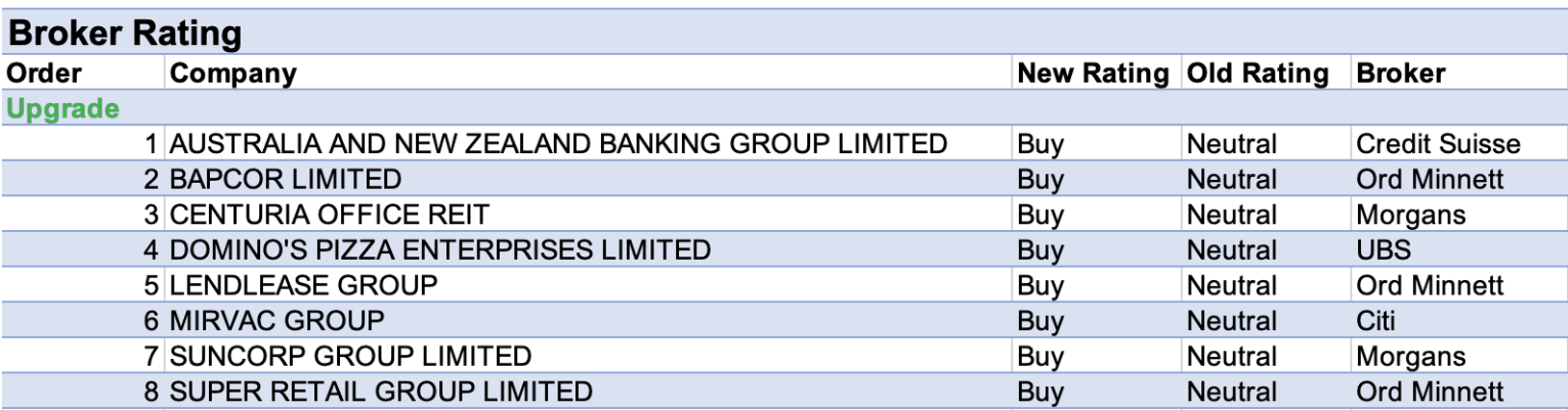

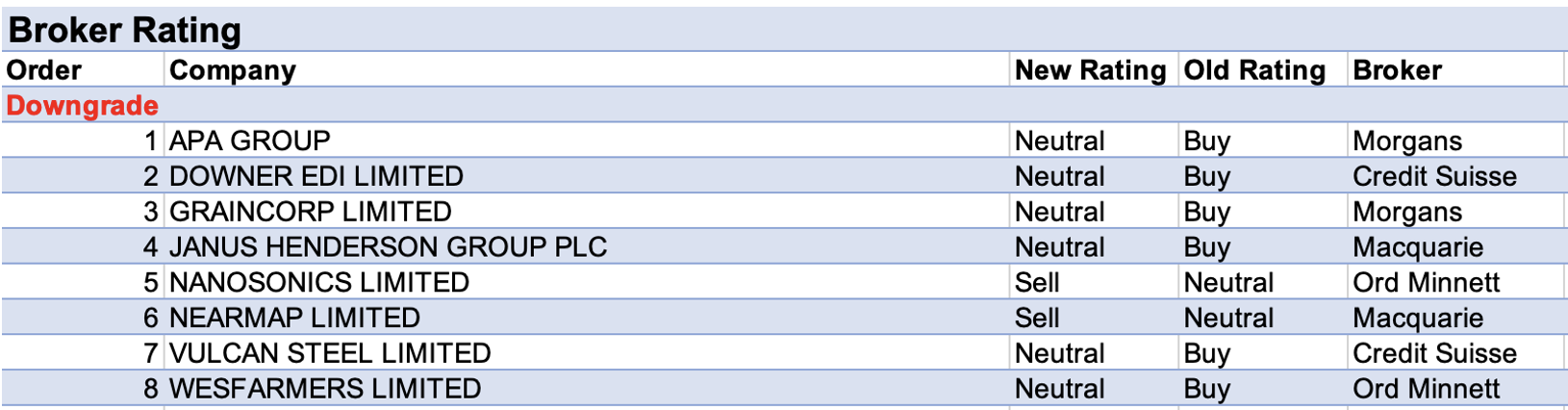

For the week ending Friday February 11, there were an equal number (eight) of upgrades and downgrades to ASX-listed companies covered by brokers in the FNArena database.

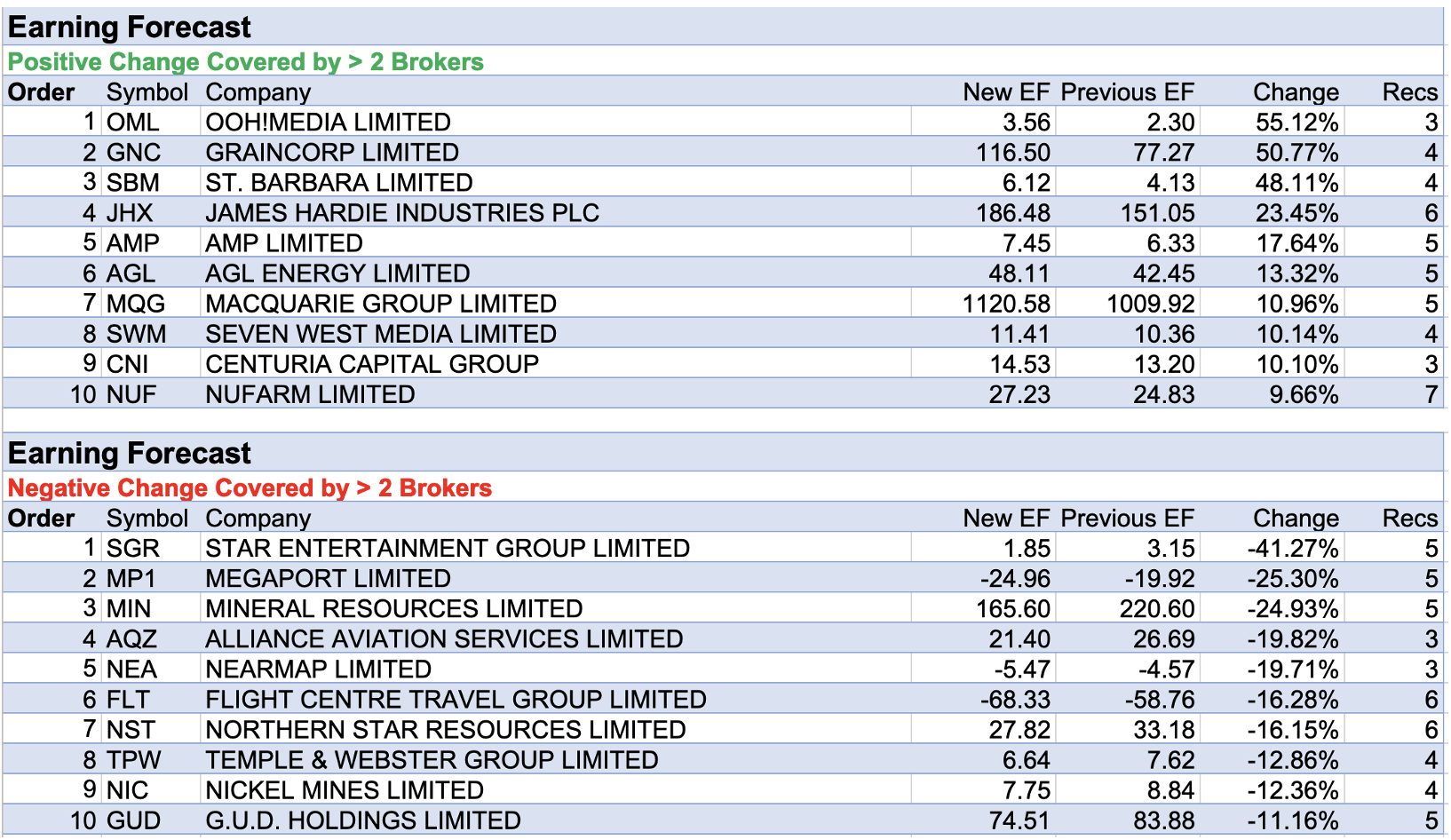

GrainCorp had the largest percentage gain in target price after the guidance range for FY22 earnings and profit were beats of 28-44% and 40-67%, respectively, versus the UBS forecast ranges. The company is experiencing increasing demand and prices for Australian grain during a period of supply challenges in the Northern Hemisphere.

However, Morgans (downgrade to Hold from Add) is wary of near-perfect trading conditions across both grain Marketing and Processing. UBS agrees and suggests the current time probably represents peak-cycle earnings and retains its Neutral rating. Macquarie is more positive and keeps an Outperform rating and lifts it target price by 18% to $9.48.

Meanwhile, Cimic Group had the largest percentage fall in target price last week. The group’s FY21 profit result was less than Macquarie’s forecast and was at the bottom end of prior guidance by management.

The broker keeps a Neutral rating while awaiting increased earnings and the delivery of improved cash conversion, with Leighton Asia the key in that regard. Credit Suisse (Neutral) believes recent contract wins ensure a robust pipeline of work.

Macquarie was responsible for the next biggest percentage fall in target price, after slashing Nearmap’s 12-month target to $1.30 from $2.20 and lowering its rating to Underperform from Neutral.

The analyst sees competition building from peer Aerometix in the A&NZ aerial mapping market, of which Nearmap has an 80% share. For the more fragmented North American market, the broker is concerned about the expenditure (and litigation risk) required to build upon a 3% share.

Nearmap also featured fifth on the list of companies experiencing the largest percentage fall in forecast earnings last week. Leading that unfortunate list was Star Entertainment Group after Macquarie cut its FY22 earnings forecast by -15% in response to a pre-release of first half results.

As indicated by Macquarie’s Outperform rating, there appears no cause for alarm as the market is expected to look through FY22 covid disruptions. UBS (Buy) and Ord Minnett (Accumulate) seem to agree and retain their respective ratings and target prices.

Next up was Megaport, after the release of second-quarter results. While most of the five brokers in the FNArena database are buoyant about the company’s prospects, the spectre of rising interest rates weighs upon Morgans’ view.

Additionally, Ord Minnett voices concerns around an investment for growth, which management expects to bear fruit in the current half though the broker feels FY23 may be more likely.

Mineral Resources reported first-half earnings -50% below Morgan Stanley’s forecast, which was already -16% below the consensus estimate. The miss was due to higher costs and lower revenues for iron ore, and higher costs at Mt Marion (lithium). In addition, management guided to increased capital expenditure across all assets.

Forecast earnings by brokers for Alliance Aviation Services also suffered, following a weaker than expected first-half result and guidance for FY22. Morgans investment thesis, predicated on strong FY23 earnings growth, is still expected. Credit Suisse agrees on the timing for the earnings uplift which should flow from an expanded fleet.

Finally, six brokers in the FNArena database adjudicated on James Hardie’s third quarter and generally agreed results were in-line with expectations. While Morgan Stanley nods approvingly to increased FY22 guidance (and favourable FY23 guidance), the old chestnut of a rising interest rate environment, and its impact on housing activity, is uppermost in thoughts. The broker retains its Equal-weight rating.

Total Buy recommendations take up 58.39% of the total, versus 34.88% on Neutral/Hold, while Sell ratings account for the remaining 6.73%.

In the good books

BAPCOR LIMITED (BAP) was upgraded to Buy from Hold by Ord Minnett, B/H/S: 6/1/0

Bapcor’s December-half result broadly met Ord Minnett’s forecasts, having suffered store closures, higher costs, supply-chain disruptions and investment in a new head office and Victorian distribution centre. The dividend outpaced the broker’s estimate at 10c.

Ord Minnett expects first-half headwinds should dissipate in the June half and spies potential for growth in Trade Auto Parts and Bapcor’s A&NZ store network. The broker also forecasts an uptick in operating margins and leverage through higher own-brand sales and long-term growth prospects in Asia.

Now the worst is out of the way, Ord Minnett upgrades to Buy from Hold and raises the target price to $8.60 from $7.20.

MIRVAC GROUP (MGR) was upgraded to Buy from Neutral by Citi, B/H/S: 5/1/0

Mirvac Group’s first-half result was in line with Citi. FY22 guidance is unchanged given omicron disruptions, as the broker expected, although the market may have been disappointed.

Operationally, the development business is performing well, Citi notes, offsetting near term covid impacts on the investment portfolio. New forecasts reflect higher development profits and lower net operating income.

Target rises to $3.13 from $2.95 on higher property values. On recent share price weakness the broker upgrades to Buy from Neutral.

In the not-so-good books

DOWNER EDI LIMITED (DOW) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 3/2/0

Downer EDI reported earnings of $181.6m in the first half, a miss on Credit Suisse’s forecast $204m, and notably the company retracted previous guidance as covid disruptions to operating conditions continue, making outlook forecasts difficult to determine.

The broker downgrades earnings per share estimates -15-20% for FY22-FY24. While covid impacts are transient, Credit Suisse does not find the stock’s current pricing low enough to reap value once normalisation occurs.

The rating is downgraded to Neutral from Outperform and the target price decreases to $5.40 from $6.50.

VULCAN STEEL LIMITED (VSL) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 1/1/0

A good first half result from Vulcan Steel, with earnings 2% above consensus forecasts, was coupled with a second upgrade to full-year guidance. The company now expects earnings of NZ194-204m, up from NZ$174-184m, and profit of NZ$107-114m, up from NZ$93-100m.

First half cash flow was weak as the company undertook inventory build to safeguard service levels amid supply chain constraint. The broker notes supply chain constraint and rising prices could persist for 6-12 months, and it is wary of where margins will normalise.

The rating is downgraded to Neutral from Outperform and the target price increases to $9.80 from $9.60.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.