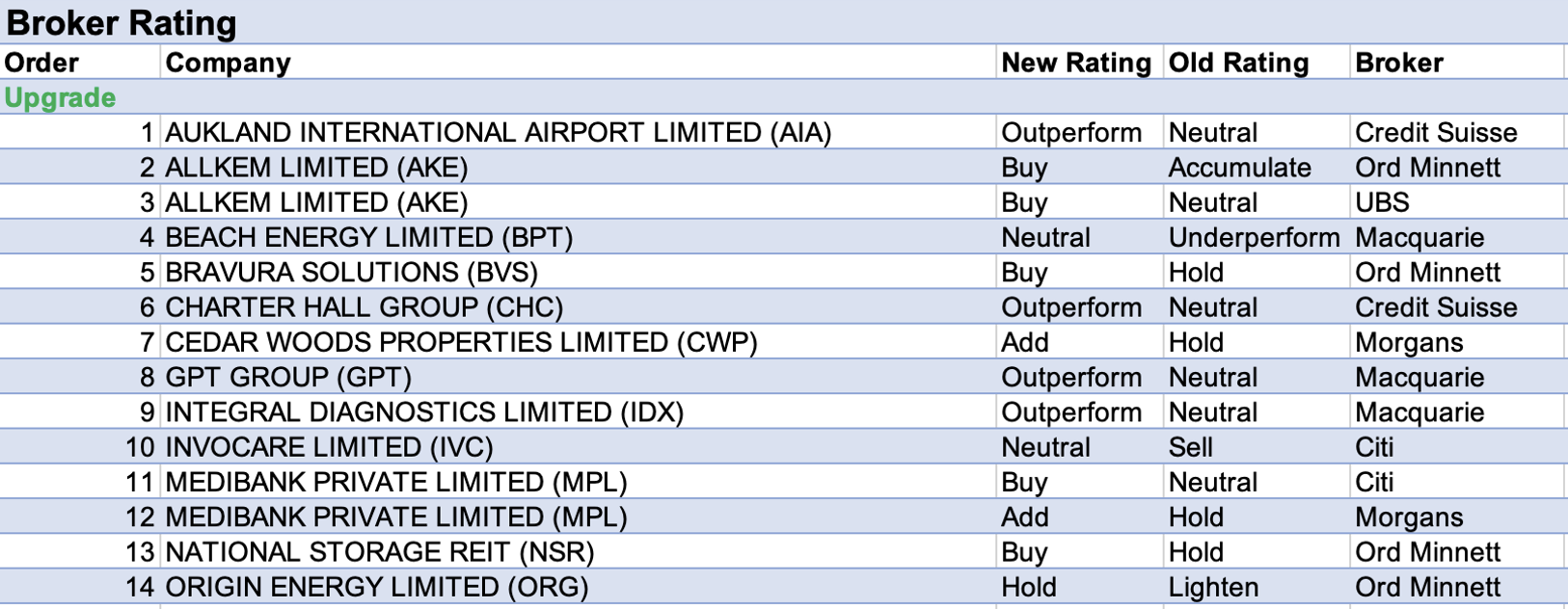

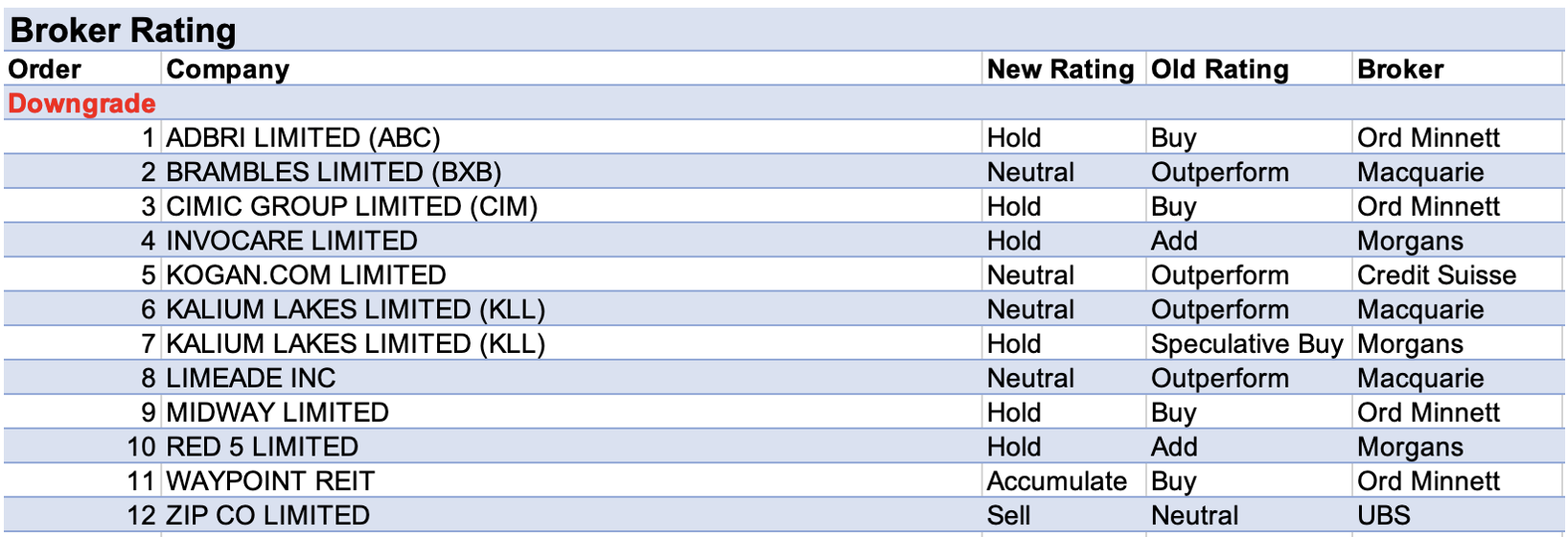

For the week ending Friday March 4, there were 14 upgrades and 12 downgrades to ASX-listed companies covered by brokers in the FNArena database.

Due to technical issues on the FNArena database, the weekly update below does not include the changes in analysts’ earnings forecasts and price targets. FNArena is expecting all technical issues to be resolved in time for next week’s edition of Buy, Hold, Sell.

In the good books

AUCKLAND INTERNATIONAL AIRPORT LIMITED (AIA) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/2/0

Credit Suisse raises its rating for Auckland International Airport to Outperform from Neutral in the expectation of strong post-pandemic travel and the potential for higher pricing.

This comes as the NZ government removes the 10 day self-isolation period for NZ citizens and highly skilled workers, and in anticipation of opening to Australia (July) and the rest of the world in October.

The analyst feels the Commerce Commission may judge airports as higher risk than pre-covid, and allow the company to set higher aeronautical pricing in the next regulatory period. The target price rises to $7.50 from $6.90.

In the not-so-good books

ZIP CO LIMITED (Z1P) was downgraded to Sell from Neutral by UBS, B/H/S: 2/1/2

UBS updates forecasts to allow for Zip Co’s unexpected -$108m negative 1H cash earnings (EBTDA), when the broker had forecast breakeven. In addition, the $150m-$200m capital raising and proposed merger with Sezzle (SZL) are taken into account.

As a result, the target price is slashed to $1 from $5.20 reflecting lower long-term profit forecasts, dilution from the capital raise and the application of a higher discount rate. The latter reflects a longer path to breakeven and overall uncertainty.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.