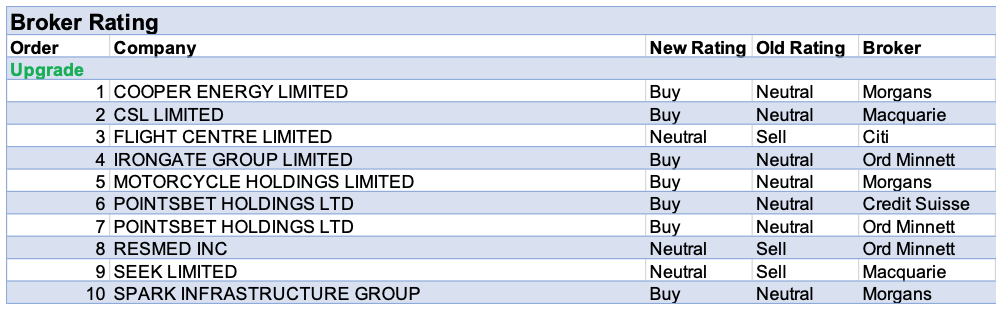

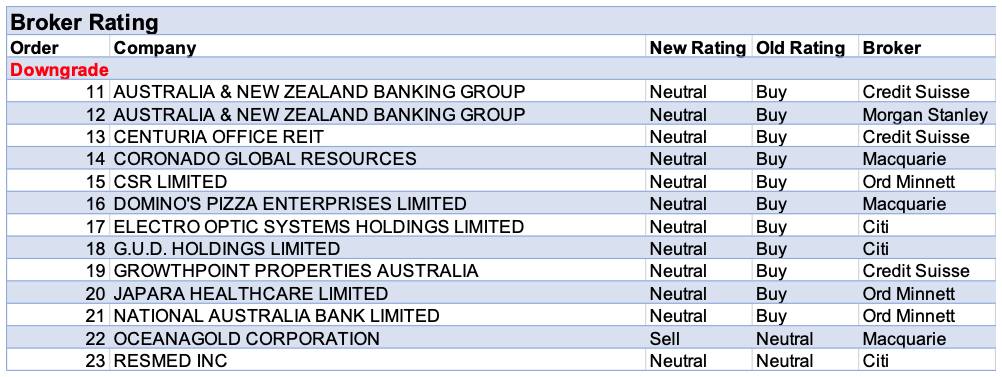

For the week ending Friday 7 May, there were ten upgrades and thirteen downgrades to ASX-listed companies by brokers in the FNArena database.

PointsBet Holdings received two upgrades to ratings from separate brokers. March quarter results demonstrated to Credit Suisse an ability to capture revenue in the US. The broker considers the company a credible number four player in the US sports betting market. Meanwhile, Ord Minnett was impressed by a record jump in active clients in the US, which resulted from a significant jump in marketing efforts.

ANZ Bank was in receipt of two downgrades to recommendations from two separate brokers. Both Credit Suisse and Morgan Stanley agreed a pause in the upgrade cycle will likely limit further upside. The downgrade to Equal-weight from Overweight by Morgan Stanley was prompted by revenue headwinds and a higher near-term cost growth outlook.

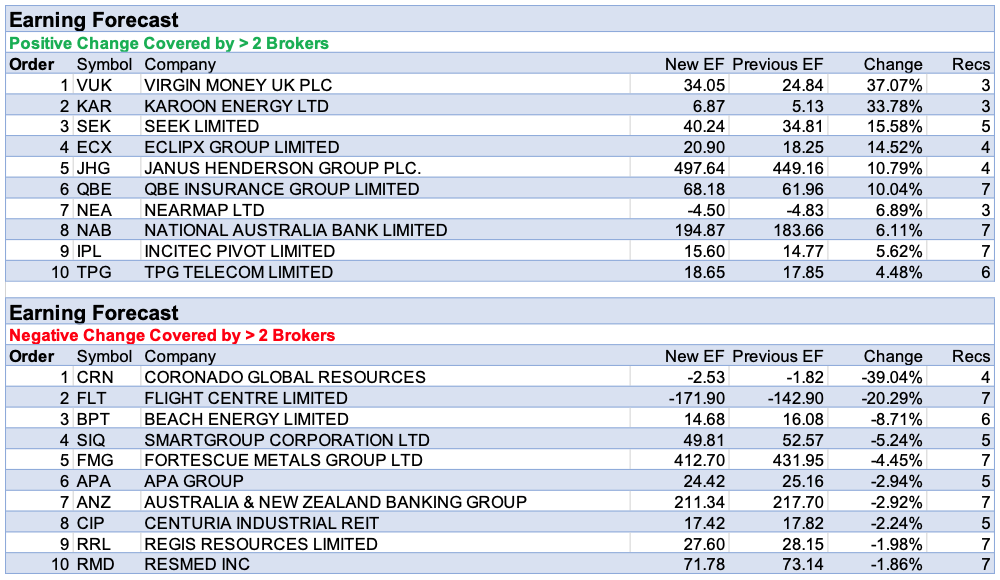

Virgin Money UK received the highest percentage upgrade to forecast earnings by brokers in the FNArena database. Lower impairments in first half results positively surprised Citi. Macquarie agreed and upgraded FY21 estimates by around 79% largely because of the lower bad debts. Further upgrades to FY22 and FY23 of 24% and 10%, respectively, were driven by lower impairment charges and an improved margin outlook.

Next was Karoon Energy, which has guided to higher production from Brazil’s Bauna oil field starting in the December quarter of 2022. Morgan Stanley has reduced its capex assumptions by circa -25% in FY22 and thinks the next 12 months will be focused on gearing up growth, with a final investment decision for the Patola field expected over the next two months.

Third on the table for percentage upgrades to forecast earnings was Seek after management upgraded prior guidance by 11%. This was the third time this financial year guidance has been lifted. Macquarie envisages further upside to FY21 earnings forecasts if the labour market continues current momentum, andhas upgraded the company recommendation to Neutral from Underperform.

Three brokers from the FNArena database updated on Eclipx Group last week and first half results exceeded the expectations of all. Profit was 43% above Morgan Stanley’s estimate on materially higher end-of-lease profits (up 107% on the pcp), despite volumes being -14% lower. It’s felt the $20m share buyback signals confidence in the underlying growth trajectory and balance sheet.

The dubious distinction of highest percentage downgrade to forecast earnings by brokers in the FNArena database went to Coronado Global Resources. Funding issues is not a term shareholders like to hear, and more might be in prospect unless there is a rally in Australian met coal prices, according to Macquarie. For now, the broker notes a liquidity runway has been provided via a US$550m refinancing package to be used to pay down the current syndicated facility agreement.

Finally, last week Flight Centre guided to a second-half loss of circa -$247m, worse than Morgan Stanley’s prior estimated loss of around -$50m. Brokers generally were reigning in the pace of prior travel recovery expectations and expressing an uncertain outlook. Citi agreed though boldly upgraded the company rating to Neutral from Sell. Firm liquidity enabled the broker to look through its own FY21 and FY22 earnings downgrades. The analyst now expects profit breakeven to occur in the first half of FY23 rather than the second half of FY22.

In the good books

COOPER ENERGY LIMITED (COE) was upgraded to Add from Hold by Morgans B/H/S: 2/3/0

Morgans upgrades the rating to Add from Hold and lifts the target to $0.34 from $0.30. The broker views the current share price assumes a material equity raising. It’s considered more likely that deals with both APA Group (APA) and customers will keep lenders comfortable. This should avoid a scenario where the company’s banks request fresh equity be injected, explains the analyst. On a longer-term basis Morgans also sees upside potential from the progression of OP3D (Otway) and Manta (Gippsland).

IRONGATE GROUP LIMITED (IAP) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 2/0/0

Ord Minnett upgrades to Accumulate from Hold with the target rising to $1.60 from $1.40. Irongate Group’s FY21 funds from operations at 9.26c were -5.3% less than FY20 and -1.6% below Ord Minnett’s 9.41c forecast. A final dividend of 4.5c was declared, translating to a full-year payout of 8.92c. Ord Minnett considers the portfolio to be in good shape with strong revaluation uplifts in the second half. While office market fundamentals deteriorated, the broker highlights Irongate’s strong asset management capabilities which in the broker’s view makes the company well placed to navigate potential headwinds. Industrial remains in demand among institutional investors.

In the not-so-good books

AUSTRALIA & NEW ZEALAND BANKING GROUP (ANZ) was downgraded to Equal-weight from Overweight by Morgan Stanley and to Neutral from Outperform by Credit Suisse B/H/S: 4/3/0

While acknowledging ANZ Bank’s leverage to recovery and better capital management has driven share price outperformance over the last year, Morgan Stanley expects a pause in the upgrade cycle to limit further upside. The broker was pleased with the bank’s margin expansion but thinks revenue growth prospects will be constrained by the loss of Australian mortgage momentum and lower institutional lending. Morgan Stanley downgrades to Equal-weight from Overweight led by revenue headwinds and a higher near-term cost growth outlook. The target drops to $28 from $28.50. Industry view: In-Line.

Following ANZ Bank’s first half result, Credit Suisse has upgraded FY21 earnings estimate by 1% while also downgrading earnings forecasts by -1-3% in outer years due to lower expected markets income. The broker notes the bank has been ahead on many aspects like portfolio re-positioning, remediation and share price rise but most of this is already factored into Credit Suisse’s forecasts. While expecting ANZ Bank to deliver, the broker believes outsized upgrades in the near term are less likely and downgrades to Neutral from Outperform. Target drops to $28.50 from $29.50.

CORONADO GLOBAL RESOURCES (CRN) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/2/0

Coronado Global Resources announced a US$550m refinancing package to be used to pay down the current syndicated facility agreement (SFA). While giving the company liquidity runway, Macquarie notes Coronado Global requires a recovery in Australian met coal prices to avoid further funding issues. Also, the broker notes a significant downside to earnings, with its forecasts shifting from a profit to a loss for 2021 onward in a spot price scenario. Macquarie downgrades to Neutral from Outperform. Target is reduced to $0.60 from $1.10.

CSR LIMITED (CSR) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 3/3/0

Ord Minnett has upgraded its housing starts forecasts across Australia, the US and New Zealand to capture the better-than-expected demand as well as the stimulus directed to increase housing supply across all three countries. Noting this to be the third consecutive upgrade made to the housing starts forecasts in seven months, Ord Minnett downgrades its recommendation on CSR to Hold from Accumulate on valuation grounds. Price target is $5.50.

G.U.D. HOLDINGS LIMITED (GUD) was downgraded to Neutral from Buy by Citi B/H/S: 2/3/0

Citi now expects leverage from favourable trading conditions may not be as much as previously believed because of cost pressures from suppliers and freight. The broker suspects the business may find it difficult to generate more than mid single-digit top-line growth over the medium term, without acquisitions or a significant export strategy. The lower end of the FY21 EBIT guidance range was raised slightly, to $98m from $95m while the top end at $100m was unchanged. Rating is downgraded to Neutral from Buy and the target lowered to $14.20 from $14.90.

NATIONAL AUSTRALIA BANK LIMITED (NAB) was downgraded to Hold from Accumulate by Ord Minnett .B/H/S: 2/5/0

National Australia Bank’s first-half cash net profit was $3.34m, -5.3% below Ord Minnett’s forecast. A fully franked interim dividend of 60c per share was declared, in line with the broker’s estimate. Ord Minnett is disappointed with the result with revenue excluding the markets division flat due to a weaker net interest margin. On the bright side, the broker sees momentum improving with a return to banking income growth likely from the second half onwards. The broker continues to expect the bank’s revenue growth trends to be a little better than peers. Even so, looking at the limited potential upside Ord Minnett downgrades to Hold from Accumulate. The target drops to $27.50 from $28.1.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.