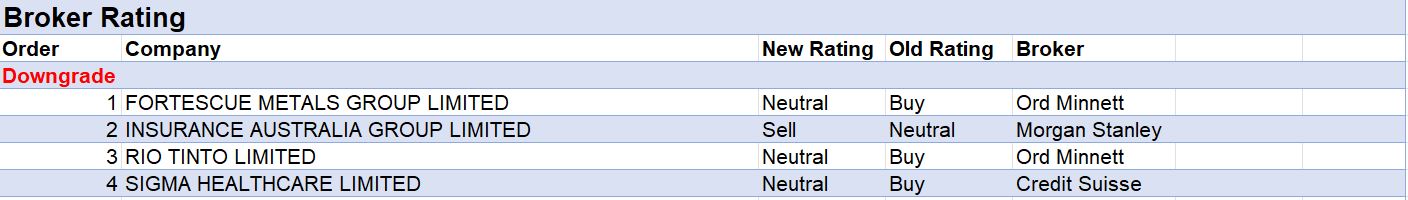

For the week ending Friday December 10, there were eleven upgrades and four downgrades to ASX-listed companies covered by brokers in the FNArena database.

Rio Tinto featured in the tables for both an upgrade and a downgrade to its rating last week.

Morgan Stanley (upgrade to Overweight from Equal-weight) feels most negative news has been factored into a share price that has underperformed rival BHP Group and the ASX200 Materials Index. Risks are also skewed to the upside, considering the broker’s positive view for aluminium and an improving economic and housing outlook in China.

By contrast, Ord Minnett downgraded its rating for Rio Tinto to Hold from Buy, following material reductions to its China steel production assumptions. This resulted in a lowering of iron ore price forecasts by -12% to US$92/t in 2022 and by -10% to US$90/t in FY23. The broker feels continuing operational challenges may prompt marginal investors to prefer other stocks in the sector.

Cooper Energy’s forecast earnings were slashed after management downgraded FY22 earnings and production guidance. According to Morgans, this was due to added costs from a spike in domestic spot gas prices when the company had to source additional third party volumes.

Management also highlighted a two month delay in planned Phase 2B works at Orbost. As bad as all this sounds, the analyst is unconcerned over the temporary nature of current setbacks and maintained its Add rating.

Finally, Redbubble was next on the list for the largest percentage reduction in forecast earnings by brokers last week.

Total Buy recommendations take up 56.81% of the total, versus 36.49% on Neutral/Hold, while Sell ratings account for the remaining 6.70%.

In the good books

EBOS GROUP LIMITED (EBO) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 3/2/0

In a transaction that will substantially accelerate strategy and scale, according to Credit Suisse, Ebos Group has announced the acquisition of LifeHealthcare for -$1.2bn. LifeHealthcare is one of the largest independent distributors of third party medical devices, consumables and capital equipment in Australia and New Zealand, explains the analyst. The company also manufactures allograft material.

There will be a $642m share placement, a $100m retail offer and the balance will be raised by new term loan debt facilities. Credit Suisse estimates the acquisition will be 11% EPS accretive in FY23/24.

IGO LIMITED (IGO) was upgraded to Buy from Neutral by Citi, B/H/S: 2/0/1

Cit has published its annual commodities 2022 Outlook and says that, after five solid quarters of outperformance, it expects the sector to take a breather, setting up a “more diversified sector for 2022 and 2023”. Citi expects energy and bulk commodities will underperform the market and that base metals will outperform.

Iron ore is expected to stage a U-shaped price move next year as China eases credit sales and property bounces back. Citi expects iron ore prices to average US$88/t in the June half and $105 in the second half, before retreating in the longer term to $60/t-$80/t as the seaborne market declines.

Citi also forecasts higher lithium prices but spies cost headwinds as energy inflation, higher feedstock prices, wages and logistics costs kick in.

FY22 earnings forecasts fall 9% but Citi says the discounted cash flow valuation is still strong at $11.30 a share; and admires the balance sheet at $888m net cash.

PERPETUAL LIMITED (PPT) was upgraded to Buy from Neutral by Citi, B/H/S: 4/3/0

Citi sees a potential opportunity after the recent slide in Perpetual’s share price and upgrades its rating to Buy from Neutral and retains its $40.40 target. Among other positives, the broker highlights the company’s strong ESG tilt and new growth opportunities for Corporate Trust.

Management is confident in achieving growth (and has an ongoing interest in acquisitions) and cites positive momentum in all its businesses.

RIO TINTO LIMITED (RIO) was upgraded to Overweight from Equal-weight by Morgan Stanley, B/H/S: 4/2/1

Morgan Stanley feels most negative news has been factored into the current Rio Tinto share price and upgrades its rating to Overweight from Equal-weight and raises its target price to $110.50 from $101.00. In-Line industry view.

The broker feels risks are skewed to the upside with a positive view for aluminium and an improving economic and housing outlook in China. In addition, Morgan Stanley notes shares have underperformed both rival BHP Group ((BHP)) and the ASX200 Materials Index.

SOUTH32 LIMITED (S32) was upgraded to Add from Hold by Morgans, B/H/S: 7/0/0

As Sierra Gorda in Chile nears completion, Morgans incorporates the recently acquired copper operations into forecasts, triggering a rating upgrade to Add from Hold. Moreover, shares offer an attractive dividend yield and there’s potential for new growth.

The Sierra Gorda acquisition is immediately earnings accretive for FY23 notes the analyst, who also cites the company’s superior diversification compared to ASX mining peers. The target price rises to $4.10 from $3.77.

WHITEHAVEN COAL LIMITED (WHC) was upgraded to Buy from Neutral by Citi, B/H/S: 6/0/0

Cit has published its annual commodities 2022 Outlook (see IGO above).

Citi upgrades Whitehaven Coal to Buy from Neutral after the recent strong retreat in the share price. Target price eases to $3.20 from $3.50 to reflect a weaker earnings outlook, the broker forecasting lower thermal coal prices ($110/t from $120/t in CY22; and CY23 unchanged at $75/t).

FY22 earnings forecasts fall -9% but Citi says the discounted cash flow valuation is still strong at $4.40 a share; expects the balance sheet to be net cash; and notes the company is offering a dividend yield of 6.3%.

In the not so good books

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.