It is quiet in the land of stockbroking analyst where attention is increasingly shifting towards the upcoming August reporting season.

With the local share market moving ever higher, destined to revisit the all-time high from 2007, it is no surprise that when it comes to recommendations for individual ASX-listed entities, the balance remains heavily weighted towards downgrades.

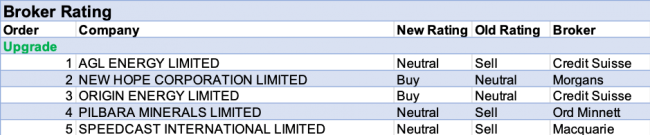

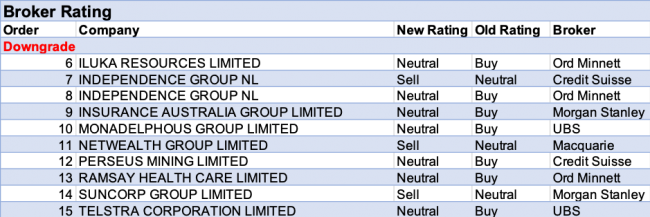

For the week ending Friday 5 July 2019, FNArena registered 5 upgrades, of which only 2 moved to Buy, and 10 downgrades. Only 3 of the downgrades moved to Sell with Independence Group, Origin Energy and Netwealth the unlucky receivers. Independence Group also received a second downgrade which ended on Neutral.

Most cited reason for the downgrade is a share price that looks too expensive with what is likely to follow next in terms of growth outlook.

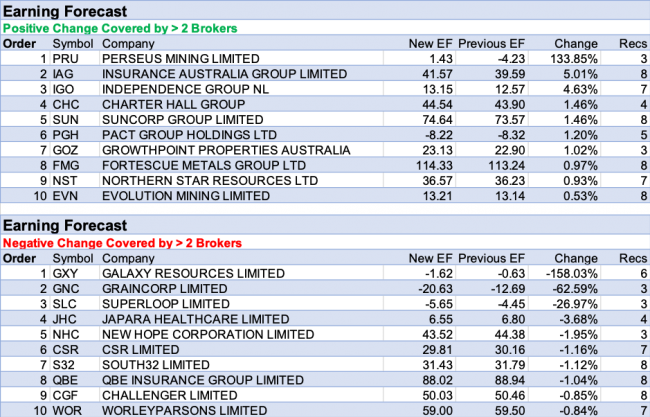

Apart from Perseus Mining, Insurance Australia Group and Independence Group there is not much to report in terms of positive changes to earnings forecasts. The negative side has Galaxy Resources, Graincorp, Superloop and Japara Healthcare standing above the crowd.

Economic data and expectations of central bank rate cuts continue to dominate equity markets globally. The focus might switch to corporate profits soon with the Q2 season about to start in the US and with Australia less than one month away from its own corporate reporting season.

In the good books

1. PILBARA MINERALS LIMITED (PLS) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 2/1/0

Ord Minnett updates commodity price forecasts, skewing its preferences towards bulk commodities and gold. Downgrades of -5-7% occur across base metals. The broker notes iron ore prices hit 2019 peak this week, pushing over US$125/t amid ongoing reductions in China’s port stocks and strength in Chinese demand. Rating is upgraded to Hold from Lighten. Target is reduced to $0.60 from $0.65.

In the not-so-good books

1. INSURANCE AUSTRALIA GROUP LIMITED (IAG) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 2/5/1

Morgan Stanley believes the investment case is robust, with cost reductions and capital initiatives, but there is a risk of a rising catastrophe budget amid lower yields and elevated compliance costs. This is likely to contribute to softer FY20 guidance. The broker downgrades to Equal-weight from Overweight. Target is reduced to $8.20 from $8.50. Industry view: In Line.

2. INDEPENDENCE GROUP NL (IGO) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 3/3/1

Ord Minnett updates commodity price forecasts, skewing its preferences towards bulk commodities and gold. Downgrades of -5-7% occur across base metals. Rating on Independence Group is downgraded to Hold from Accumulate. Target is steady at $5.30.

3. ILUKA RESOURCES LIMITED (ILU) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 3/3/0

Ord Minnett updates commodity price forecasts, skewing its preferences towards bulk commodities and gold. The broker downgrades its rating on Iluka Resources to Hold from Accumulate and raises the target to $10.75 from $10.50.

4. SUNCORP GROUP LIMITED (SUN) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 4/2/2

Morgan Stanley expects the second half will show the company is struggling to maintain volumes in personal lines. Guidance is expected to disappoint, as Suncorp balances growth campaigns alongside the need to price for a higher FY20 catastrophe budgets, amid the impact of lower yields Rating is downgraded to Underweight from Equal-weight. Target is reduced to $11.90 from $12.50. In-Line sector view.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.