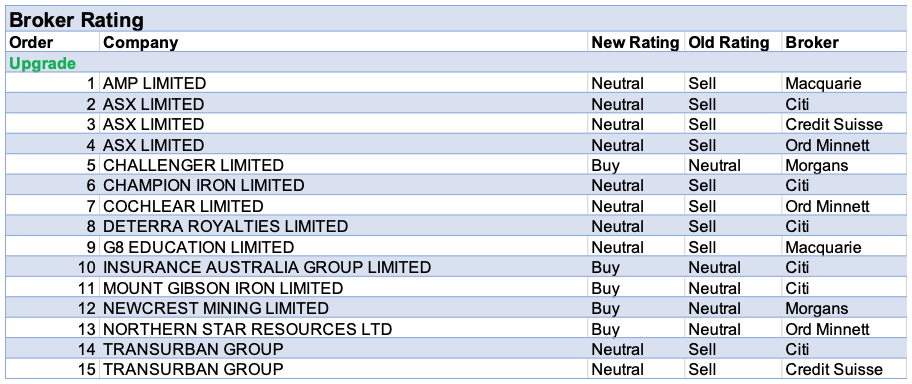

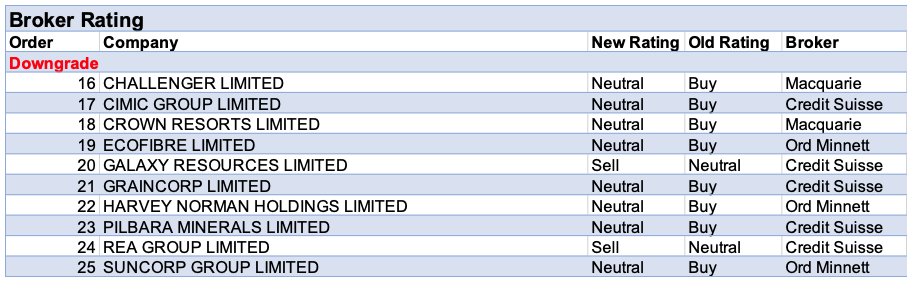

For the week ending Friday 12 February, there were 15 upgrades and 10 downgrades to ASX-listed companies by brokers in the FNArena database.

ASX received three upgrades to Neutral from Sell by separate brokers and Transurban Group received two upgrades to Neutral from Sell.

There was some consensus amongst brokers regarding a turnaround for ASX. Ord Minnett considers the company has reached the bottom of its earnings cycle and is expected to see some rebound in FY22, while Citi believes all of the main negatives are now known.

Citi upgraded Transurban Group after a -20% share price underperformance over the past three months. Meanwhile, Credit Suisse raised FY21 distribution estimates with higher numbers expected in FY22 and FY23, due to lower financing costs after Chesapeake proceeds are received.

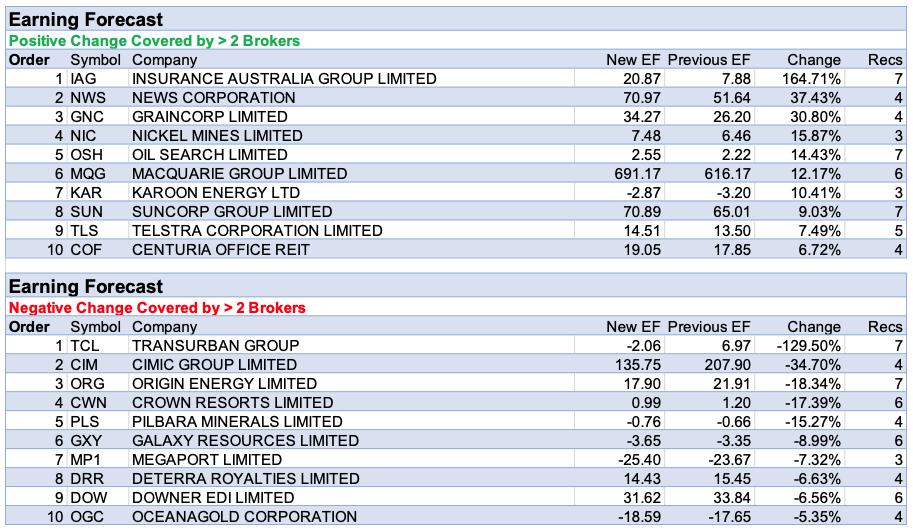

The largest percentage fall in earnings forecasts by brokers in the FNArena database went to Transurban Group.

Cimic Group, Origin Energy and Pilbara Minerals were placed in the top three for percentage declines in forecast earnings by brokers.

Next was Crown Resorts which has been deemed unsuitable for the Crown Sydney licence and Macquarie assesses the pathway to obtaining approval is onerous and may take two years.

In the case of positive revisions to earnings forecasts for the week, Insurance Australia Group was the standout. Six of a possible seven brokers updated estimates and Citi upgraded the rating to Buy from Neutral.

It seemed to be a case of relief after first half results were impacted by a -$1.2bn provision loss, booked due to Business Interruption claims. Macquarie feels the result was strong under the circumstances and Citi can see momentum starting to build in the business.

There were surprises all around for the four brokers that updated earnings forecasts for News Corp after second half results. They were by driven by cost-out and operating leverage and the trends from both the Move and Dow Jones businesses were seen as indicative of structural growth.

GrainCorp appeared high on the table for largest percentage earnings upgrades after higher-than-expected grain receivals and grain exports. This comes after the largest east coast winter grain crops on record.

Nickel Mines was next after Macquarie noted a remarkable surge in electric vehicles in the fourth quarter, which has propelled nickel sulphate prices higher. The company is the broker’s preferred nickel exposure, featuring strong forecast free cash flow yields, which increase further in a spot price scenario.

Finally, Oil Search and fellow Papua LNG partners (Total and ExxonMobil) have finally signed an agreement with the PNG government. This is considered an important milestone for the project.

In the good books

AMP LIMITED (AMP) was upgraded to Neutral from Underperform by Macquarie B/H/S: 1/6/0

Having initially retained an Underperform rating after a first glance at AMP’s result, Macquarie has now decided to upgrade to Neutral. The result was overshadowed by the back-down of Ares Management from any takeover intentions, which led to the big share price fall. Macquarie sees it differently, suggesting the focus can now return to that within management’s control. That includes an unchanged cost-out target. AMP managed to get close to its FY20 cost-out target even with additional unforeseen covid costs. No dividend was declared but the board is committed to reinstating capital management, and a breakdown of divisional earnings has provided more clarity, and led the broker to upgrade forecasts. Target rises to $1.45 from $1.30.

ASX LIMITED (ASX) was upgraded to Neutral from Sell by Citi and to Neutral from Underperform by Credit Suisse B/H/S: 0/6/1

Citi upgrades its rating to Neutral from Sell. ASX has increased guidance for both capex and costs, a development that had already been anticipated by Citi. Costs grew 8% in the first half but Citi still expects cost growth to moderate from here while expecting higher revenue. Issuer services revenue grew strongly by 44% in the first half, notes the broker, mainly reflecting the strong growth in retail broking accounts and activity. Citi expects momentum to soften from here. With all the main negatives now known, the broker upgrades its earnings forecasts for FY21-23. Target price rises to $70 from $68.

Credit Suisse upgrades its rating to Neutral from Underperform with a target price of $71. ASX’s first-half net profit was 3% above Credit Suisse’s forecast. ASX’s latest result demonstrates the resilience of its business, suggests the broker, with earnings down only -3% versus last year. Going ahead, the broker believes ASX’s earnings will contract by -5-10% in FY21 and a further -0-5% in FY22 led by softening of certain revenue lines like capital raisings supporting issuer services and elevated cash equities activity.

INSURANCE AUSTRALIA GROUP LIMITED (IAG) was upgraded to Buy from Neutral by Citi B/H/S: 3/4/0

Citi assesses momentum is building in the business and underlying margins although on current estimates there is only modest value appeal. Still, enough to upgrade to Buy from Neutral. The broker anticipates the margin target of 15-17% will be achieved by FY23. Target is raised to $5.90 from $5.00. Citi expects a significant increase in hazards allowance in FY22 while in the short term there is likely to be a modest adverse impact from lower investment returns and higher costs.

NEWCREST MINING LIMITED (NCM) was upgraded to Add from Hold by Morgans B/H/S: 6/1/0

Morgans regards strong cash flow and progress towards operational growth at Lihir and Cadia as positives for Newcrest Mining after first half results were released. The company is on track for mid-point FY21 guidance for gold and copper production, predicts the broker. The analyst highlights guidance for costs was revised to the top of the range for FY21, on the back of a higher Australian dollar and additional covid-19 costs. Underlying profit (NPAT) was up 98% from the first half FY20 and broadly in-line with consensus, driven by an increase in the gold and copper price, assesses Morgans. The broker lifts the target price to $29.98 from $27.87, driven by the longer-term growth and strategy spelt out by management for both Lihir and Cadia. The rating is lifted to Add from Hold.

NORTHERN STAR RESOURCES LTD (NST) was upgraded to Buy from Hold by Ord Minnett B/H/S: 3/1/1

Northern Star’s result was in line with Ord Minnett’s forecast and the broker can see over 10% free cash flow (FCF) yields from FY23. With $123m net debt and no material capex on the horizon, cash flow and returns will remain an important part of the analyst’s investment case. The company has reconfirmed the 6% revenue-based dividend policy. Ord Minnett highlights significant leverage to the gold price with only 13% of the three year forward production hedged in the broker’s model. Upgrade to Buy from a Hold rating with the price target rising to $14.40 from $14.3.

TRANSURBAN GROUP (TCL) was upgraded to Neutral from Underperform by Credit Suisse and to Neutral from Sell by Citi B/H/S: 3/4/0

Credit Suisse upgrades its rating to Neutral from Underperform with the target price increasing to $13 from $12.6. Transurban Group’s first-half result showed toll revenue at $1,165m, -3% below Credit Suisse’s forecast of $1,204m. Proportional operating income for the half came in at $840m, -11% below the broker’s forecast. Credit Suisse notes the miss was driven by weak traffic performance in Melbourne, and lower average dynamic toll pricing in the US Express Lanes. FY21 distribution estimates have been raised by the broker in FY21 to 33.8c with higher numbers expected in FY22 and FY23 due to lower financing costs after the Chesapeake proceeds are received.

Citi has upgraded Transurban Group to Neutral from Sell following the release of an interim report that proved slightly above expectations, even though the analysts also suggest it missed market consensus by some -5% at the operational (EBITDA) level. The upgrade was more so inspired by the -20% share price underperformance over the past three months, explain the analysts. Three key factors are preventing Citi from lifting the rating to a Buy: the valuation remains above long-term average, with leverage high and potential downside risks medium term from increased work-from-home (which impacts on the traffic on toll roads). Citi’s target price has lifted to $13.35 from $12.83.

In the not-so-good books

CIMIC GROUP LIMITED (CIM) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 1/3/0

Rating is downgraded to Neutral from Outperform. Target is reduced to $21.90 from $34. Credit Suisse is disappointed by CIMIC Group’s weak full-year result noting the subdued result was further compounded by various one-offs and suboptimal cash flows that will likely dampen sentiment in the near term. While the company’s investment thesis includes a capital-light structure and an improving balance sheet, Credit Suisse believes this will take time to reflect in the stock’s multiples. Post a lukewarm 2021 guidance, the broker cuts its 2021-22 earnings forecasts by -36-42%.

ECOFIBRE LIMITED (EOF) was downgraded to Hold from Buy by Ord Minnett B/H/S: 0/1/0

Ecofibre’s first-half revenue at $14.7m was in line with Ord Minnett’s estimate, although the operating loss was more than expected. The company has revised its guidance from “break-even” to expecting a loss of circa -$7m in FY21 due to the lack a meaningful near-term recovery in revenue. Ord Minnett remains convinced on the long-term potential of CBD and Hemp and views Ecofibre as a key player in the development of the industry. Even then, with trading severely curtailed in the US and uncertainty on the timing of the recovery, Ord Minnett downgrades its recommendation to a Hold from Buy with the target price reducing to $1.65 from $2.26.

GRAINCORP LIMITED (GNC) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 3/1/0

Credit Suisse believes GrainCorp’s FY21 guidance puts to rest some arguments with respect to crop leverage under the new crop production contract. Carry out for FY21 is guided to 2.5-3.5mt, implying a circa 0.5-1mt boost to FY22 export volume due to carry-out. Net profit is guided to be $60-85m versus the broker’s $80m forecast. Credit Suisse thinks normalisation of inventory will likely lead to the core net debt rising to $130m in the first half. Credit Suisse downgrades its rating to Neutral from Outperform with the target price rising to $5.06 from $5.03.

REA GROUP LIMITED (REA) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 1/4/1

Despite REA Group reporting first half results broadly in-line with Credit Suisse’s estimates, the broker lowers the rating to Underperform from Neutral following the recent strong share price performance. A key takeaway for the analyst includes a flattening out of depth listings, with a slight sequential decline, despite the 4% year-on-year growth in National listings in the first half. The target price is lowered to $136.70 from $137.7

SUNCORP GROUP LIMITED (SUN) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 3/4/0

Suncorp Group reported a first half FY21 net profit of $490m, below Ord Minnett’s $518m forecast, while the headline result was boosted by the bank achieving a high net interest margin (NIM) and low bad debt charges. A fully franked interim dividend of 26 cents was declared, versus the broker’s 22 cent forecast. The analyst makes a significant reduction to forecasts due to weak underlying trends, a period of reinvestment in the business and a strong share price performance relative to other general insurance stocks. The rating is downgraded to Hold from Accumulate and the target price falls to $12 from $12.83.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.