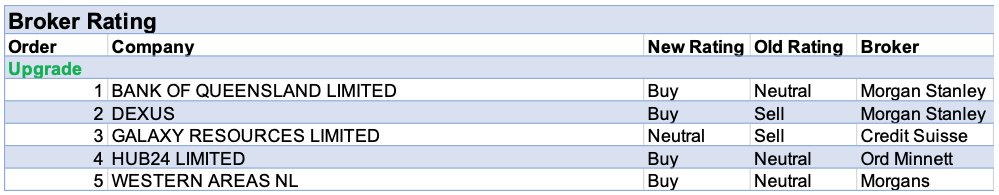

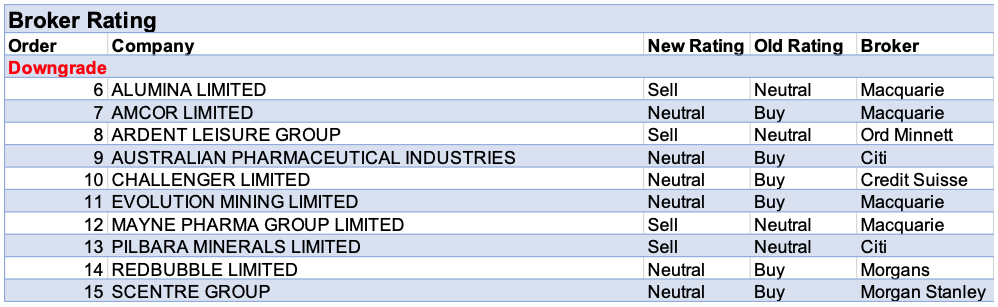

For the week ending Friday 23 April, there were 5 upgrades and 10 downgrades to ASX-listed companies by brokers in the FNArena database.

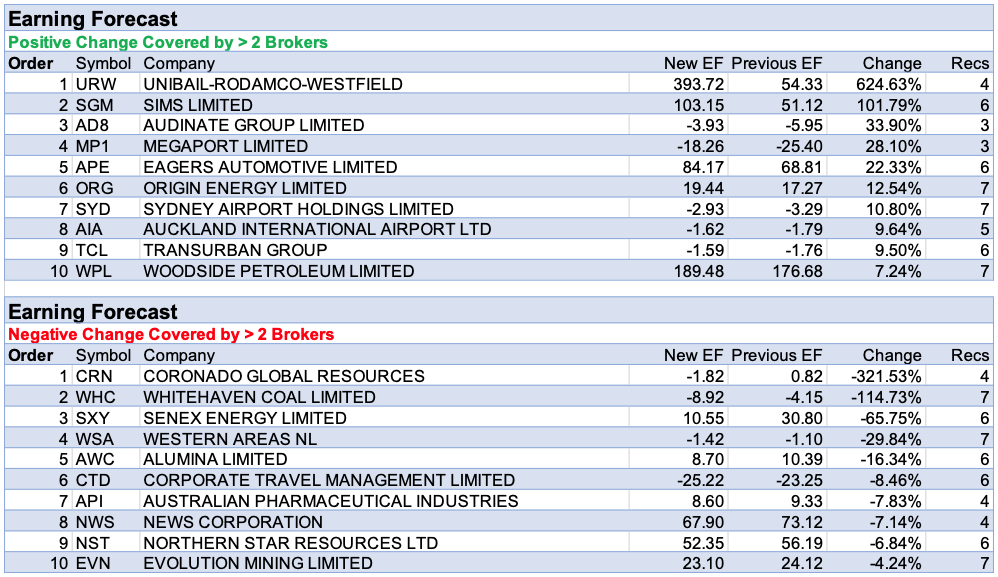

Despite retaining a Sell on Unibail Rodamco-Westfield, stockbroker Citi expects a rebound in 2022 earnings. This was enough to ensure the company headed the list last week for the largest percentage gain in earnings forecasts by brokers in the FNArena database. However, after assuming a capital raise during 2023-25, the broker calculates earnings will decline by an average -5% over the period.

Sims was next after FY21 earnings guidance was approximately 65% above the top of the range of consensus expectations, according to Credit Suisse. The latest trading update showed Morgan Stanley improved intake volumes in the third quarter. There was also an improvement in gross margin owing to higher scrap prices and margin management.

Audinate also hit the high notes by setting a new quarterly revenue record, driven by continued strength of chips, cards and modules. Looking forward, Morgan Stanley expects corporate to drive results and a demand rebound in higher education.

Earnings expectations were also on the up last week for Megaport. Management confirmed 80m in FY21 revenue, which implies to Morgans a meaningful re-acceleration in fourth quarter sales. The broker feels this should awaken investor interest. Less sanguine views emanated from both UBS and Ord Minnett after reflecting upon third quarter results that were in-line and softer than expected, respectively, compared to in-house forecasts.

The five brokers on the FNArena database that updated research on Eagers Automotive last week were impressed by the first quarter trading result. Ord Minnett explains the company is benefiting from industry tailwinds with constrained original equipment manufacturer supply driving gross margins higher. It’s now expected this dynamic will continue for much of 2021.

Coronado Global Resources was the worst performer in terms of percentage adjustments to earnings forecasts by brokers last week. Talk from Morgans of the need to extend debt covenant waivers does not inspire confidence. However, Macquarie remains positive on the outlook for metallurgical coal. This view is informed by buoyant steel demand and the fact seaborne prices are converging towards Chinese import prices.

Frustration ruled at Morgans due to ongoing faulting issues at Whitehaven Coal’s Narrabri mine. The broker feels the company should be fully leveraging the current spike in high calorific value coal prices. Consequently, the analyst’s FY21 earnings (EBITDA) forecasts were lowered by -30% on lower revenue and higher costs.

Senex Energy’s March quarter production was a little weaker than Macquarie expected while the Atlas project reached nameplate in February. The potential for government intervention in the east coast gas market and the coal seam gas (CSG) well performance are considered key risks to the outlook. The broker lowered operating earnings estimates by -13-14% across FY21-23 to reflect a slower ramp up in CSG production compared with prior forecasts.

Finally, after six brokers reviewed March quarter production for Western Areas, the average earnings estimates of all seven brokers on the FNArena database fell around -30%.

In the good books

In the not-so-good books

ARDENT LEISURE GROUP (ALG) was downgraded to Sell from Hold by Ord Minnett B/H/S: 1/0/1

Main Event is now reporting strong comparable numbers and Ord Minnett suspects its fears when the company announced a deal with RedBird Capital for a 51% stake in this business are likely materialising. At the time of the deal, in the depths of the pandemic, the broker asserted, while this was positive for short-term cash flow, it could cap shareholder exposure to the upside in a potential recovery. Despite valuing Main Event at $912m on a 100% basis, the broker estimates RedBird will be able to acquire its controlling stake for just $234m. Rating is downgraded to Sell from Hold and the target rises to $0.75 from $0.60.

AMCOR LIMITED (AMC) was downgraded to Neutral from Outperform by Macquarie B/H/S: 4/3/0

Amcor’s nine-month result is expected on May 5. Going by last year’s nine-month numbers, Macquarie expects US$785m in net profit for the nine months, up 9%. While the June quarter is Amcor’s largest quarter in terms of contribution to the company’s profit, this year Macquarie expects the contribution to be slightly lower due to higher raw material costs. Macquarie reduces its rating to Neutral from Outperform with the target dropping to $16.09 from $17.19.

AUSTRALIAN PHARMACEUTICAL INDUSTRIES (API) was downgraded to Neutral from Buy by Citi B/H/S: 1/3/0

Citi lowers the rating to Neutral from Buy and the target price to $1.35 from $1.50 as FY21-23 EPS forecasts fall by -12% to -15%, to reflect a lower-than-expected first half result. Management guided to FY21 earnings (EBIT) of $75m, implying 2H earnings of $43m. The broker explains the result was negatively impacted by the lockdowns and closures of Priceline stores (without a pharmacy) and ClearSkin clinics across Australia. The Consumer Brands division was impacted by the drop in demand for cold and flu products.

CHALLENGER LIMITED (CGF) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/5/0

Challenger reported its strongest quarter of annuity book growth in the 10-year time series, comments Credit Suisse. This was supported by $1bn in low margin/discounted institutional term annuities without which there would have been no growth. The benefit of a stronger book was overshadowed by an FY21 downgrade and guidance is now for the lower end of the $390-440m pre-tax profit range. Credit Suisse downgrades to Neutral from Outperform, assessing the recovery story is delayed. Target is reduced to $6.05 from $6.65.

EVOLUTION MINING LIMITED (EVN) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/4/1

Evolution mining posted a weak March quarter, with production down -9% on Macquarie’s forecast and costs up 18%. Red Lake continued to perform above expectation but Mt Rawdon was impacted by heavy rain. Guidance for FY21 implies a strong end to the year, with higher copper credits driving a reduction in overall cost guidance. Studies at Cowal and Red Lake could provide upside but the broker’s expectation of a lower gold price could weigh. Recent share price outperformance leads to a downgrade to Neutral from Outperform. Target unchanged at $4.80.

PILBARA MINERALS LIMITED (PLS) was downgraded to Sell from Neutral by Citi B/H/S: 1/1/2

Citi lowers the rating to Sell from Neutral after the share price has rallied 25% since mid-February. The price is now calculated to be trading ahead of underlying valuation. The $1.10 target price is maintained. March quarter lithium concentrate shipments missed expectations, due largely to a fire on an inbound cargo vessel at berth that pushed 11.5kt of shipment into April. Costs were also higher quarter-on-quarter, thanks to a stronger Australian dollar and higher freight charges.

REDBUBBLE LIMITED (RBL) was downgraded to Hold from Add by Morgans B/H/S: 0/1/0

Morgans lowers the rating to Hold from Add and the target price is decreased to $4.88 from $6.64, after forecasting near-term earnings downgrades and longer-term margin reduction. The business model and long-term growth profile are still considered appealing. The broker explains near-term investment is occurring just when there’s cycling of tough comparisons to periods with covid tailwinds and unlikely-to-be-repeated mask sales. It’s believed there’s a large opportunity to increase customer loyalty and repeat prior purchase rates. Management disclosed 2024 aspirational targets that imply a 20-30% revenue compound annual growth rate (CAGR), which is well above rates factored into the analyst’s estimates.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.