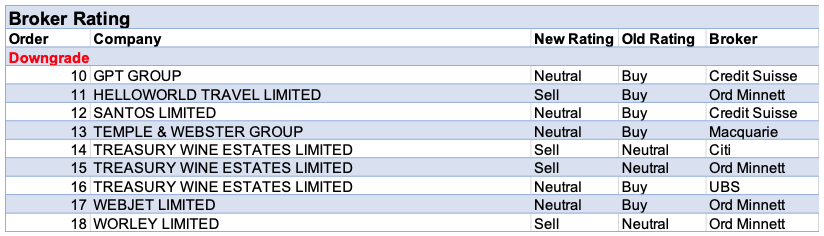

For the week ending Friday December 4, there were 9 upgrades and 9 downgrades for ASX-listed stocks on the FNArena database. Of the 9 upgrades, 4 were made by separate brokers for Domino’s Pizza Enterprises.

The majority of the 7 brokers in the database were effusive in praise for Domino’s. It’s considered the company is set for multi-year earnings growth led by store expansion, growth in same-store-sales and operating earnings margin expansion.

Three of the downgrades (and 1 upgrade) pertained to Treasury Wine Estates following the China-imposed 169% provisional anti-dumping measure rate. This outcome was worse than expected and reallocation plans are expected to take time. Credit Suisse took a counter-cyclical approach and upgraded the rating to Outperform from Neutral on the basis news is unlikely to get worse.

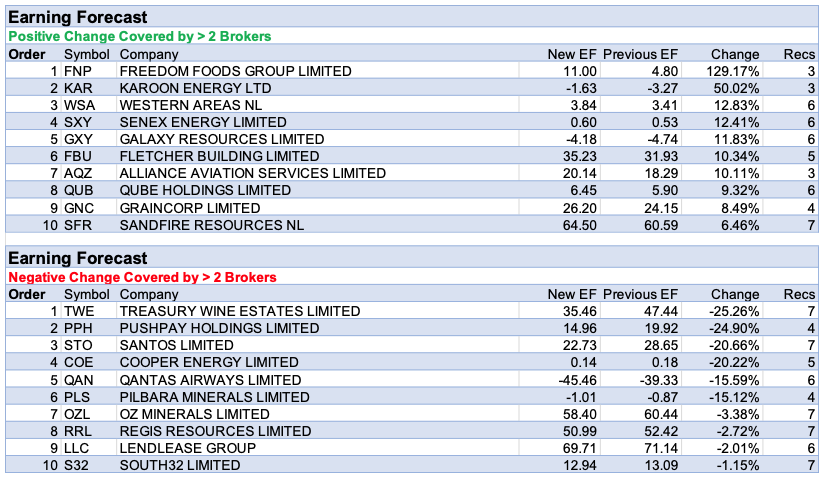

It was a big news week for Freedom Foods Group, which resulted in the largest percentage earnings upgrade for the week. Around -$590m has been written off or re-stated, largely related to fixed assets, goodwill, brands and new product costs. However, Citi can see some positives emerging and plans to simplify the business and board turnover should be well received. Also feeding into earnings forecasts is the mooted capital raising of up to $280 million, via a listed secured subordinated convertible note.

Karoon Energy shares are on an earnings upgrade roll since the recent Bauna acquisition. Macquarie also envisages “forgotten” upside in the Neon & Goia oil fields. The broker assesses the company is turning its attention to a broader Santos Basin strategy in order to boost oil production.

A higher nickel price assumption led to higher forecast earnings by Credit Suisse for Western Areas. Finally, Senex Energy had a material percentage earnings upgrade following the divestment of the company’s Cooper Basin business and upgraded Surat CSG growth targets.

It comes as little surprise that Treasury Wine Estates had the largest percentage fall in earnings forecasts by brokers for the week. The tale of woe is adequately covered above.

In the wake of an investor day, some analysts downgraded earnings forecasts for Santos. Ongoing capital costs for the base business are substantially higher than the prior broker estimates, and the company is experiencing some delays to growth projects.

Now there are five brokers researching Cooper Energy in the FNArena database, after Morgan Stanley initiated coverage last week with an Equal-Weight rating and a target price of $0.40. The new broker’s earnings projection had the effect of lowering the overall average of the five.

In the good books

KOGAN.COM LTD (KGN) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 1/1/0

In the opinion of Credit Suisse, the acquisition of New Zealand based online retailer Mighty Ape represents a material step-change in the Kogan.com business. The broker considers Mighty Ape is a quality business and management is being retained. They are considered to have strong incentives to deliver financial objectives. There is opportunity to grow the acquired company’s private label offer and leverage the marketplace of Kogan.com, in the analyst’s view. Also, there is considered a number of potential synergies across the merged group. The target price is increased to $20.60 from $19.49. The rating is increased to Outperform from Neutral.

In the not-so-good books

WORLEY LIMITED (WOR) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 4/1/0

Worley is well-placed to capitalise on growth in environmentally sustainable projects, Ord Minnett observes. These projects represent a small portion of current revenue and may not be a major contributor for some time, the broker points out. Moreover, the outlook is challenging as projects are still being deferred. The stock appears expensive and consensus forecasts optimistic and Ord Minnett downgrades to Lighten from Hold. The broker has become more cautious on the stock since the onset of the pandemic on the basis of reduced global capital expenditure. Target is raised to $11.50 from $11.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.