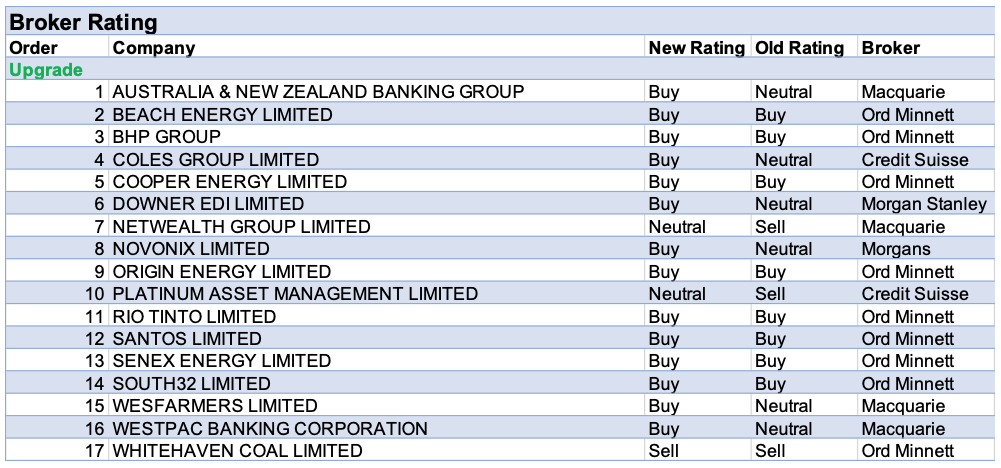

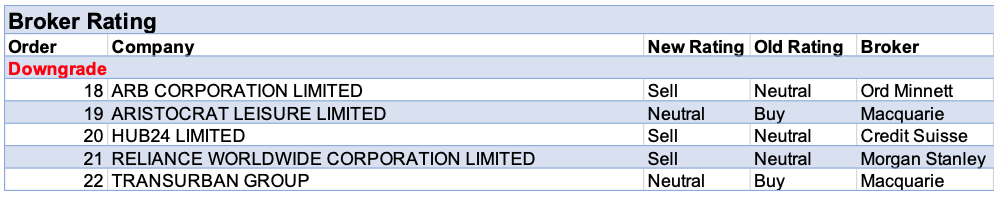

The week ending Friday October 9 was positive for individual ASX-listed stocks covered by stockbroking analysts in the FNArena database. There were 17 upgrades and five downgrades. Of those 17, 14 received an upgrade to a Buy. However, five of the seventeen upgrades were for oil companies due to Credit Suisse increasing oil prices forecasts in the broker’s valuation models. Of the five downgrades in ratings for the week, two were lowered to a Sell.

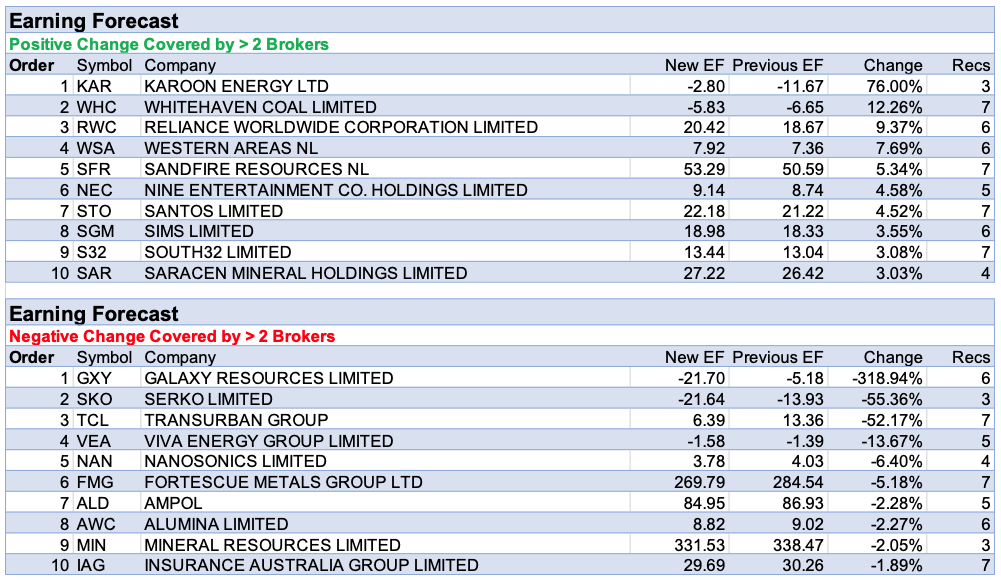

Karoon Energy and Whitehaven Coal appeared above Reliance Worldwide on the largest percentage rise in forecast earnings table. Macquarie determined the recent FY20 result for Karoon Energy was above expectations, but earnings were largely lifted as a consequence of the broker raising base case forecasts for Brent oil. Meanwhile, earnings estimates were lifted by Ord Minnett for Whitehaven Coal after a 20% rally in coal prices. This is considered the reason for recent material outperformance by the company. The broker also upgraded the rating for the company to Lighten from Sell.

With lithium market conditions to remain challenging, Galaxy Resources received a large percentage downgrade to forecast earnings. Second on the table for downgrades was Serko despite general agreement on the transformational qualities of the company’s deal with Booking.com. This was due to a capital raise and low corporate travel volumes due to covid-19.

Transurban Group also suffered a large percentage decline in earnings forecasts after a first quarter traffic update. In addition, there was a rating downgrade by one broker who noted covid-19 continues to ravage Citylink traffic volume by -59% and declines of between -30% to 50% for the US.

In the good books

BHP GROUP (BHP) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 5/2/0

After an exceptionally strong June quarter, Ord Minnett expects Western Australia Iron Ore (WAIO) exports to fall -5% on a quarterly basis to 72Mt. Petroleum output is forecast to be flat with output for coal and copper expected to fall slightly. The broker does not expect any changes to BHP Group’s production guidance. Net profit forecasts remain above consensus for 2020. The broker upgrades BHP’s rating to Buy from Accumulate with the target reducing to $44 from $45.

DOWNER EDI LIMITED (DOW) was upgraded to Overweight from Equal-weight by Morgan Stanley B/H/S: 5/1/0

The budget 20/21 has earmarked $7.5bn to fund new road and rail links and upgrade key highways. Morgan Stanley believes this bodes well for Downer EDI given it is Australia’s largest road player with government stimulus forming about 35% of the company’s revenue. The broker also points out water infrastructure received a $2bn boost over 10 years which is considered good for Downer’s utilities business. Also, Downer has transport future work in hand worth $3.5bn in FY21 and $3.2bn in FY22. Looking at the proposed infrastructure spending by the government, the broker increases its net profit estimates for FY21-23. Morgan Stanley upgrades its rating to Overweight from Equal-weight with the target price rising to $5.60 from $4.60. Industry view: In-line.

NETWEALTH GROUP LIMITED (NWL) was upgraded to Neutral from Underperform by Macquarie B/H/S: 0/5/1

Netwealth Group reported net inflows for the first quarter of $1.9bn bringing the total funds under administration (FUA) up to $34bn. Macquarie highlights flows continue to meet or beat expectations and expects platform margin pressure to persist. Macquarie adjusts EPS forecasts for FY21 and FY22 by -3.3% and 7%, respectively. For the period FY23-26 forecasts are raised by between 20-40%. These changes incorporate a -15 basis point cut to forecast interest rates offset by material increases to inflow expectations by the broker to reflect increased market share for the company. The rating is upgraded to Neutral from Underperform and the target price is increased to $17.50 from $7.25 (not a typo).

RIO TINTO LIMITED (RIO) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 3/4/0

Based on Bloomberg shipping data, Ord Minnett estimates iron ore shipments for Rio Tinto of 84mt, down from 87mt in the second quarter. The broker considers the 2020 guidance of 324–334mt to be achievable although admits it is disappointed to see shipments lower in a clear weather quarter. Also, copper volumes are expected to be lower on a quarterly basis on the back of grades at Kennecott Utah Copper (KUC), and workforce restrictions at Escondida. The rating for Rio Tinto is upgraded to Buy from Accumulate with the price target unchanged at $122.

SOUTH32 LIMITED (S32) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 6/0/1

Ord Minnett expects a mixed quarter for South32 with steady aluminium, coal and manganese ore production marred by lower output at Cannington and Cerro Matoso. The broker notes news on the SAEC divestment and updates on the Hermosa study will be watched keenly by the market. The broker upgrades its rating to Buy from Accumulate with the target price unchanged at $3.

WESFARMERS LIMITED (WES) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/3/1

Macquarie observes stronger consumer expenditure and an improved outlook are providing tailwinds across the company’s divisions. The federal budget should also drive sales for Bunnings through renovations and Officeworks through working from home. Furthermore, the broker suspects upside risk exists to sales and margins estimates for Bunnings in FY21. Meanwhile supply chain issues in Kmart are improving and Catch provides operating leverage and growth. Macquarie upgrades to Outperform from Neutral and raises the target to $51.00 from $49.10.

In the good books (oil stocks)

Ord Minnett has updated its oil price forecasts in line with the forward curve. The broker has shifted its US$60 per barrel (bbl) long-term oil price assumption from 2023 to 2024. Using the forward curve over the next 13 quarters, the broker sees a lower 2023 oil price of US$45/bbl. Investors are recommended to seek a broad sector exposure.

BEACH ENERGY LIMITED (BPT) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 5/1/0

Beach Energy’s rating has been upgraded to Buy from Accumulate with the target price falling to $2.20 from $2.25.

COOPER ENERGY LIMITED (COE) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 2/2/0

Within its small-cap coverage, Ord Minnett prefers Cooper Energy because of the company’s fixed-price contracts and strong balance sheets. Ord Minnett upgrades its rating to Buy from Accumulate with the target price reducing slightly to $0.57 from $0.58.

ORIGIN ENERGY LIMITED (ORG) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 4/3/0

Ord Minnett upgrades its rating on Origin Energy to Buy from Accumulate with the target price falling to $7.45 from $7.60.

SANTOS LIMITED (STO) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 6/1/0

The broker prefers Santos among the large-cap energy stocks under its coverage. Its 2020 earnings forecast for Santos has increased 2% after including actual September-quarter commodity prices. Ord Minnett upgrades its rating to Buy from Accumulate with the target price decreasing slightly to $7.25 from $7.50.

SENEX ENERGY LIMITED (SXY) was upgraded to Buy from Accumulate by Ord Minnett B/H/S: 5/1/0

Within Ord Minnett’s small-cap coverage, Senex Energy remains the preferred energy pick on account of its fixed-price contracts and strong balance sheet. Rating upgraded to Buy from Accumulate with the target price intact at $0.39.

In the not-so-good books

ARISTOCRAT LEISURE LIMITED (ALL) was downgraded to Neutral from Outperform by Macquarie B/H/S: 6/1/0

Macquarie assesses the opportunity for Aristocrat Leisure in the US iGaming industry. Industry revenue could exceed US$7bn in 2025, assuming 28 states are live and the addressable population base is expanded to 51% from the current 11%. The broker assumes Aristocrat Leisure participates as B2B content provider with a marginal benefit considering the impact on land-based and social casino. Macquarie downgrades to Neutral from Outperform as the stock appears fair value, trading on a 20x FY22 price/earnings ratio, broadly in line with the long-run average. Target is raised to $31.50 from $29.50.

ARB CORPORATION LIMITED (ARB) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 0/3/0

ARB Corp’s first-quarter FY21 trading update was positive, observes Ord Minnett, with sales rising 17.7%. This was somewhat dampened by lockdown restrictions in Victoria and a full order book. Management’s focus is on increasing production and overcoming logistical difficulties. The broker considers meaningful near-term earnings tailwinds for ARB Corp due to the recent re-rating of the share price. Ord Minnett downgrades its recommendation to Lighten from Hold with the target price increasing to $24 from $20.50.

TRANSURBAN GROUP (TCL) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/3/2

The first quarter traffic update for Transurban Group revealed to Macquarie softer-than-expected traffic as a result of a weak August in Sydney and Brisbane. The broker notes that covid-19 continues to ravage Citylink -59% and the US -30% to -50%. By pursuing external investors for US assets the group will reduce an ongoing capex burden, according to the analyst. Macquarie warns the yield will be under pressure as the covid-19 recovery drags out. The rating is downgraded to Neutral from Outperform and the target price is increased to $14.49 from $14.45.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.