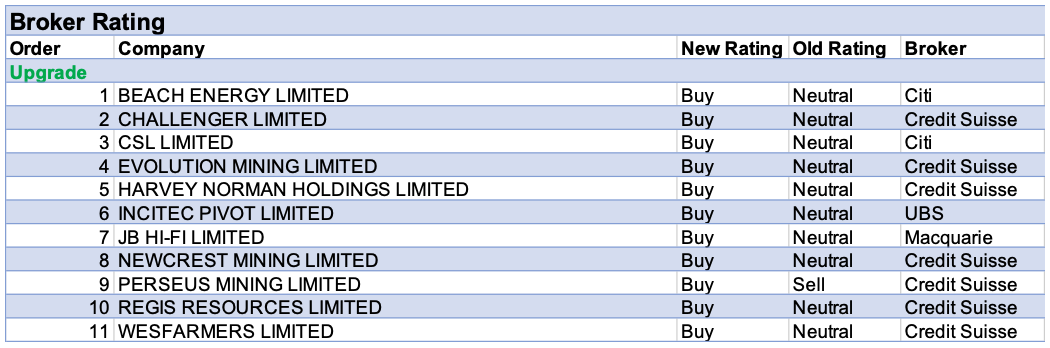

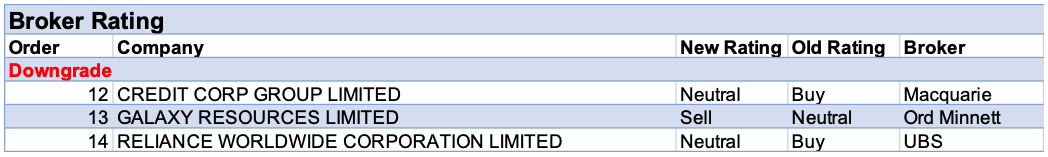

For the week ending Friday 18 September, there were 11 upgrades by stockbroking analysts for individual ASX-listed stocks. All of those stocks received an upgrade to a direct Buy. Only three stocks received a downgrade, with just one going to a direct Sell. Four of the upgrades were in the gold sector and all were a direct result of Credit Suisse adopting a bullish gold price outlook and increasing forecasts accordingly.

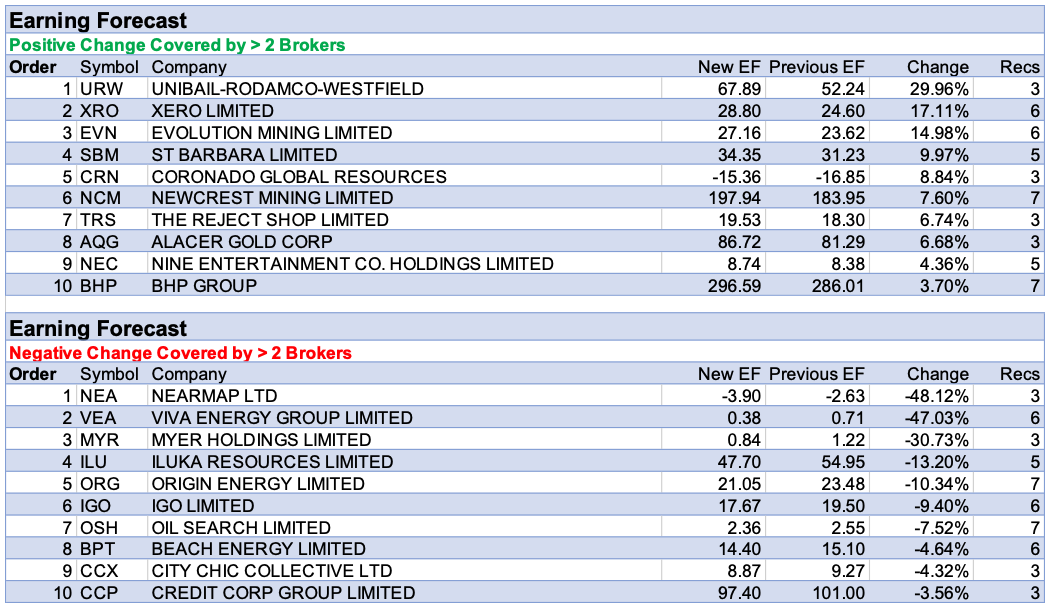

As was the case last week, Nearmap led percentage earnings downgrades for the week after announcing a capital raising. This will both support the balance sheet and allow the acceleration of growth plans in the US. However, questions have arisen whether growth is now harder to achieve and if additional investment can deliver adequate returns. Viva Energy came second on the table for percentage earnings downgrades, with concerns over cash burn, given weaker refiner margins. Rounding out the top three is perennial under-performer Myer. Brokers deem the external environment as challenging, the shape of the recovery uncertain, and the risk of an equity raise as a possibility.

Unibail-Rodamco-Westfield received the largest percentage upgrade to earnings estimates. The owner of shopping malls is looking to raise capital and will be reducing dividends and non-essential capital expenditure, while looking to complete asset disposals. The second largest upgrade to earnings in percentage terms was for Xero. A quality product is considered to have inspired a loyal customer base during pandemic tribulations, and cloud penetration should increase over time. Coming in third for earnings upgrades was Evolution Mining. This tallies nicely with the previously mentioned positives derived from a rating upgrade and a significant percentage gain in target price.

Total Neutral/Hold recommendations take up 49.83% of the total, versus 39.27% on Neutral/Hold, while Sell ratings account for the remaining 10.90%.

In the good books

BEACH ENERGY LIMITED (BPT) was upgraded to Buy from Neutral by Citi B/H/S: 5/1/0

With the recent pullback in oil prices, Citi considers the $1.36 closing share price for Beach Energy affords investors a buying opportunity with a compelling margin of safety. This is based on an analysis of past metrics as compared to peers. The broker also thinks the stock may be underperforming some peers due to a perceived lack of catalysts. While this may be true, the analyst believes the lack of balance sheet overhang as compared to peers is a positive. The rating is increased to Buy from Neutral and the target price is unchanged at $1.94.

In the not-so-good books

RELIANCE WORLDWIDE CORPORATION LIMITED (RWC) was downgraded to Neutral from Buy by UBS B/H/S: 3/3/0

UBS downgrades Reliance Worldwide Corp to Neutral from Buy with the target price increasing to $3.85 from $3.65. The downgrade is driven by a 40% share price rise after the company released its FY20 results. UBS notes the market is currently pricing in a long-term US revenue growth rate of 7% (which was 0% before the results) and which is ahead of the broker’s estimated 5%.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.