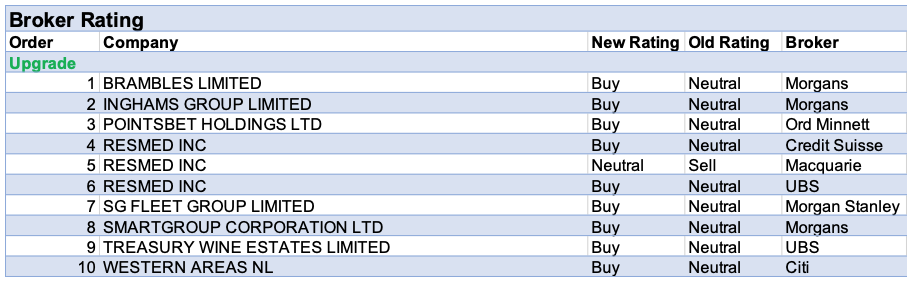

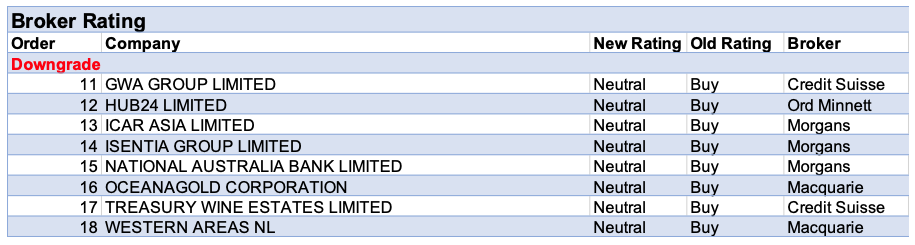

For the week ended Friday November 6, there were 10 upgrades and 8 downgrades to broker ratings for ASX-listed stocks on the FNArena database. All 8 downgrades went to a Hold rating from a Buy. Nine of the 10 upgrades went to a Buy rating, while ResMed received ratings upgrades from three different stockbrokers. The company was boosted by quarterly results that showed a rebound in sleep-related sales and management’s confidence in future quarterly improvements for device sales.

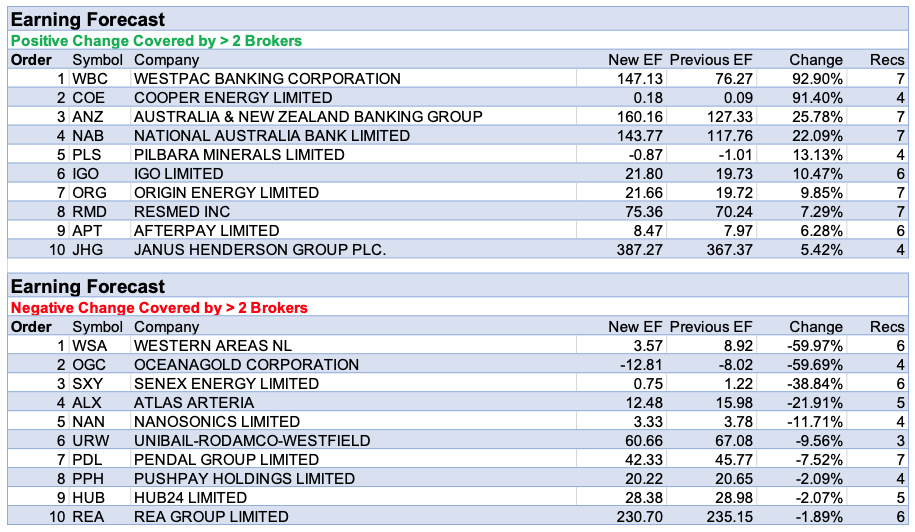

At the top of the list of percentage forecast earnings downgrades for the week was Western Areas after an update by five brokers in the wake of lower production guidance and increased cost estimates by management. After a significant share price fall, Citi saw opportunity to buy the pure-play nickel stock and upgraded the rating. Macquarie took the opposite strategy and downgraded the rating to Neutral from Outperform over some longer-term debt concerns. Those concerns would amount to nought should current spot nickel prices be maintained.

OceanaGold was second on the list after September quarter production figures were well below broker estimates, while costs were greater than expected. This was attributed to exceptional rainfall events and pandemic effects on personnel levels at the Haile project in South Carolina. As a result, Macquarie downgraded the company’s rating to Neutral from Outperform.

The management of Senex Energy updated earnings guidance in the wake of the company’s divestment of its Cooper Basin assets. The loss in earnings appeared to outweigh the cash injection in the opinion of brokers, but on the whole they were comfortable with the company’s increased coal-seam-gas focus.

Atlas Arteria broker earnings forecasts continue to suffer from concerning trends regarding the Atlantia’s Abertis (French) toll road network and the impact on both earnings and dividends in 2021. Fortunately, the company has plenty of surplus cash and Macquarie sees no financial threat.

The Westpac full year result was a mixed bag. On one hand higher costs resulted in a “miss” on core profits, while on the other a much higher dividend plus asset quality surprised on the upside. The positives triumphed as the bank had the largest percentage increase in earnings forecasts by brokers in the FNArena database for the week.

In a good week for banks, both the ANZ Bank and the National Australia Bank also had a material lift in broker earnings forecasts. As mentioned last week the ANZ Bank benefited from positive signs on both costs and asset quality, with impairment charges lower than generally expected. The majority of the seven brokers on the FNArena database agreed the bank’s FY20 result either exceeded or met expectations.

Multiple positives propelled earnings forecasts higher for National Australia bank. Brokers generally agreed with management’s margin management and provision build-up, while in the case of some brokers, the dividend exceeded expectations.

In amongst the three banks mentioned above, Cooper Energy was rewarded with earnings forecast upgrades after news that production at the Sole gas project would soon transition to term contracts. This will allow the company to start selling gas into the GSAs (gas sales agreements) it has with its Sole customers.

In the good books

INGHAMS GROUP LIMITED (ING) was upgraded to Add from Hold by Morgans B/H/S: 3/3/0

A recovery in Inghams Group’s first quarter core poultry sales volumes was stronger than Morgans expected and has supported a reduction in the group’s inventory build. While commentary on profitability was limited, the broker expects the first quarter earnings (EBITDA) figure has improved sequentially on the prior quarter. Feed costs are still expected to reduce from the fourth quarter 2021. Despite a slight accounting induced dividend policy change, the analyst doesn’t expect the quantum of the FY21 dividend will change. Morgans lifts earnings forecasts in FY22 and FY23 by 4.2% and 3.6%, respectively. The broker expects earnings to normalise and for it to benefit from a full year of lower grain prices. The target price is increased to $3.76 from $3.57 and the rating is increased to Add from Hold.

SMARTGROUP CORPORATION LTD (SIQ) was upgraded to Add from Hold by Morgans B/H/S: 3/2/0

The third quarter update indicates to Morgans broader car purchasing demand is picking up, while cash generation and the balance sheet remain solid. The broker points out trading showed improvement in the recovery run rate, in particular novated lease volume. On a short-term view Morgans increases the rating to Add from Hold and expects recovery trends to continue to show improvement. The target price is decreased to $6.55 from $6.75.

TREASURY WINE ESTATES LIMITED (TWE) was upgraded to Buy from Neutral by UBS B/H/S: 2/5/0

UBS believes the key driver for Treasury Wine Estates is China, with risks including tariffs from an anti-dumping investigation and potential retrospective tariff on imports. Additionally, there is speculation on a wine import suspension by 5 November. Separately, the broker considers the first quarter update was incrementally positive, driving 2-3% EPS upgrades. As the share price is factoring in an around -$4.40 valuation impact from tariffs, the analyst thinks the risk/reward is now favourable and upgrades to Buy from Neutral. The target price is decreased to $8.80 from $12.50.

See downgrade below.

In the not-so-good books

ISENTIA GROUP LIMITED (ISD) was downgraded to Hold from Add by Morgans B/H/S: 0/1/0

Isentia Group announced a -$7.0m to -$8.5m profit (PBT) impact from a recent cybersecurity incident. The estimated impact relates to remediation costs and foregone revenue for services effected by the outage. The incident is now largely under control with the company progressively restoring services. Morgans believes how professionally the company handles the incident and interacts with its client base will determine whether significant reputational damage is caused. If handled well the company could emerge stronger, as a result of reinforced systems and processes. The broker expects management to handle the situation well. Investors are considered likely to wait and see how the business and the competitive environment evolve before buying stock. The rating is downgraded to Hold from Add and the target price decreased to $0.15 from $0.36.

NATIONAL AUSTRALIA BANK LIMITED (NAB) was downgraded to Hold from Add by Morgans B/H/S: 4/2/1

The FY20 cash earnings (from continuing operations) for National Australia Bank were two percent less than Morgans expected, largely due to a higher-than-expected credit impairment charge. The charge was higher because the bank significantly bolstered its collective provision (CP) to credit risk weighted assets (CRWA) coverage. The broker highlights second half revenue was supported by a strong performance in the markets and treasury divisions. A final dividend of 30cps fully franked was declared, which is better than the broker’s expectation of 28cps. Morgans downgrades to Hold from Add partly due to a slight reduction in target price to $20 from $20.50, but largely due to share price strength over the last month.

TREASURY WINE ESTATES LIMITED (TWE) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/5/0

Credit Suisse has decided to downgrade to Neutral from Outperform, reflecting the political risk and uncertainty associated with the China export market. The broker’s channel checks indicate distributors may have become hesitant to order. Target is reduced to $8.50 from $12.30 to account for the temporary and short-term risk.

See upgrade above.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.