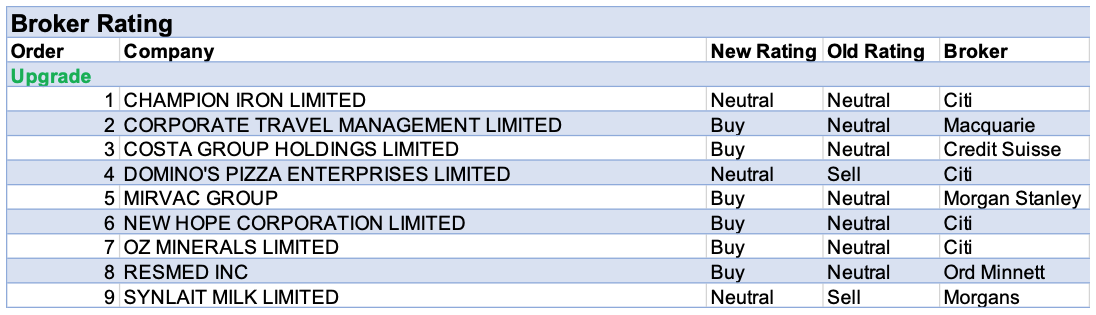

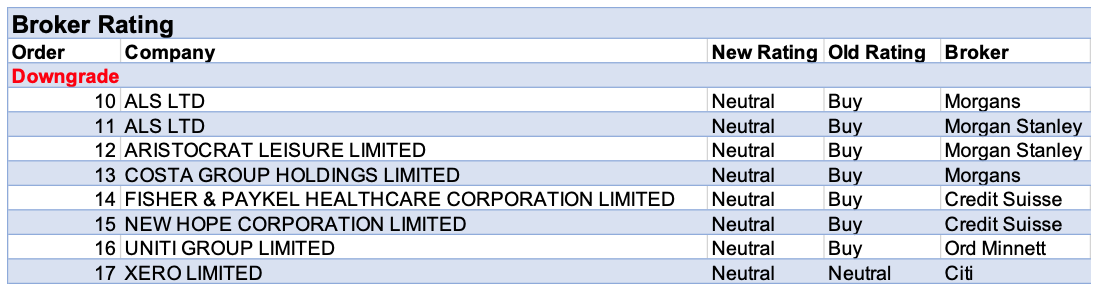

For the week ending Friday 28 May, there were 9 upgrades and 8 downgrades to ASX-listed companies by brokers in the FNArena database.

After ALS Ltd posted an underlying FY21 profit 4.5% ahead of consensus last week, two brokers in the FNArena database downgraded the company rating due to a strong recent share price. Morgans attributed the result to astute management of costs and capacity, while Morgan Stanley was impressed by momentum in the Commodities segment, but notes the risk with cost inflation.

The final dividend of 14.6 cents was well ahead of expectations, underpinned by strong cash conversion and debt reduction.

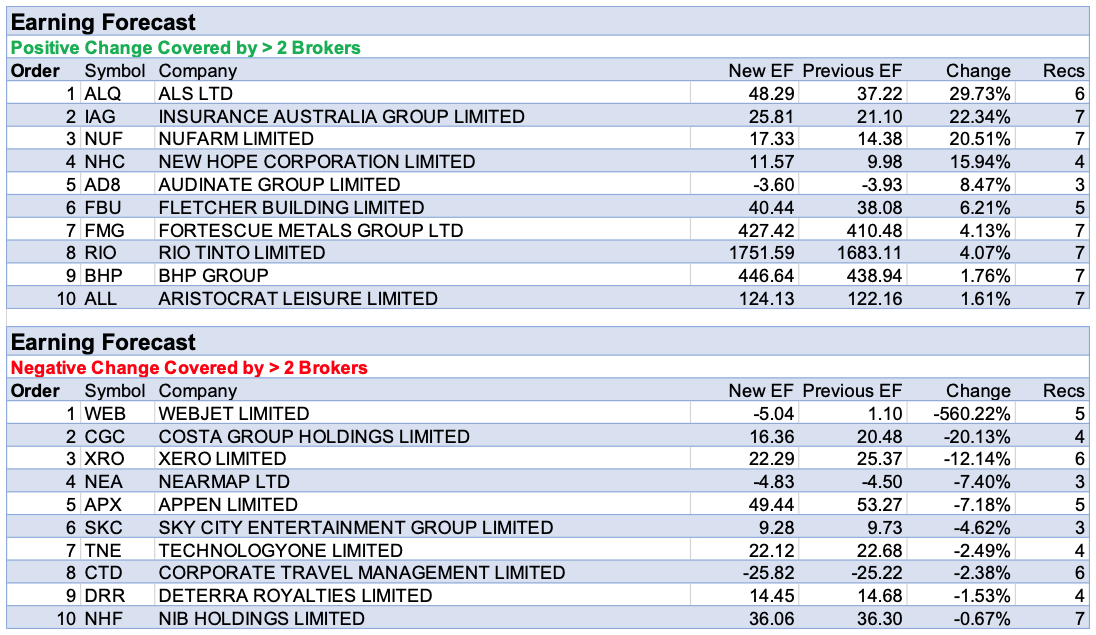

There were several material upgrades to forecast earnings, including the second-placed Insurance Australia Group. Following the release of APRA’s quarterly general insurance performance statistics for March, Macquarie estimated industry price rises remain strong. However, the broker also concluded covid-19 benefits, particularly in Home and Commercial lines, are dissipating for IAG.

Next up was Nufarm, after Citi assessed the earnings trajectory looks positive through to FY23. The company offers leverage to strong agricultural fundamentals across key markets on top of continued execution on cost-out initiatives, explains the broker. In the short term, the one negative is a higher tax rate outlook in the second half, which had the analyst lowering the FY21 profit forecast by -9%.

Finally, Costa Group Holdings was next in terms of earnings downgrades last week. The more limited visibility for the earnings potential of the domestic Produce business, and uncertainty remaining over the extent of the second half earnings recovery, prompted Morgans to lower the rating to Hold from Add. Conversely, Credit Suisse upgraded to Outperform from Neutral while lowering the target price dropping to $4.15 from $4.70.

While management guidance was below market expectations it resulted from factors the broker considers are seasonal and not structural. Meanwhile, the company expects the June half performance to be marginally ahead of the last year.

In the good books

COSTA GROUP HOLDINGS LIMITED (CGC) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 1/3/0

Credit Suisse upgrades to Outperform from Neutral with the target price dropping to $4.15 from $4.70. Costa Group Holdings expects the June half performance to be marginally ahead of the last year. This guidance was below market expectations and a result of factors that Credit Suisse considers seasonal and not structural. The broker finds it difficult to ascertain a normal margin for the group’s domestic product since in a 12-month period, the group’s peak margins have been about 14%-15% while in a bad year, margins have been as low as 5%-6%. The 2021 operating income forecast has been reduced by -7.5%.

See downgrade below.

CHAMPION IRON LIMITED (CIA) was upgraded to Neutral from Sell by Citi B/H/S: 1/1/0

Citi upgrades to Neutral from Sell with the target price rising to $7.10 from $6.40. Champion Iron delivered a record quarterly revenue, observes Citi, with strong price momentum in iron ore. Net profit for FY21 was slightly below Citi’s forecast at $477m but more than doubled over FY20. In the broker’s view, the company is well-positioned to capitalise on a global de-carbonisation theme and expansion upside via Phase II delivery and potential Phase III expansion post Kami acquisition.

MIRVAC GROUP (MGR) was upgraded to Overweight from Equal-weight by Morgan Stanley B/H/S: 4/2/0

Morgan Stanley notes Australian dwelling prices have been pacing at 2-3% per month for most of 2021 and believes housing affordability will become a key issue in the physical as well as the equities market. After completing a deep dive into the affordability of 72 residential projects by Mirvac Group and Stockland Corp (SGP), Morgan Stanley concludes the group’s land product is more affordable than Stockland’s core products. Analysing Mirvac Group’s 31 active projects, the broker suggests 79% of the lots look affordable. The broker is positive on the group’s prospects and has increased its FY22 residential forecast to 2.6k from 2.3k while modelling in more apartment settlements in FY23-25. Morgan Stanley upgrades to Overweight from Equal Weight rating with the target price rising to $3.15 from $2.60. Industry view is In-Line.

NEW HOPE CORPORATION LIMITED (NHC) was upgraded to Buy from Neutral by Citi B/H/S: 2/2/0

Citi updates coal prices to allow for marking-to-market adjustments and the recent rally in thermal coal. This results in material earnings upgrades for New Hope and the rating is upgraded to Buy from Neutral. The broker notes risk appetite is low but argues the stock is now trading on 3x enterprise value/EBITDA for FY22 and the balance sheet is moving to a net cash position in FY23. Target is raised to $1.75 from $1.55.

OZ MINERALS LIMITED (OZL) was upgraded to Buy from Neutral by Citi B/H/S: 3/2/1

Copper has eased back from highs of US10,700/t to US$9900/t, yet Citi expects this to be a temporary pullback before prices rebound. The broker envisages another 20% upside to spot prices over the next six months and forecasts copper will hit US$12,200/t. The broker understands investors are hesitant about buying a stock that has rallied around 50% in the past six months but still expects it will trade higher and upgrades to Buy from Neutral. Target is $27.

In the not-so-good books

ALS LTD (ALQ) was downgraded to Hold from Add by Morgans and to Equal-weight from Overweight by Morgan Stanley B/H/S: 2/4/0

Morgans downgrades the rating for ALS to Hold from Add after a strong share price rise. It’s considered astute management of costs and capacity drove underlying FY21 profit 4.5% ahead of consensus. The broker lifts FY22-24 EPS forecasts by 4-11% due mainly to a lift in assumed Commodities margins close to 30%, to reflect the sector outlook. The target rises to $11.56 from $10.35.

ALS Ltd provided a strong FY21 result, in Morgan Stanley’s view. Commodities momentum impressed amid higher volumes which lead to higher earnings margins. Still, cost inflation is a risk. In life sciences there was modest margin compression, the broker notes. Morgan Stanley upgrades estimates by 8% and 3% for FY22 and FY23, respectively, noting that the stock has performed well and while there may be further upside the magnitude is likely to be lower. Morgan Stanley downgrades to Equal-weight from Overweight. Target is raised to $12.90 from $10.70. Industry view: In-line.

COSTA GROUP HOLDINGS LIMITED (CGC) was downgraded to Hold from Add by Morgans B/H/S: 1/3/0

Morgans downgrades Costa Group to Hold from Add, after first half guidance was for marginal growth. Also, from the guidance, there was considered implicit contraction in Produce segment that is materially weaker than expected. The broker lowers FY21-23 underlying earnings (EBITDA-S) forecasts by -10%, -5% and -5%, respectively. Also, increased D&A guidance and operating deleverage has seen material downgrades at the profit (NPAT-S) level. Overall, the more limited visibility on the earnings potential of the domestic Produce business and uncertainty remaining over the extent of the second half earnings recovery, prompts the analyst to lower the rating. The target price falls to $3.54 from $5.03.

See upgrade above.

FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED (FPH) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 1/1/2

Credit Suisse downgrades Fisher & Paykel Healthcare Corp to Neutral from Outperform with the target dropping to $30 from $34. Post the FY21 result, Credit Suisse has lowered its earnings estimates for FY22-23. Earnings uncertainty is expected to persist over the next six months and the broker does not see a short-term catalyst for the stock to outperform. Management conceded there is too much uncertainty in the monthly and quarterly earnings to provide any guidance or be confident that the current trends will continue. The broker notes demand is tracking covid-related hospitalisations and in countries where hospitalisations have fallen, there has not been evidence of sustained strong utilisation of the installed base outside of covid patients.

UNITI GROUP LIMITED (UWL) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 0/1/0

Ord Minnett reviews the outlook for Uniti Group in light of a strong housing backdrop and stability in the wholesale broadband price. The March quarter dwelling numbers highlight another quarter of above-trend growth, observes the broker, supported by positive sales and pricing from greenfield property developers in 2021. The broker expects FY21 operating income of $84.4m and operating cash flow of $71m after-tax but prior to re-investment in new fibre construction. Ord Minnett also highlights lower integration risks with the recent OptiComm acquisition. Ord Minnett downgrades to a Hold recommendation from Accumulate with the target rising to $2.90 from $2.23.

XERO LIMITED (XRO) was downgraded to Neutral by Citi B/H/S: 2/2/1

While noting there isn’t a lot to read-through for Xero from Intuit’s third quarter, Citi sees Intuit’s commentary on the use of online accounting and associated services as positive for Xero. In the broker’s view, the results from both companies point to home markets outperforming the International markets although going by Intuit’s comments, it looks to the broker Xero could be outperforming Quickbooks in the UK. Neutral rating with a target price of $136.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.