Above average volatility has hit the local share market, but the balance between upgrades and downgrades in stockbroker ratings for ASX-listed stocks remains remarkably stable thus far in June.

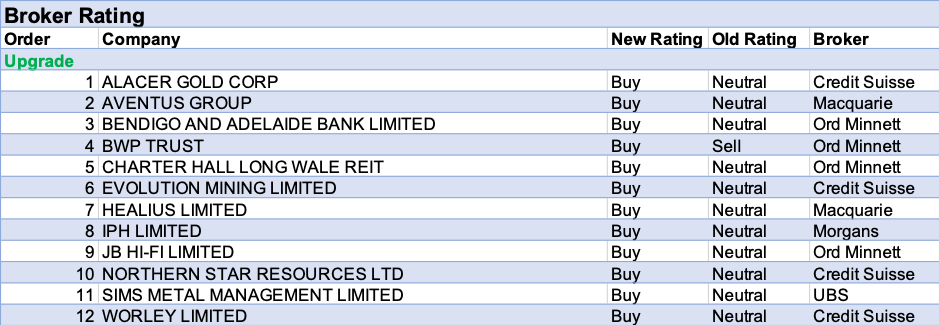

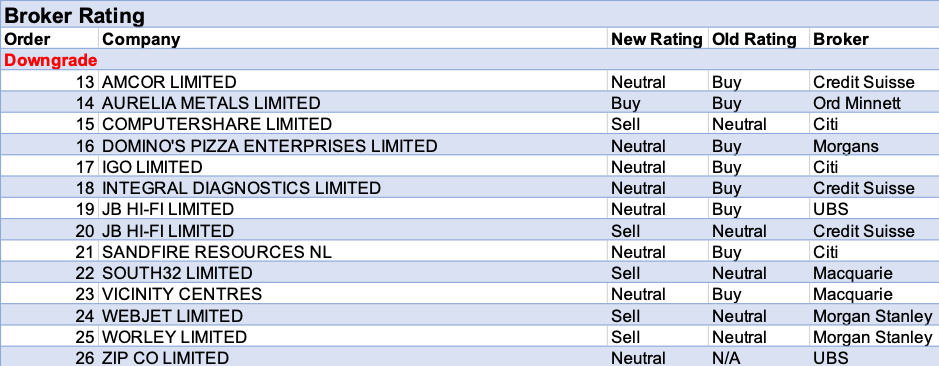

For the week ending Friday, 12 June 2020 FNArena counted 12 upgrades versus 14 downgrades issued by the seven stockbrokers monitored daily.

One of the observations to make is the total percentage of Buy and equivalent ratings has now crossed the 50% mark, against 40% holds and 9.20% Sell ratings.

Given the strong rally in the share market, that high percentage in Buy ratings is a reminder of how polarised the share market remains in 2020, irrespective of COVID-19 impacts and fallouts.

Equally remarkable, Citi, Credit Suisse and Morgans are all carrying more Buy ratings than Hold/Neutrals, with Ord Minnett evenly balanced.

This means Macquarie, Morgan Stanley and UBS have their majority recommendations grouped together in the Hold basket.

Macquarie carries the most Sell ratings of all seven.

In what can possibly be interpreted as a sign of the times, all 12 upgrades for the week moved to a fresh Buy with gold producers prominently represented.

The opposite side shows five downgrades to Sell, with Computershare, JB Hi-Fi, South32, Webjet and Worley the receivers.

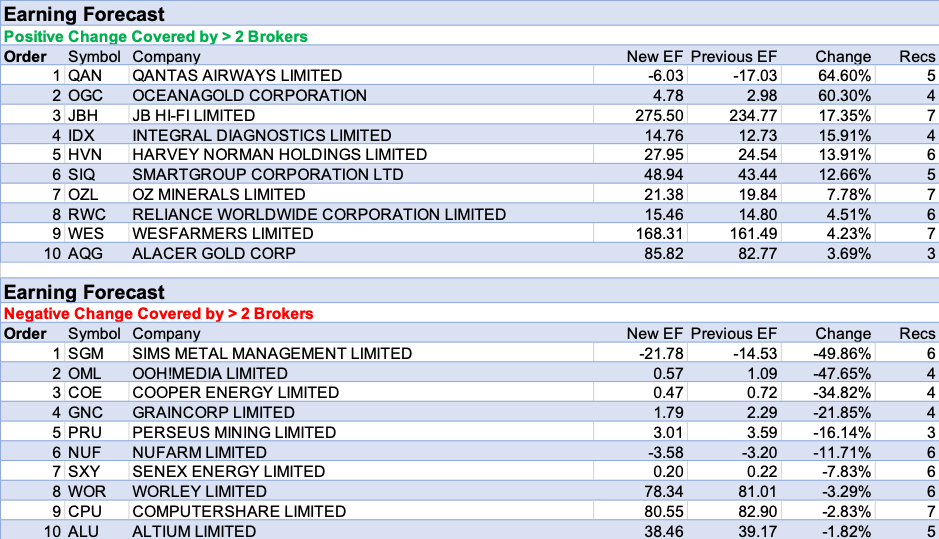

Both upgrades and downgrades to forecasts show multiple hefty adjustments, with the week’s overview for positive revisions showcasing numerous hefty increases, led by Qantas, OceanaGold and JB Hi-Fi.

On the negative side, Sims Metal Management received the heaviest cuts for the week, only just beating oOh!media for the bottom spot, with Cooper Energy, Graincorp, Perseus Mining, and Nufarm all seeing forecasts drop by double-digit percentages.

In the good books

ALACER GOLD CORP (AQG) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/1/0

Credit Suisse increases gold price forecasts for 2020-22, again. Fundamentals underpinning the gold sector include low and negative yields, a weakening US dollar and expectations that significant fiscal stimulus from various governments will ultimately be highly inflationary. Alacer Gold’s rating is upgraded to Outperform from Neutral and the target is raised to $9.40 from $8.60.

AVENTUS GROUP (AVN) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/1/0

Macquarie believes Aventus Group is well placed to benefit from the reopening of the economy and a residential rebound. Peer disclosure implies rental abatements of 32-37% over the lockdowns and the broker has applied the same assumption for Aventus. The broker also suggests Aventus‘ higher quality portfolio implies upside risk. Gearing is elevated, but asset values are relatively defensive, the broker notes, and on an 8% plus yield and -12% discount to net tangible asset value. The broker sees the stock as a sustainable longer-term discretionary play. Upgrade to Outperform from Neutral, target rises to $2.57 from $2.43.

EVOLUTION MINING LIMITED (EVN) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/3/2

Credit Suisse increases gold price forecasts for 2020-22, again. Fundamentals underpinning the gold sector include low and negative yields, a weakening US dollar and expectations that significant fiscal stimulus from various governments will ultimately be highly inflationary. Evolution Mining’s rating is upgraded to Outperform from Neutral and the target is raised to $5.65 from $4.85.

IPH LIMITED (IPH) was upgraded to Add from Hold by Morgans B/H/S: 2/0/0

IPH announced the acquisition of New Zealand based Baldwins Intellectual Property for circa $7.4m, considered a strategically sound move by Morgans. The broker also expects patent filing activity in the second half to be down with a weak final quarter. Overall, FY20 operating income is expected to go down by -1.5% to $114.5m while FY21-22 forecasts stand reduced. Despite this, the company is well-positioned and operates in a defensive sector, notes the broker. Morgans upgrades its rating to Add from Hold. Target decreased to $8.69 from $9.78.

JB HI-FI LIMITED (JBH) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 2/4/1

JB Hi-Fi’s trading update reports strong sales growth for JB Australia and The Good Guys for the five months to May. Ord Minnett considers JB Hi-Fi a winner in the retail sector with an attractive product mix, diversified channel and location mix. Earnings forecasts have been revised by the broker for FY20-22 with FY20 growth expected to be driven by JB Australia and The Good Guys. The broker is also confident about FY21 with the ongoing momentum to continue into the first half while the combination of product and channel/location mix is expected to support the second half. Ord Minnett upgrades its rating to Accumulate from Hold with target increased to $44 from $37.

See downgrades below.

NORTHERN STAR RESOURCES LTD (NST) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 1/2/2

Credit Suisse increases gold price forecasts for 2020-22, again. Fundamentals underpinning the gold sector include low and negative yields, a weakening US dollar and expectations that significant fiscal stimulus from various governments will ultimately be highly inflationary. The broker prefers the large gold stocks such as Northern Star and believes it offers the best value. Rating is upgraded to Outperform from Neutral and the target is raised to $14.70 from $13.00.

In the not-so-good books

AMCOR LIMITED (AMC) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 5/2/0

Credit Suisse assesses Amcor is approaching fair value. The investment case remains the same and the revenue streams have proven largely defensive throughout the pandemic. The main risk is exchange rates, in the broker’s opinion. Hence, the rating is downgraded to Neutral from Outperform. Target is lowered to $15.65 from $16.90.

COMPUTERSHARE LIMITED (CPU) was downgraded to Sell from Neutral by Citi B/H/S: 2/2/2

Challenges are expected to prevail in the short term but potential positives remain down the track, Citi ascertains. The broker believes a rebound in earnings is unlikely until FY22. Revenue growth in US mortgage servicing is expected to slow materially amid an inability to collect fees during forbearance as well as lower margin income. The broker downgrades to Sell from Neutral. Target is lowered to $12.00 from $12.40.

INTEGRAL DIAGNOSTICS LIMITED (IDX) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 3/1/0

The company provided a strong trading update, with Credit Suisse noting the resilience of end markets. The company has acquired Ascot Radiology in New Zealand for $48m which, while not cheap, is a sensible acquisition, in the broker’s opinion. Revenue has recovered from the April trough and is approaching pre-pandemic levels. Credit Suisse makes material upgrades to estimates but downgrades to Neutral from Outperform on valuation grounds. Target rises to $4.30 from $3.15.

JB HI-FI LIMITED (JBH) was downgraded to Underperform from Neutral by Credit Suisse and to Neutral from Buy by UBS B/H/S: 2/4/1

Credit Suisse suggests taking some profits after the company has benefited significantly from the restrictions, amid the likelihood consumer expenditure will be lower once government support packages end. While acknowledging the “quality” argument, the broker observes the stock is trading at a significant premium to peers. Sales for JB Hi-Fi Australia are up 20% and The Good Guys up 24% year-on-year, which suggests a market share loss to Harvey Norman (HVN) in electrical. Location factors are likely to be the main cause, in the broker’s view. Rating is downgraded to Underperform from Neutral and the target is raised to $34.52 from $32.87.

The outlook for housing appears better than UBS feared but a downturn is still expected. House prices, the largest driver of retail sales, are expected to fall -5-10% and FY21 household goods sales are expected to fall -4%. Following recent outperformance, JB Hi-Fi is downgraded to Neutral from Buy as the share appears to be factoring in large upgrades for FY20/21, the broker comments. Target is raised to $44 from $40.

See upgrade above.

SOUTH32 LIMITED (S32) was downgraded to Underperform from Neutral by Macquarie B/H/S: 6/0/1

Commodity price weakness is continuing to increase downside risk against Macquarie’s forecasts and now currency is becoming a major headwind. The majority of South32’s commodities are trading below the broker’s FY21 forecasts and all are below for FY22. Under current spot prices, earnings would fall in excess of -60% from the broker’s forecast. Hence a downgrade to Underperform from Neutral. Target unchanged at $1.90.

WEBJET LIMITED (WEB) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 2/2/1

Morgan Stanley downgrades to Underweight from Equal-weight, preferring Corporate Travel (CTD) to Webjet. Since January Corporate Travel has materially outperformed in terms of the share price, yet when valuing the business Webjet’s market cap and valuation have increased 30% and 1%, respectively, because of a highly dilutive capital raising. Corporate Travel on the other hand has not experienced the same level of business stress and has not needed to raise capital, with its market cap and valuation down -31% and -32%, respectively. The broker believes this divergence in relative value is not warranted by fundamentals. Target is raised to $3.30 from $2.50. Industry View is In-Line.

WORLEY LIMITED (WOR) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 4/1/1

Morgan Stanley considers the period ahead is uncertain and it is unclear how revenue and margins will adjust. Worley focused its investor briefing on the transition to new energy, which sets up long-term investment fundamentals but is less likely to be a driver of earnings momentum in the short term. Hence, relative to other energy coverage, Morgan Stanley downgrades to Underweight from Equal-weight. Target is $8.40. Industry view is Cautious.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.