The pre-season to the February reporting of corporate profits in Australia has opened up a glaring gap between forecasts for shareholder profits (falling) and stockbroking analysts’ valuations for ASX-listed companies (rising).

Remarkable is that one of the sectors that is carrying a big chunk of investor hopes for the calendar year ahead -mining and energy- is prominently represented among the companies receiving downgrades to estimated earnings. Profit warnings from the likes of Downer EDI, Suncorp and Super Retail further add to the continuous downtrend in earnings forecasts.

On the sunny side, small cap miners and energy producers are equally represented among companies receiving upgrades to forecasts. All this probably goes to show, individual stories more so than broad sector dynamics are dominating previews for the February reporting season.

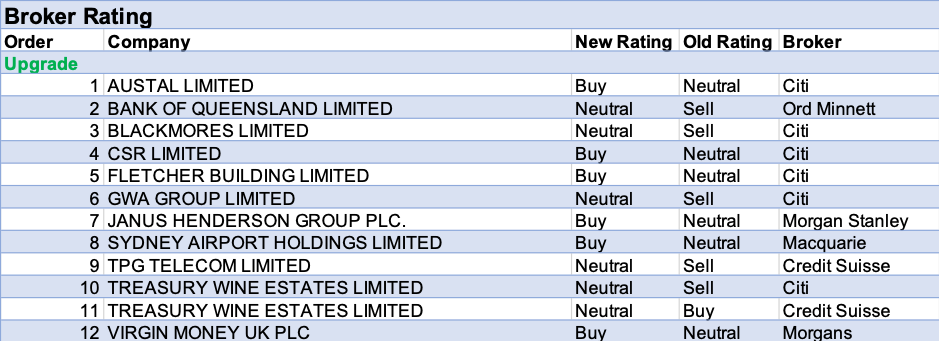

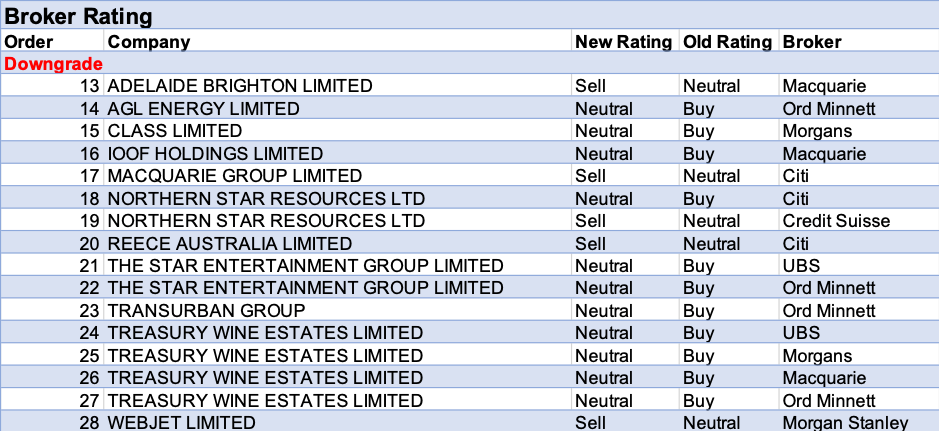

Meanwhile, analysts are not holding back in upgrading and downgrading their recommendations. For the week ending Friday, 31 January 2020, FNArena registered 12 upgrades versus 16 downgrades. Treasury Wine Estates (profit warning) stole the show attracting two upgrades (to Neutral) and four downgrades during the week.

Other companies that received more than one change in rating include Star Entertainment and Northern Star, both receiving multiple downgrades.

Only half of the week’s upgrades moved to Buy (six out of 12), while only five of the downgrades sank to a Sell, including for Macquarie Group, Webjet and Adelaide Brighton.

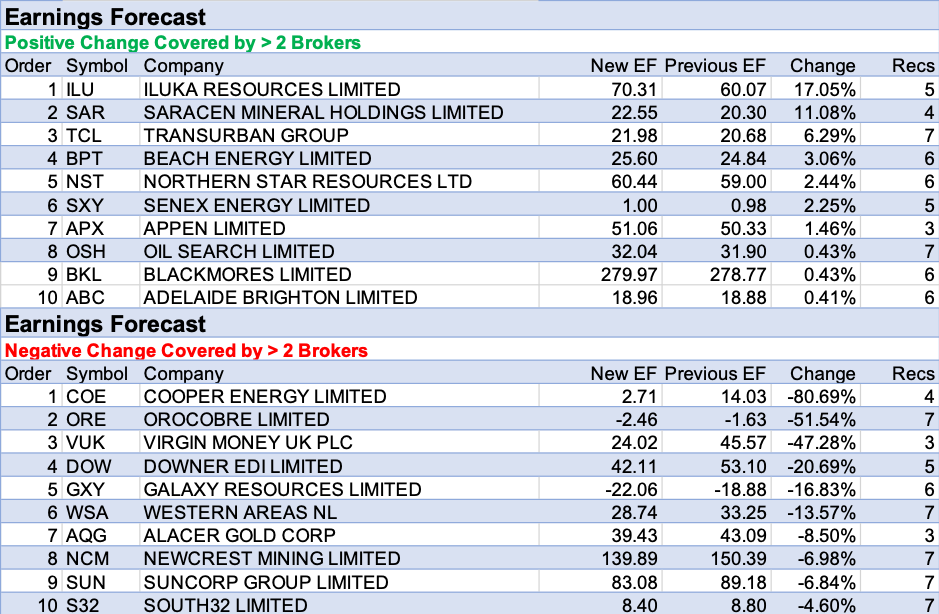

Iluka Resources and Saracen Mineral Holdings enjoyed the week’s largest increases to earnings estimates, beating Transurban, Beach Energy and Northern Star. The largest reduction, by some distance, was reserved for Cooper Energy, while forecasts for Orocobre equally received the chainsaw treatment. As did, ironically, forecasts for Virgin Money UK, Downer EDI, Galaxy Resources and Western Areas.

Early reporting season continues this week, but overall numbers of companies reporting remain benign as is the usual pattern in Australia.

In the good books

AUSTAL LIMITED (ASB) was upgraded to Buy from Neutral by Citi B/H/S: 2/1/0

Citi upgrades to Buy from Neutral, believing the stock should be a relative safe haven in reporting season given the improved execution on the US defence backlog. There is a potential positive catalyst surrounding Subic Bay and the weaker Australian dollar. Citi raises the target to $4.40 from $4.30. While the broker retains concerns around the US Navy retiring the LCS early and the FFG (X) tender being highly competitive, these factors are unlikely to impact on earnings over the next 12 months.

CSR LIMITED (CSR) was upgraded to Buy from Neutral by Citi B/H/S: 1/1/3

Citi assesses the domestic housing cycle is bottoming and forecasts a medium-term shortage that will underpin a cyclical recovery. Along with a strengthening US housing cycle the broker recommends a selectively bullish position. The rating on CSR is upgraded to Buy from Neutral and the target lifted to $5.60 from $4.30.

FLETCHER BUILDING LIMITED (FBU) was upgraded to Buy from Neutral by Citi B/H/S: 1/4/0

Citi assesses the domestic housing cycle is bottoming and forecasts a medium-term shortage that will underpin a cyclical recovery. Along with a strengthening US housing cycle the broker recommends a selectively bullish position. The broker upgrades Fletcher Building to Buy from Neutral and raises the target to NZ$6.25 from NZ$5.10.

GWA GROUP LIMITED (GWA) was upgraded to Neutral from Sell by Citi B/H/S: 0/4/0

Citi assesses the domestic housing cycle is bottoming and forecasts a medium-term shortage that will underpin a cyclical recovery. Along with a strengthening US housing cycle the broker recommends a selectively bullish position. The broker upgrades GWA Group to Neutral from Sell and raises the target to $3.60 from $3.13.

TREASURY WINE ESTATES LIMITED (TWE) was upgraded to Neutral from Underperform by Credit Suisse and to Neutral from Sell by Citi B/H/S: 0/7/0

The fall in the share price has put the stock back at fair value and Credit Suisse upgrades to Neutral from Underperform. The company has guided to FY20 earnings (EBITS) growth of 5-10% versus FY19, excluding any second half impact from coronavirus. Management will complete commercial wine review by the end of FY20 with the aim of aligning management incentives rather than cost reductions. Credit Suisse models below guidance, reflecting 4% growth, and incorporates flat second half Asian volumes. Target is steady at $12.80.

First half results and the weaker outlook have reset high expectations, Citi observes. Forecasts for earnings per share in FY20 and FY21 are lowered by -12%. As a result of the share price reaction to the profit warning, the rating is upgraded to Neutral from Sell. Target is reduced to $13.70 from $15.60. Citi considers the outlook mixed, with a double-digit growth opportunity in China and margins peaking in Australia, while the Americas will not be easy to fix.

See downgrades below.

VIRGIN MONEY UK PLC (VUK) was upgraded to Add from Hold by Morgans B/H/S: 3/0/0

Virgin Money signalled a continued contraction in the mortgage book in its quarterly update. Net interest margins have stabilised while there was a rise in the net cost of risk. Amid less Brexit-related uncertainty, and with the PPI issue now approaching a conclusion, Morgans upgrades to Add from Hold. The broker envisages a clearer path to a double-digit return without a material dent in net tangible assets. Having said that, the broker points out the risk of share price weakness in the near term if the Bank of England decides to cut the base rate. Target is raised to $4.23 from $3.08.

In the not-so-good books

ADELAIDE BRIGHTON LIMITED (ABC) was downgraded to Underperform from Neutral by Macquarie B/H/S: 0/2/4

Adelaide Brighton continues facing challenges in its strategically important South Australian market, Macquarie notes. Cement volumes continue to arrive from foreign sources and expansion in SE Queensland concrete capacity comes at a bad time as market dynamics will be significantly tested. The broker assumes no price growth. Downgrade to Underperform, target falls to $3.30 from $3.40.

AGL ENERGY LIMITED (AGL) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 0/1/6

Ord Minnett has been caught out by the rapid and significant slump in wholesale electricity prices over the past three months. The broker believes this is being driven by weakness in gas prices as east coast producers set new records for output. Ord Minnett does not believe the current prices are sustainable but this has challenged its positive view on the stock. Rating is downgraded to Hold from Accumulate and the target is lowered to $20.50 from $24.10.

IOOF HOLDINGS LIMITED (IFL) was downgraded to Neutral from Outperform by Macquarie B/H/S: 1/3/1

IOOF ‘s net flows held up reasonably well in the December quarter, Macquarie notes, despite industry disruption. Advisor migration drove inflows. With the completion of the OnePath acquisition now imminent, attention turns to deal synergies. The stock has rallied 30% since September and the broker sees no immediate catalysts. Downgrade to Neutral, target falls to $8.00 from $8.10.

NORTHERN STAR RESOURCES LTD (NST) was downgraded to Neutral from Buy by Citi and to Underperform from Neutral by Credit Suisse B/H/S: 3/1/2

Citi is pleased there are signs of a turnaround at Pogo. The broker believes Pogo and the Kalgoorlie Superpit will be transformational and make the company the second biggest gold producer on the ASX, as it moves towards more than 1m ounces per annum. However, the rating is downgraded to Neutral from Buy after a 30% gain in the share price since the acquisition of the stake in the Superpit. For now, Citi believes the value is priced in. Target is raised to $12.70 from $12.40.

Pogo and Kalgoorlie improved in the December quarter after dragging on September quarter production outcomes. Credit Suisse notes Jundee was also solid, producing 80,069 ounces at a cost of $1030/oz. A new larger ball mill has been approved for Jundee, which will increase mill capacity from FY21. The highlight for the broker was the acquisition of the 50% interest in the Kalgoorlie Superpit, as Northern Star will bring expertise in narrow vein mining and align with Saracen Resources (SAR) which has open pit expertise. Rating is downgraded to Underperform from Neutral on valuation. Target rises to $10.30 from $9.60.

REECE AUSTRALIA LIMITED (REH) was downgraded to Sell from Neutral by Citi B/H/S: 0/1/1

Citi assesses the domestic housing cycle is bottoming and forecasts a medium-term shortage that will underpin a cyclical recovery. Along with a strengthening US housing cycle the broker recommends a selectively bullish position. However, given a stretched valuation and risk to consensus expectations, the broker downgrades Reece Australia to Sell from Neutral. Target is lowered to $10.50 from $11.42.

TRANSURBAN GROUP (TCL) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 0/5/2

Ord Minnett expects significant delays and costs exceeding budget will prevail for the West Gate tunnel project. This follows a decision by the contractors to give notice of termination after detecting a dangerous industrial chemical in the soil. Transurban has not consented to the termination but the broker expects completion will be deferred 12 months. The broker anticipates lost revenue from the delay will be covered by liquidated damages. However higher forecast development expenditure and increased capital releases are likely to dilute underlying free cash over FY22-24. Ord Minnett downgrades to Hold from Accumulate and lowers the target to $16.00 from $16.50.

TREASURY WINE ESTATES LIMITED (TWE) was downgraded to Hold from Add by Morgans and to Neutral from Outperform by Macquarie B/H/S: 0/7/0

First half results and revised FY20 guidance disappointed Morgans. The broker notes the tough operating conditions in the US and is concerned about the extent of the second quarter deterioration in earnings. Morgans makes double-digit downgrades to forecasts. While acknowledging there is a lot to like about this stock, given the short-term uncertainties the rating is downgraded to Hold from Add. Target is reduced to $14.28 from $20.60.

Treasury Wine Estates has downgraded earnings guidance by -10% due to a wine glut and aggressive discounting in the US. The issue is unlikely to be resolved in the short term, Macquarie warns. Risks are also increasing to the downside due to the coronavirus. The broker has cut earnings forecasts by around -20% and lowered its target to $13.30 from $19.97. Downgrade to Neutral.

See upgrades above.

WEBJET LIMITED (WEB) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 2/2/1

Morgan Stanley assesses the company’s B2C business in Australia is most at risk from the trends that are playing out elsewhere. Expedia and TripAdvisor have both cited increased monetisation of search traffic by Google as a contributing factor to declines in their earnings and outlook. Morgan Stanley expects revenue leakage, growth in marketing costs and ultimately compression in multiples. The implications are considered material and the broker downgrades to Underweight from Equal-weight. Target is reduced to $10.00 from $12.40. Industry View is In-Line.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.