The script from the weeks prior continued in the week ending Friday 27 March 2020. While equities continued to be exposed to wild gyrations, with a bias to the downside, securities analysts kept on frantically updating and responding to profit warnings and removals of guidance by individual companies. And the scrapping of dividends, which no doubt will be hitting hard on large cohorts of the Australian investor community.

Total Buy (and equivalent) ratings for the seven stockbrokerages monitored daily by FNArena is now well and truly the largest group of recommendations, but still only two out of these seven are carrying more Buy ratings than Neutral/Holds; Citi and Macquarie.

Total Buy recommendations for individual stocks have now risen above 47% with 42.2% on Neutral/Hold and the remaining 10.5% on Sell.

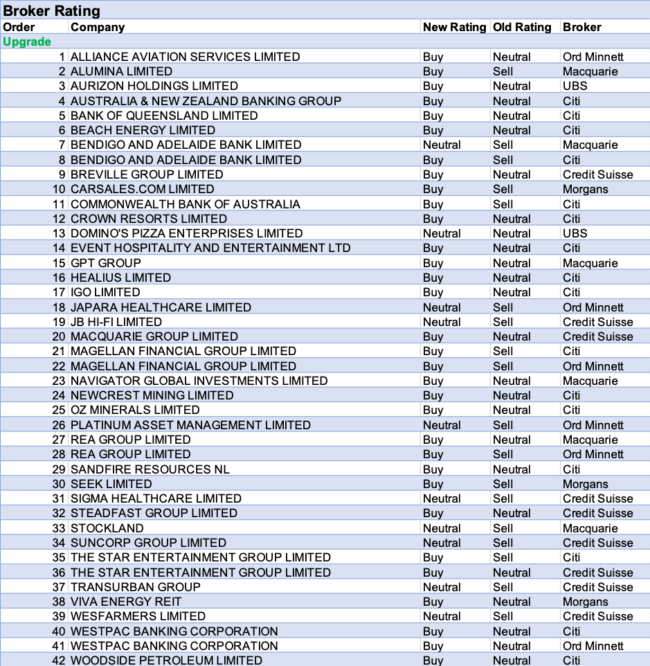

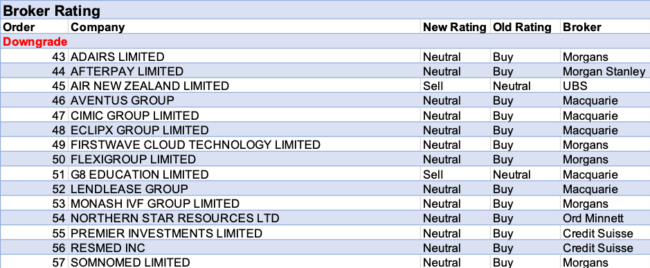

As far as upgrades and downgrades are concerned, the week saw 42 upgrades and 15 downgrades, and the overwhelming majority of upgrades moved to Buy (32 new Buys out of 42). Stocks that received multiple upgrades (not necessarily all to Buy) include Bendigo and Adelaide Bank, Magellan Financial, REA Group, Star Entertainment, and Westpac.

As expected, only two of the 15 downgrades shifted to a fresh Sell recommendation with Air New Zealand and G8 Education the receivers.

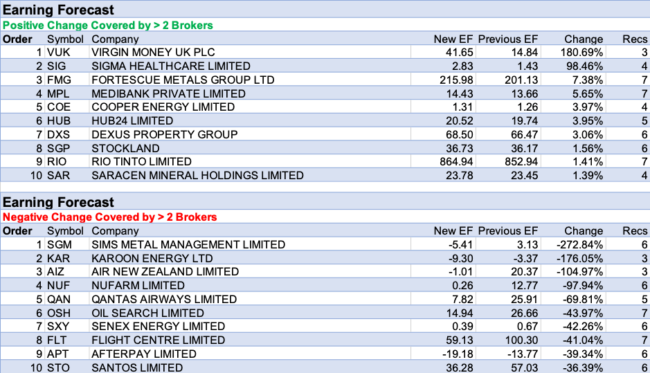

There are still companies receiving upgrades to earnings forecasts, and they include Virgin Money UK, Sigma Healthcare, Fortescue Metals, Medibank Private and numerous others. But, no surprise here, for the real fireworks we need to cast our eye over the table showing negative adjustments.

Downward adjustments to earnings forecasts are simply enormous, led by cyclical, highly leveraged companies such as Sims Metal Management, Karoon Energy, Air New Zealand, Nufarm, Qantas, and Oil Search.

It is most likely the above trends will continue in the week(s) ahead.

In the good books

BENDIGO AND ADELAIDE BANK LIMITED (BEN) was upgraded to Neutral from Underperform by Macquarie B/H/S: 1/3/2

Macquarie has downgraded forecast earnings across the major banks by -2-10% to account for the RBA cut, repricing initiatives, virus support packages and rising impairments due to economic weakness. The impact on regionals is less severe as they benefit from the majors’ repricing initiatives. Exposure to SME impairments lead to material downgrades for Virgin Money UK. Bendigo & Adelaide Bank target falls to $6.00 from $7.50, upgrade to Neutral from Underperform.

CROWN RESORTS LIMITED (CWN) was upgraded to Buy from Neutral by Citi B/H/S: 3/3/0

Citi envisages earnings risks for the near term and downgrades estimates by -48%. However, the broker remains confident in the FY22 earnings outlook and considers the stock undervalued. Rating is upgraded to Buy from Neutral and the target reduced to $8.20 from $12.10.

DOMINO’S PIZZA ENTERPRISES LIMITED (DMP) was upgraded to Neutral from Sell by UBS B/H/S: 3/2/2

UBS upgrades to Neutral from Sell, noting the balance sheet is solid and the company will benefit in the longer term from an accelerating shift to deliveries. The broker believes earnings risk from the coronavirus crisis is manageable and transitory. The stock appears to be trading broadly in line with peers and is seen as representing fair value. Target is reduced to $51.00 from $52.50.

IGO LIMITED (IGO) was upgraded to Buy from Neutral by Citi B/H/S: 3/2/1

Citi upgrades to Buy from Neutral. At current levels the broker assesses the valuation is attractive. Across base metals coverage, the stock carries the lowest operating risk profile given the locations of its mines and the revenue mix. The broker reduces the target to $5.90 from $6.30.

JAPARA HEALTHCARE LIMITED (JHC) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 0/4/0

Ord Minnett is now a little more confident that residential aged care facilities have the procedures to manage infection control throughout the current coronavirus outbreak without undue risk. The broker has also become more constructive on the outlook for occupancy, as the sector should benefit from efforts to clear hospitals ahead of the influx of coronavirus patients. Despite the company’s decision to step away from guidance, the broker lifts forecast slightly and upgrades to Hold from Lighten. Target is reduced to $0.65 from $0.80.

MACQUARIE GROUP LIMITED (MQG) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/2/1

Credit Suisse envisages further risk to FY21, given annuity businesses are likely to start from a lower base and performance fees are likely to fall, given asset price deflation. Increased impairments could be recognised in FY20 and FY21. The broker reduces FY20 forecasts by -12% and FY21 forecasts by -20%. Given the volatile market, the broker suspects Macquarie Group may not provide any guidance statement for FY21 at the FY20 result. The share price has fallen -40% since mid-February and the broker upgrades to Outperform from Neutral. Target is reduced to $110 for $135.

OZ MINERALS LIMITED (OZL) was upgraded to Buy from Neutral by Citi B/H/S: 4/2/1

Citi upgrades to Buy/High Risk from Neutral. The stock has de-rated substantially and, while the broker is cautious on the ramp up of Carrapateena, the risk is considered priced in. Target is reduced to $10.70 from $11.00.

REA GROUP LIMITED (REA) was upgraded to Accumulate from Lighten by Ord Minnett B/H/S: 5/1/0

Ord Minnett upgrades to Accumulate from Lighten, assessing the current valuation is attractive as an entry point. The broker points to the strong network and unique real estate advertising structure in Australia underpinning the stock. The stock is now down -33% in 2020 to date. The broker reduces the target to $88 from $99. Revised estimates take into account a -50% decline year-on-year in new listings over the next six months.

STEADFAST GROUP LIMITED (SDF) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 4/0/0

Credit Suisse decreases FY20 net profit estimates by -4%. A very severe economic downturn with a large number of small businesses collapsing could put additional pressure on income. While not ruling out the downside risk in such a scenario, the broker suspects this would be less severe compared with the broader sector. Therefore, the rating is upgraded to Outperform from Neutral. Target is lowered to $3.50 from $4.00.

SANDFIRE RESOURCES NL (SFR) was upgraded to Buy from Neutral by Citi B/H/S: 4/3/0

Citi upgrades to Buy/High Risk from Neutral/High Risk. Target is reduced to $5.00 from $6.20. The sole producing asset, Monty, is generating cash and the main overhang continues to be the timing of new projects to ensure production continuity when DeGrussa reserves deplete during FY22.

THE STAR ENTERTAINMENT GROUP LIMITED (SGR) was upgraded to Buy from Sell by Citi and Upgrade to Outperform from Neutral by Credit Suisse B/H/S: 5/2/0

Citi envisages earnings risks for the near term and downgrades estimates by -48%. However, the broker remains confident in the FY22 earnings outlook and considers the stock undervalued. The broker upgrades to Buy from Sell and reduces the target to $2.40 from $4.10.

Credit Suisse downgrades FY20 estimates for earnings per share by -38% and FY21 estimates by -20%. FY22 estimates are downgraded by -8% as the broker considers it plausible that economic recovery could take a couple of years. The company has ample liquidity even in the case of more extensive shutdowns to casinos. Finance industry indications are that Australian banks are likely to resist calling in debt. The stock is presenting deep value and the broker upgrades to Outperform from Neutral, although the growth profile is partially compromised by the opening of Crown ((CWN)) Sydney. Target is reduced to $3.90 from $4.20.

SIGMA HEALTHCARE LIMITED (SIG) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/2/2

FY20 underlying operating earnings were ahead of Credit Suisse estimates. No final dividend was announced. While the balance sheet appears stretched, Credit Suisse notes the company is pursuing a sale & lease-back of its distribution centres. The broker believes FY20 was a trough in earnings and in the short term the company can benefit from the increased demand for pharmaceuticals. Rating is upgraded to Neutral from Underperform. Target is raised to $0.64 from $0.53.

SUNCORP GROUP LIMITED (SUN) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 1/5/1

Credit Suisse makes changes to key assumptions, lowering FY20 net profit forecasts by -25%. FY21 estimates are lowered by -8-10% on a lower underlying investment yield on insurance and higher bad debts and the bank. The share price is tracking around -20% below that of Insurance Australia Group (IAG), which the broker assumes is because of the banking exposure. Credit Suisse is becoming more comfortable with the reinsurance renewal risk and upgrades to Neutral from Underperform. Target is reduced to $9.15 from $12.00.

TRANSURBAN GROUP (TCL) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 2/4/1

Traffic levels are likely to be severely impacted by travel bans, lock-downs and other measures to slow the spread of coronavirus. Credit Suisse expects a reduction in the dividend of -23% in FY21 because of lower free cash flow. A $0.62 dividend is forecast for FY20, in line with guidance, although the broker acknowledges there is downside risk depending on how the crisis develops in the next few weeks. Rating is upgraded to Neutral from Underperform as the valuation appears more reasonable. Target is lowered to $10.65 from $13.00.

VIVA ENERGY REIT (VVR) was upgraded to Add from Hold by Morgans B/H/S: 1/1/1

Viva Energy REIT is well placed in the current environment, Morgans suggests, with balance sheet, leases structures and long lease expiries all in its favour. Importantly, petrol stations are an essential service. The broker upgrades to Add from Hold. Target falls to $2.71 from $2.77.

In the not-so-good books

AFTERPAY LIMITED (APT) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 4/2/0

Morgan Stanley believes this recession is unique and will test Afterpay’s business model. The broker suspects the company faces a trade-off between maintaining revenue growth and containing credit risk. Retailers, faced with the lock-down of physical stores, will seek to accelerate the shift to online. Afterpay is well-placed to capitalise on this for the short term. Yet, Morgan Stanley suspects this will be a temporary tailwind. Rating is downgraded to Equal-weight from Overweight. Target is reduced to$19.00 from $46.50. Industry view is In-Line.

AVENTUS GROUP (AVN) was downgraded to Neutral from Outperform by Macquarie B/H/S: 1/2/0

Guidance has been withdrawn. The company has indicated trading was solid up until the outbreak of the coronavirus. The distribution is being reduced to protect the balance sheet, although Macquarie notes absolute gearing levels are high versus peers. Exposure to discretionary retail tenants is the main risk, in the broker’s opinion. Rating is downgraded to Neutral from Outperform and the target lowered to $2.43 from $3.45.

CIMIC GROUP LIMITED (CIM) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/2/0

Hochtief has been coming to support Cimic Group, increasing its stake by 2.2% to 74.9% in the last two weeks, Macquarie notes. Under law, Hochtief can buy 3% every six months. The announced buyback will also go ahead, in contrast to just about everyone else. All well and good but the sector is clearly now challenged, which is not in contrast to everyone else. The broker downgrades to Neutral from Outperform as the share price is approaching an unchanged $25.73 target.

ECLIPX GROUP LIMITED (ECX) was downgraded to Neutral from Outperform by Macquarie B/H/S: 3/2/0

Increased asset, credit risk and strain on working capital has caused Macquarie to apply a -75% discount to the fundamental valuation. Rating is downgraded to Neutral from Outperform and the target reduced to $0.49 from $1.93. The company has recently reiterated the sale of Right2Drive and CarLoans is still expected in FY20. Macquarie also notes that all asset exposures are secured and are income-generating business assets. Still, working capital in the current environment is highly uncertain.

FIRSTWAVE CLOUD TECHNOLOGY LIMITED (FCT) was downgraded to Hold from Add by Morgans B/H/S: 0/1/0

Firstwave Cloud Technology continues to make all the right moves, Morgans suggests, is leveraged to a large and growing market and has created an innovative cyber-security solution for SMEs. However the business is not yet self-funding and relies on ongoing access to equity markets. Clearly that is a challenge right now. The broker has changed neither earnings forecasts nor valuation but has applied a valuation discount under the current circumstances. Target falls to 11c from 24c, downgrade to Hold from Speculative Buy.

G8 EDUCATION LIMITED (GEM) was downgraded to Underperform from Neutral by Macquarie B/H/S: 0/4/1

The implications of the lock-downs and a recession from rising unemployment magnifies the risks to the balance sheet and equity, Macquarie asserts. With a recession as a base case, the broker believes child-care demand after the coronavirus crisis could be in difficulty amid high unemployment. Rating is downgraded to Underperform from Neutral. Target is reduced to $0.50 from $1.77.

NORTHERN STAR RESOURCES LTD (NST) was downgraded to Hold from Buy by Ord Minnett B/H/S: 1/3/2

Northern Star has downgraded March quarter production guidance by -10-15% and withdrawn FY20 guidance, deferring the interim dividend. Ord Minnett reduces estimates by -23% in FY20 and -11% in FY21. Disruptions are largely because of restrictions being imposed on the movement of workers and suppliers in Western Australia and Alaska. The broker lowers the target to $12.00 from $13.50 and downgrades to Hold from Buy.

PREMIER INVESTMENTS LIMITED (PMV) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/3/0

The company has temporarily closed most of its stores to protect cash flow. Employees are being stood down and the company does not intend to pay rent during the period of closure. Credit Suisse reduces earnings estimates for FY20 to reflect two months of full closure and trading at around 70% of the normal level of June and July. No adjustments are yet made to FY21. Given the uncertainty in the low likelihood of outperformance in recession, Credit Suisse reduces the rating to Neutral from Outperform. Target is raised to $10.17 from $9.94.

RESMED INC (RMD) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 1/5/1

The pandemic has created strong demand for ventilators globally and the company has committed to increasing its manufacturing capacity although it will take time to source parts. These are typically higher margin items. Still, with sleep laboratories closing as part of government mandated lock-downs, Credit Suisse expects a sharp decline in new sleep apnoea treatment. The broker estimates 90% of sleep apnoea device sales are new patient set-ups. Rating is downgraded to Neutral from Outperform and the target lowered to $25.10 from $27.00.

SOMNOMED LIMITED (SOM) was downgraded to Hold from Add by Morgans .B/H/S: 0/1/0

The effects of the crisis on the company’s operations are considered significant for the short term as dental and medical societies are recommended to refrain from the company’s treatments until coronavirus rates are under control. Morgans assumes the next two quarters of revenue are negligible amid a gradual return to previous expectations by FY22. The company has announced an accelerated entitlement offer to raise $15.5m to fund the business through the period of uncertainty. Rating is downgraded to Hold from Add and the target lowered to $1.33 from $3.75.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.