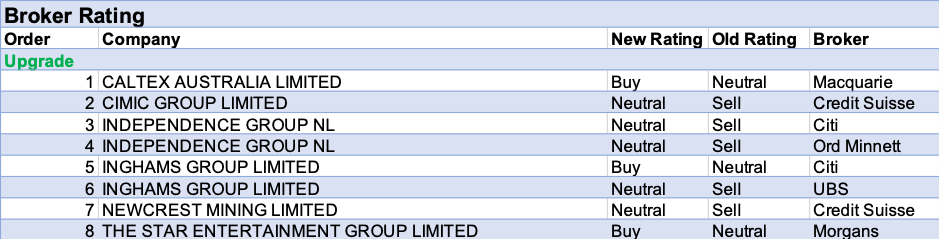

Amidst a lot of portfolio switching going on – from “Growth” and “Quality” into “Value” and “Cyclical” and back – stockbroking analysts monitored daily by FNArena issued eight upgrades for ASX-listed securities, but only three moved to (an equivalent of) Buy. Maybe this illustrates the current state of affairs?

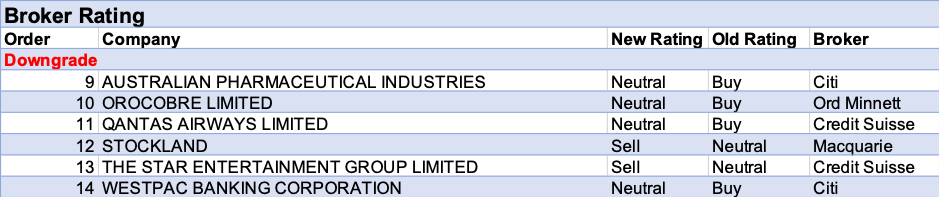

One positive observation is that last week only generated six downgrades from the same seven stockbroking firms, with only two of those shifting to a Sell. Equally noteworthy is that mining stocks hardly feature among the downgrades but they do among the upgrades.

Very little is happening in terms of changes to valuations and price targets. This might change as more out-of-season financial earnings reports are being released this week and in November.

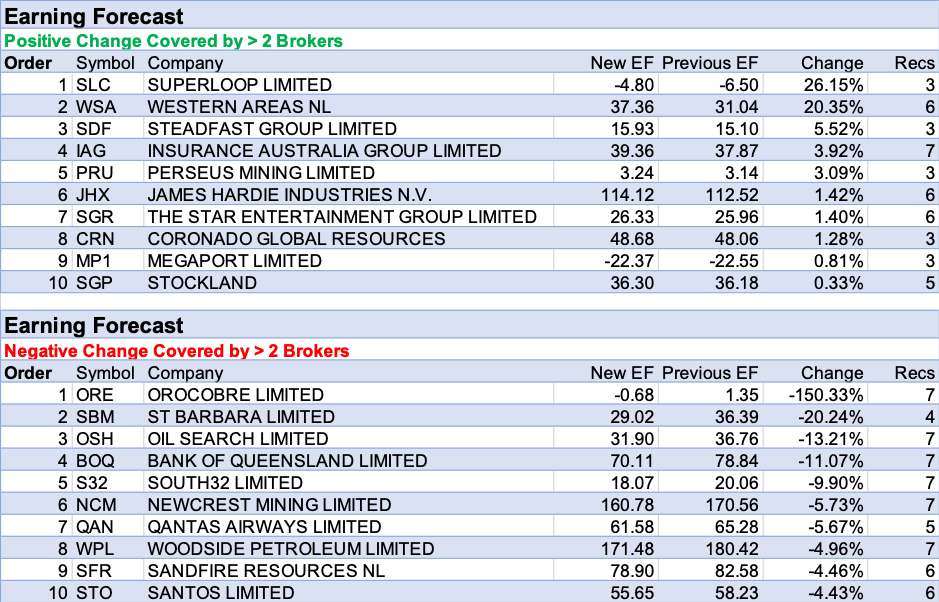

More action can be observed in the tables for positive and negative adjustments to earnings estimates. On the positive side, the week’s show was stolen by Superloop and Western Areas, both enjoying gains in excess of 20%. The numbers on the negative side look decidedly larger led by lithium miner Orocobre, followed by St Barbara, Oil Search and Bank of Queensland.

Here, it has to be noted, the table for negative adjustments carries an overweight in resources companies.

In the good books

1. CALTEX AUSTRALIA LIMITED (CTX) was upgraded to Outperform from Neutral by Macquarie B/H/S: 3/3/0

Caltex reported strong regional refiner margins in the Sep Q driven by supply reductions in the Middle East. The Dec Q outlook is softer but the volume skew will be material due to planned turnaround and inspection (T&I). The broker sees margins as stabilising in Dec before improving in 2020. Headwinds remain for Convenience but the company is taking action to defend its return on investment which the broker sees as positive. The broker increases earnings forecasts, and target to 27.97 from $24.78. Outperform retained, with a preference over Viva Energy (VEA).

2. CIMIC GROUP LIMITED (CIM) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/3/0

The company has reaffirmed net profit guidance of $790-840m for 2019. Credit Suisse upgrades forecast to the lower end of guidance and raises the target to $36 from $35. Rating is upgraded to Neutral from Underperform. Operating cash flow was down -29% in the September quarter while operating earnings conversion was 52% vs 54% in the prior quarter. Credit Suisse suspects this was because of a reversal in the build up of payables and a higher proportion of alliance-style contracts, as well as completion and delays for some large infrastructure projects.

3. INDEPENDENCE GROUP NL (IGO) was upgraded to Neutral from Sell by Citi B/H/S: 1/4/1

The share price has pulled back in the last month as the nickel price has eased and Citi upgrades to Neutral from Sell on valuation. The broker envisages downside risks to nickel from global growth risks and the disconnect between prices and exchange tightness. However, for Independence Group these factors are partly offset by the appeal of gold as a macro portfolio hedge.

4. NEWCREST MINING LIMITED (NCM) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/3/3

Credit Suisse notes the September quarter was sequentially much weaker as all operations underperformed other than the now less-relevant Gosowong. Political changes in PNG have resulted in indefinite delays at Wafi Golpu. Key areas of focus include reliability at Cadia and Lihir and Red Chris drilling results. The broker upgrades to Neutral from Underperform on valuation. Target is unchanged at $31.80.

5. THE STAR ENTERTAINMENT GROUP LIMITED (SGR) was upgraded to Add from Hold by Morgans B/H/S: 5/0/1

The trading update was ahead of expectations. The company is forecasting first half operating earnings of $300-310m on the back of domestic revenue growth and cost reductions. With the stock offering 17% upside to the revised target price Morgans upgrades to Add from Hold. The broker also notes the current dividend yield of 4.5% is attractive in the current environment. Target is raised to $5.48 from $4.17.

See downgrade below.

In the not-so-good books

1. AUSTRALIAN PHARMACEUTICAL INDUSTRIES (API) was downgraded to Neutral from Buy by Citi B/H/S: 0/1/1

FY19 results were difficult to reconcile, in Citi’s view. Benefits accrued from a low tax rate. Reported underlying earnings (EBIT) of $94m were -1% below guidance. However this included the Sigma dividend income and a $17m fair value benefit from Clearskin Care. Citi downgrades to Neutral from Buy on valuation and reduces the target to $1.50 from $1.60. FY20 estimates are reduced by -17%.

2. THE STAR ENTERTAINMENT GROUP LIMITED (SGR) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 5/0/1

Credit Suisse notes positive momentum so far and updates numbers to reflect this. Earnings per share have been upgraded 7-8% over the forecast period. Still, with Crown Resorts (CWN) opening its Sydney casino in January 2021 the FY21 and FY22 earnings profile is less exciting for the broker. Credit Suisse downgrades to Underperform from Neutral, suspecting the stock has run too hard. The company has submitted a proposal to the Queensland government to upgrade the Gold Coast convention centre and the Sheraton Mirage. This proposal is not included in the broker’s modelling. Target is raised to $4.00 from $3.75.

See upgrade above.

3. WESTPAC BANKING CORPORATION (WBC) was downgraded to Neutral from Buy by Citi B/H/S: 2/4/1

Westpac has announced further customer remediation and Citi downgrades FY19 cash earnings estimates by -4.5%. From here the broker considers the prospect of further outperformance is difficult and expects the bank will reduce the dividend at the FY19 result. Capital appears tight post further remediation and the rating is downgraded to Neutral from Buy. Target is unchanged at $31.25.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.