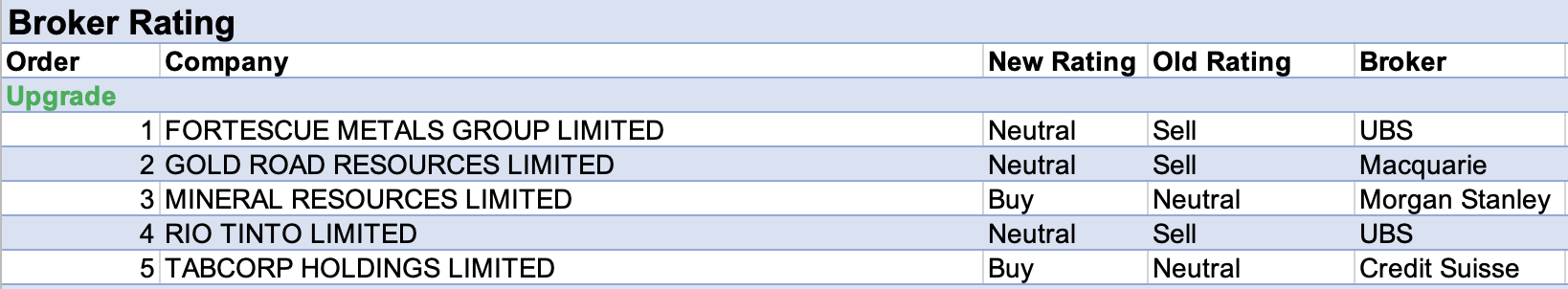

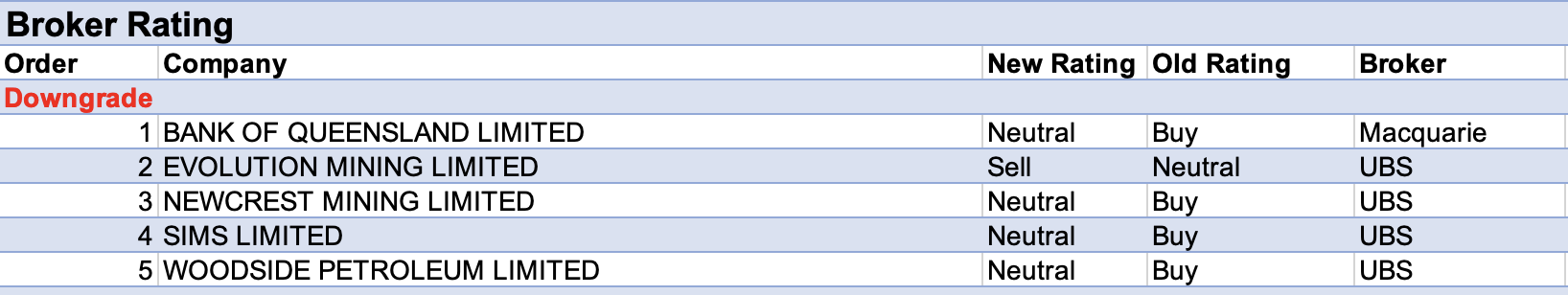

For the week ending Friday April 1 there were seven upgrades and five downgrades to ASX-listed companies covered by brokers in the FNArena database.

Brokers made no material percentage changes to price targets last week.

Gold Road Resources had the largest percentage increase in forecast earnings by brokers after releasing FY21 results. Macquarie raised its rating to Neutral from Underperform as expectations were exceeded for both profit and dividend and due to recent share price weakness.

UBS noted production growth of around 60% by 2024 for the Gruyere mine places the company at a relative advantage to peers in a time when the industry is facing ongoing covid and cost pressures (e.g. labour and oil).

As a result of these rising input costs, the strategists at Morgan Stanley expect longer-term commodity price estimates will need to be raised across the sector. This is especially the case for commodities like aluminium, alumina and zinc, which have high input costs.

While the broker maintained its Underweight rating for Western Areas, the earnings forecast was raised and the target price increased to $3.40 from $2.95.

The same commodity review by Morgan Stanley resulted in the broker’s rating for Mineral Resources being upgraded to Overweight from Equal-weight. While the company’s lithium production is ramping up and high prices are being achieved, the analyst also pointed out higher iron ore prices are benefiting the company’s high-cost operations.

Meanwhile, Macquarie also raised its earnings forecast for Mineral Resources after noting upside risk to the gas resource estimate for Lockyer Deep from testing results and a strong flow rate. Lockyer Deep, situated in the Perth basin, is a joint venture with ASX-listed Northwest Energy. Gas from the joint venture is not expected for two years.

Next, in terms of the largest increase in forecast earnings by brokers in the FNArena database last week, was 29Metals. Again, the Morgan Stanley commodity review resulted in a target price rise to $3.40 from $3.10 due to higher EPS estimates and a higher forecast long-term copper price.

Morgan Stanley’s review also impacted earnings forecasts for both IGO Ltd and Whitehaven Coal. The former’s target price was raised to $11.35 from $10.05, while the latter’s increased to $5.45 from $3.75.

For Whitehaven Coal, the broker expects thermal coal to trade higher for longer and sees a 31% upside for the share price. It’s felt longer-term value should derive from project approvals and development, particularly at the Vickery project. The company is Morgan Stanley’s second most preferred pick across its mining sector coverage, behind South32.

Total Buy recommendations take up 58.97% of the total, versus 35.15% on Neutral/Hold, while Sell ratings account for the remaining 5.88%.

In the good books

TABCORP HOLDINGS LIMITED (TAH) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 3/1/0

Tabcorp’s Demerger Scheme Booklet disclosed better than anticipated operational expenditure and net debt allocation according to Credit Suisse. The broker’s target price now incorporates $4.95 per share for The Lottery Corp and $1.25 per share for the new Tabcorp.

The Scheme booklet also warned of potential litigation risk, but the broker expects this offers an opportunity to harmonise wagering industry fee structures. The broker assumes a -7 cents per share impact from litigation settlement.

The broker also noted a 10% lottery revenue increase in the March quarter, driving a target price increase and a suggested return of more than 15% in the next year.

The rating is upgraded to Outperform from Neutral and the target price increases to $6.20 from $5.70.

In the not-so-good books

BANK OF QUEENSLAND LIMITED (BOQ) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 5/1/0

Macquarie downgrades its rating for Bank of Queensland to Neutral from Outperform due to increased competition and because lower deposit pricing has resulted in very slow deposit growth. It’s also felt the bank has relatively lower leverage to higher rates.

The target price falls to $9 from $9.25 as the broker sees increasing risk of mortgage margin impacts and a deposit cost blowout as the bank’s funding gap widens.

For the overall sector, Macquarie expects the Bank sector to consolidate at current levels given near-term results are likely to disappoint due to weaker margins. While volume growth remains solid, it is slowing, and competitive pressures are expected to remain intense.

Mortgage competition has shifted to variable rates due to higher rates, explains the analyst. Also, higher term deposit costs and

switching are expected to limit the upside from those higher rates.

SIMS LIMITED (SGM) was downgraded to Neutral from Buy by UBS, B/H/S: 3/3/0

Sims has outlined opportunities to diversify from traditional metals recycling into a broader ESG strategy, but UBS notes pursuing this will take time and capital expenditure, and in the near-term scrap pricing and volumes will continue to drive earnings.

Given a settling of scrap metal pricing at higher levels the broker anticipates pricing declines from the first half of FY23. On company guidance, UBS notes volumes look unlikely to offset lower pricing.

Based on the limited opportunity for organic growth seen by the broker, the rating is downgraded to Neutral from Buy and the target price increases to $22.00 from $20.30.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.