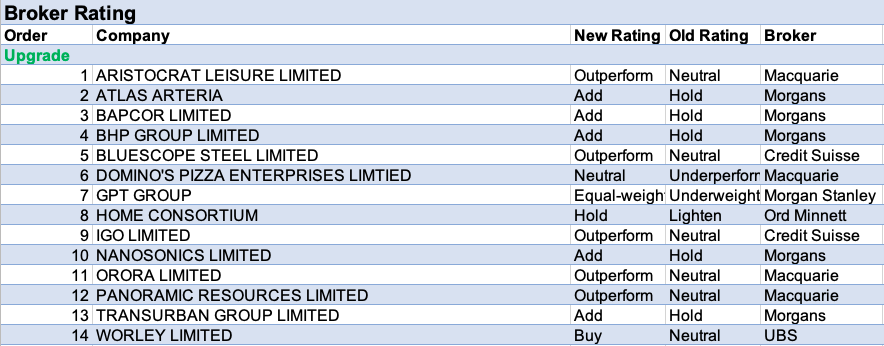

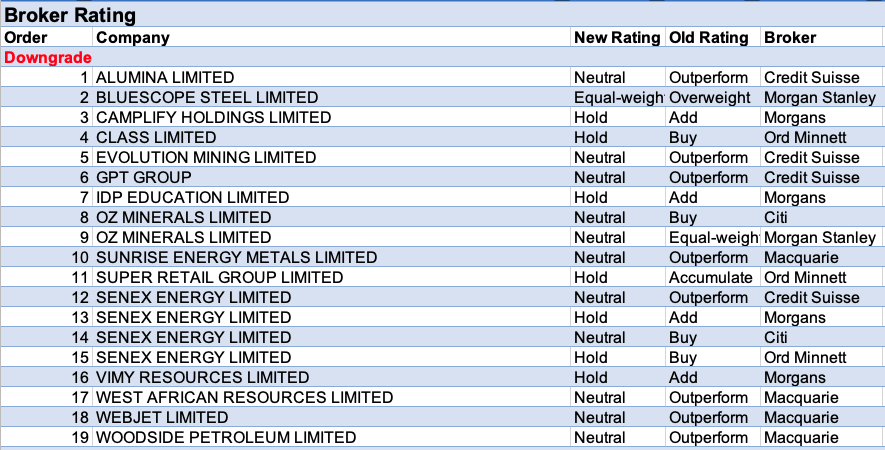

For the week ending Friday October 22, there were 14 upgrades and 19 downgrades to ASX-listed companies covered by brokers in the FNArena database.

There was only one material change to forecast target prices. Aristocrat Leisure received the largest percentage upgrade by brokers after making an offer for UK online gaming software provider, Playtech. The transaction is worth $5bn, to be funded by cash, debt and equity.

Macquarie considers the potential acquisition highly complementary to the company’s existing business and has upgraded its rating to Outperform from Hold. Morgans agrees and feels the transaction creates an opportunity to get to scale quickly in a market segment forecast to grow at a double digit rate over the next five years.

Meanwhile, Audinate Group had the largest percentage decrease in forecast earnings last week. This came after news of a supply shortage of silicon chips used in products that have historically accounted for 43% of Audinate’s revenue. All three covering brokers in the FNArena database consider this situation to be transitory.

29Metals was next after the September quarter featured weak production at Golden Grove, offsetting a better result at Capricorn Copper, according to Macquarie. Management has nonetheless retained 2021 production guidance though the broker believes costs will be higher than guidance suggests.

More positively, the analyst believes grades at Golden Grove should lead to significant improvement in earnings and cash flow in the December quarter. Credit Suisse, likewise is upbeat, and suggests the company offers the best value copper play on the ASX.

Zip Co was next as first quarter revenue revealed a negative impact in the US from rebranding and Macquarie noted implied growth rates in September were well below those disclosed as part of FY21 results. Australasian growth is also considered to have moderated. Morgans is also cautious, and believes the FY22 consensus revenue forecast will be hard to achieve and downgrades both its FY22 and FY23 EPS forecasts.

By initiating coverage on Nickel Mines, Ord Minnett effectively lowered what is now a four-broker average forecast earnings figure derived from the FNArena database. The broker begins with an Accumulate rating and a $1.10 target price. The miner is considered a unique Indonesian nickel pig iron producer that is generating significant cash flow.

On the flipside, Coronado Global Resources had the largest percentage increase in forecast earnings last week. Commenting after soft September quarter coal sales, Macquarie noted buoyant prices continue to drive earnings and valuation upside, with current spot prices suggesting an 85% free cash flow yield. Credit Suisse expects future increases in US domestic contract pricing will increase earnings by as much as US$230m in 2022, and lifts its target price to $2.00 from $1.60.

Both Whitehaven Coal and New Hope Coal featured in the table for material rises in forecast earnings and it seems the common factor is Macquarie. The broker revisited the investment theses for coal miners after reports that China is studying intervention measures and price caps.

The broker is forecasting a retraction in coal prices though considers present upside is material and maintains a positive view on both companies, which are enjoying free cash flow yields of more than 20% on the analyst’s forecasts.

In another positive for Whitehaven Coal, its September quarter production report suggests to Morgans there’s upside risk to the broker’s base-case FY22 price forecast.

Finally, brokers generally put aside the slightly disappointing third quarter results for Alumina Ltd, as alumina prices have climbed sharply after the end of the quarter to around US$480/t. This suggests to Citi that margins will be strong in the fourth quarter. Morgan Stanley agrees and notes that while third quarter costs were a 6% miss versus the broker’s estimate, this was largely driven by production disruptions.

Total Buy recommendations take up 54.68 % of the total, versus 38.54% on Neutral/Hold, while Sell ratings account for the remaining 6.77%.

In the good books

BLUESCOPE STEEL LIMITED (BSL) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 4/2/0

Bluescope Steel has increased first half earnings before tax guidance by $300m to $2.1-2.3bn, in a move that Credit Suisse notes was largely anticipated.

The broker noted around $160m of the earnings increase was driven by US North Star spreads, reportedly US$570 per tonne compared to a modeled US$420 per tonne. Credit Suisse expects current trends to continue into 2022, with strong demand already predicted.

An additional $120m of the earnings increase was attributed by the broker to higher volumes and improved margins in Australian Steel.

The rating is upgraded to Outperform and the target price increases to $28.30 from $26.00.

DOMINO’S PIZZA ENTERPRISES LIMITED (DMP) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 0/4/1

Domino’s Pizza Enterprises reiterated its European long-term store target at the 2021 Europe Investor Day.

Macquarie expects store ramp-ups in December and June but says covid headwinds persist, including lack of tourism, labour shortages, inflation and social distancing restrictions.

The broker revises down EPS forecasts -2.5% for FY22, but raises FY23 and FY24 forecast 4.3% and 2.8% expecting covid headwinds to dissipate.

Target price rises to $132.50 from $113.00.

The broker upgrades to Neutral from Underperform, thanks to the recent share price retreat.

NANOSONICS LIMITED (NAN) was upgraded to Add from Hold by Morgans, B/H/S: 1/1/1

Morgans upgrades its rating for Nanosonics to Add from Hold as there is more than 15% upside to its target price, which has been lowered to $6.97 from $7.26. The lower target comes as the analyst realigns its cost base in-line with management guidance.

By increasing the cost-base forecast to $90m from $82.5m, the broker’s profit forecast falls to $10.8m from $15.3m. A continued investment in R&D helps underpin the long-term growth prospects in the business, believes Morgans.

ORORA LIMITED (ORA) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/6/0

Orora reiterated full year growth guidance at its AGM and announced a new $150m buyback.

First half earnings for Australian beverages are expected to decline due to the loss of Chinese wine sales. The company has done a good job of replacing that market, Macquarie notes, but the impact will take a while to flow though.

Solid demand and well managed costs should deliver growth in North America earnings.

The broker upgrades to Outperform from Hold on a forecast total shareholder return of 16% and a PE discount to market. Target unchanged at $3.60.

PANORAMIC RESOURCES LIMITED (PAN) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 2/0/0

Panoramic Resources has reported its first concentration milestone three weeks ahead of schedule and is on track for a December shipment, reports Macquarie.

The broker expects the miner will now turn its attention to exploration at Savannah.

Macquarie upgrades to Outperform from Neutral, given the risk profile is much lower.

Target price rises 22% to 28c from 23c.

In the not-so-good books

CAMPLIFY HOLDINGS LIMITED (CHL) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

After a first quarter update by Camplify Holdings, Morgans increases its target price to $4.20 from $1.99 though reduces its rating to Hold from Add, due to the share price tripling since IPO.

The analyst highlights continued growth in Australia led by Queensland and WA, while the UK and Spain are showing promising early momentum post covid restrictions. There’s considered a prodigious growth opportunity and the analyst likes the business model.

OZ MINERALS LIMITED (OZL) was downgraded to Neutral from Buy by Citi and Equal-weight by Morgan Stanley, B/H/S: 2/2/1

Oz Minerals’ September-quarter production was robust and Citi raises net profit estimates for 2021 by 3%. Still, the share price is up 20% over two weeks so the broker downgrades to Neutral from Buy. Target is reduced to $27.00 from $27.50.

Growth projects are going forward with the expansion of the shaft mine at Prominent Hill’s Wira commencing and the West Musgrave study progressing. September-quarter copper production rose 3% despite a lower contribution from Carrapateena.

Oz Minerals’ third quarter update revealed higher-gold-grade stockpiles at Prominent Hill, which led to a guidance upgrade for gold production and group all-in sustaining costs (AISC).

Morgan Stanley points to lower copper grades at Carrapateena and lower mining grades and tonnages at Prominent Hill. Equal-weight rating is maintained. Target is steady at $23.50. Industry view: In-Line.

SUPER RETAIL GROUP LIMITED (SUL) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 4/3/0

Ord Minnett downgrades Super Retail Group’s rating to Hold from Accumulate after assessing a full valuation and sees downside risk of up to -7% for consensus earnings forecasts. This comes despite like-for-like sales growth being thought resilient in the first 16 weeks of the first half.

The analyst believes gross margins have likely peaked at 48% in FY21 and expects them to moderate by -70bps per year over the next two years. The return of promotions and increased logistics costs are cited as the main causes. Target price rises to $14.20 from $14.

WEBJET LIMITED (WEB) was downgraded to Neutral from Outperform by Macquarie, B/H/S: 2/5/0

Macquarie downgrades Webjet to Neutral from Outperform in response to recent share-price strength. Target price rises to $6.65 from $6.45.

Webjet’s annual general meeting tells Macquarie that global uncertainty persists but signs of a strong and instant recovery have featured where borders have re-opened (international leisure bookings now outpace domestic bookings)

The broker pushes out the growth profile 6-9 months to reflect A&NZ border closures. Several countries are profitable or approaching break-even.

EPS forecasts rise 15% and 4% for FY22 to FY24.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.