This won’t surprise regular readers of my market analysis when I reveal that I’m bullish for this year, despite some potentially worrying headwinds. And I’d be surprised if the overall market was not up 10% with dividends and franking credits taking overall returns higher.

That said, I know this year will be volatile, but the ups and downs will be on a rising trend. So, if you doubt me over the year with some of the sell offs, have faith!

Here are possible headwinds

Before mounting my overall case for remaining long stocks, let’s look at the possible headwinds that could hit and hurt stock prices:

- The Fed raising interest rates and maybe going too hard too soon.

- China engaging in trade wars or even a real war!

- Omicron or another covid variant impeding the expected economic recovery of 2022.

- Some ‘black swan’ event.

First up, the black swan

In reverse order, a black swan is hard to see, so it’s always something you have to deal with when you invest beyond government-guaranteed term deposits.

What about Omicron?

Meanwhile, I’m gambling that Omicron remains less troubling than the Delta strain, so the economic restrictions will be less and more manageable in coming months. It could reduce global and country-by-country economic growth outcomes compared to forecasts made before Omicron appeared. But I’m estimating the growth rates over the year will continue to rise because there won’t be lockdowns to the magnitude of 2020 and 2021.

On the China threat

On China as a threat, it’s hard to be certain about what Beijing decides and I’m not a great fan of the ganging up on China over its Winter Olympics, at a time when economic and market experts see the world’s second-biggest economy looking like it’s trying to offset its Evergrande property problems by embarking on greater growth policies for the year ahead.

China might need disciplining but not now, with the world needing big economic growth to pay off the budget deficits used to avoid a global Great Depression.

I’m gambling that President Xi Jinping might love to stick it to Joe and Scott but he has a big middle class he needs to keep onside — 400 million of them! And he’s been hitting their investments with his crackdown on companies such as Alibaba and Tencent. I’m sure one day China will try to get even with its Western rivals but not this year, considering it too is trying to get over the Coronavirus.

Rising rates this year?

So, we’re left with the big and very likely threat of the US raising interest rates this year.

Patti Domm on CNBC gave us what Fed noises about rate rises were before its December meeting. This is what she wrote: “In its last forecast, [1] the Fed’s so-called dot-plot chart of inflation forecasts shows that half the Fed officials expected one or two rate hikes next year, but there was no consensus for a hike.”

But there is a growing view that the Yanks could see three rate rises this year because growth and inflation will be strong enough to warrant it.

Think buying opportunity

My take on what would happen if the Fed started raising rates, possibly as early as March, is that the stock market would sell off, but I’ve been saying it would be a buying opportunity. History has told me that it takes a few interest rate hikes before the big stock market influencers turn tail and run away from the share market.

Remember this…

And it should be remembered there were times when these big money managers could give up on stocks and retreat to interest-paying assets at 5%, so that made bonds or bank deposits attractive to increasingly worried share players. Those alternatives aren’t around nowadays.

Keeping me positive on stocks for this year

Keeping me positive on stocks for 2022, despite expected interest rate rises is one of my favourite market analysts — Wharton finance professor Jeremy Siegel. This guy is an academic, who really understands Wall Street, and we know how influential that market has been for global stock markets since it was founded in 1792.

“In the first year of the rates hikes, actually that has marked good stock markets,” Siegel told CNBC’s Halftime Report. “Maybe late 2022 or 2023 [is] when you begin to get the wobbles in the stock market. Basically, the first year of increases, with the liquidity that’s in the market, I think still makes a positive market for 2022.”

Adding to my positivity for 2022 is the chief US equity strategist at Goldman Sachs, David Kostin, in New York, who sees a 10% gain for stocks. He pinpoints four concerns for stocks — supply chain problems, rising commodity prices, worker shortages and Covid. Kostin argues US companies have pricing power and his best guess on the S&P 500 Index is 5,100 by the end of 2022, which implies a 10% gain. Others are tipping a rise of more like 8% but these forecasts are always guesses based on the balance of probable outcomes for key market drivers.

Taking a 10% gain for US stocks, I’m arguing that we should at least match Wall Street’s gains because tech stocks will not surge as much this year, while commodity price rises will be good for the Aussie stock market.

Nearly every credible forecaster expects higher commodity prices this year. It’s why Macquarie’s BHP expert analysts think the major iron ore miner will see a 27.63% rise in share price over 2022.

In fact, I think we could outperform the US stock market and the charts below show why.

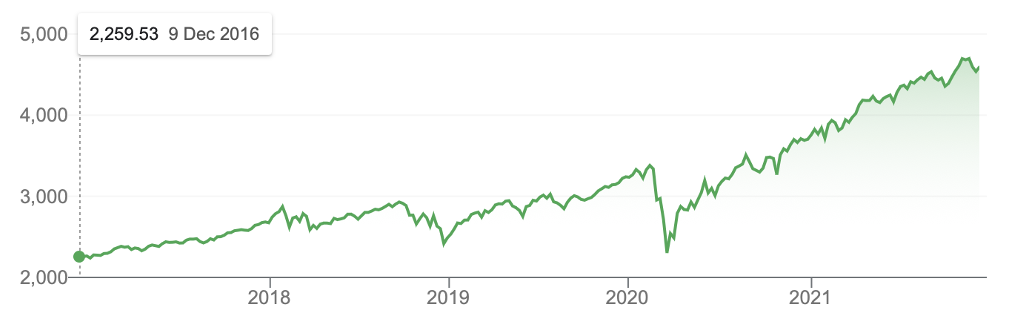

These charts compare the S&P 500 Index to the S&P/ASX 200 and I want you to look at where both indexes were before the Coronavirus crash. Then run your eye across laterally and see how much the US index has surged compared to our index.

When I transplanted these graphs, it showed a 38% gain for US stocks since the pre-pandemic high, while we were up about 4%. The US tech stocks had helped the S&P 500 hit successive, big all-time highs, while our market suffered lockdowns and slow vaccination rates that prevailed here in mid-2021.

S&P 500

ASX 200

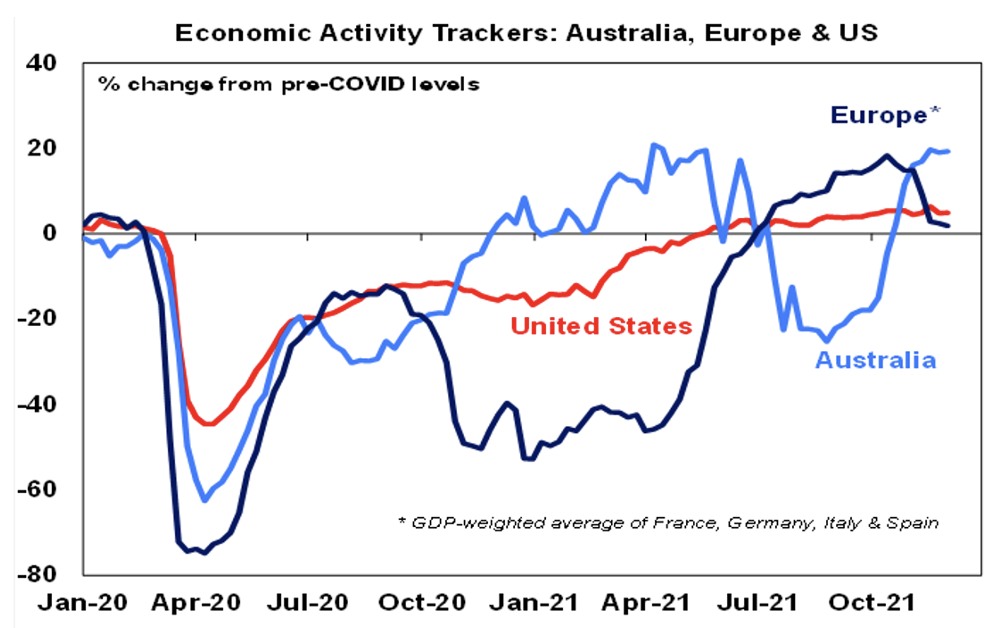

This chart from AMP Capital shows what happens when an economy like ours escapes lockdown, and it’s another reason for my optimism for stocks.

That rebounding blue line shows how economic activity is surging out of the end of lockdowns powered by 90% plus vax rates in our two biggest economies — NSW and Victoria.

A strong economy looks very likely

A strong economy looks very likely this year — the RBA says 5% growth and Westpac’s Bill Evans has a 7% number out there! — and this must feed into company profits and then share prices.

I might turn more defensive next year, when more interest rate rises will undoubtedly show up but for this year, I’m playing an attacking game with stocks!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.