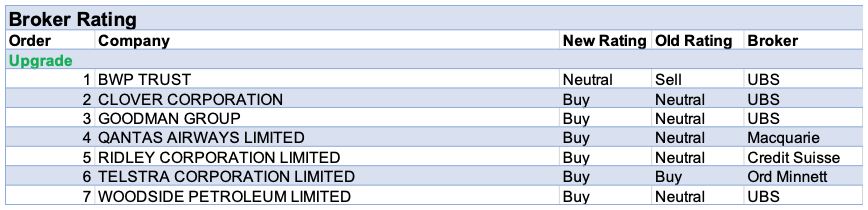

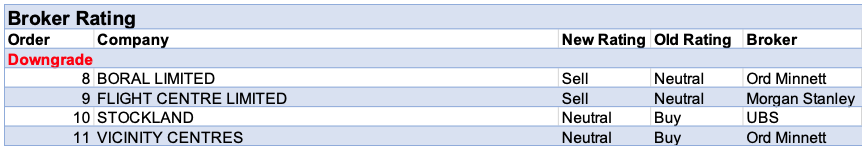

For the week ending Friday 19 March there were seven upgrades and four downgrades to ASX-listed companies by brokers in the FNArena database.

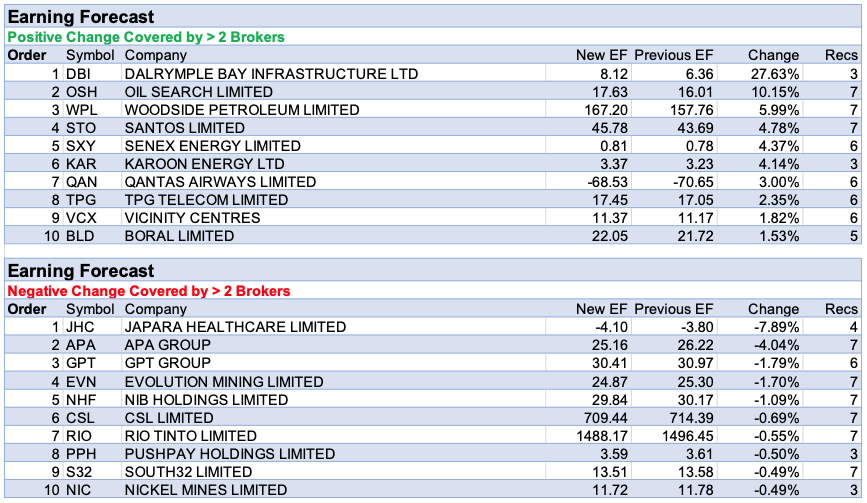

Dalrymple Bay Infrastructure was atop the table for the largest percentage increase in earnings forecasts by brokers for the week after Citi noted two potential near-term catalysts. The first is inclusion in the ASX300 today (March 22) and also the Queensland Competition Authority is due to decide around a light-touch regulatory structure. This would allow the company to negotiate the price with miners for use of its terminal instead of having the regulator set maximum prices.

Next in terms of percentage increase to forecasts earnings was Oil Search after both Citi and UBS revised up forecast oil prices for the sector. Although UBS notes the company has the highest sensitivity to changes in the oil price, it is the broker’s least preferred of the energy stocks due to few near-term catalysts.

Japara Healthcare was the only company in the FNArena database to experience a material percentage fall in forecast earnings for the week. After reviewing the final report from the Royal Commission, UBS was underwhelmed by potential delays to much needed regulatory clarity until the FY22 Budget (to be delivered in May this year).

In the good books

In the not-so-good books

BORAL LIMITED (BLD) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 3/1/0

Ord Minnett lowers the rating to Lighten from Hold as the valuation appears stretched and the company’s new $300m earnings (EBIT) benefit target, tied to a transformation program, seems ambitious. In addition, the broker highlights a risk to the US business are rising US mortgage rates, which may temper demand for housing as the year progresses. The analyst acknowledges upside risk should the US Building Products business be sold for $1.5bn. It’s considered the majority of this could be returned to shareholders. The target is increased to $5 from $4.90.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.