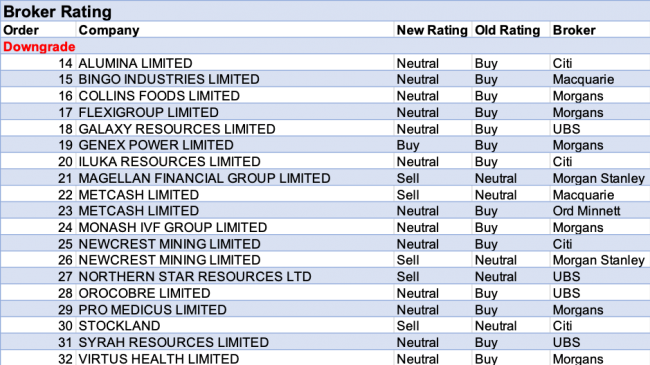

Against a background of equities enjoying a stellar ride higher, stockbroking analysts are unusually busy issuing downgrades and upgrades for individual ASX-listed entities. For the week ending Friday 28 June 2019, FNArena registered no less than 13 upgrades in recommendations and 19 downgrades.

Irrespective of the quite impressive looking tally, the underlying observation remains that individual stock ratings are trending towards the Neutral/Hold zone. Out of all recommendations for the eight stockbrokers monitored daily by FNArena, more than 44% are now carrying a Hold/Neutral rating versus 39%+ in the Buy zone and the remaining 16% on Sell. This marks quite an unusually large gap between Hold/Neutral ratings and Buys.

A reflection of positive sentiment ignoring the tough macro-environment that’s keeping a lid of corporate profits? All of the eight stockbrokers are now carrying more Hold/Neutral ratings than Buys.

Nevertheless, a positive trend seems to be emerging in valuations and price targets where analysts are lifting their numbers for stocks including Collins Foods, Northern Star, Bingo Industries, Growthpoint Properties, and Mirvac. With exception of perennial underperformers Syrah Resources and Metcash, there is literally not much happening on the negative side.

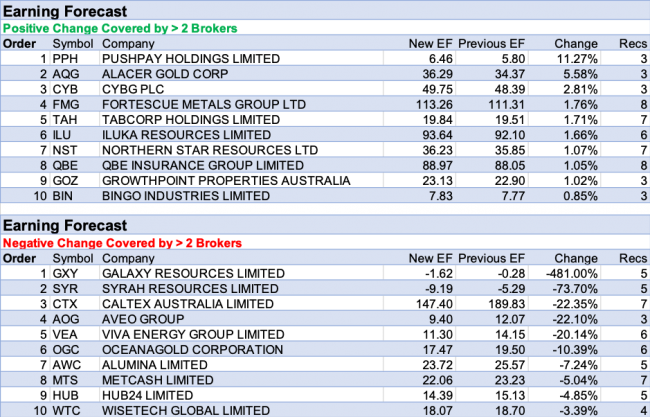

But then, this week’s tables for earnings estimates show a busy crowd of analysts equally cutting estimates at high speed, just as companies including Pushpay Holdings and Alacer Gold are enjoying noticeable increases. Here, however, the balance is overwhelmingly weighted to heavy reductions with stand-out names Galaxy Resources, Syrah Resources, Caltex Australia, Aveo Group, and Viva Energy Group.

Investors will be hoping the upcoming reporting season in August will turn the trend in corporate profits. How else can this year’s share market buoyancy continue for much longer?

In the good books

1. CALTEX AUSTRALIA LIMITED (CTX) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 3/4/0

Caltex’s operations have been under pressure causing the share price to fall and investors adopting a more negative view. Morgan Stanley analysts think Caltex management will respond. In anticipation, they have upgraded to Equal-weight from Underweight. The analysts do add success from management’s response will depend on the extent of fuel margin compression across the industry versus cost-out initiatives and/or property divestments.Target is $24. Underweight. Industry view: In-Line. Note: Both EPS and DPS estimates have received a noticeable haircut.

2. GROWTHPOINT PROPERTIES AUSTRALIA (GOZ) was upgraded to Neutral from Underperform by Macquarie B/H/S: 0/2/1

Growthpoint Properties has announced a $150m institutional placement and a $15m share purchase plan. The company reaffirmed FY19 guidance and guided to an FY20 rise of 1.8%. Macquarie breaks this down into 4% dilution from the placement; 2.6% accretion from a $475m breaking of swap contracts to a lower hedged debt rate; and 1% accretion from the acquisition of a $50m metro office building. Combined, the broker estimates the impact to be a less-than -1% dilution in earnings before the deployment of proceeds. The broker tinkers with earnings-per-share estimates and the target price rises 15.3% to $4.08 from $3.54 to reflect stronger cap rate compression assumptions. Broker upgrades to Neutral from Underperform, expecting the company to benefit from the rosier bond outlook.

3. GALAXY RESOURCES LIMITED (GXY) was upgraded to Neutral from Underperform by Macquarie B/H/S: 3/2/0

Macquarie downgrades Galaxy Resources earnings-per-share estimates -20%, -3% and -3% across FY21-23 following news of delayed spodumene shipments, recent softness in the seaborne spodumene market, and higher debt and associated interest expenses following the Alliance equity investment. Two shipments of spodumene concentrate have been shipped from Mt Cattlin this quarter, another has been pushed into the September quarter. The target price falls to $1.30 from $1.50. Upgrade to Neutral from Underperform on valuation grounds.

See downgrade below.

4. NRW HOLDINGS LIMITED (NWH) was upgraded to Hold from Sell by Deutsche Bank B/H/S: 1/2/0

The share price has now fallen far enough to warrant an upgrade to Hold from Sell, report analysts at Deutsche Bank. No other changes have been made.

5. PACT GROUP HOLDINGS LTD (PGH) was upgraded to Neutral from Underperform by Macquarie B/H/S: 2/3/0

Pact Group has refinanced a $380m July 2020 debt facility out to January 2022, reducing the likelihood of an equity raising. Given guidance has been confirmed, Macquarie upgrades to Neutral from Underperform and increases the target price to $2.81 from $2.66. The broker says the company can now look forward to higher earnings to reduce debt levels, rather than equity, and says it should be aided by a slow recovery in raw material costs, network redesign, full-year impact of the TIC acquisition, and crates expansion with Aldi. Macquarie downgrades earnings-per-share estimates -6% and -4% to account for the expected growth trajectory, awaiting input from the new chief executive officer Sanjay Dayal.

6. VOCUS GROUP LIMITED (VOC) was upgraded to Buy from Neutral by UBS B/H/S: 2/5/0

UBS suggests the reason Vocus has de-rated is the swiftness with which recent suitor AGL Energy (AGL) and others before it, had walked away from a deal after access to due diligence, raising concern in the market. But the broker believes the key reason AGL bailed is that it could not hit its rate of return requirement at the $4.85 bid price. While UBS still has its own reservations about the business, the broker upgrades to Buy now the stock has pulled back far enough that returns for a suitor are more achievable, implying an unpriced option value on enterprise execution. Target unchanged at $3.85.

In the not-so-good books

1. ALUMINA LIMITED (AWC) was downgraded to Neutral from Buy by Citi B/H/S: 1/4/0

A general update on metals producers in Australia has revealed a downgrade for Alumina ltd to Neutral from Buy. This is the result of the share price moving near the broker’s price target, which has remained unchanged post the general sector update.

2. BINGO INDUSTRIES LIMITED (BIN) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/1/0

At its investor day, Bingo noted the integration of Dial-a-Dump is going well and -$5m of cost savings have been realised thus far. Ahead of Queensland introducing a waste disposal levy from July1, Bingo plans to increase NSW pricing by 20-25%, however visibility on traction, the broker notes, is thus far low. With the closing of the Dial-a-Dump deal mitigating risks and progress in capacity additions underpinning Bingo’s growth trajectory, Macquarie lifts its target to $2.35 from $2.00. The share price has now enjoyed a recovery off its lows to a 24% premium to the ASX200 Industrials and here Macquarie sees valuation as fair. Downgrade to Neutral.

3. GALAXY RESOURCES LIMITED (GXY) was downgraded to Neutral from Buy by UBS B/H/S: 3/2/0

UBS downgrades Galaxy Resources to Neutral from Buy to reflect continued weakness in the lithium-carbonate market. The broker says the company’s operations have improved and its cash position is strong enough to develop Sal de Vida (Galaxy said it was formally closing the sale process) but the probability of it moving forward has been reduced to 25% from 75%. Downward revisions to the broker’s lithium carbonate forecasts of -8% in 2019 and -21% in 2020 have resulted in cuts to the company’s 2019 and 2020 net profit estimates of -33% and -255% respectively. Net present value falls -41% to reflect Sal de Vida issues. Target price cut to $1.40 from $2.30.

See upgrade above.

4. ILUKA RESOURCES LIMITED (ILU) was downgraded to Neutral from Buy by Citi B/H/S: 4/2/0

Iluka Resources’ shares have rallied 20% over the month past and Citi analysts think it’s time for a breather; they have downgraded to Neutral from Buy. Also, the analysts believe it will be challenging for Iluka to continue to outperform into a slowing China property sector in 2H CY19. Price target lifts to $11.40 from $11.

5. MAGELLAN FINANCIAL GROUP LIMITED (MFG) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 0/6/1

Recommendation has been downgraded to Underweight from Equal-weight as the analysts at Morgan Stanley believe market expectations have risen too high, while also observing the share price is already up more than 100% year-to-date. Countering market enthusiasm, Morgan Stanley states it thinks growth options in retirement products are not certain to succeed, expansion to US is unlikely to accelerate, and Magellan’s business mix remains narrow. Target is raised to $38 from $28.60. Industry view: In-Line. Both EPS and DPS forecasts have received a serious boost.

6. MONASH IVF GROUP LIMITED (MVF) was downgraded to Hold from Add by Morgans B/H/S: 1/1/0

Morgans downgrades Monash IVF to Hold from Add to reflect recent share price strength. The broker remains optimistic on the stock, believing guidance for 15% net-profit-after-tax growth will be met and industry feedback suggests competition is moderating. Morgans adjusts longer term growth rates and raises the valuation-based target price to $1.37 from $1.25.

7. NEWCREST MINING LIMITED (NCM) was downgraded to Neutral from Buy by Citi B/H/S: 0/3/5

A general update on metals has forced Citi analysts to upgrade their prior price forecasts for gold, with positive impact on all Australian producers under coverage. Newcrest Mining, however, has nevertheless been downgraded to Neutral from Buy. Citi believes, despite the positive impulse from higher gold price forecasts, the share price has run too far. Price target lifts to $33.25 from $28.50. Estimates have received a boost.

8. NORTHERN STAR RESOURCES LTD (NST) was downgraded to Sell from Neutral by UBS B/H/S: 1/2/4

UBS downgrades Northern Star to Sell from Neutral after the recent 50% run in the share price. The broker notes the prognosis remains positive for company, and expects a big rise in production for the June quarter and a maiden reserve at Pogo in August. A 7% upgrade to the broker’s gold-price forecasts (and lesser upgraded operating assumptions for Pogo) triggers a 30% upgrade to net-profit-after-tax estimates. The target price rises to $10.60 from $9.

9. OROCOBRE LIMITED (ORE) was downgraded to Neutral from Buy by UBS B/H/S: 5/2/1

UBS downgrades Orocobre from Buy to Neutral to reflect the malaise in the lithium-carbonate market. Delays to commissioning downstream capacity, downgrade revisions to lithium carbonate prices, and the move of China to a net exporter (seaborne prices continue to outperform domestic prices), all played their part. Add to that cash issues and flat production, the broker expects an uneventful year. The broker has downgraded lithium carbonate forecasts -8% in 2019 and -21% in 2020. Net present value falls -17% as UBS increases the discount rate from 10% to 12%. Target price falls to $3.50 from $4.20.

10. PRO MEDICUS LIMITED (PME) was downgraded to Hold from Add by Morgans B/H/S: 0/2/0

Morgans downgrades Pro Medicus to Hold from Add in the light of recent share-price strength and is awaiting a better entry point. The broker expects a good FY19 result struck on revenue and margin growth but suspects the adoption of ASC606 accounting standards around contracts may create some volatility. The broker believes that once the market better understands the accounting rebasing, the market can expect consensus upgrades to the outer years. Target price is $25.46, previously $23.69.

11. STOCKLAND (SGP) was downgraded to Sell from Neutral by Citi B/H/S: 2/1/3

Citi’s team of property specialists has been negative on the outlook and risks for owners of retail property, and they have again reiterated that view in the latest sector update. They point out their price targets for many a retail landlord in Australia is at least -10% below the share price. In an attempt to emphasise the risk, Citi analysts state they expect falling underlying values to weigh heavily on retail landlords’ share prices, similar to what has occurred in markets such as the US and the UK. Stockland has been downgraded to Sell from Neutral. Price target falls to $3.80 from $3.88.

12. SYRAH RESOURCES LIMITED (SYR) was downgraded to Neutral from Buy by UBS B/H/S: 2/3/0

UBS downgrades Syrah Resources to Neutral from Buy to reflect downgrades to the broker’s graphite prices forecasts. The broker has lost patience on the Balama project, which has yet to reach positive cash flow despite yet another capital raising. UBS doubts the company can expand production without further diluting the price and says a slow ramp-up of Balama will extend the cash burn period. Nevertheless, operations capacity is sufficient, the underlying problem is weak market demand, with anode producers favouring synthetic graphite to natural flake. Graphite forecasts fall -14% to -19% across 2019-2022, resulting in downgrades to FY19 and FY20 net profit forecasts of -16% and -419%. Net present value falls to 62% after a rise in the discount rate of 18% and the inclusion of the one for five equity raising. Target price more than halves to 90c from $2.40.

13. VIRTUS HEALTH LIMITED (VRT) was downgraded to Hold from Add by Morgans B/H/S: 1/2/0

Morgans downgrades Virtus Health to Hold from Add given the share price has rallied 18% over June to reflect fair value. The broker remains positive on the company and is awaiting a better entry point. The broker expects the company to outpace consensus primarily because of a contribution from a licence fee for its artificial intelligence software called Ivy that can predict viable pregnancies in embryos, from the Swedish company Embryoscope and Australian company Harrison AI. The technology supports elective single embryo transfers and shorten pregnancy times. Target price rises to $4.87 from $4.60.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.