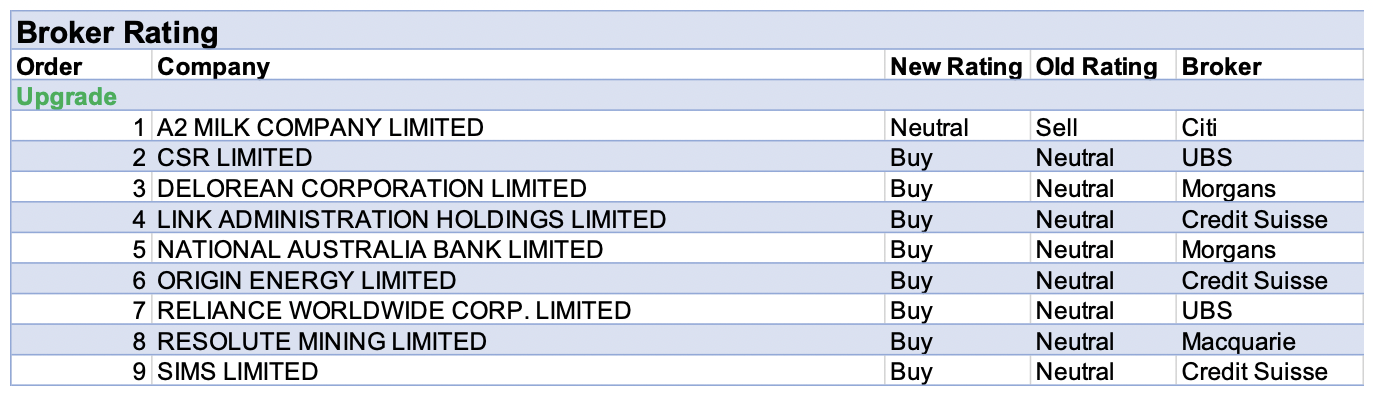

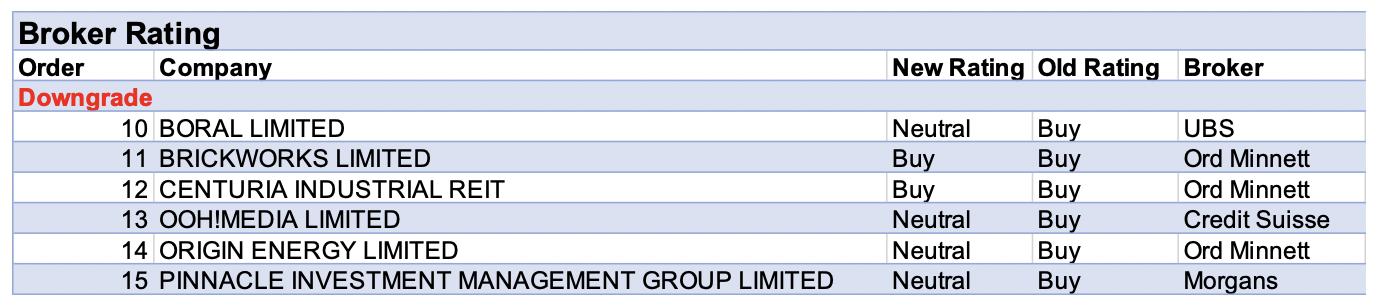

For the week ending Friday 6 August, there were 9 upgrades and 6 downgrades to ASX-listed companies by brokers in the FNArena database.

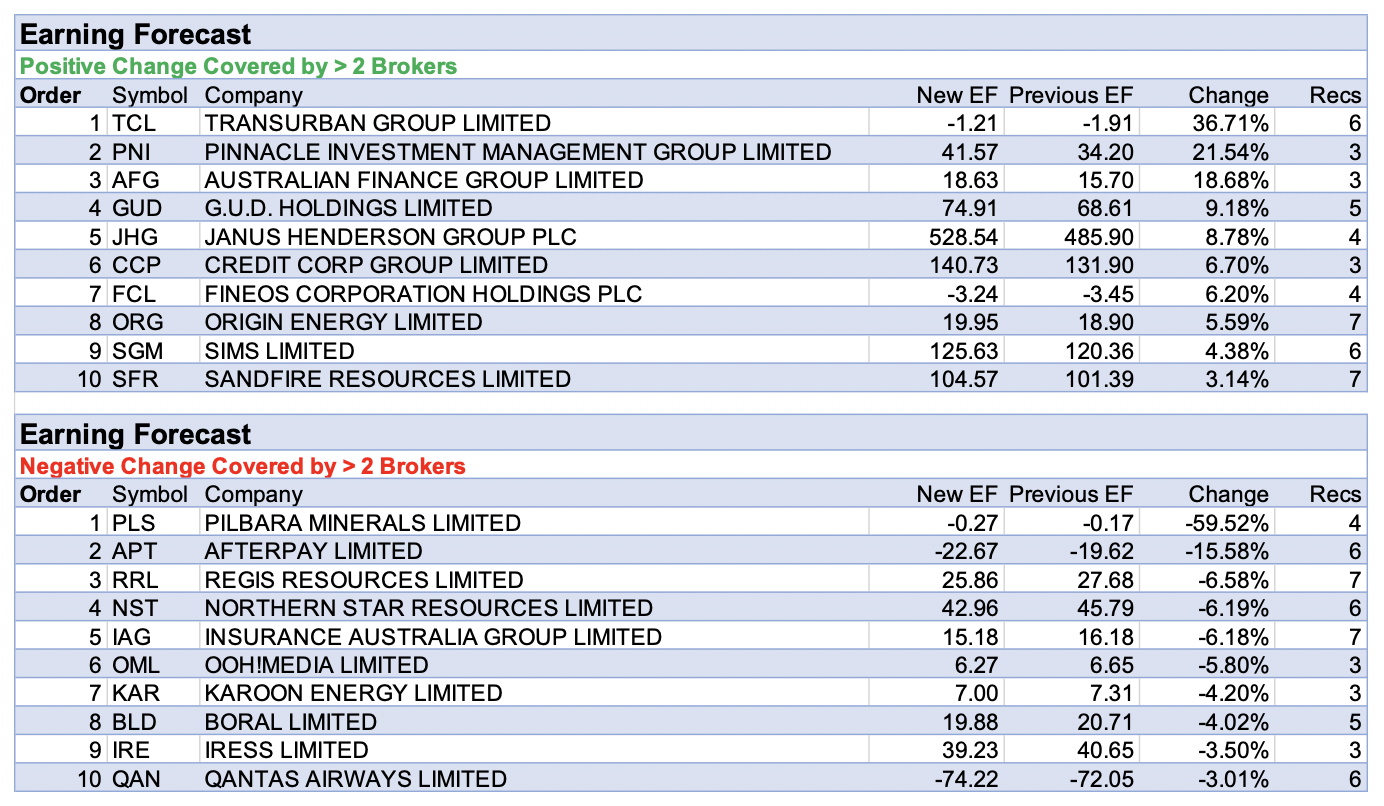

Transurban Group had the largest upgrade to forecast earnings. Only Citi updated forecasts last week, in anticipation of FY21 results due out today. The broker expects investor focus to be on the effect of lockdowns to date, progress on the West Gate Tunnel project and updates on flagged growth opportunities in Australia and the US.

The analyst has cut first-half FY22 Sydney traffic assumptions and now expects Sydney traffic to be lower than first-half FY21 though sees upside to the consensus dividend per share forecast.

Next, in terms of significant forecast earnings upgrades last week, was Pinnacle Investment Management.

Pilbara Minerals headed the list for percentage forecast earnings downgrades last week. However, commentary from Macquarie (the sole broker that updated forecasts) was generally positive and noted rising spot lithium prices present the key risk to base case forecasts. The broker maintains its Outperform rating and 12-month price target of $2.00.

Finally, despite receiving a bid from Square Inc at a 30% premium to the prior close, brokers were a little cautious on Afterpay after the release of FY21 results. Morgan Stanley reduced revenue forecasts by -5% in FY22-23, given lower FY21 gross merchant value, partly offset by around 10bps better merchant margins.

Citi considers Afterpay, when combined with Square’s cash app and seller system, will be a much stronger operation to succeed in the US. Still, as it is early in BNPL history the broker considers the timing of the bid surprising and the offer price low. However, Credit Suisse feels there is low risk of the deal not completing and a small chance of competing bids. The Afterpay story may not be over yet!

In the good books

CSR LIMITED (CSR) was upgraded to Buy from Neutral by UBS B/H/S: 4/2/0

Following a period of suspension of coverage for CSR, UBS now forecasts FY22 profit of $180m, based on a more positive view of Australian housing volumes and margins. Property is valued at $900m and long-run Building Product earnings (EBIT) margins are assumed to be 11% by 2026. The broker lowers its target price to $6.10 from $6.17 and lifts its rating to Buy from Neutral. It’s felt the market is yet to fully price-in an extended housing cycle, and resulting elevated earnings.

DELOREAN CORPORATION LIMITED (DEL) was upgraded to Add from Hold by Morgans B/H/S: 1/0/0

Morgans upgrades its rating to Speculative Buy from Hold, believing the share price has found a floor near $0.20, after soft trading following its IPO. The broker’s target price of $0.25 is maintained. The analyst highlights domestic spot gas prices have surged, and recent volatility in spot electricity prices have provided significant opportunities for gas fired generation.

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/1/0

Link Administration, ex PEXA, is assessed is assessed to be trading at around $2.50 a share. Hence, Credit Suisse believes value has emerged and raises the target to $5.55 from $5.40, while upgrading to Outperform from Neutral. Not only is there better value, the broker also believes tailwinds are emerging and there are several areas of potential upside. Catalysts could include a buyback announcement at the results and a stronger-than-expected outlook.

RELIANCE WORLDWIDE CORP. LIMITED (RWC) was upgraded to Buy from Neutral by UBS B/H/S: 4/2/0

UBS expects momentum to continue, with lead indicators suggesting repairs and renovation markets should grow in FY22. This comes after the company’s third quarter trading update showed a positive sales trend in the US and Europe. Following a period of suspension of coverage, the broker upgrades its rating to Buy from Neutral and lifts its target price to $6.16 from $4.84. A FY21 profit of $202m is forecast. The analyst cautions the spot copper price at US$9,500/t remains a concern and represents a -$36m headwind in FY22. However, through a combination of price and cost-out, this is expected to be largely offset.

SIMS LIMITED (SGM) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 4/2/0

Sims’ five-year improvement in earnings is impressive, Credit Suisse suggests, being not price or volume driven but reflecting cost reductions and gross margin management regardless of market conditions. If Sims can sustain this, and volume growth is evident through a network with 20-30% of spare capacity, the company should hit its FY25 target, the broker believes. Upgrade to Outperform from Neutral. Target rises to $18.70 from $16.10.

In the not-so-good books

BORAL LIMITED (BLD) was downgraded to Neutral from Buy by UBS B/H/S: 0/3/1

Following a period of suspension from coverage of Boral, UBS resumes with a Neutral rating and $7.35 target price (previously Buy and $5.40). The broker forecasts profit of $174m (continuing operations) for the FY21 result. The analyst’s long-term earnings (EBIT) margin for Boral Australia is largely dependent on the transformation process, which targets a benefit of $200-250m in Australia. Fly Ash is seen as the valuation swing factor, with management currently pursuing a sale of the business.

CENTURIA INDUSTRIAL REIT (CIP) was downgraded to Accumulate from Buy by Ord Minnett B/H/S: 3/3/0

Centuria Industrial REIT reported FY21 funds from operations (FFO) of $91.4m, up 44% on FY20 and broadly in line with Ord Minnett’s $92.1m forecast. The company has nearly doubled its portfolio value in the past 12 months to $2.9bn following $920m of net acquisitions and $590m in revaluations, which saw net tangible asset value (NTA) rise 36% to $3.83. Ord Minnett notes the portfolio is in good shape with a 9.6-year average weighted average lease expiry (WALE) and a 96.9% occupancy rate, down slightly. The broker believes Centuria Industrial REIT remains the best way to play Australian industrial and, while guidance was a touch soft, expect positive industry dynamics to continue to support the stock. Following the recent strong run in the share price, the broker has downgraded the REIT to Accumulate from a Buy rating and raises the target to $4.10 from $4.00.

OOH!MEDIA LIMITED (OML) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 1/2/0

Given the uncertainty around second half bookings, Credit Suisse lowers its FY21 estimates for oOh!media by -9% at the EBITDA level. A delayed recovery to the sector along with the cyclical nature of the advertising market and, specifically, the uncertainty around the Sydney Trains contract leads the broker to downgrade to Neutral from Outperform. The company will report its first half result on August 23. Target is reduced to $1.80 from $2.35.

PINNACLE INVESTMENT MANAGEMENT GROUP LIMITED (PNI) was downgraded to Hold from Add by Morgans B/H/S: 2/1/0

Morgans lifts its target price to $14.48 from $11.85 though lowers its rating to Hold from Add, as the stock is now trading in-line with valuation. The company reported FY21 group profit 107% higher than the previous corresponding period (pcp). Group funds under management (FUM) closed up 52% on the pcp, driven by net inflows and investment performance. Net inflow momentum accelerated in the second half, with retail inflows of $2.6bn. The broker expects strong flows of $8bn in FY22. The analyst points out FY22 commences with starting FUM greater than 20% above average FY21 levels, supporting a ‘baseline’ earnings level (before performance fees) around FY21 levels.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.