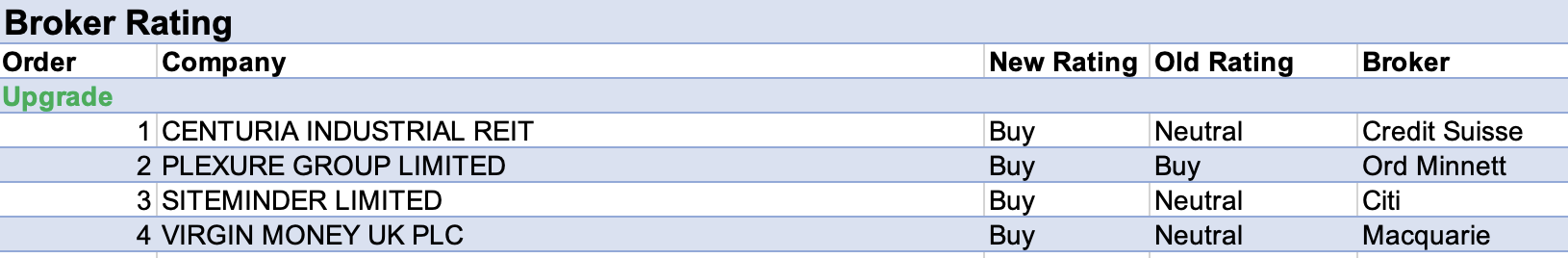

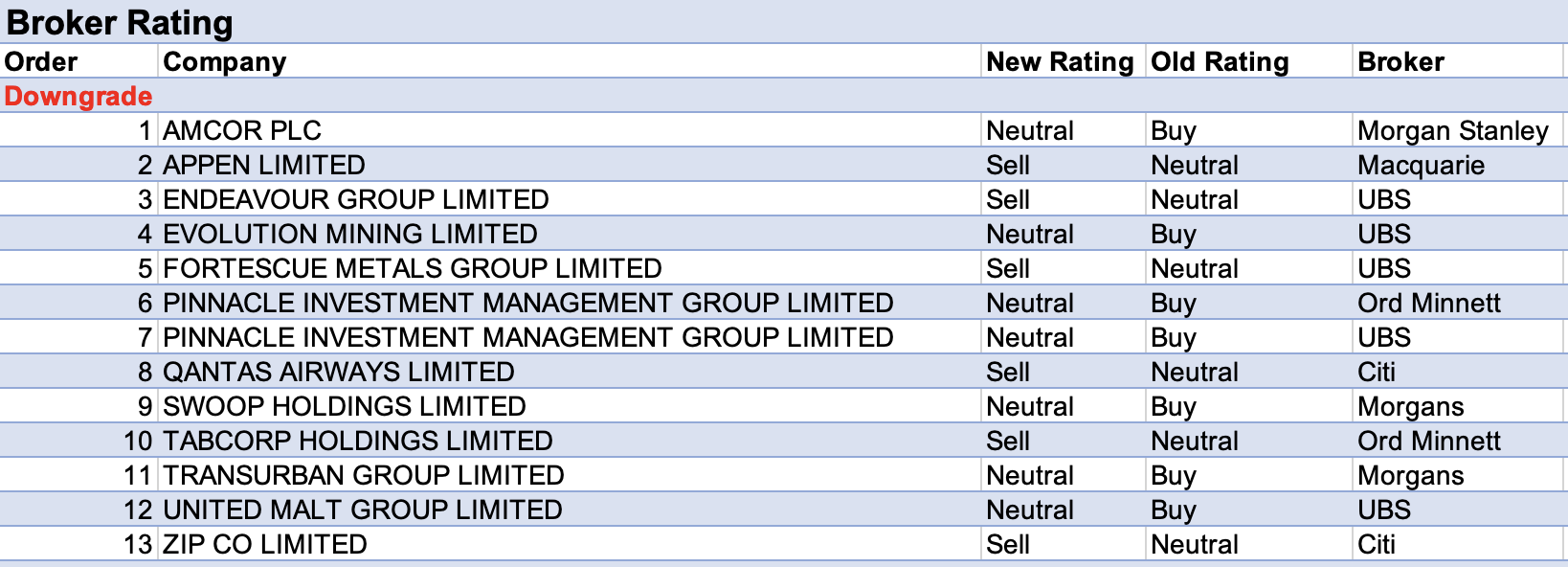

For the week ending Friday August 5 there were 4 upgrades and 13 downgrades to ASX-listed companies covered by brokers in the FNArena database.

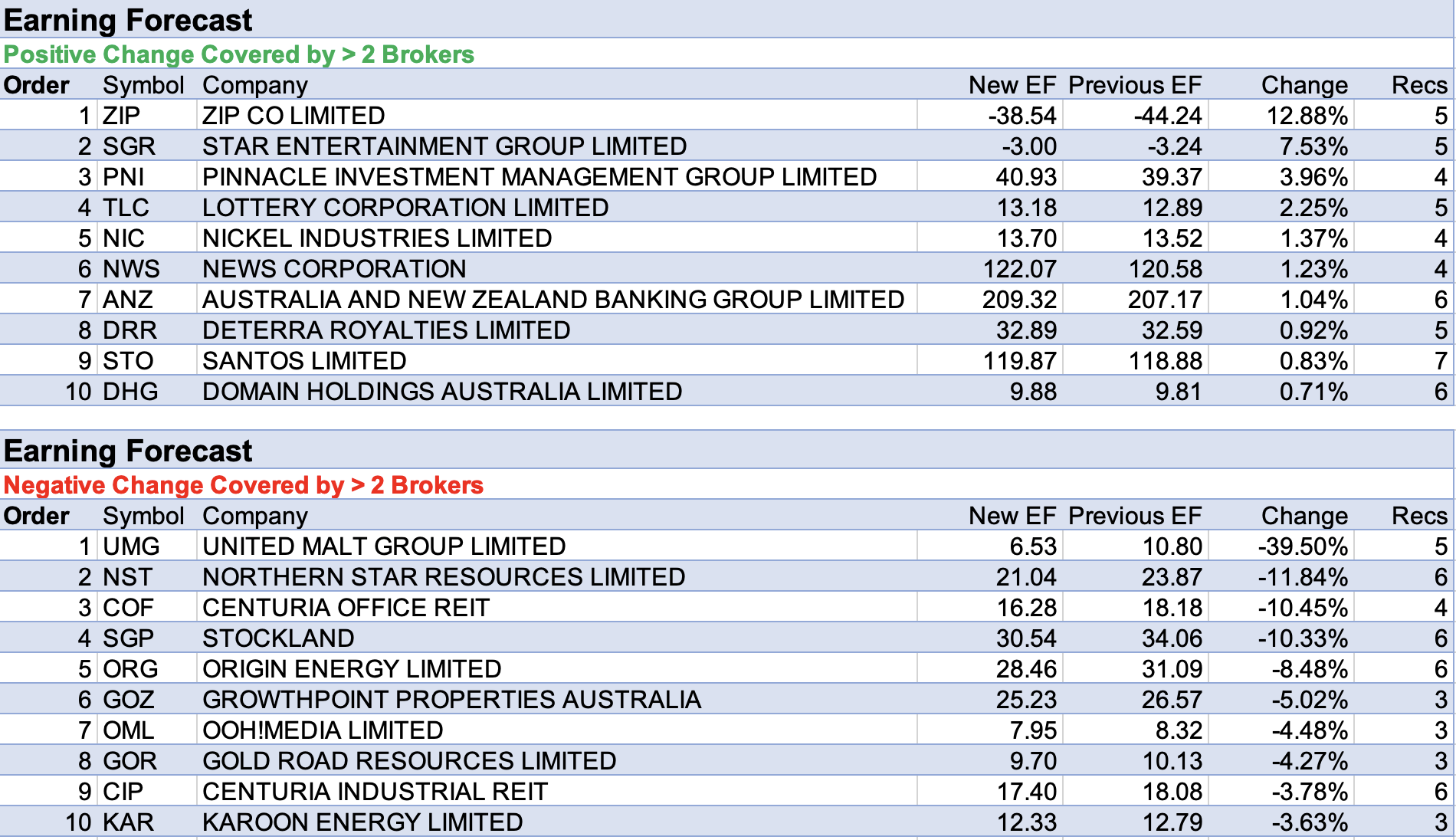

Pinnacle Investment Management received the largest percentage upgrade to target prices set by brokers last week after the release of FY22 results. UBS noted a 5% better result than forecast and responded by both raising its earnings forecasts and lowering its rating to Neutral from Buy on valuation grounds.

For the same reason, Ord Minnett downgraded its rating to Hold from Accumulate, despite fund flows and funds under management (FUM) exceeding expectations. Morgans noted net inflows slowed over the second half though remained positive and attributed softer retail flows to market conditions rather than performance.

On the other side of the coin, Zip Co had the largest percentage fall in target price set by brokers. Early in the week, Citi downgraded its rating to Sell/High Risk from Neutral/High Risk and halved its target price to $0.70.

These changes were made after the broker’s growth forecasts were lowered meaningfully in response to the company’s tightened risk settings (to reduce bad debts), which is expected to negatively impact total transaction volume.

The broker also holds concerns over management’s decision-making (following costs of -$60m during the failed Sezzle acquisition) and the likelihood of a capital raise in FY24.

Later in the week, the company reported fourth-quarter trading results and unveiled a new strategy to turn around the business operations. Brokers within the FNArena database are yet to express a view on either the results or strategy.

United Malt Group was next on the list for percentage fall in target price last week, after management downgraded earnings guidance only two months after a re-affirmation.

UBS suggested the turnaround revealed a lack of management “visibility” into earnings and operations and lowered its rating to Neutral from Buy and its target to $3.05 from $4.65. As gearing levels ballooned, questions emerged over the company’s ability to deleverage debt levels in FY23.

Morgans also reduced its target to $3.46 from $4.20 and raised the spectre of a structural change to the business, given more normalised earnings now appear to be well below proforma pre-covid levels.

United Malt also headed up the table for the largest percentage fall in forecast earnings. Coming second was Northern Star Resources after UBS strategists downgraded gold price forecasts for FY23-25 by -4%, -5% and -3%, respectively.

The broker felt stocks within the gold sector are not as cheap as they look, due to both lower company growth ambitions and continued operating and inflation headwinds. Near-term earnings forecasts for stocks under coverage were lowered by -10-15% and price targets reduced on average by -3-5%.

UBS’s preferred large cap exposure is Northern Star Resources for its net cash position and strong organic growth pipeline, and the Buy rating was retained, while the target fell to $9.80 from $10.00.

Centuria Office REIT also received forecast earnings downgrades from brokers last week, following lower-than-expected FY23 guidance. While FY22 results were broadly in-line with consensus forecasts, Credit Suisse noted interest costs and higher incentives to grow occupancy rates, alongside declining leasing spreads, are impacting the FY23 outlook.

Morgan Stanley suggested management’s interest rate strategy has not served the REIT well in the current macro environment. Heading into FY23, the average hedge duration is less than one year on the 56% of debt that is hedged.

Despite negative broker adjustments to Zip Co’s target price, the company had the only material increase in broker earnings forecasts last week.

The increased earnings forecasts reflect a lower provision for bad debts, given the prior acquisition target Sezzle had higher losses.

Total Buy recommendations take up 58.89% of the total, versus 33.73% on Neutral/Hold, while Sell ratings account for the remaining 7.37.

In the good books

CENTURIA INDUSTRIAL REIT (CIP) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/2/0

Centuria Industrial REIT reported FY22 results which came in line with Credit Suisse’s expectations.

Notably, the FY23 guidance was reduced below the broker’s and consensus forecasts due to higher debt cost assumptions, which may prove to be overly conservative.

The price target is adjusted down to $3.42 from $3.75 and the stock is now seen trading at a -30% discount to NTA.

Credit Suisse views the bad news regarding debt costs as discounted in the price and upgrades to Outperform from Neutral.

In the not-so-good books

AMCOR PLC (AMC) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 4/3/0

While Morgan Stanley continues to like Amcor’s quality and dividend support, growth may be more challenging in FY23, and the stock may be left behind in the event of a risk-on rally by the wider market. The rating is reduced to Equal-weight from Overweight.

The analyst highlights the stock has benefited from the prior risk-off sentiment, with shares outperforming the ASX200 by 17% this year.

Growth challenges in FY23 may derive from the currency, while the analyst observes higher funding costs have begun to emerge. The target price falls to $17.50 from $18.00. Industry view: In Line.

ENDEAVOUR GROUP LIMITED (EDV) was downgraded to Sell from Neutral by UBS, B/H/S: 2/1/2

Endeavour Group is downgraded to a Sell from Neutral by UBS following the rise in the share price and a deteriorating risk/reward profile for investors.

The broker views the valuation as too stretched with the stock now trading at a similar PER multiple to (WOW) with the company’s revenues not as defensive as assumed.

UBS highlights moderating retail spending will impact at the same time as Hotels re-opening is slowing and gaming is moving online, while inflationary pressures will impact margins, such as rising labour costs.

Earnings forecasts are reduced by 3.2% for FY23.

A Sell rating and the price target is maintained at $7.20.

EVOLUTION MINING LIMITED (EVN) downgraded to Neutral from Buy by UBS, B/H/S: 2/5/0

UBS downgrades its gold price forecasts for FY23-25 by -4%, -5% and -3%, respectively. It’s felt stocks within the gold sector are not as cheap as they look with the combined headwinds of lower company growth ambitions and continued operating and inflation headwinds.

The broker lowers its near-term earnings forecasts by -10-15% and reduces price targets on average by -3-5%.

The rating for Evolution Mining falls to Neutral from Buy and the target price is reduced to $2.80 from $2.90.

PINNACLE INVESTMENT MANAGEMENT GROUP LIMITED (PNI) was downgraded to Neutral from Buy by UBS, B/H/S: 2/2/0

After a 70% rally off the June low share price, UBS views Pinnacle Investment Management as expensive compared to other asset managers and downgrades the recommendation to Neutral from Buy.

The FY22 result, up 5% was better than the analyst forecast and excluding seed losses ($5.7m) the underlying numbers were strong.

Net inflows moderated in the 4Q22 from the previous quarter, ten boutiques provided $58m in performance fees and investment in Horizon 2 are likely to keep costs elevated.

Broker earnings forecasts have been raised 15% and 17% for FY23 and FY24, respectively.

UBS increases the price target 22% from $10.00 to $12.20.

The recommendation is downgraded to Neutral from Buy on valuation grounds.

QANTAS AIRWAYS LIMITED (QAN) was downgraded to Sell from Neutral by Citi, B/H/S: 4/0/2

Citi forecasts lower capacity growth and higher cost per available seat kilometres (CASKs) than the market is expecting and lowers its rating to Sell from Neutral for Qantas. Higher staffing levels to address on-time performance levels are expected to weigh.

In the short term, the broker expects higher fuel prices and overstaffing will put pressure on margins and decrease capacity. The target falls to $4.28 from $5.47 on earnings revisions, higher Capex estimates and lower market multiples.

TABCORP HOLDINGS LIMITED (TAH) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 2/3/0

Ord Minnett feels Tabcorp Holdings has missed the boat on digital market share by comparison to online bookmakers and downgrades its rating to Lighten from Hold on the prospects for heightened competition.

The broker also increases its capital expenditure estimates and lowers its target to $0.90 from $1.15. News Corp’s (NWS) market entry via BetR is expected to increase costs that have so far been necessary for Tabcorp to maintain market share.

UNITED MALT GROUP LIMITED (UMG) was downgraded to Neutral from Buy by UBS, B/H/S: 3/2/0

United Malt downgrades earnings guidance at the Investor Day, only 2 months after re-affirming guidance which UBS believes raises concerns around management “visibility” into the earnings and operations.

The company highlighted headwinds across the business including crop problems with quality, supply chains and costs and pointed out aims to improve internal forecasting and more dynamic pricing contracts with clients to pass on cost increases.

Gearing levels ballooned and UBS questioned the ability of United Malt to deleverage the debt levels in FY23.

The recommendation is changed to Neutral from Buy in the absence of a takeover offer or a turnaround in the earnings outlook.

Adjusting for a downgrade in earnings forecasts of -59%, -35& and -22% for FY22, FY23 and FY24, the target price is lowered to $3.05 from $4.65.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.