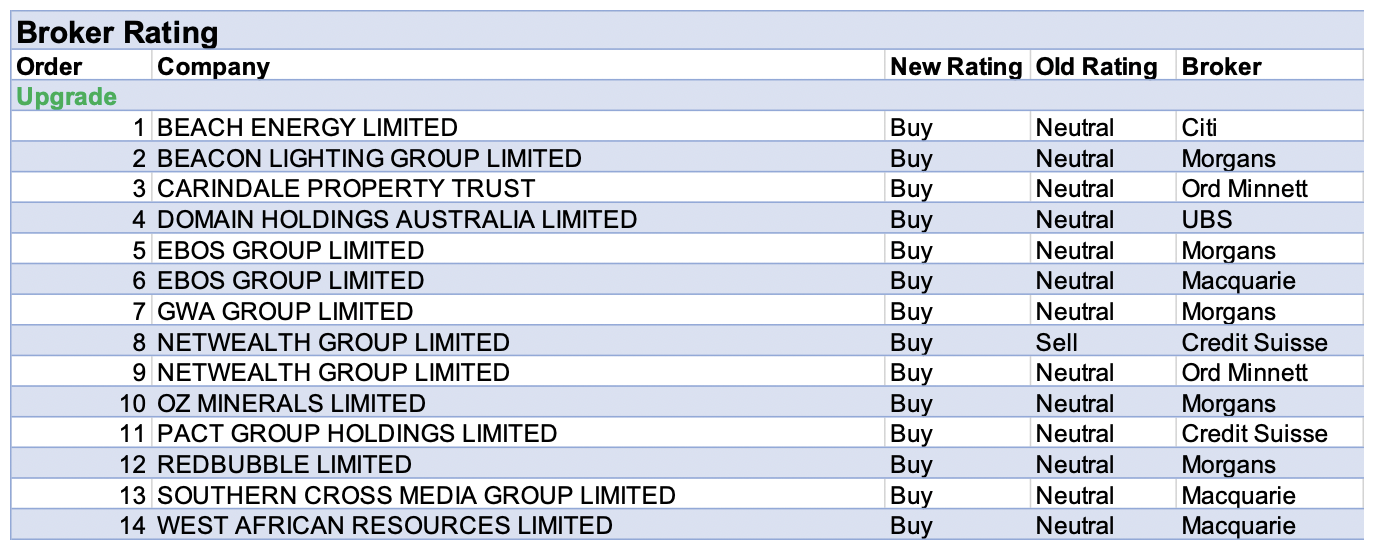

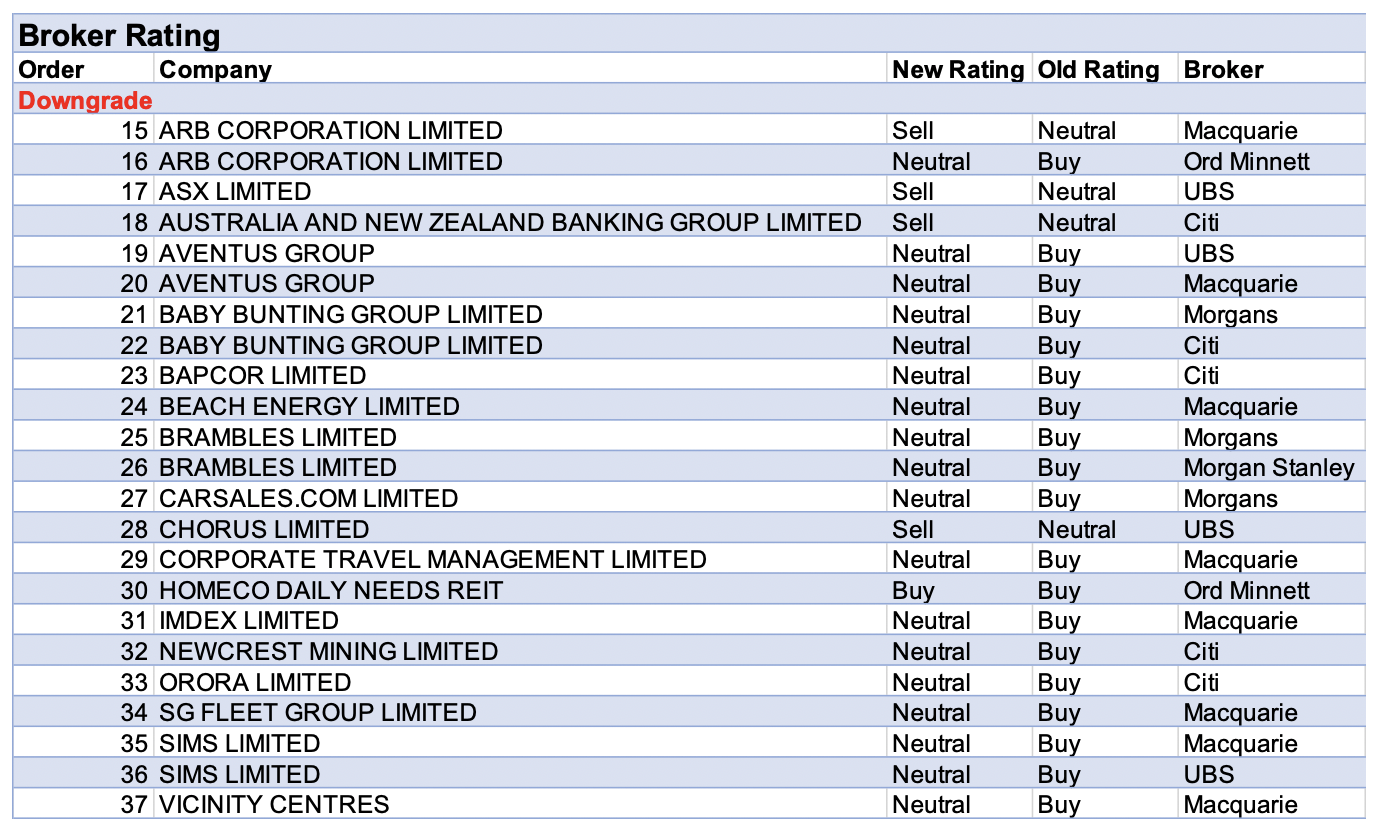

For the week ending Friday 20 August, there were 14 upgrades and 23 downgrades to ASX-listed companies by brokers in the FNArena database.

There were several companies which received ratings changes from two separate brokers. Ebos Group and Netwealth Group had twin ratings upgrades while ARB Corp, Aventus Group, Baby Bunting, Brambles and Sims experienced dual downgrades.

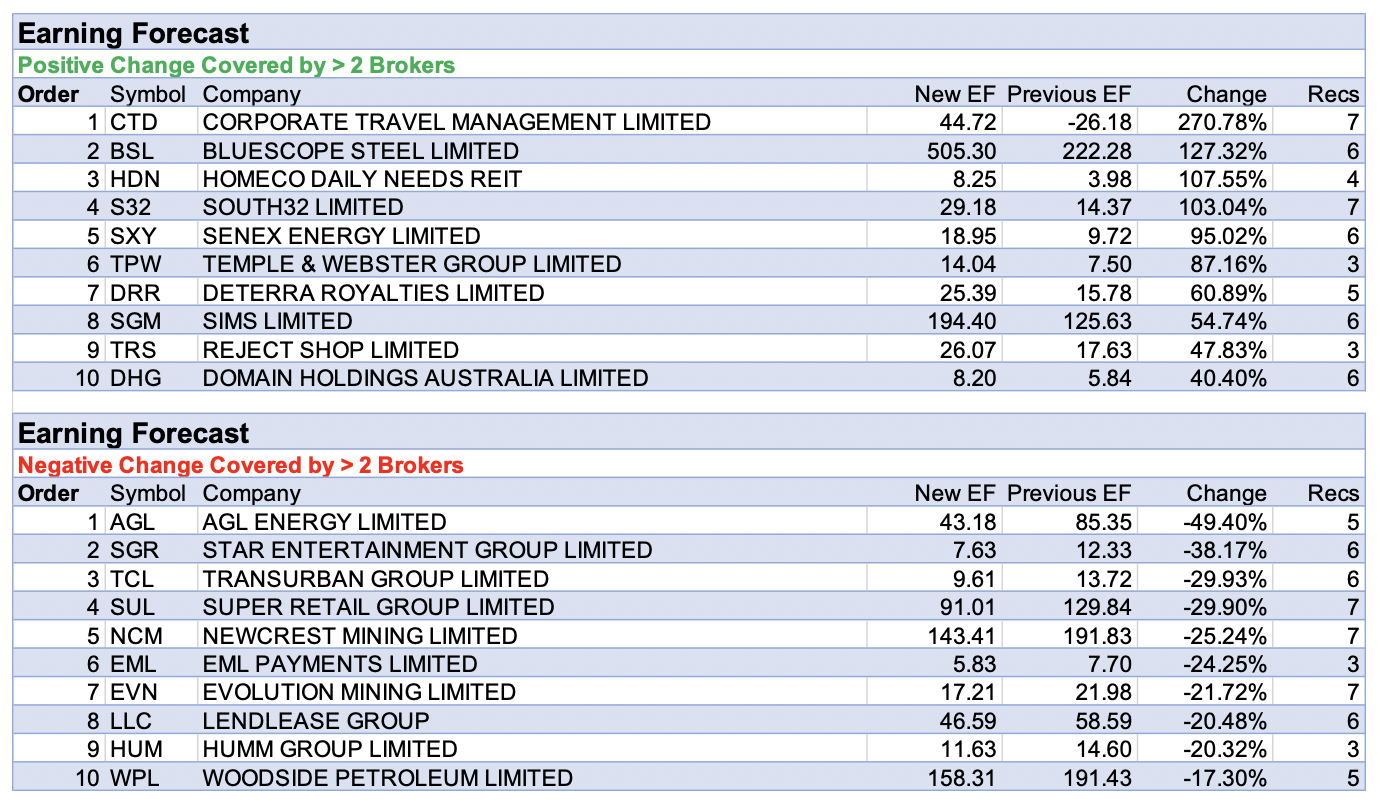

Corporate Travel Management had the largest percentage earnings upgrade last week, after revealing a strong fourth quarter. Credit Suisse can see upside to consensus FY23 earnings, an undemanding valuation, and the likelihood of more M&A, while Ord Minnett forecasts improving margins and efficiency improvements.

Macquarie, the most negative of all seven brokers that cover the stock in the FNArena database, downgraded its rating to Neutral from Outperform due to heightened risk from the delta variant, while also pointing out activity in both North America and Europe picked up in the fourth quarter, with revenue increases of 48% and 84%, respectively.

Next up was BlueScope Steel. Morgan Stanley noted an in-line FY21 result, a significantly higher dividend and a $500m buyback, but the key surprise was guidance around 50% ahead of consensus expectations. As a result, Macquarie also highlighted a strong upcoming first half and lifted FY22 and FY23 EPS estimates by 28% and 8%.

AGL Energy had the largest percentage earnings downgrades by brokers in the FNArena database last week. As mentioned in last week’s article, FY22 guidance for underlying profit fell -36% short of Morgans’ expectation and Morgan Stanley anticipates near-term underperformance for the stock. Meanwhile, UBS still expects margin compression as east coast gas prices are expected to rise through to FY23-24 as supply tightens.

Coming second on the list for earnings downgrades last week was Star Entertainment Group, though brokers were accentuating the positives. While FY21 results were below UBS forecasts there was continued strength in trading conditions in Queensland, which delivered a record profit. Macquarie maintained its Outperform rating and can envisage a pathway in which leverage drops below 2 times in FY23, allowing dividends to be reinstated.

In the good books

BEACON LIGHTING GROUP LIMITED (BLX) was upgraded to Add from Hold by Morgans B/H/S: 2/0/0

FY21 results demonstrate the significant potential of the company’s push into the trade market, Morgans asserts. Net profit was up 69%. The broker suspects earnings will normalise in FY22, although not as much as consensus assumes, and then resume a positive growth trend in FY23. Morgans transfers coverage to another analyst and upgrades to Add from Hold. Target is raised to $2.30 from $2.01.

CARINDALE PROPERTY TRUST (CDP) was upgraded to Buy from Hold by Ord Minnett B/H/S: 1/0/0

Carindale Property Trust’s funds from operations increase beat Ord Minnett by 5.5%, assisted by a -$1m decline in property outgoings in the second half versus the first. Guidance is for a distribution increase in FY22 of at least 9% above FY21. Carindale’s current share price implies a further -20% write-down in the value of Carindale Shopping Centre. The broker believes this is too negative for a centre that continues to perform well, with sales growth of 7.6% versus FY20 and slightly ahead of pre-covid levels. To that end the broker upgrades to Buy from Hold. Target rises to $5.20 from $4.80.

EBOS GROUP LIMITED (EBO) was upgraded to Outperform from Neutral by Macquarie and to Add from Hold by Morgans B/H/S: 3/2/0

Macquarie notes solid FY21 results, which reflected continued momentum in community pharmacy, in turn supporting earnings growth in the short to medium term. Management provided no specific guidance but expects earnings growth in FY22, with risk caveats related to the pandemic. The broker finds earnings momentum quality supportive and upgrades to Outperform from Neutral. Target rises to NZ$35.49 from NZ$33.70.

Ebos Group posted a strong FY21 result in-line with Morgans forecasts, with the highest recorded return on capital employed (ROCE), reflected by double digit earnings growth. The broker increases its rating to Add from Hold and raises its target to $31.68 from $31.03. Announcements were made for strategic investments/acquisitions, a pet manufacturing facility and a medical device distributor. No FY22 guidance was provided though management remained positive that growth is expected to continue.

NETWEALTH GROUP LIMITED (NWL) was upgraded to Outperform from Underperform by Credit Suisse and to Buy from Hold by Ord Minnett B/H/S: 3/2/0

Mostly driven by a lower-than-expected revenue margin, Netwealth Group reported FY21 net profit -2% below consensus and -3% below Credit Suisse. The group guided to FY22 flows of around $10bn, in line with expectations. The platform operator announced a sizeable step up in expenses in FY22 to maintain its position of leadership with differentiated tech/offerings, support new services to generate revenue, and allow the business to scale with investment in the underlying technology infrastructure. Credit Suisse assumes 20-25% cost growth in FY22 with an additional $2m increase in lease expenses, which the broker thinks should allow the group to deliver a 53-54% earnings margin in FY22, broadly stable with second-half FY21 levels. Credit Suisse updates Netwealth to Outperform from Underperform and the target is lowered to $15.80 from $16.50.

Ord Minnett upgrades it rating to Buy from Hold and lifts its target to $17.50 from $16. While the FY21 result was just below expectations, there’s believed to be upside risk to net flow guidance and significant scope for increased organic growth. The final dividend of 9.5cps was just below the analyst’s 9.9cps forecast, while revenue was up 16.9% over the year though also below forecast. Guidance is for around $10bn of net flows in FY22, which compares to $9.8bn in FY21. The analyst sees potential for market share gains in a rapidly changing marketplace.

OZ MINERALS LIMITED (OZL) was upgraded to Add from Hold by Morgans B/H/S: 4/1/1

A larger dividend was the main surprise in the first half results. While it is clear that OZ Minerals expects to unlock value in the Prominent Hill expansion over time, Morgans still finds the project economics underwhelming at face value. The broker upgrades to Add from Hold as a cooling of macro sentiment and a subdued response to the expansion update could crystallise an opportunity at lower prices. Target ratchets up to $24.45 from $24.44.

PACT GROUP HOLDINGS LIMITED (PGH) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/1/1

With Pact Group restoring its packaging business, growing volume, and positioning for the future in a sustainable plastic industry based on recycling, Credit Suisse has upgraded the company to Outperform from Neutral and raised the target $4.95 from $3.65. The broker believes the group’s access to capital, large customer base (2,000+), diversified packaging formats and industry-leading output gives it an advantage in securing waste for recycled plastic resin. Credit Suisse notes while the trading update for first-quarter demand is “good” so far, guidance was for non-prescriptive “earnings resilience”, with first-quarter expecting margin reduction from higher raw material and international freight costs. Dividend payout ratio to remain at 40% until FY25.

REDBUBBLE LIMITED (RBL) was upgraded to Add from Hold by Morgans B/H/S: 1/0/0

FY21 results were slightly below forecasts. Morgans decides to take a longer-term view, believing that while the worst may be yet to come, the potential in earnings and growth is strong. The rating is upgraded to Add from Hold as earnings expectations appear to be re-based. Target is reduced to $4.83 from $4.88.

SOUTHERN CROSS MEDIA GROUP LIMITED (SXL) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/0/1

FY21 results were in line with forecasts. Macquarie notes the costs related to the pandemic have returned in FY22 although the impact will be moderated by a recovery in advertising markets. Earnings are expected to trough in FY22. The broker considers Southern Cross Media offers a compelling income proposition and a stable exposure to advertising markets through its radio assets. Rating is upgraded to Outperform from Neutral. Target is steady at $2.10.

In the not-so-good books

ASX LIMITED (ASX) was downgraded to Sell from Neutral by UBS B/H/S: 1/3/3

FY21 net profit was slightly ahead of UBS forecasts. While ASX has an attractive diversified exchange, it still remains in the investment phase, the broker points out, with elevated costs growth relative to revenue. As the stock has traded 20% higher since the February results, UBS downgrades to Sell from Neutral. Target is $70.

AVENTUS GROUP (AVN) was downgraded to Neutral from Buy by UBS and Downgrade to Neutral from Outperform by Macquarie B/H/S: 0/5/0

FY21 results were in line with forecasts. UBS downgrades to Neutral from Buy on valuation grounds following the outperformance versus the A-REIT sector over the last 12 months. The broker suggests growth in asset values is increasingly being priced into the portfolio. Moreover, there are income headwinds from lockdowns and higher overheads to come in FY22. Target is raised to $3.29 from $3.00.

Aventus Group posted FY21 funds from operations in line with forecast. In the current climate, no FY22 guidance was provided. That said, Macquarie notes that as of this week, 80% of the REIT’s stores were trading, with 32% offering click & collect. The broker believes Aventus’ tenant base will be relatively less impacted by rent relief requirements compared to large mall peers, but is not immune, given 11% of tenants have requested rent relief. The balance sheet stands ready for acquisitions but the problem is a lack of opportunities. With limited valuation support, and risk to discretionary spending, the broker downgrades to Neutral. Target falls to $3.30 from $3.33.

BAPCOR LIMITED (BAP) was downgraded to Neutral from Buy by Citi B/H/S: 5/2/0

Citi downgrades to Neutral from Buy, envisaging few catalysts over the medium term. The broker assesses increasing risks around disruptions from the pandemic to FY22 while acquisitions appear less likely than previously anticipated. FY21 results beat estimates and FY22 and FY23 net profit estimates are upgraded by 5% and 6%, respectively. Target is reduced to $8.24 from $9.55 as earnings changes are offset by higher net debt and increased working capital requirements.

BRAMBLES LIMITED (BXB) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 3/3/0

Brambles FY21 result edged out the broker but Morgan Stanley urges caution, noting an imminent capital expenditure step-up and an absence of guidance. The broker expects the company’s September 13 investor day should be telling and, in the meantime, cuts the target price to $12.50 from $12.90. Rating falls from Overweight to Equal Weight. Industry view: In line.

CHORUS LIMITED (CNU) was downgraded to Sell from Neutral by UBS B/H/S: 0/1/1

UBS notes the share price has rallied since the draft Commerce Commission regulated asset base review. UBS considers this an overreaction as it appears to be treating Chorus the same as other regulated utilities. The broker disagrees with that assessment and also believes increased competition from wireless will constrain fibre revenue and long-term distributions. Rating is downgraded to Sell from Neutral. Target is steady at NZ$6.30.

CORPORATE TRAVEL MANAGEMENT LIMITED (CTD) was downgraded to Neutral from Outperform by Macquarie B/H/S: 6/1/0

Corporate Travel Management’s FY21 underlying earnings of -$7.3m were in line with Macquarie’s expectations, while revenue was ahead of forecast. Macquarie notes that activity in both North America and Europe picked up in the fourth quarter, reporting revenue increases of 48% and 84% respectively. Despite this, due to heightened risk from the delta variant Macquarie reduces confidence in its forecasts. The broker has updated earnings per share forecasts by -14 and -1% for FY22 and FY23 respectively. The rating is downgraded to Neutral from Outperform and the target price increases to $21.80 from $20.75.

HOMECO DAILY NEEDS REIT (HDN) was downgraded to Accumulate from Buy by Ord Minnett B/H/S: 3/1/0

HomeCo’s FY21 result proved broadly in-line with Ord Minnett’s expectations. The reaffirmation of FY22 guidance is taken as a positive with the broker pointing out this is the only REIT to provide guidance thus far. Guidance is for FY22 funds from operations (FFO) and DPS of 8.3cpu and 8.0cpu respectively. The broker highlights the REIT reported a portfolio valuation uplift of $47m in FY21, resulting in the NTA increasing to $1.36/unit (prior to post June 2021 acquisitions). As the share price has approached the target, Ord Minnett has downgraded to Accumulate from Buy. The target price rises to $1.54 from $1.52.

NEWCREST MINING LIMITED (NCM) was downgraded to Neutral from Buy by Citi B/H/S: 6/1/0

While FY21 results were ahead of estimates with record underlying net profit, Citi notes guidance for FY22 indicates a softer year ahead. FY22 group production guidance is below 2.0m ounces while Lihir is also below expectations. Production is nevertheless expected to lift in FY23/24 while upcoming feasibility studies should provide more clarity. Citi downgrades to Neutral from Buy and lowers the target to $27 from $30.

ORORA LIMITED (ORA) was downgraded to Neutral from Buy by Citi B/H/S: 0/7/0

Results were “solid” in Citi’s view. Yet, going forward, the broker observes less positive news may weigh on the stock. Particularly this involves the need to replace lost glass capacity and tougher North American growth as the business cycles the easy wins. As the risk/reward is more balanced, the rating is downgraded to Neutral from Buy. The broker also remains cautious about acquisitions, given the focus on adjacencies and new markets which inherently mean a lack of operating experience. Target is raised to $3.26 from $3.20.

SIMS LIMITED (SGM) was downgraded to Neutral from Buy by UBS B/H/S: 2/4/0

UBS found operating cash flows underwhelming although believes the company has done a good job of boosting earnings on elevated scrap prices. There was hope Chinese demand could lead to higher global prices and volumes but the broker does not envisage any meaningful upside for Sims in FY22-FY23 from policy changes. UBS downgrades to Neutral from Buy and reduces the target to $17.30 from $18.00.

VICINITY CENTRES (VCX) was downgraded to Neutral from Outperform by Macquarie B/H/S: 0/5/1

Following a re-basing of earnings and the FY21 result, Macquarie reduces medium-term expectations. In the absence of any evidence of successful execution of the strategy to grow earnings and reposition the business, the broker considers the growth outlook limited. Moreover, Macquarie is cautious about a rebound in trading associated with a re-opening. Rating is downgraded to Neutral from Outperform and the target reduced to $1.66 from $1.70.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.