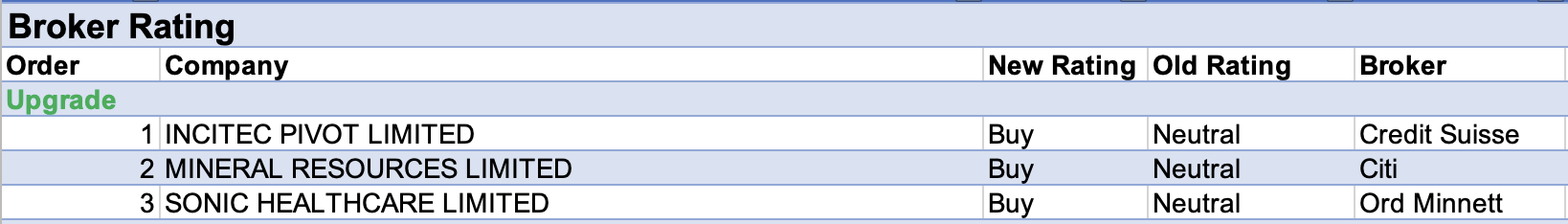

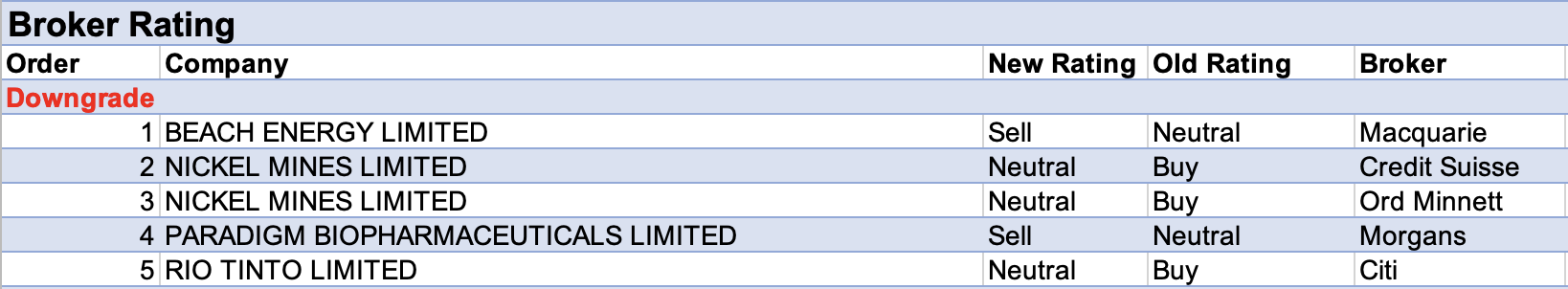

There have been no further upgrades and only two additional downgrades since our Buy, Hold, Sell report last Thursday. As such, for the week ending Friday March 11 there were three upgrades and five downgrades to ASX-listed companies covered by brokers in the FNArena database.

Media reports of China-based Tsingshan being caught on the wrong side of a short squeeze in nickel prices resulted in broker downgrades for Nickel Mines. The company is a junior partner co-invested in several Indonesian nickel projects with Tsingshan.

Ord Minnett felt negative sentiment will weigh on Nickel Mines’ near-term share price and downgraded its rating to Hold from Accumulate. Moreover, according to Credit Suisse (Neutral from Outperform) the company’s large cost base exposure to price rises in nickel ore and coal were already placing pressure on margins.

Brokers in the FNArena database made no material percentage changes to price targets last week.

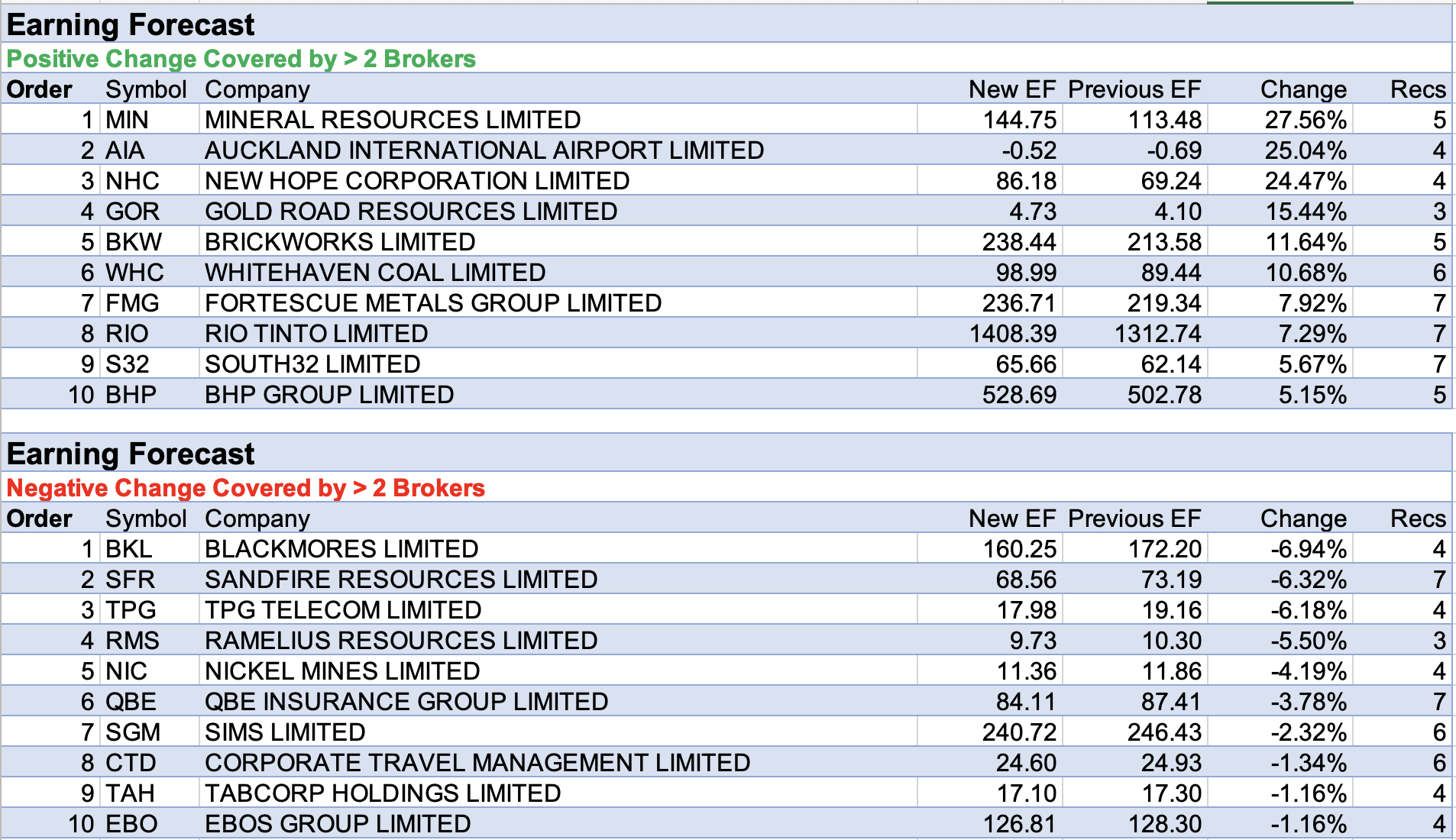

Meanwhile, the only material changes made by brokers to forecast earnings were positive. Mineral Resources received the largest percentage upgrade after Citi’s commodity team raised near-term commodity price forecasts in the belief the Russia/Ukraine war will prolong the pandemic-recovery boom.

Thermal coal, oil, nickel, aluminium and iron ore received the biggest upgrades as Russia/Ukraine combined is a key exporter.

The broker upgraded its rating for Mineral Resources to Buy from Neutral not only because of high leverage to forecast iron ore price increases but also exposure to increased lithium price forecasts. The $58 target price was maintained.

Next was Auckland International Airport, after Credit Suisse raised its rating to Outperform from Neutral in expectation of strong post-pandemic travel and the potential for higher pricing.

This comes as the NZ government removes the 10-day self-isolation period for NZ citizens and highly skilled workers. Also, the broker is anticipating a full opening of borders to Australia (July) and the rest of the world in October.

Regarding higher prices, the analyst feels the Commerce Commission may judge airports as higher risk than pre-covid and allow the company to set higher aeronautical pricing in the next regulatory period.

New Hope Corp was next on the list of companies that received the largest percentage increase in forecast earnings. This was partly attributable to the increased coal price forecasts made by Citi’s commodity team last week.

In addition, Morgans previewed the company’s pre-released 1H results due on March 22, and now sees upside for the FY22 dividend. The broker estimates 36cps and raises its target price to $3.05 from $2.61 on stronger recent prices for coal.

While the broker maintained its Add rating, there’s some concern that spot coal prices may have peaked, which may result in a cheaper entry point for shares.

Total Buy recommendations take up 59.25%of the total, versus 34.77% on Neutral/Hold, while Sell ratings account for the remaining 5.98%.

In the good books

In the not-so-good books

NICKEL MINES LIMITED (NIC) was downgraded to Hold from Accumulate by Ord Minnett and Neutral from Outperform by Credit Suisse, B/H/S: 2/2/0

Ord Minnett expects negative sentiment will weigh on Nickel Mines’ near-term stock price given ties to joint venture partner Tsingshan Holding, following allegations that Tsingshan spiked a nickel price rally as it attempted to address a shortfall.

Nickel prices more than doubled on Monday, reaching more than US$100 per kilogram from US$45 per kilogram, before the London Metal Exchange suspended trading, with limited spot inventory driving the rally.

With reports suggesting the company was short 100,000 tonnes of nickel at the beginning of the year, Ord Minnett predicts losses of -US$2.0-10.0bn but adds the Chinese state has likely already moved to bail out Tsingshan.

The rating is downgraded to Hold from Accumulate and the target price of $1.60 is retained.

Tsingshan Holdings allegedly secured a credit agreement to cover the cost margin requirements that saw the company drive up nickel prices earlier in the week, but Credit Suisse notes Nickel Mines’ market perception impact will likely linger given its relationship with Tsinghshan.

Despite this, large cost base exposure to price rises in nickel ore and coal were already placing pressure on Nickel Mines’ margins. Credit Suisse attributes earnings per share forecast changes to higher unit costs.

The rating is downgraded to Neutral from Outperform and the target price decreases to $1.35 from $1.74.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.