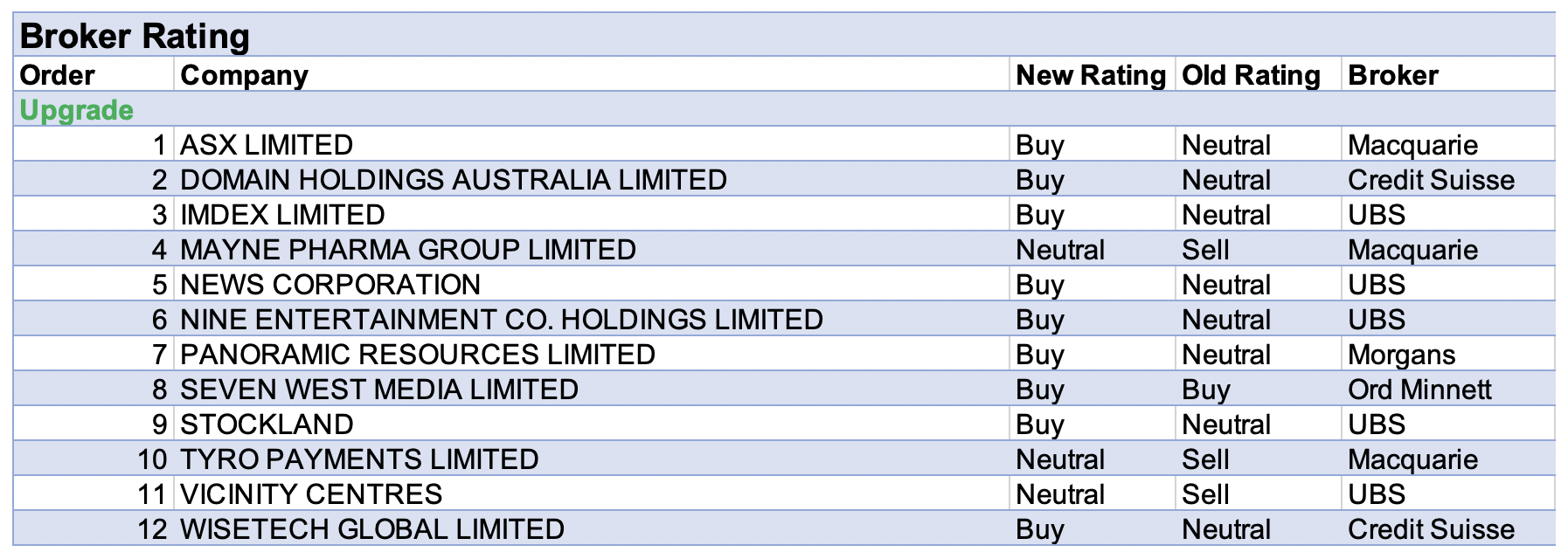

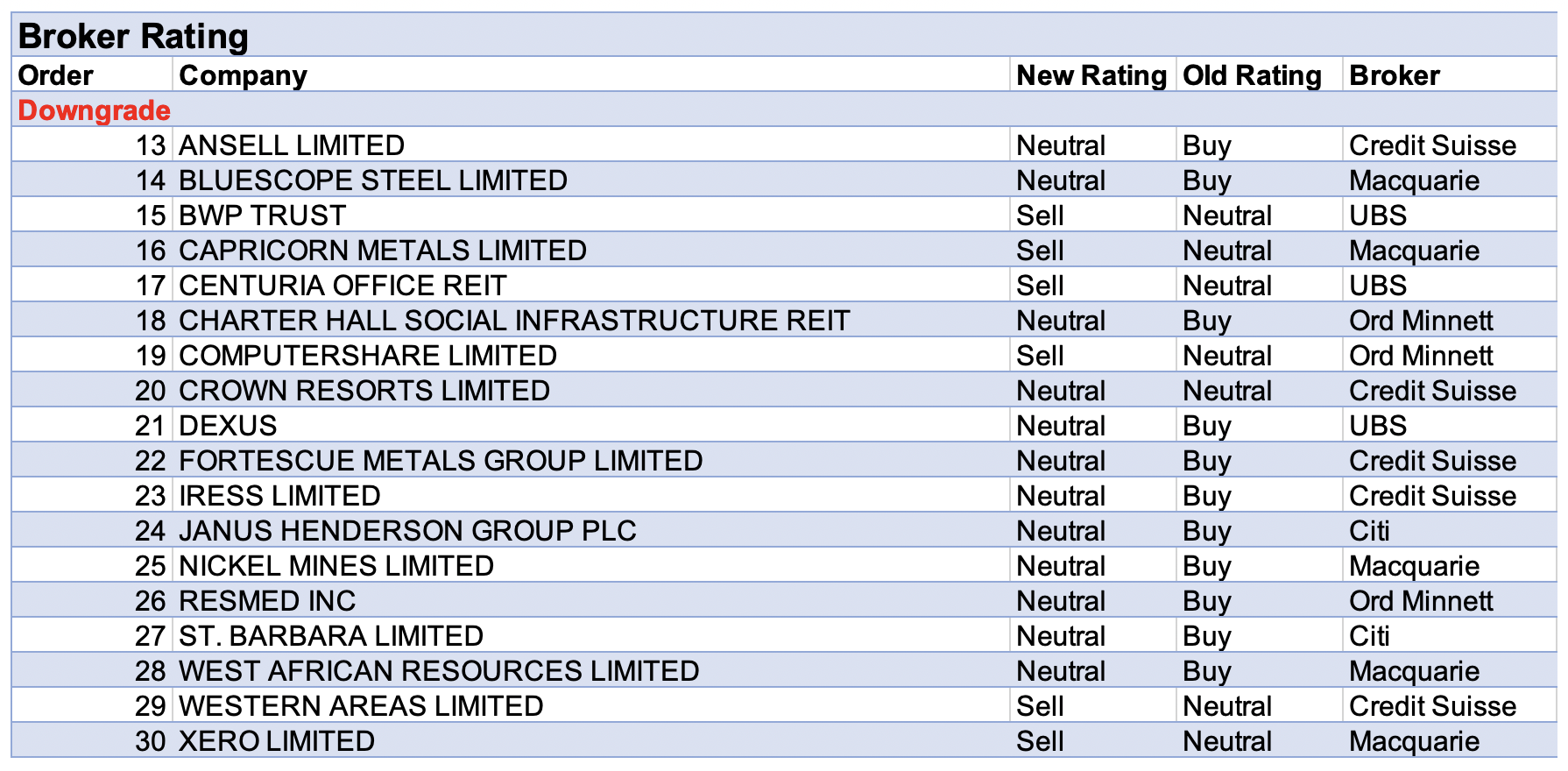

For the week ending Friday 30 July, there were 12 upgrades and 18 downgrades to ASX-listed companies by brokers in the FNArena database.

The table for the largest percentage rise in earnings forecasts was headed by Spark Infrastructure Group. It received a revised $2.89 takeover bid from the Ontario Teachers Pension Plan and Kravis Kohlberg & Roberts consortium. Ord Minnett believes the bid is fair, while Morgans believes the current share price suggests a close to 100% probability that the deal proceeds at the bid price. On operational matters, the group expects to report half year results on Tuesday, August 24.

Next on the table was Coronado Global Resources. As mentioned last week, after the June quarter results Macquarie explained that a rally in coal prices has driven earnings upside momentum, with forecasts more than doubling under a spot price scenario. The broker lifted its rating to Outperform from Neutral. Credit Suisse also remained positive, and suggests potential further upside from US domestic contract prices (US$87/t for calendar year 2021). The next round of negotiations will start in the September quarter.

Macquarie believes the merger with Orocobre, expected to complete on 25 August, presents a key catalyst for Galaxy Resources. Ord Minnett agrees, and sees a solid growth pipeline, optimisation options and a strong lithium market outlook for the merged entity. Separately, Morgan Stanley noted strong June quarter production with spodumene production 23% above estimates.

Tyro Payments also appeared in the table for the largest percentage rise in earnings forecasts by last week. Macquarie believes the current lockdowns are weighing on sentiment and this should be considered temporary. The broker upgraded its rating to Neutral from Underperform and raised its target to $3.50 from $2.65. Ahead of the FY21 result, the broker notes that risks to merchant growth, following the terminal outages in January, have significantly diminished though remains cautious on longer-term growth and margin expectations.

On the flipside, Western Areas suffered the largest percentage fall in forecast earnings last week. This was not helped by the bearish mid-term commodity forecast from the commodities team at Credit Suisse. It’s felt the nickel market may be flooded with new supply by mid-decade, underpinned by Tsingshan’s aggressive expansion plan to lift its Indonesian nickel output capacity. Consequently, the broker downgraded its rating to Underperform from Neutral and lowered its target price to $2.00 from $2.40.

Despite a generally positive FY21 production report, Morgans lowered revenue forecasts slightly in coming years for Western Areas, due to higher anticipated non-cash costs. As an aside, Macquarie noted the company’s serious leverage to nickel prices. Current spot prices would increase the broker’s earnings forecasts by 25% and 162% in FY22-23.

Coming second for percentage fall in forecast earnings was Pilbara Minerals, after turning in a weak June quarter performance, according to Macquarie. While shipments were in-line, higher costs impacted on cash flow. More positively, a key upside catalyst is the progression of downstream plans.

Next was Zip Co, with Citi analysts seeing downside risk to the growth and margin outlook from a medium-term perspective, given its US and UK operations lack scale. However, growth from Quadpay’s Shop Anywhere offering is seen as the offset.

Macquarie noted customer additions for Quadpay slowed in the June quarter though transaction volumes increased domestically, thanks to the new “Tap & Zip” initiative.

Temple & Webster Group also featured among the larger percentage falls in forecast earnings by brokers last week, though the three brokers that updated in the FNArena database weren’t overly negative. Macquarie perhaps best summarised matters by saying investors understand the permanent gains from acceleration through the pandemic have been captured, and the key issue is the longer-term earnings potential.

The maximum number of seven brokers in the FNArena database updated earnings estimates for Insurance Australia Group last week. Preliminary financial results revealed a reported loss, which was -$180m worse than UBS’s estimate. Morgan Stanley feels lockdowns are depleting the group’s safety buffer on Business Interruption provisions, doesn’t believe the stock is cheap and sees few positive catalysts. Alternatively, Citi is encouraged by an in-tact outlook for FY22, and while leaving FY22 and FY23 forecasts largely unchanged, the broker still expects the underlying momentum in the business to drive margin improvement.

Finally, Credit Suisse returned from restriction on coverage for Crown Resorts with a bang, and lowered its rating to Neutral from Outperform, and reduced its target price to $10.10 from $13.50. This comes after the broker lowered FY21-23 earnings (EBITDA) forecasts by -15-23%, due to potentially higher costs associated with a more stringent regulatory regime, and a review of premium-mass player financial health.

If that wasn’t enough, there’s the prospect of further China ‘blacklisting’ of gaming destinations and potential for more rolling covid restrictions, points out Credit Suisse. The broker has removed the takeover premium it had previously added to the valuation.

In the good books

DOMAIN HOLDINGS AUSTRALIA LIMITED (DHG) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/4/0

Credit Suisse reviews listings growth forecasts to take into account an unseasonably strong end to FY21. The broker now models 28.5% volume growth in listings for Domain Holdings in the second half. Changes to earnings estimates reflect a pulling forward of volume growth into FY21 and heading into FY22 the broker assumes just 2% growth in listings. Rating is upgraded to Outperform from Neutral with upside envisaged in current trading levels. Target is raised to $5.40 from $5.15.

MAYNE PHARMA GROUP LIMITED (MYX) was upgraded to Neutral from Underperform by Macquarie B/H/S: 0/4/0

Prescription data highlight weaker second half FY21 trends for Mayne Pharma’s generic and specialised products. But in the medium term, Macquarie’s forecasts assume strong contributions from key pipeline products, mainly Nexstellis. This, and recent stock underperformance, lead the broker to upgrade to Neutral from Underperform. Target falls to 33c from 38c.

PANORAMIC RESOURCES LIMITED (PAN) was upgraded to Add from Hold by Morgans B/H/S: 2/0/0

Underground mining activities have commenced at Savannah ahead of schedule, and the company reaffirms ore processing is scheduled to commence in November. The first concentrate shipment is forecast for December. Morgans upgrades its rating to Add from Hold, and increases its target price to $0.19 from $0.18 as the project continues to de-risk. Management has flagged the potential for Savannah to exceed a number of the cost and production estimates used in the feasibility study, though the analyst maintains them as the base case, until performance is demonstrated.

SEVEN WEST MEDIA LIMITED (SWM) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 4/0/0

Ord Minnett raises its rating for Seven West Media to Buy from Accumulate, on continued strength in free-to-air media spending levels, and the transition to digital formats such as broadcaster (BVOD) and subscription (SVOD) video on demand. The $0.65 target is retained. The broker reduces forecast revenue from Google and Facebook in FY22, and lowers its FY21 earnings (EBITDA) estimate to $252.5m (the mid-point of guidance).

In the not-so-good books

ANSELL LIMITED (ANN) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 4/3/0

As the pandemic has driven peak earnings, Credit Suisse expects volumes to remain elevated above pre-pandemic levels going forward. Yet prices are expected to normalise as demand/supply moves towards equilibrium in the next year or so. While first half earnings are expected to be strong the current level is not considered sustainable and the broker lowers FY23 estimates by -10%. As the stock is trading above its historical PE multiples, limited upside is envisaged and the rating is downgraded to Neutral from Outperform. Target is reduced to $44 from $47.

CAPRICORN METALS LIMITED (CMM) was downgraded to Underperform from Neutral by Macquarie B/H/S: 0/0/1

Capricorn Metals will acquire Mt Gibson Gold for $39.6m, with mining studies to commence immediately. The transaction will comprise $25.6m cash and $14.0m in Capricorn Metals shares. Mt Gibson represents an inferred 2.1m ounce resource. The company will spend around $5m at the project over the first year for infill and extensional drilling, geotechnical and metallurgical testing, and environmental studies. Macquarie notes while potential for another development project is positive and presents a key opportunity for the company to diversify its production base, the ramp-up of Karlawinda is likely to be more meaningful for Capricorn Metals in the near-term. Given recent share price strength, the rating is downgraded to Underperform and the target price increases to $2.20 from $2.10.

FORTESCUE METALS GROUP LIMITED (FMG) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/3/2

June quarter production beat expectations as did price realisation. This was offset by higher costs. Higher costs and increased capital expenditure could prove sticky, Credit Suisse suspects, given the inflationary backdrop. The broker also suspects efficiency initiatives are more of an attempt to limit cost escalation rather than reduce costs. Credit Suisse envisages an opportunity to take profits on valuation grounds and downgrades to Neutral from Outperform. Target is reduced to $22 from $23.

IRESS LIMITED (IRE) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 1/2/0

Credit Suisse expects organic growth will be driven by the UK, Australian superannuation and OneVue. The company’s update, which reaffirmed guidance, supported the broker’s expectations. While the outlook has improved and there is takeover interest, although the offer of $15.30-15.50 was rejected, Credit Suisse believes growth acceleration is required to warrant further upside. Hence, the rating is downgraded to Neutral from Outperform. Target is raised to $13.50 from $11.00.

JANUS HENDERSON GROUP PLC (JHG) was downgraded to Neutral from Buy by Citi B/H/S: 1/3/0

Janus Henderson’s second-half result is a 16% beat driven by higher assets under management (AuM) from market strength and outperformance and even stronger performance fees than Citi expected. Citi sees the potential for a further rerate if flows turn, and lifts earnings per share estimates by 9% in FY21-23. The broker notes the lack of second-quarter flows from the intermediated channel is disappointing and believes there remains some risk surrounding the trends in US small and mid-cap strategies. Neutral rating is retained and the target price increases to $58.10 from $54.

NICKEL MINES LIMITED (NIC) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/1/0

Nickel Mines’ June quarter featured lower than expected production and higher than expected costs, leading Macquarie to cut earnings forecasts by -6-10%. While the nickel price is enjoying a run, so is the price of smelter input coal. That pressure is not expected to abate, and the broker notes its FY22 earnings forecast is now -28% below consensus. Downgrade to Neutral from Outperform, target falls to $1.10 from $1.25.

ST. BARBARA LIMITED (SBM) was downgraded to Neutral from Buy by Citi B/H/S: 2/2/1

Gwalia is showing signs of improvement, Citi observes, while production at Simberi and Atlantic will drop over FY22/23. FY22 production guidance relies heavily on replicating the June quarter performance at Gwalia which Citi believes will raise concerns, given the poor performance in the past. The broker believes gold prices have peaked and trims the target to $1.75 from $2.30 while downgrading to Neutral/High Risk from Buy/High Risk.

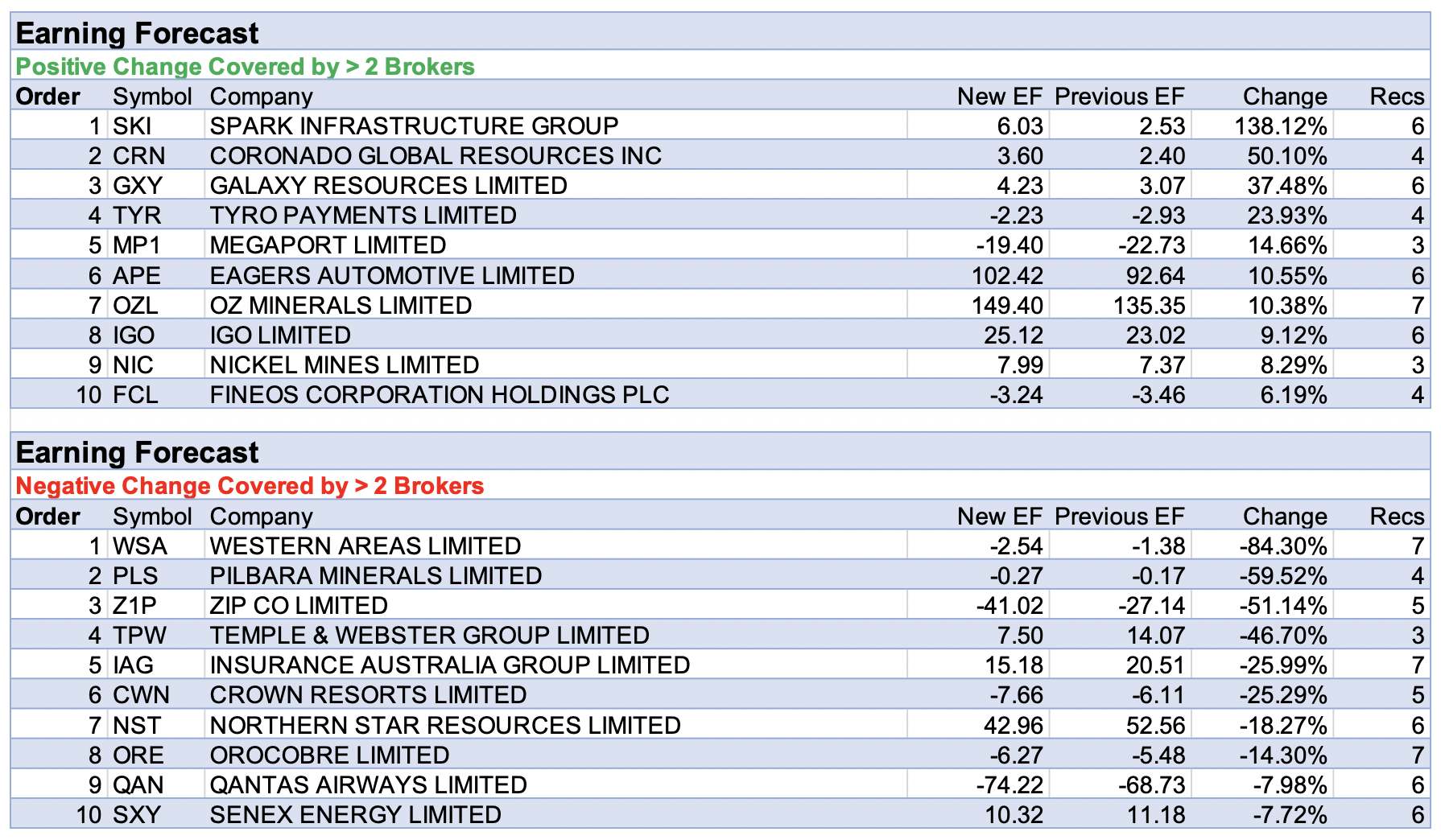

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.