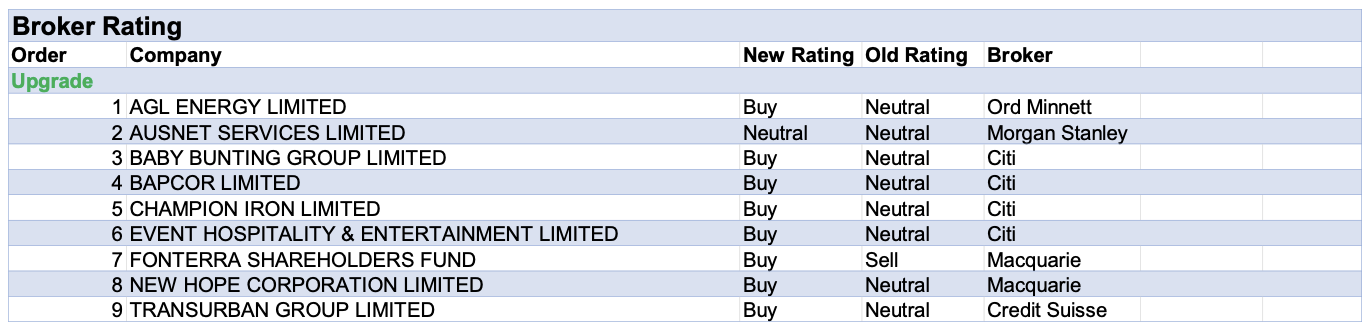

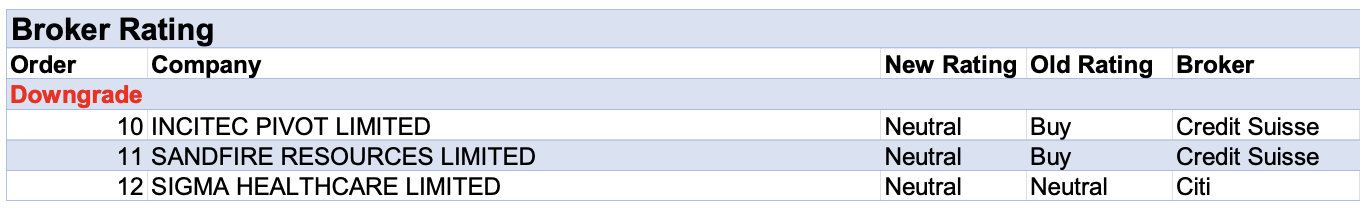

For the week ending Friday 24 September, there were nine upgrades and three downgrades to ASX-listed companies covered by brokers in the FNArena database.

Sandfire Resources had the largest percentage fall in target price last week after announcing the acquisition of the MATSA underground copper mine and production plant project in Spain for $2.6bn. This will add around 110,000 tonnes per annum copper production in FY22 and will be funded by a $1.2bn equity raising, $1.1bn in debt and existing cash. Credit Suisse estimates the deal may be -30% dilutive to shareholders and downgrades its rating to Neutral from Outperform.

Meanwhile, New Hope Corp had the largest forecast percentage rise in both target price and earnings by brokers in the FNArena database, after a FY21 result that was largely in line with expectations. Nonetheless, Credit Suisse reacted by lifting its coal price forecasts, which in turn increased FY22 earnings estimates by 29%. Assuming no M&A or major investment in the near-term, Morgans sees upside for both capital and shareholder returns.

Next up was Transurban Group after announcing a $5.6bn acquisition cost for a 49% stake in WestConnex via a 1-for-9 entitlement offer at $13 to raise $4.2bn. Ord Minnett considers the transaction is positive, given the group’s expertise, intimate knowledge and control of the asset. Management emphasised the acquisition will mean a further $600m in capital is released in coming years that will be used to offset dilution caused by the acquisition.

The largest percentage fall in forecast earnings by brokers in the FNArena database last week went to Premier Investments. The final dividend of 46cps was below consensus of 54.7cps and the forecast for 64.5cps by UBS. Retail earnings margins were also slightly lower than the analyst’s forecast. Morgan Stanley feels earnings growth in FY22 is looking increasingly challenged due to lockdowns, lower demand and lower margins.

Upgrade

AGL ENERGY LIMITED (AGL) was upgraded to Buy from Hold by Ord Minnett .B/H/S: 1/2/2

With shares now trading below the estimated value for AGL Australia (Retail) alone, Ord Minnett upgrades its recommendation on AGL Energy to Buy from Hold, while the target price reduces to $7.55 from $7.80.

The company remains committed to separating its business into retail and generation (Accel Energy) by mid-2022.

While the broker sees potential for strong corporate appeal in AGL Australia, there’s likely to be very little interest in Accel Energy. This is because of its exposure to coal, its leverage to wholesale prices and its sizeable rehabilitation costs, explains the analyst.

BAPCOR LIMITED (BAP) was upgraded to Buy from Neutral by Citi .B/H/S: 5/1/0

Citi considers the risk/reward trade-off has become favourable now the share price has declined substantially from its August peak. The emergence from lockdowns in NSW and Victoria should start from October and the company obtain a benefit.

Rating is upgraded to Buy from Neutral and the target raised to $8.25 from $8.20.

FONTERRA SHAREHOLDERS FUND (FSF) was upgraded to Outperform from Underperform by Macquarie .B/H/S: 1/1/0

Fonterra reported towards the top end of the guidance range and better than the last update implied. The last quarter was nevertheless slight loss-making, Macquarie notes, on lower milk prices.

The company has revealed its long-term strategy, targeting 40-50% underlying earnings growth by FY30, which would drive around a 75% increase in earnings per share, the broker calculates.

This is driven by increased focus on value-add, including “Active Living”, supported by higher capital investment and ramp up in R&D spending. On this positive outlook, and on current valuation, the broker double-upgrades to Outperform from Underperform.

Target rises to NZ$4.28 from NZ$4.25.

Downgrade

SANDFIRE RESOURCES LIMITED (SFR) was downgraded to Neutral from Outperform by Credit Suisse .B/H/S: 2/3/0

Sandfire Resources’ acquisition of the Aguas Tenidas copper/polymetallic mining complex for $2.64bn is expected to close in the March quarter. Credit Suisse notes the transaction is expected to add around 110,000 tonnes per annum copper production in FY22.

It is Credit Suisse’s view that the acquisition presents a dilution risk, estimating the deal may be 30% dilutive to shareholders.

The rating is downgraded to Neutral from Outperform and the target price decreases to $6.00 from $7.70.

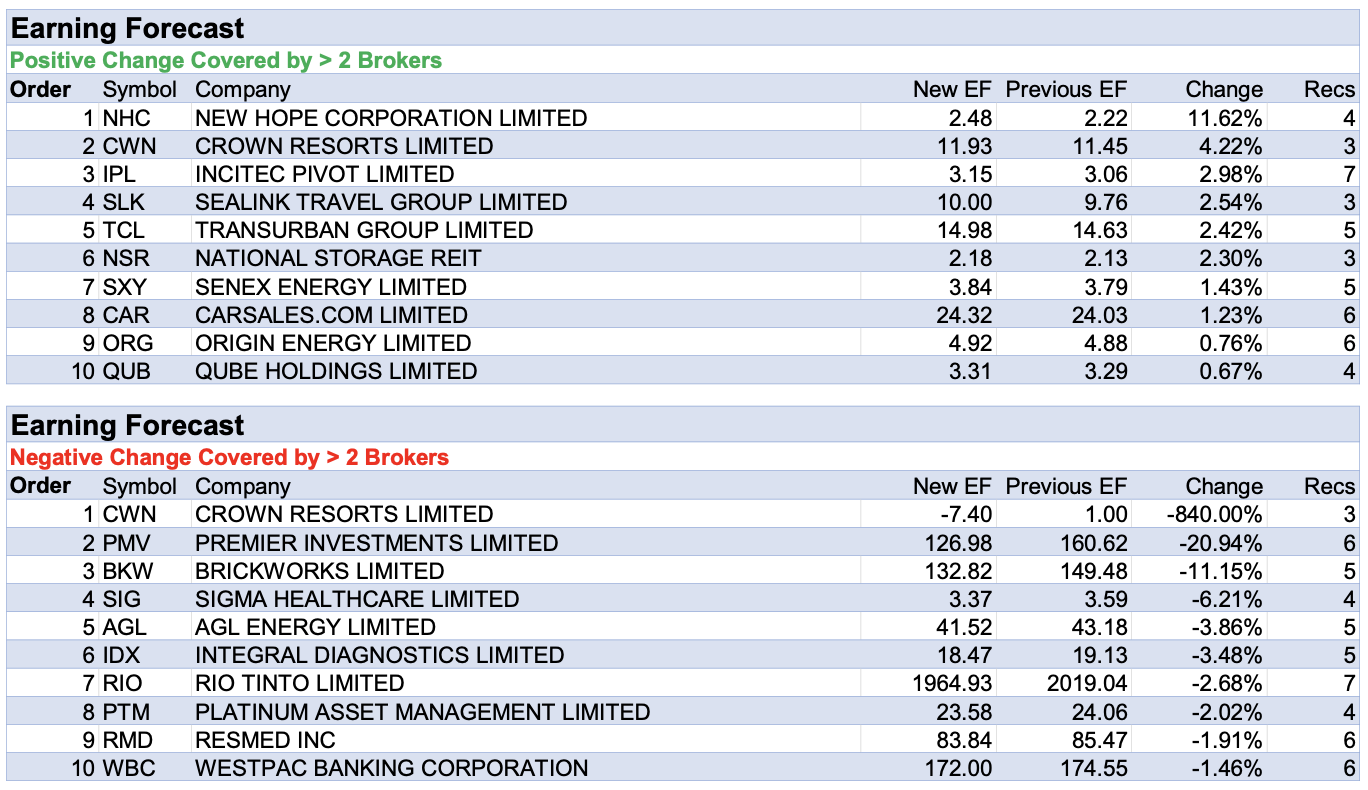

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances