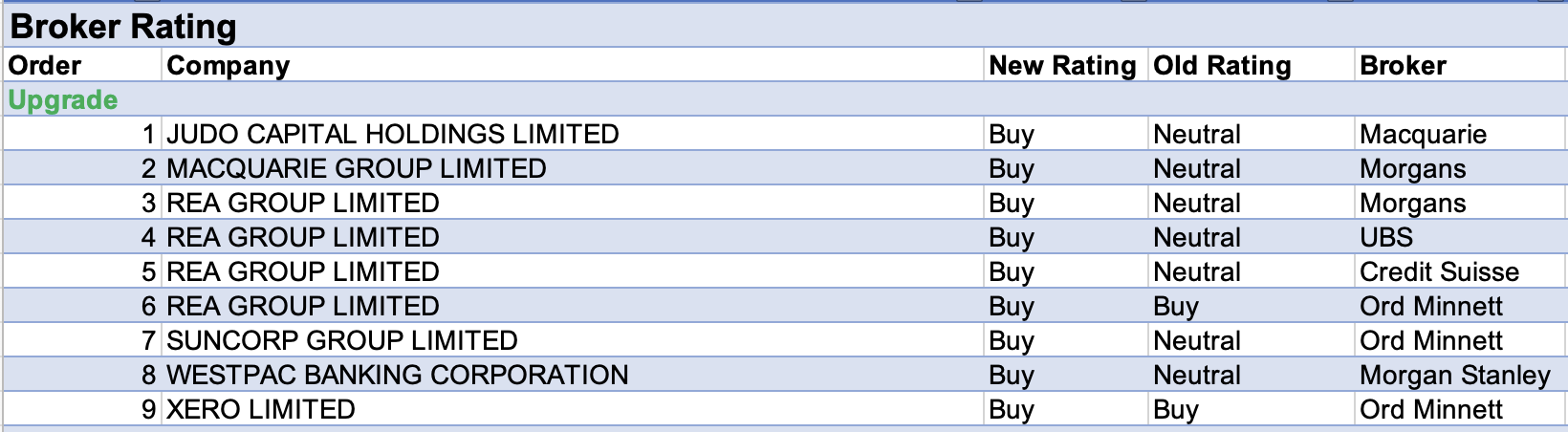

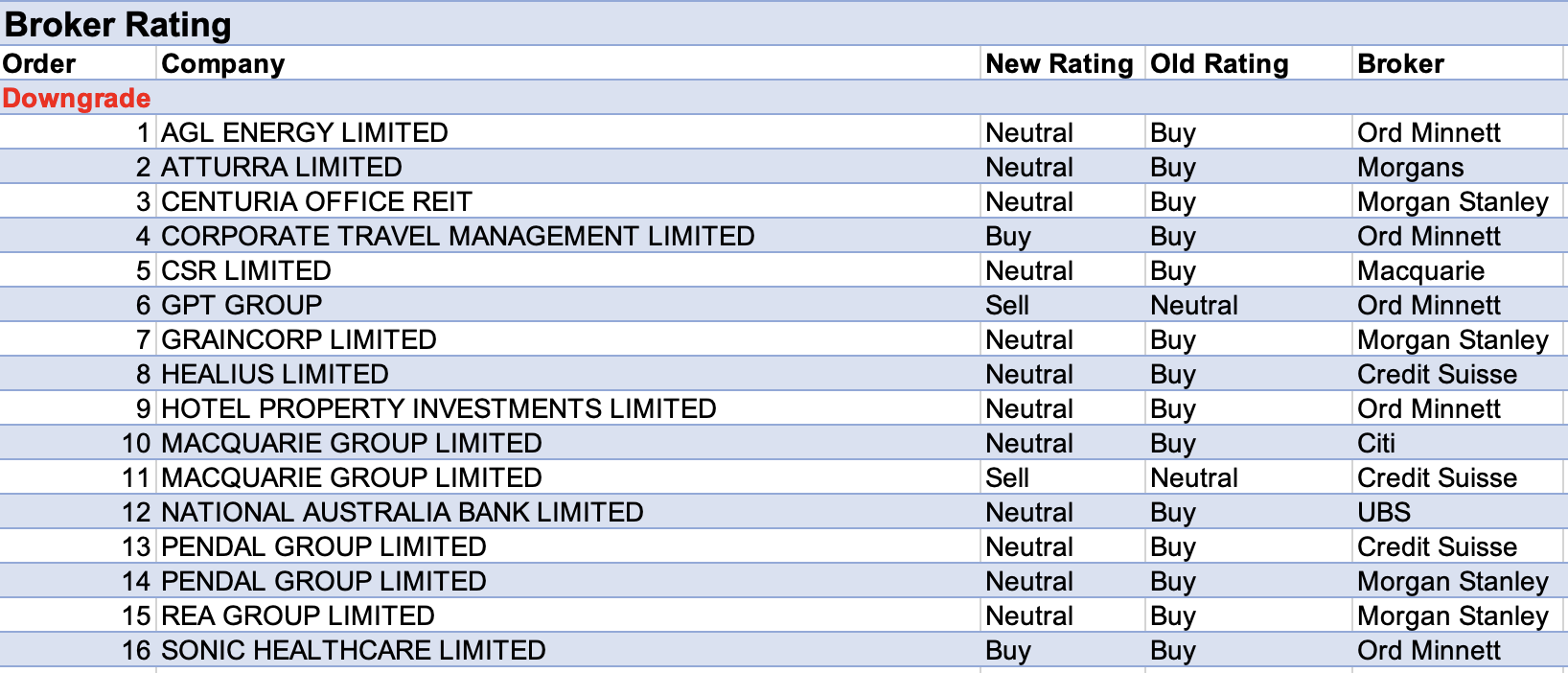

For the week ending Friday May 13 there were 9 upgrades and 16 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Morgan Stanley reduced its earnings forecasts for REA Group to reflect cyclical weakness and predicted things will worsen before getting better. By cutting its rating to Equal-weight from Overweight following third quarter results, the broker was at odds with four other brokers who upgraded ratings for REA to Buy or equivalent.

Despite a weaker residential volume outlook in FY23 and current weakness in building approvals figures, UBS was prepared to look through the cycle. Ord Minnett also noted the current 20% relative premium to peer Domain Holdings (DHG) should widen again to the traditional 30%. Meanwhile, both Morgans and Credit Suisse also lifted their ratings on valuation grounds.

Broker opinions on Macquarie Group were also divided following the release of FY22 results. Morgans upgraded its rating to Add from Hold and raised its 12-month target price to $215 from $209.60. The result was considered hard to fault, beating the consensus forecast by 7% after strong performances in the Commodities and Global Markets division and within Macquarie Capital.

Citi agreed and described the results as extraordinary though believed they signal the peak of a ten-year upward earnings cycle and downgraded its rating to Neutral from Buy. Credit Suisse also believed earnings have peaked, is concerned by a deteriorating macroeconomic outlook, and downgraded to Underperform from Neutral.

Despite a strong first half result by Pendal Group, two brokers downgraded their ratings to Neutral or equivalent from Buy or equivalent. Slowing momentum in retail, a modest range of new strategies and industry-wide pressures concerned Morgan Stanley, while Credit Suisse noted global equity markets have declined further since the results period, and performance fees are likely to be significantly lower in early FY23.

GrainCorp had the largest percentage increase in target price last week after the release of first-half results. Trade disruptions continue to support above-average grain margins and crop conditions look favourable for the 2022/23 growing season. Nonetheless, UBS maintained the period FY22 to FY23 representing peak super-cycle earnings before normalisation is expected in FY24.

On the flipside, REA Group had the largest percentage fall in target price last week though brokers remained upbeat as evidenced by the rating upgrades detailed above.

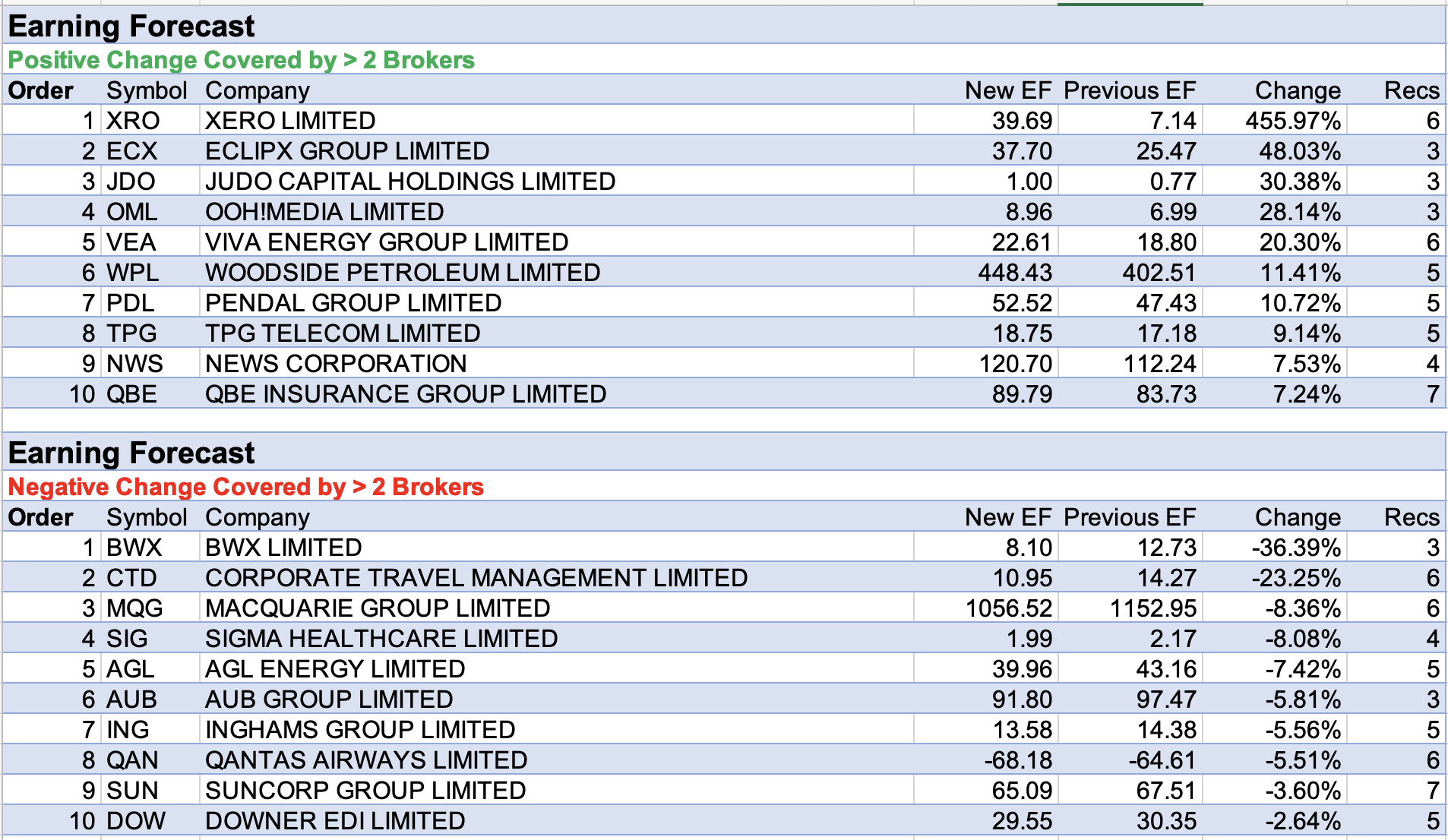

Meanwhile, BWX had the largest percentage fall in forecast earnings by brokers following reduced FY22 profit guidance. Lower sales for FY22 will provide a lower base for growth, according to Macquarie, and as the broker’s forecast cost assumptions also increased, FY23 and FY24 EPS estimates were lowered by -24% and -19%, respectively.

Despite decreasing its target price for BWX to $2.40 from $5.00 the broker retained its Outperform rating due to the longer-term margin benefits from a new manufacturing facility and the potential of the company’s brands.

A data glitch was responsible for Xero’s position atop the largest percentage upgrade to forecasts earnings by brokers last week. Also, a carryover from the previous Friday had Eclipse Group in second place, leaving Judo Capital as the de facto leader.

Following an inaugural strategy day, Macquarie considered Judo well positioned to deliver ahead-of-system loan growth over the next three years and upgraded its rating to Outperform from Neutral. Management noted immediate benefits will flow from rising interest rates as 91% of the company’s lending is linked to the bank bill swap rate.

Finally, after oOh!media’s good first-quarter update appeared to flow into a strong April, Macquarie increased its earnings per share forecasts by 113%, 37% and 35% through to FY24. The broker retained its Outperform rating and raised its target price to $2.30 from $2.00.

Total Buy recommendations take up 59.34% of the total, versus 34.32% on Neutral/Hold, while Sell ratings account for the remaining 6.34%.

In the good books

JUDO CAPITAL HOLDINGS LIMITED (JDO) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 3/0/0

Judo Capital has held its inaugural strategy day, with Macquarie noting a number of positives look to improve investor prospects.

Macquarie considers the company positioned to deliver ahead of system loan growth over the next three years, and notes Judo Capital appears to be pre-funding this growth with accelerated banker hiring, 12% ahead of expectations.

Given reduced execution risk, the rating is upgraded to Outperform from Neutral and the target price increases to $2.15 from $2.10. Macquarie notes de-rating has shifted risk-reward payoff in favour of investors.

XERO LIMITED (XRO) was upgraded to Buy from Accumulate by Ord Minnett, B/H/S: 4/1/1

Xero’a full year underlying earnings of $213m were 2.6% ahead of Ord Minnett’s forecast and an 11% increase on its FY21 result, but a -$9m net loss exceeded the broker’s expected -$7m.

Ord Minnett notes the market did not respond positively to the company’s continued cash burn in pursuit of growth, but the broker feels Xero has a good case for continued reinvestment given the opportunity set remains sizeable.

Recent share price decline sees Ord Minnett upgrade its rating to Buy from Accumulate and decrease the target price to $97.00 from $107.00.

In the not-so-good books

ATTURRA LIMITED (ATA) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

Atturra has upgraded underlying earnings (EBITDA) guidance by around 13%, and announced the acquisition of Perth-based Hayes, an OpenText/ECM specialist for $12m.

Morgans attributes the upgraded guidance to stronger results in March and April and less impact from the Federal election than originally envisaged. A one-off gain from completing a project under budget in the 4Q also contributed.

Following the acquisition, the broker removes a 10cps premium in the target price for future acquistions and after upgrading earnings estimates (offset by downgraded peer multiples), the target falls to $0.72 from $0.78. The rating is downgraded to Hold from Add on valuation.

CSR LIMITED (CSR) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 4/2/0

While CSR missed Macquarie’s full year expectations slightly, reported underlying earnings of $291.4m and net profit of $192.6m compared to anticipated $304.3m and $197.6m, the broker noted improved efficiencies and topline momentum drove a quality result.

Performance from the Building Products segment was a feature, delivering a 160 basis point improvement to earnings margin in the second half and with solid detached activity lined up through FY23, while the company capitalised on market conditions with its Aluminium segment.

Looking ahead, house activity forecasts see Macquarie revise earnings per share forecasts -7%, -5% and -4% through to FY25.

The rating is downgraded to Neutral from Outperform and the target price decreases to $6.05 from $6.80.

GRAINCORP LIMITED (GNC) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 1/4/0

The first half was slightly ahead of Morgan Stanley’s expectations and, with the risks for FY22 reduced, the focus is now on FY23. Risks are weighted to the upside because of high wheat prices and improved seasonal conditions.

The broker raises FY22 EBITDA forecast by 3%, at the top end of management’s guidance range. There is potential for another above-average crop in FY23 owing to increased soil moisture levels and elevated grain prices.

Management has also turned to paying fully franked dividends and away from buybacks and the broker raises its forecasts for FY22-23 total dividends to $1 a share.

As a result, now is time to take profits in the broker’s opinion and the rating is downgraded to Equal-weight from Overweight. Target is $10.70. Industry View: In-Line.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.