The end of a busy February reporting season has significantly reduced the research output by stockbrokers, but this has not prevented sell-side analysts from continuing to issue more downgrades than upgrades for ASX-listed stocks. The fact the ASX200 might be hovering near 6200 might have something to do with it.

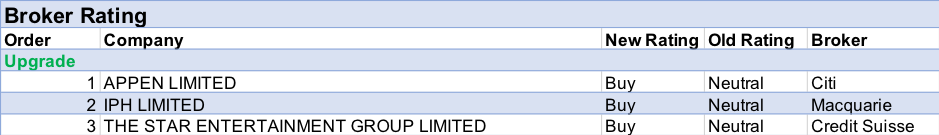

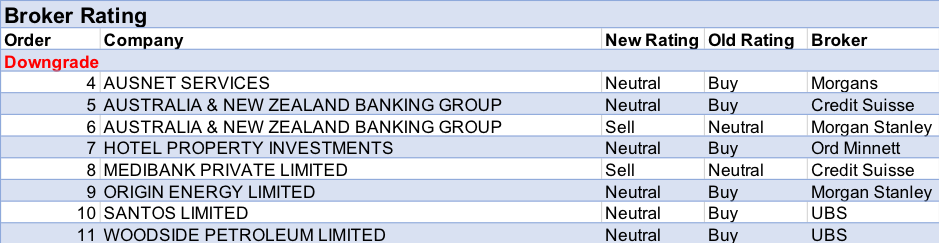

For the week ending Friday 15 March 2019, FNArena registered eight downgrades versus only three upgrades. All upgrades shifted to Buy or an equivalent of Buy.

The stand-out observation, perhaps, is that ANZ Bank received two downgrades during the week, of which one went to Sell.

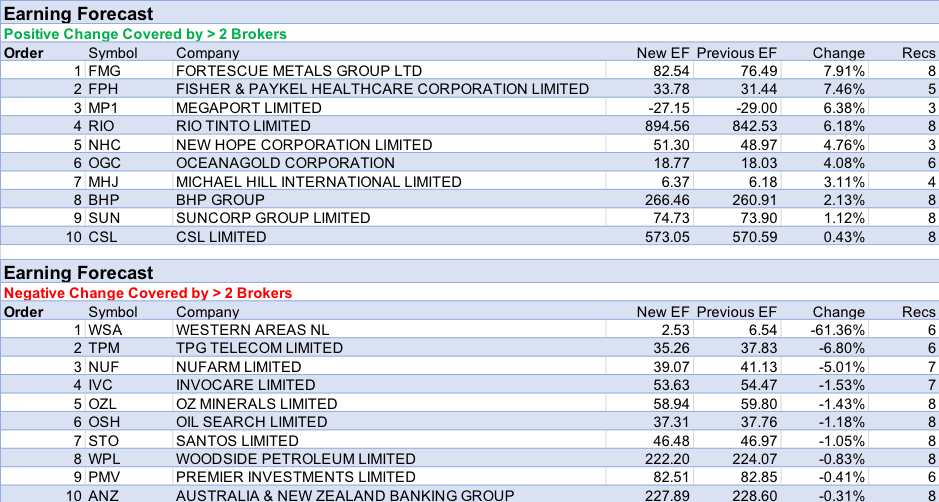

There is more action in the week’s tables for changes to earnings forecasts, with the underlying trend remaining positive, albeit largely carried by resources companies. Notable exceptions are Fisher & Paykel Healthcare and Megaport.

On the negative side, Western Areas is experiencing significant pull back in analysts’ forward projections, but otherwise energy producers, clearly, are suffering from falling oil price forecasts, while TPG Telecom, Nufarm, InvoCare and OZ Minerals are all experiencing small declines in forecasts.

There are a handful of companies reporting this week, and there always remains plenty of macro to keep investors’ attention firmly focused in March.

In the good books

In the not-so-good books

1. AUSTRALIA & NEW ZEALAND BANKING GROUP (ANZ) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 2/5/1

Morgan Stanley believes pressure on the bank’s revenue is growing and positive surprises on costs are unlikely. While ANZ’s business mix should have scope to adapt to an increasingly difficult operating environment, the broker believes the bank is currently facing execution challenges in Australian retail & business banking, with housing loan and deposit growth below system. Recent results have enhanced the bank’s credibility on cost management, but the broker suggests it is unlikely to beat forecasts for a -1% decline in underlying expenses this year. Morgan Stanley downgrades to Underweight from Equal-weight and reduces the target to $25 from $26. Industry view: In-Line.

2. AUSNET SERVICES (AST) was downgraded to Hold from Add by Morgans B/H/S: 0/6/0

Morgans downgrades to Hold from Add following the outperformance of the share price. Target is $1.73, up from $1.71. The next event is the FY19 results release on May 13, and the broker expects a reduction to earnings. This should also include first time FY20 distribution guidance, which the broker assumes will be flat. Morgans believes the share price has been driven by falling government bond rates and a switching to Ausnet from Spark infrastructure (SKI) because of the latter’s tax issues and reduction in its distribution outlook.

3. HOTEL PROPERTY INVESTMENTS (HPI) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 1/2/0

The company’s major tenant, Coles (COL) has entered a joint venture with Australian Venue Co in relation to its hotel operations. Ord Minnett expects that bringing in an experienced venue operator should drive a stronger operating performance and, in turn, reduce the risk around the exercise of options, while improving the revaluation outcomes. The broker also believes Australian Venue Co will be more willing to partner with Hotel Property in exploring growth opportunities in hotels and accommodation compared with Coles. As the stock is trading in line with the broker’s unchanged $3.20 target the rating is downgraded to Hold from Accumulate.

4. MEDIBANK PRIVATE LIMITED (MPL) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 1/3/3

Credit Suisse finds considerable uncertainty prevails for FY20 and FY21 earnings and does not envisage much upside for the share price. The broker finds listed health insurers expensive. Private health insurance profit growth has been slowing recently, driven by a slowdown in premium growth and a stabilising of the margin. Hence, the broker downgrades to Underperform from Neutral. The main risks to the negative view are acquisitions, funded from the debt-free balance sheet. Target is steady at $2.50.

5. ORIGIN ENERGY LIMITED (ORG) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 5/3/0

Morgan Stanley downgrades energy market earnings estimates and the company’s valuation multiple. The broker revises its renewable power purchase agreement forecasts, deferring an FY20 earnings tailwind of around $65m. Morgan Stanley is also more cautious about FY21 gas margins. The broker downgrades to Equal-weight from Overweight as the stock is up 11% so far this year. The broker believes de-leveraging is now factored into the share price. Target is reduced to $7.67 from $8.43. Industry view is Cautious.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FN Arena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.