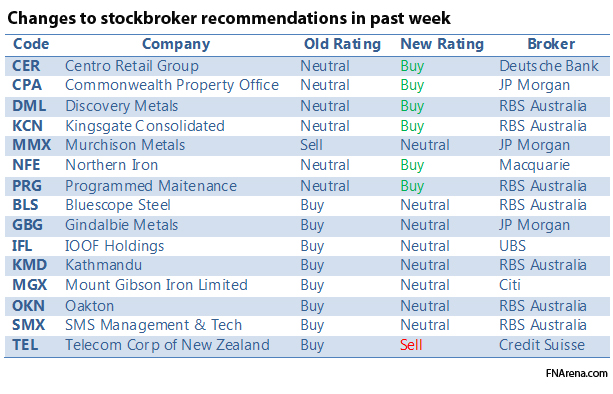

[1]The past week has been a relatively balanced one in terms of changes to ratings on stocks covered by the eight brokers in the FNArena database. A total of seven upgrades and eight ratings downgrades brought total Buy recommendations to 57.4%, down a little from nearly 57.7% last week.

[1]The past week has been a relatively balanced one in terms of changes to ratings on stocks covered by the eight brokers in the FNArena database. A total of seven upgrades and eight ratings downgrades brought total Buy recommendations to 57.4%, down a little from nearly 57.7% last week.

Centro Retail (CER) was one to enjoy an upgrade, with Deutche Bank moving it to a Buy from Hold in response to revised aggregation terms. Deutsche believe the new terms significantly reduce Centro’s risk profile while offering additional incentives for unitholders to approve the proposal.

Elsewhere in the property sector, plans for a share buyback by Commonwealth Property Office (CPA) were enough for JP Morgan to upgrade it to Overweight from Underweight. The buyback should act as a catalyst for the share price. The broker is also attracted to CPA’s low gearing levels and conservative balance sheet because this offers scope for expansion opportunities.

In the resources sector, RBS Australia upgraded Discovery Metals (DML) to Buy from Hold, reflecting both an upside from ongoing exploration success and an improved valuation after recent share price weakness.

RBS also upgraded Kingsgate (KCN) to Buy from Hold on the expectation the end of the wet season in northern Thailand will deliver improved quarterly production results from the Chatree project. The upgrade comes despite a lowering of the broker’s price target.

Murchison Metals (MMX) was upgraded to Neutral from Underweight by JP Morgan on news the company has entered an agreement to sell its interests in Crosslands and OPR. The funds to be received imply a value of $0.47 per share and improve both the valuation and financial position of Murchison.

While Northern Iron (NFE) remains on track to meet production targets for the full year, the move by the company to raise a further $9 million from its debt facility to alleviate a tight cash position has been viewed favourably by Macquarie. This is enough for an upgrade to an Outperform rating from Neutral.

Among industrials, Programmed Maintenance (PRG) enjoyed an upgrade from RBS Australia, with the broker moving to Buy from Hold after Programmed’s solid interim result. The result increases confidence in the company’s outlook and should also help restore some credibility in the market, according to RBS.

BlueScope (BSL) was downgraded to Hold from Buy this week by RBS, the broker arguing that while an equity raising will improve the group’s balance sheet, there remains a significant amount of earnings uncertainty. This uncertainty means a Buy rating is no longer appropriate.

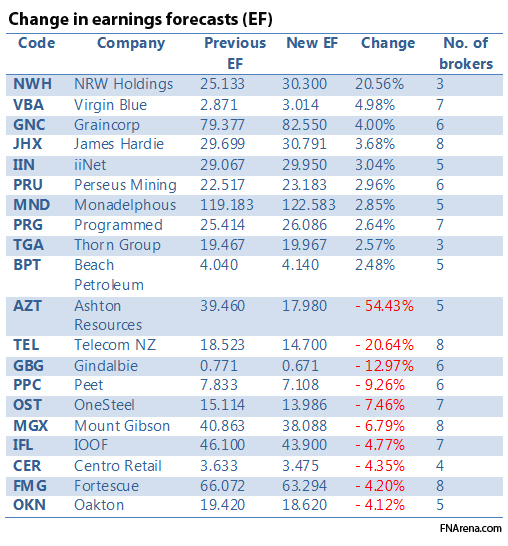

Cuts to iron ore prices by JP Morgan resulted in Gindalbie (GBG) being downgraded to Neutral from Overweight, while price target and earnings estimates were also reduced. It was a similar story for Mount Gibson (MGX), though in this case it was Citi lowering its numbers and downgrading to a Neutral rating from Buy.

In a tough week for IT stocks, both Oakton (OKN) and SMS Management and Technology (SMX) were downgraded by RBS to Hold ratings from Buy. The changes reflect still difficult operating conditions in key markets.

Things are no easier for wealth managers as evidenced by weak guidance from IOOF (IFL), the update causing brokers to lower earnings forecasts and price targets. UBS also downgraded it to a Neutral rating from Buy.

In contrast, Kathmandu (KMD) delivered a solid trading update but it only triggered minor changes to estimates. RBS has still downgraded it to a Hold rating on valuation grounds post recent share price gains.

Telecom New Zealand (TEL) de-merged its network division and this has prompted Credit Suisse to downgrade it to an Underperform from Neutral.

[2]Note: FNArena monitors eight leading stockbrokers daily. The eight experts are: BA-Merrill Lynch, Citi, Credit Suisse, Deutsche Bank, JP Morgan, Macquarie, RBS and UBS.

[2]Note: FNArena monitors eight leading stockbrokers daily. The eight experts are: BA-Merrill Lynch, Citi, Credit Suisse, Deutsche Bank, JP Morgan, Macquarie, RBS and UBS.

For more financial news, visit FNArena.com [3].

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: Has the ECB gone mad? [4]

- Paul Rickard: A positive geared SMSF property play [5]

- Tony Negline: Your pension payment options [6]