avoid a sizeable cost increase.

The rating is upgraded to Neutral from Underperform and the target price increases to $28.00 from $14.50.

In the not-so-good books

AUSTRALIAN CLINICAL LABS LIMITED (ACL) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 0/1/1

While Australian Clinical Labs closed out the year with a net profit of $184.5m, Credit Suisse notes year-on-year growth of 108% missed consensus forecasts by -4% as slow base business dragged on the second half.

With covid revenue down -45% in the half, the broker notes Australian Clinical Labs’ base business is yet to show signs of improvement as fewer GP visits, higher cancellation rates and staffing shortages continue to take a toll. Credit Suisse does not expect deficit recovery in the short term.

Credit Suisse lifted its FY23 earnings per share forecast by 8%, predicting covid revenue to improve to $92m in the first half. The rating is downgraded to Neutral from Outperform and the target price decreases to $5.35 from $6.00.

ARENA REIT (ARF) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 0/3/0

Arena REIT’s FY22 earnings were in line with Macquarie’s forecast. FY23 dividend guidance is nevertheless -3% below expectations,

mainly driven by lower development completions and returns.

Arena maintains superior growth relative to peers driven by its development pipeline in early learning centres, Macquarie notes. but with development returns moderating and interest expense headwinds impacting growth, the broker has become more cautious on the outlook.

Given an elevated valuation and forecast 3.5% dividend yield, Macquarie downgrades to Neutral from Outperform. Target falls to $4.74 from $4.92.

COMPUTERSHARE LIMITED (CPU) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 6/1/0

Benefiting from rising interest rates, Credit Suisse notes Computershare has been in an earnings upgrade cycle over the last year but anticipates the cycle is coming to an end as interest rate cuts from FY24-26 begin to be priced in to fixed income markets.

The company delivered a 2% beat to its earnings per share guidance and is guiding to 55% growth in FY23, but Credit Suisse is predicting earnings growth will decline to just 13% in FY24 and no growth will occur in FY25 and FY26. Earnings per share forecasts are downgraded by -13-15% through to FY24.

The rating is downgraded to Neutral from Outperform and the target price decreases to $25.00 from $27.00.

See upgrade above

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.