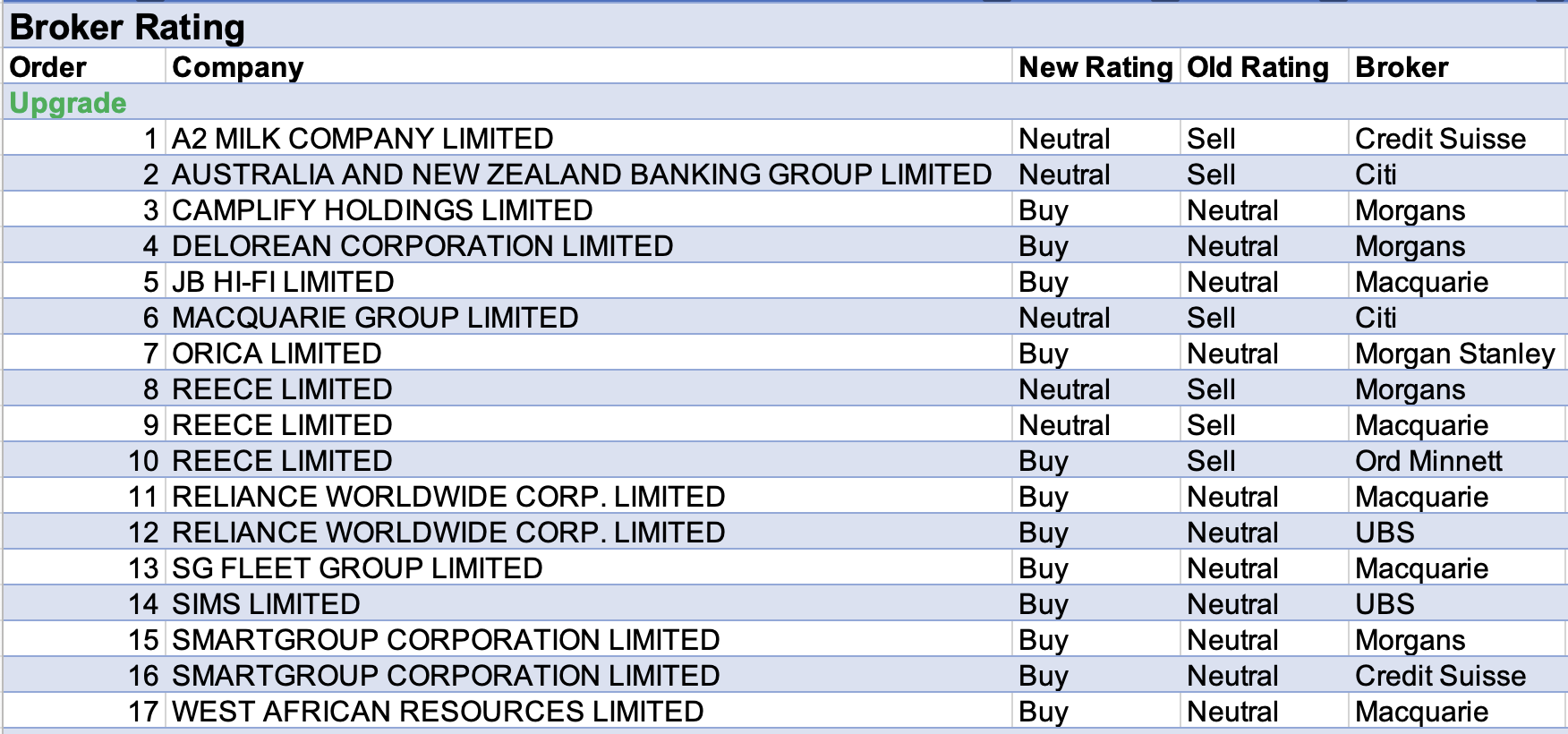

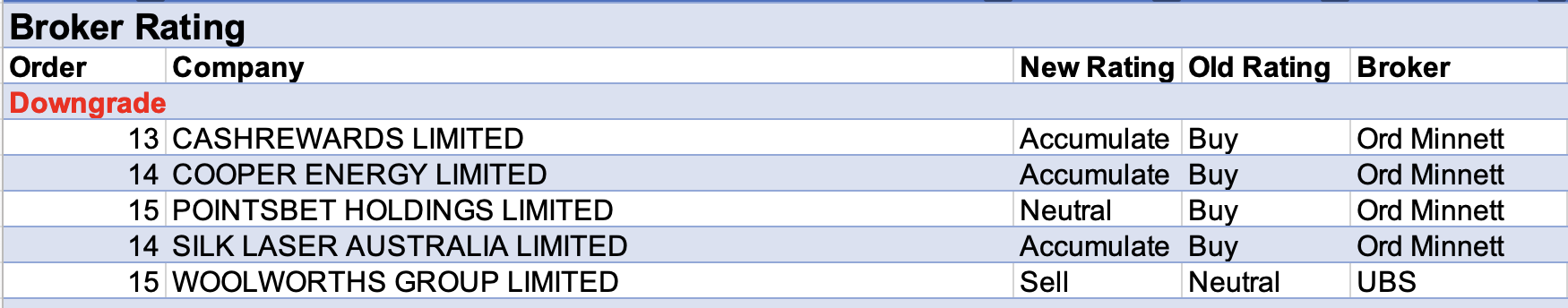

For the week ending Friday October 29, there were 17 upgrades and 5 downgrades to ASX-listed companies covered by brokers in the FNArena database.

During the week there were three ratings upgrades for Reece by separate brokers, while there were two upgrades apiece for Reliance Worldwide Corp and SmartGroup Corp.

Morgans (Upgrade to Hold from Reduce) assessed the first quarter performance of Reece’s US business was much better than expected and the A&NZ business was less impacted by lockdowns than estimated. Ord Minnett (upgrade to Buy from Lighten) agreed and assessed robust growth over the past quarter for both A&NZ and the US. Despite a full valuation, Macquarie (Upgrade to Neutral from Underperform) feels the share price has de-rated sufficiently to suggest it should stabilise from here.

Regarding Reliance Worldwide, Macquarie (upgrade to Outperform from Neutral) assessed trading was solid over the first quarter and the acquisition of the EZ-FLO business adds diversity. Meanwhile, recent market checks suggest to UBS (upgrade to Buy from Neutral) renovations in the US will be robust for the next year.

Last week SmartGroup Corp rejected an amended takeover offer. Despite this, Morgans upgraded its rating to Add from Hold to reflect resilient earnings in the face of lockdowns and expected incremental growth in FY22. Credit Suisse also upgraded (to Outperform from Neutral) and expects a good EPS recovery, with a potential boost from the company’s uplift program by FY24.

There were no material changes to forecast target prices last week.

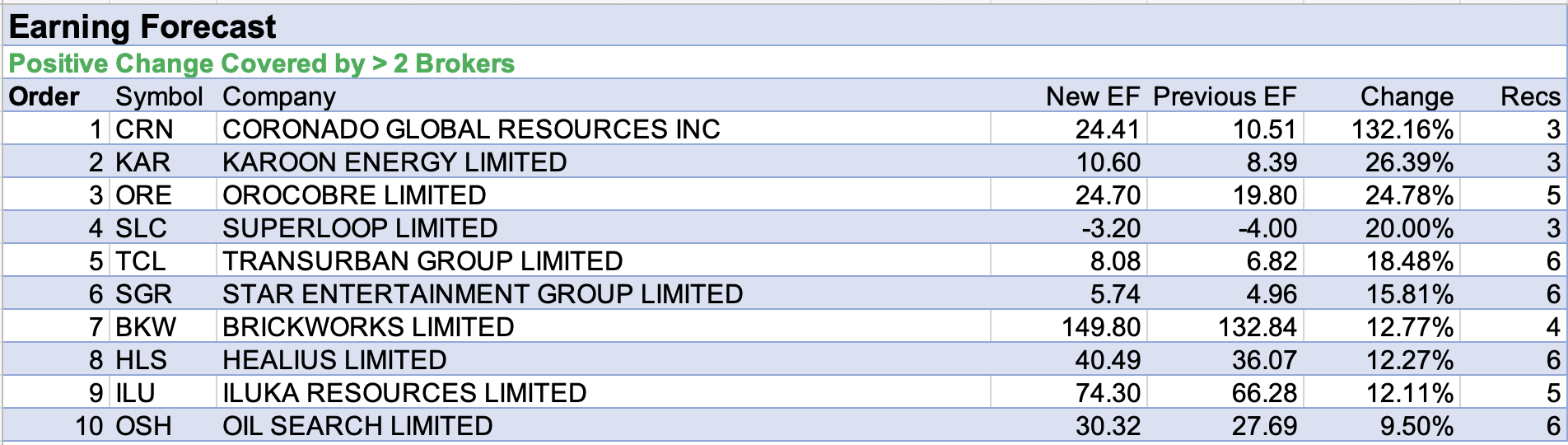

In terms of changes to forecast earnings, Coronado Global Resources received the largest percentage upgrade. Morgans says the investment case for the company is best illustrated by an approaching net-cash position, just months after two recapitalisations. This has been achieved with the help of buoyant metallurgical coal prices and the recent sale of the Amonate asset for US$30m, points out Macquarie.

Karoon Energy had the next largest percentage upgrade to earnings, after September quarter production exceeded Macquarie’s forecast by 9%. Strong cash flows at current spot prices and outperformance from the Buana oil field in Brazil are thought to position the company well for growth investment in 2022.

Orocobre was next after management upgraded price and volume guidance for the Mount Cattlin mine in WA for 2021. Incorporating updated pricing and guidance means a 7% and 3% lift to Macquarie’s FY22 and FY23 forecasts.

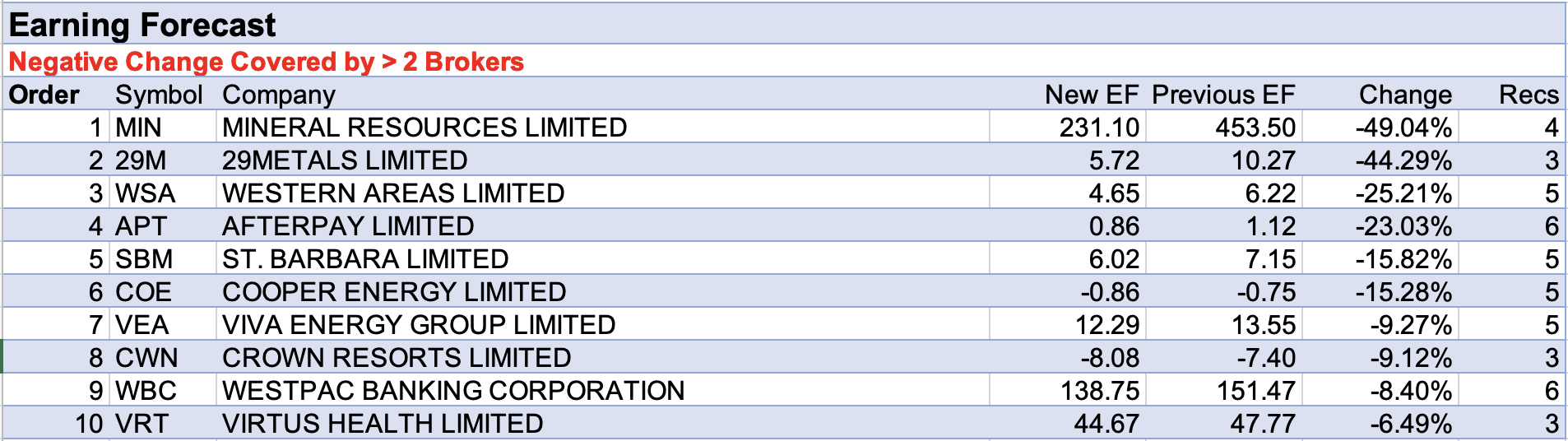

On the flip side, Mineral Resources appeared atop the table for the largest percentage decrease in forecast earnings last week. This came as September-quarter production was weaker than Ord Minnett expected, and the achieved iron-ore price of US$78/t was just 48% of the benchmark. Morgan Stanley also remains concerned about the heavy capital expenditure on low-grade ore projects.

Earnings forecasts were also down for Western Areas, as September quarter nickel production came in -5% below Macquarie’s forecast and costs were 24% higher. The latter is due to tight labour markets and high shipping rates.

Finally, Afterpay had a material fall in earnings forecasts by brokers after the final report from the RBA on Payments Regulation concluded that it would be in the public interest if the “no surcharge” rules of the BNPL sector are prohibited.

Given the company’s reliance on high merchant fees to fund its economics, UBS believes this is a large negative development. Moreover, completion risk may now surround the proposed acquisition by Square.

Total Buy recommendations take up 55.28 % of the total, versus 38.21% on Neutral/Hold, while Sell ratings account for the remaining 6.51%.

In the good books

A2 MILK COMPANY LIMITED (A2M) was upgraded to Neutral from Underperform by Credit Suisse, B/H/S: 2/2/1

Credit Suisse upgrades the a2 Milk Company to Neutral from Underperform to reflect rising English Label sales and more ambitious market-share targets for China.

Still the total market is declining, risk remains with the company’s ambitions in China (from a reduction in newborns and government regulation), and the company has a long road to hoe, although much of this is priced in, says the broker.

EPS forecasts fall roughly -3% in FY22 and rise 3% and 12% in FY23 and FY24.

Target price rises to $5.75 from $5.50.

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ANZ) was upgraded to Neutral from Sell by Citi, B/H/S: 2/4/0

Citi upgrades its rating for ANZ Bank to Neutral from Sell and raises its target to $29.25 from $28 following FY21 results. The analyst likes the improved revenue outlook and sees strong leverage to a steepening yield curve. Institutional volume growth has also resumed.

The analyst upgrades cash earnings forecasts by circa 15%. Half of this is attributable to lower bad debts and the balance from improved core earnings.

CAMPLIFY HOLDINGS LIMITED (CHL) was upgraded to Add from Hold by Morgans, B/H/S: 1/0/0

Morgans raises its target price to $5 from $4.20 and upgrades its rating to Add from Hold for Camplify Holdings after an agreement was struck to buy Mighway and SHAREaCAMPER for -$7.4m, in an all-scrip transaction from Tourism Holdings.

The analyst notes the transaction sets up the company to be the dominant peer-to-peer (P2P) RV platform in A&NZ. A strategic relationship with Tourism Holdings is also thought to confer additional marketing and revenue benefits.

DELOREAN CORPORATION LIMITED (DEL) was upgraded to Speculative Buy from Hold by Morgans, B/H/S: 1/0/0

Morgans thinks Delorean Corp may be well positioned to capture a slice of the potentially large market for biomethane in Australia, following an announcement with Brickworks ((BKW)). The rating is lifted to Speculative Buy from Hold.

A memorandum of understanding has been entered into, in an attempt to alleviate Brickworks gas consumption and carbon footprint. The broker feels this presents a sizeable growth opportunity and raises its target price to $0.275 from $0.20.

JB HI-FI LIMITED (JBH) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 3/2/1

The JB Hi-Fi business and The Good Guys business were hit by 55% of stores closed over the September quarter but improving sales trends have been evident since the August update, Macquarie notes. The NZ business remains weak.

But lockdowns have simply held up demand so the broker expects a big surge into Christmas, albeit with a caveat of possible supply chain issues. Looking further out, uncertainty hangs over electronics demand in a vaccinated world.

Macquarie nevertheless upgrades to Outperform from Hold. Target unchanged at $52.50.

REECE LIMITED (REH) was upgraded to Neutral from Underperform by Macquarie, to Buy from Lighten by Ord Minnett and to Hold from Reduce by Morgans, B/H/S: 1/2/2

A trading update at the Reece AGM revealed revenue growth was stronger than expected but investment in the US network, inflation and supply side issues are weighing on margins, Macquarie notes. These issues lead management to warn of assuming another solid quarter.

But the share price has de-rated sufficiently for the broker to suggest it should stabilise from here, while still fully valued. Upgrade to Neutral from Underperform, target falls to $18.40 from $18.80.

Ord Minnett lifts its rating to Buy from Lighten and raises its price target to $21.50 from $18. Robust growth was assessed for both A&NZ and the US.

In the US, sales growth increased 18.6% (in USD), more than double the analyst’s forecast, while revenue in A&NZ came in at 9% compared to the 5% forecast by Ord Minnett.

Management has flagged a step-change in both operating expenditure and capital expenditure, in search of market share growth across the sunbelt states of America.

Morgans was pleasantly surprised in a number of ways from Reece’s 1Q trading update, as group revenue rose 13% versus the broker’s expectation for -4% for the 1H. The rating is upgraded to Hold from Reduce and the target price climbs to $18.83 from $14.30.

The performance of the US business was much better than expected by the analyst, and the A&NZ business was less impacted by lockdowns than estimated.The broker lifts FY22-24 earnings (EBITDA) forecasts by between 9-14%.

RELIANCE WORLDWIDE CORP. LIMITED (RWC) was upgraded to Buy from Neutral by UBS, B/H/S: 5/1/0

UBS observes Reliance Worldwide is benefiting from a strong environment, with recent market checks suggesting renovations in the US will be robust for the next year.

UBS assumes the trend continues into FY23 which will also benefit from the acquisition of EZ-FLO and result in synergies. The broker believes this is a logical expansion into adjacencies for the company.

Rating is upgraded to Buy from Neutral, given the recent underperformance in the share price, and the target is raised to $6.20 from $5.90.

WEST AFRICAN RESOURCES LIMITED (WAF) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/0/0

West African Resources will buy the 6.8m ounces Kiaka project for US$100m and raise $126m to support the transaction. Macquarie envisages an 11.5-year mine life for Kiaka, producing 254,000 ounces per annum at an all-in sustainable cost of US$1213/oz.

Significantly, previous work done on the project reveals a conventional cyanide leach plant will be sufficient for about 90% recovery.

This has potential to be a meaningful asset, the broker asserts, and upgrades to Outperform from Neutral. Target is raised to $1.60 from $1.50.

In the not-so-good books

COOPER ENERGY LIMITED (COE) was downgraded to Accumulate from Buy by Ord Minnett, B/H/S: 2/2/1

Ord Minnett found Cooper Energy’s September-quarter update but a “mixed” affair as both production and realised pricing missed the mark.

On the positive side, the troubled Orbost operation is finally showing improvement in operations. The broker has made only minor amendments.

Target price remains 33c but as the share price has moved higher, the recommendation shifts to Accumulate from Buy.

POINTSBET HOLDINGS LIMITED (PBH) was downgraded to Hold from Buy by Ord Minnett, B/H/S: 1/1/0

Following a trading update by Pointsbet Holdings, Ord Minnett points to only a -1% miss on US customer numbers though average turnover per active customer was only $2,019. Management feels increasing competition is to blame for a loss of market share.

Due to that risk of competition, the broker lowers its rating to Hold from Buy and slices its target price to $8.80 from $13.10.

New Jersey market share fell to 3.9% in the quarter from 7.8% in the June quarter. More positively, the Australian business was 10%

ahead of the analyst’s expectation at the net win line.

WOOLWORTHS GROUP LIMITED (WOW) was downgraded to Sell from Neutral by UBS, B/H/S: 1/4/2

UBS has downgraded Woolworth’s Group to Sell from Buy (double downgrade) as the latest market update revealed more signs of a broad slowing for food retailing in Australia.

Woolworths’ main competitor, Coles (COL), was already rated Sell.

UBS sees margin pressure on the horizon, and a share price at elevated level. The sector as a whole is facing de-rating, predicts the broker. Target drops to $37 from $40.

Only minor changes have been made to forecasts.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.