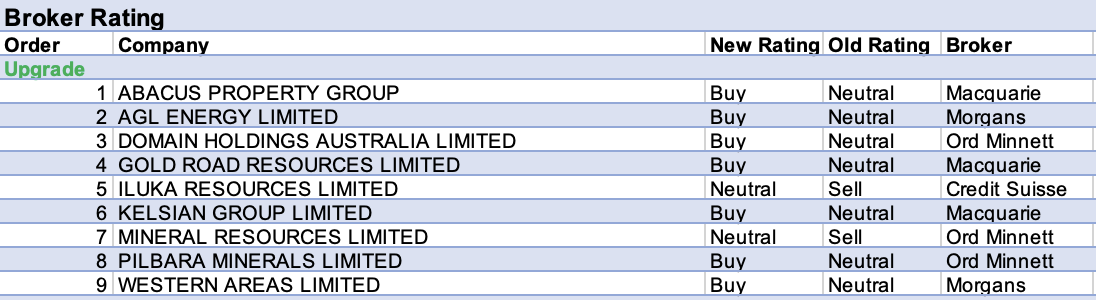

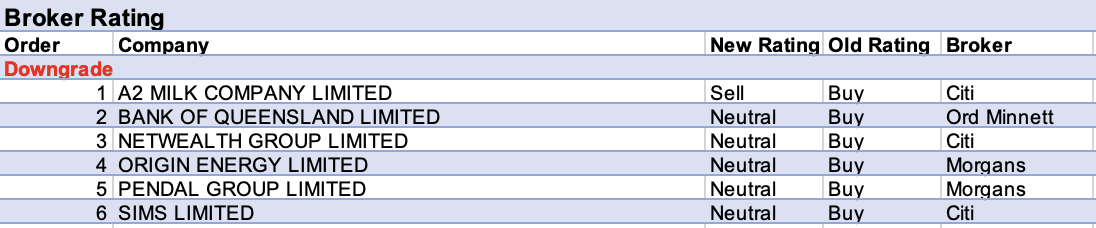

There have been no further upgrades and only one additional downgrade since our Buy, Hold, Sell report last Thursday. As such, for the week ending Friday April 8 there were nine upgrades and six downgrades to ASX-listed companies covered by brokers in the FNArena database.

Ord Minnett began the week with an upgrade to its outlook for lithium. The 2023 price forecast for spodumene was doubled to US$5,000/t, while hydroxide and carbonate estimates were raised by 50% and 60%, respectively. Meanwhile, the broker raised its long-term forecast by 18%.

A few days later, UBS increased its 2022 spodumene forecast by around 17%, while longer term price forecasts were placed under review.

As a result of Ord Minnett’s increased lithium forecast, the analyst raised its rating for Pilbara Minerals to Buy from Hold and lifted its price target to $4.50 from $2.90. Credit Suisse also raised its target price to $3.90 from $3.20 after estimating the company should achieve a realised spodumene price in the June quarter near the US$5,000 per tonne that peer Allkem is hoping to achieve for the same period.

Meanwhile, Macquarie sees an opportunity for the company to capture more value along the lithium value chain following a positive scoping study at the Mid-Stream Product Demonstration Plant. A key near-term catalyst due to a potential spot sale on the company’s battery material exchange (BMX) platform was also noted.

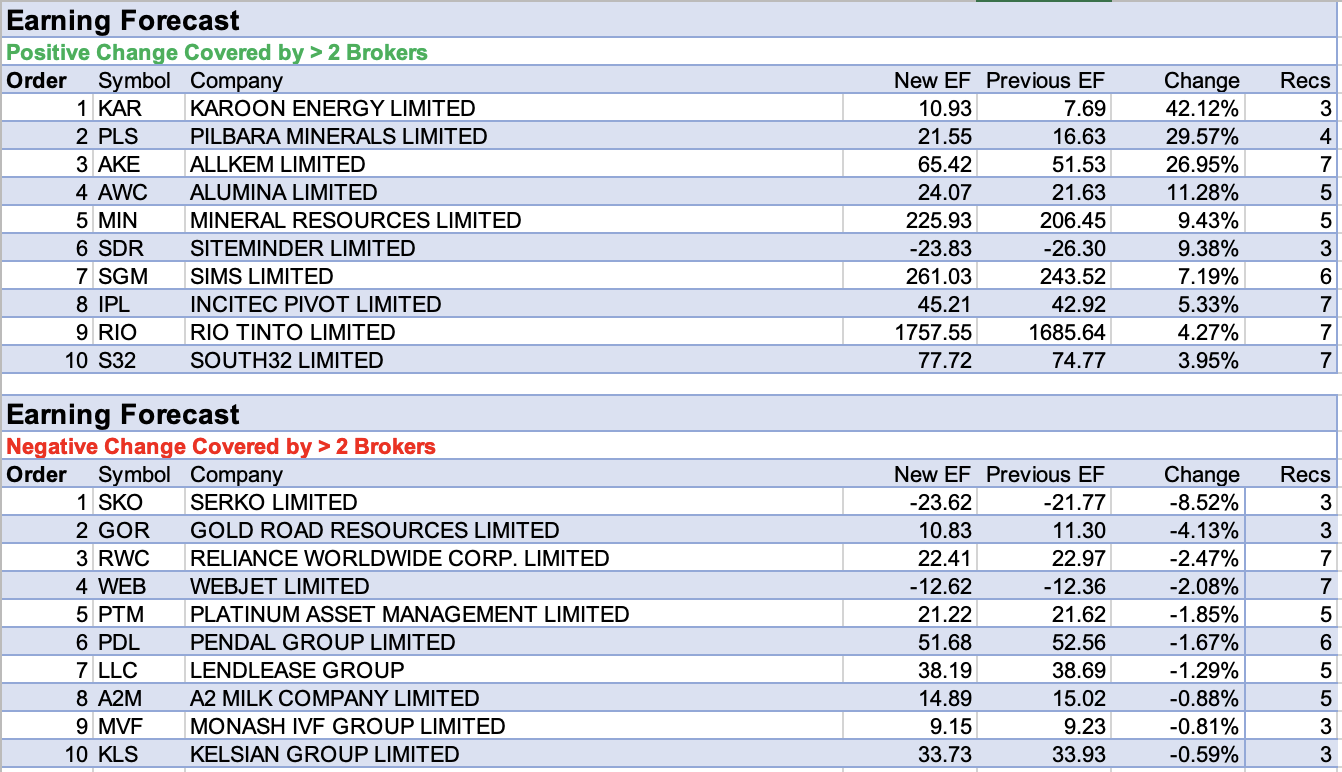

As a result of revised views from these three brokers, Pilbara Minerals headed the table last week for the largest percentage increase in price target among stocks in the FNArena database.

Next on the table was lithium (and iron ore) producer Mineral Resources, which announced an agreement with its joint venture partners to increase production from the Mt Marion and Wodgina spodumene mines in Western Australia, in response to unprecedented global demand for its lithium products. Management announced the Wodgina Train restart will yield first production in May; Train 2 will restart in July; and Train 3 is under assessment, as is a possible Train 4 in late 2022. The company will also upgrade Mt Marion spodumene processing facilities to increase output at a cost of -$120m.

Continuing the theme, Pilbara Minerals and Allkem placed second and third on the table for the largest percentage increase in forecast earnings by brokers.

Following Allkem’s strategy day, Macquarie pointed to a material increase in the optionality at the flagship brine-based Olaroz Lithium Facility in Argentina after an upgrade to resources, and highlighted targeted volumes at the Sal de Vida project in Brazil have been both increased and brought forward. Realised spodumene and carbonate prices were also better than UBS had expected.

Top spot on the table for earnings upgrades last week went to Karoon Energy. Morgans likes the potential move to acquire a 50% stake in the Atlanta field, an existing oil field in Brazil that has growth options. Similar to the company’s existing Bauna field, Atlanta is located in the Santos Basin. Such an acquisition had been previously flagged by management, noted Macquarie, and the price paid, when disclosed, is considered the key.

Finally, Alumina Ltd also featured in the same earnings table after Ord Minnett increased its 2023 price forecast for aluminium and alumina by around 20% in reaction to rising metal prices from the Russia/Ukraine conflict. Longer term forecast prices were also lifted by 19% for aluminium and 23% for alumina.

Total Buy recommendations take up 59.15% of the total, versus 34.92% on Neutral/Hold, while Sell ratings account for the remaining 5.93%.

In the good books

In the not-so-good books

ORIGIN ENERGY LIMITED (ORG) Downgrade to Hold from Add by Morgans, B/H/S: 2/4/0

Morgans lowers its rating for Origin Energy to Hold from Add due to the rising potential negative exposure in the electricity market and after the share price moved past the broker’s target price.

The Eraring plant is important for management to manage its average pool price exposure, according to the analyst. Should there be a need to buy financial contracts to manage this physical exposure, earnings this half and next financial year could be suppressed.

The target price falls to $6.42 from $6.44.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.