I have been warning investors for the last four years about being shareholders in the major listed investment companies such as Australian Foundation Investment Company (AFI) or Argo Investments (ARG). As recently as June 2022, I nominated these companies as “sells” (see https://switzerreport.com.au/3-listed-investment-companies-to-sell/ [1] )

This was due to one single fact – they were trading at significant premiums to their net tangible asset value. I have never understood why someone would pay $1.20 for something that was worth $1.00. But that is exactly what investors were choosing to do though there were very accessible alternatives (passively managed index tracking exchange trade funds (ETFs)) that were “guaranteed” to produce better returns.

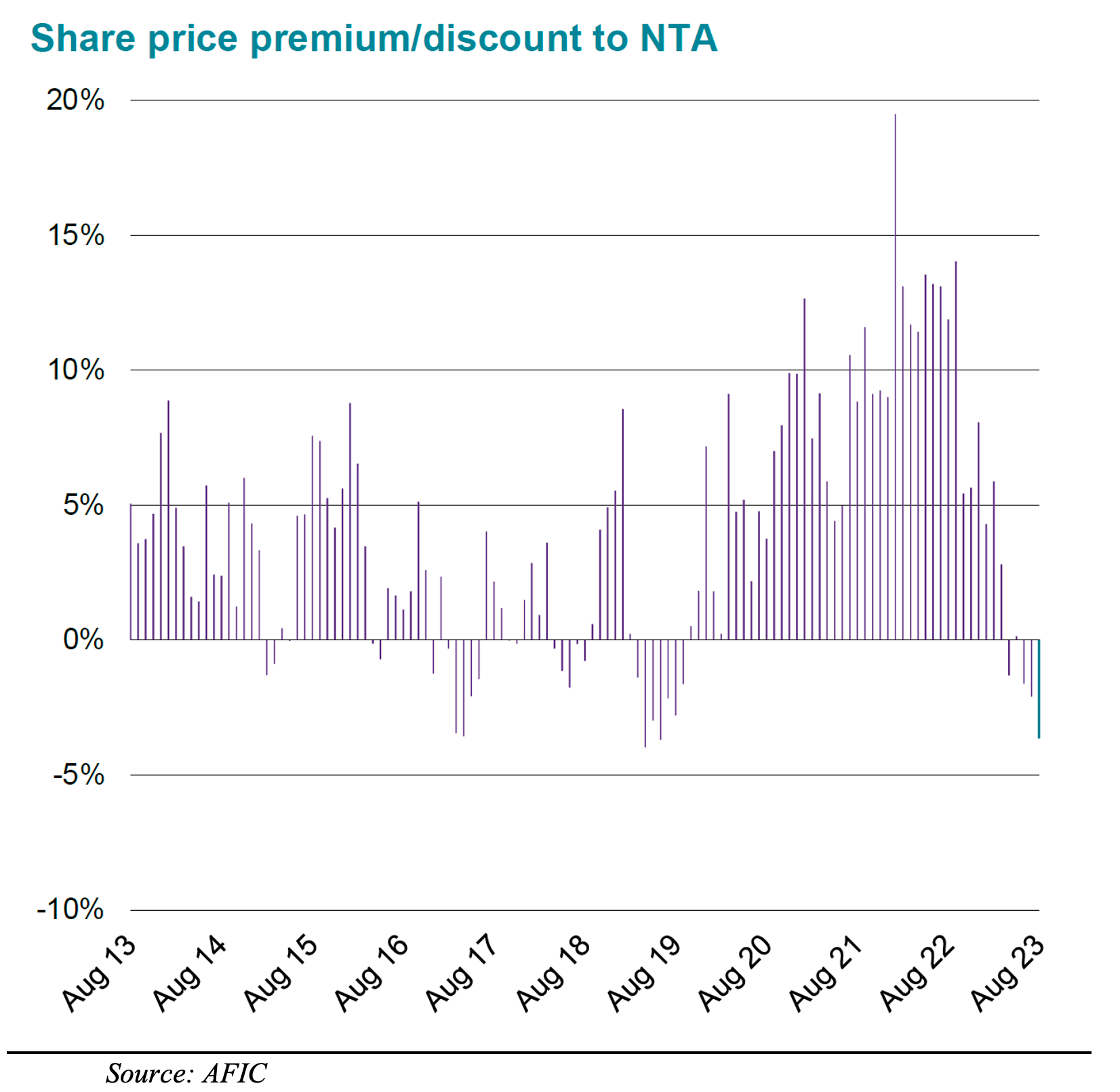

Interestingly, this situation has now reversed. The major listed investment companies are trading at a discount for the first time since 2019. The chart below from Australian Foundation Investment Company (AFIC of AFI – the latter is its ASX ticker) shows the premium or discount over the last 10 years. Premiums have been as high as 15%, averaging around 7%, while discounts have been less frequent, typically 3% or 4%.

To calculate the premium or discount, take the closing ASX price at the end of the month and compare this to the published pre-tax NTA. For example, Australian Foundation (AFI) closed on the ASX on 31 August at $6.94. Its pre-tax NTA was $7.20, implying that it was trading at a discount of 3.6%.

Adding a bit of complexity is that listed investment companies publish two NTAs – a pre-tax NTA and a post-tax NTA. The latter is an interesting measure that discloses the company’s liability to pay capital gains tax (or not) if it sold all its assets – but as this is not going to happen in practice, it can be ignored. So, focus on the pre-tax NTA. Simply, this is the market valuation of the company’s assets (which are almost exclusively listed company shares), divided by the number of shares on issue – identical to the unit price of a managed fund.

Historically, better performing, more liquid and larger listed investment companies (LICs) have tended to trade at a premium to their NTA (that is, the ASX price exceeds the pre-tax NTA), while poorer performing, less liquid and smaller LICs have tended to trade at a discount (the ASX traded price is less than the pre-tax NTA). With the growth of actively managed exchange traded funds, many LICs are now trading at a discount – some quite substantial. However, for the majors with their very loyal shareholder base, cyclical factors should dominate, and it is hard to imagine that the discount will blow out.

Here is a review of the big two, Australian Foundation and Argo.

- Australian Foundation Investment Company (AFI)

Australian Foundation Investment Company (AFI) is Australia’s biggest LIC at around $9.0bn and 163,000 shareholders. Its investment objective is to provide shareholders with attractive investment returns through access to a growing stream of fully franked dividends and enhancement of capital invested over the medium term.

AFIC’s portfolio reads like a “top 50” list of companies – Commonwealth Bank, BHP, CSL, NAB, Macquarie, Wesfarmers, Transurban, Westpac, Woolworths and James Hardie are the largest holdings – but there are biases. On a sector basis, it is overweight in financials, healthcare, consumer staples and industrials, and underweight materials, energy, information technology and real estate. It has a notable holding in Mainfreight (NZE: MFT).

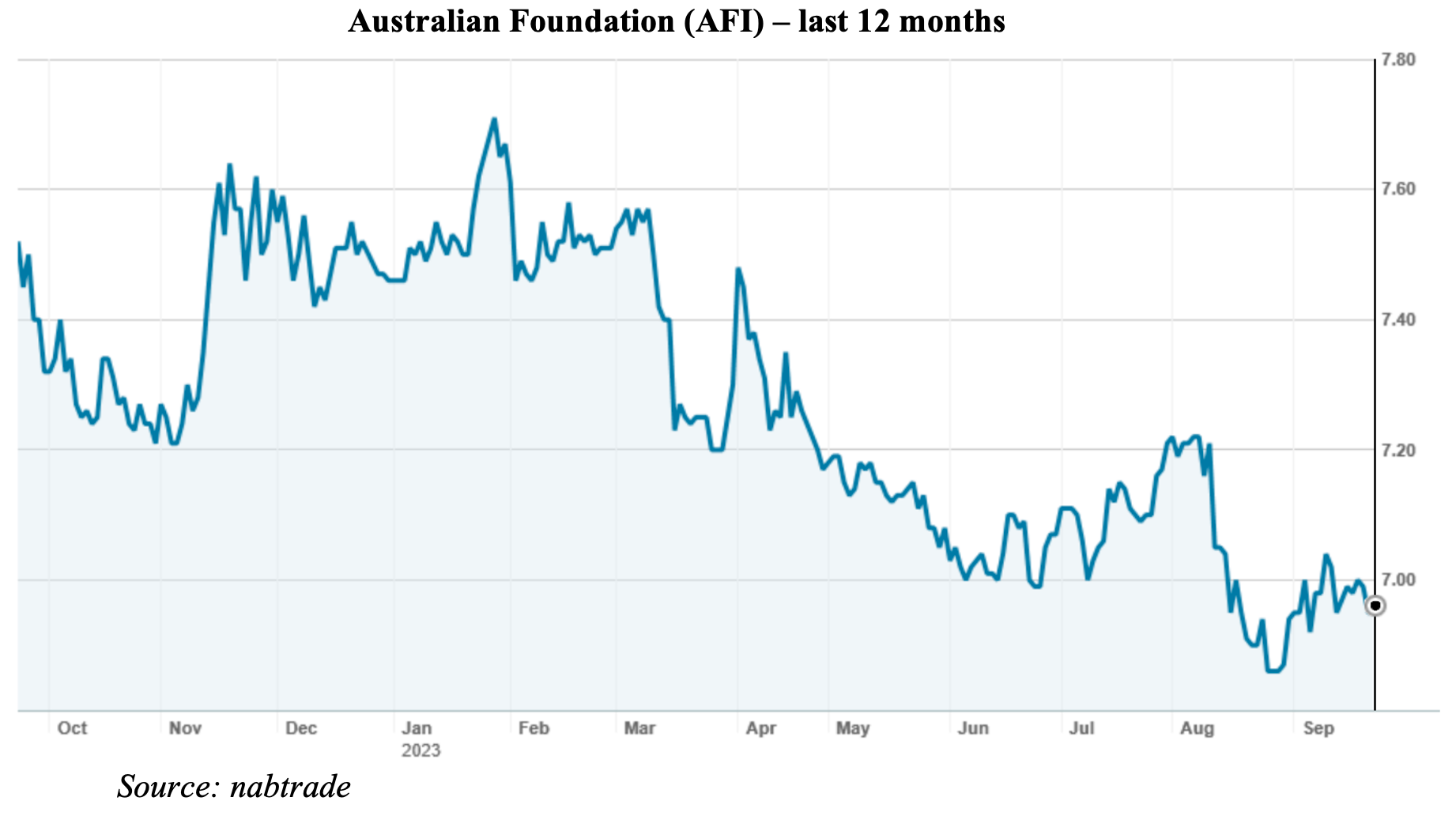

It benchmarks against the S&P/ASX 200 Accumulation index, but measures performance against the franking adjusted index, which adds about 1.5% to the overall return. Over 5 and 10 years, it has marginally underperformed compared to the index (8.8% pa to 31 August compared to the index’s 9.5% pa for 10 years). Over the last 12 months, it has underperformed (9.6% compared to the index return of 11.4%), no doubt in part due to its overweight position in healthcare.

Interestingly, its dividend yield is not that attractive. On a prospective dividend of 28c for FY24 and Friday’s closing share price of $6.95, it is yielding 4.0%.

AFIC’s management fee of 0.14% pa (and no performance fees) is one of the lowest for an actively managed portfolio.

At the end of August, it was trading at a discount to NTA of 3.6%. By Friday, that discount had narrowed to around 1% (the market is down 2.6% over the month, AFI’s share price is flat).

On the assumption that “index style” performance can be expected over the medium to long term, AFI (when trading at a discount to NTA) is a strong alternative to the major index tracking ETFs such as VAS, IOZ, STW or A200.

- Argo Investments Limited (ARG)

Argo (ARG) is similar in style to AFIC, but not quite as big at $6.5bn and 95,000 shareholders. It also boasts a very low management fee of 0.155% pa.

Its objective is to maximise long term shareholder returns through reliable fully franked dividend income and capital growth. It has a well-diversified portfolio, with the ‘top 10’ in descending order being Macquarie, BHP, CSL, CBA, Wesfarmers, Rio, ANZ, Santos, Telstra and Westpac.

The company benchmarks against the S&P/ASX 200 Accumulation Index. Argo has gone a little coy on monthly reporting of investment performance, but for the year to 30 June, it returned 9.6% compared to the index return of 11.4%. Over 3 years, it has outperformed, but over 5 years and 10 years, it has marginally underperformed. For the 10 years to 30 June 2023, it delivered a portfolio return (after fees) of 8.8% pa compared to the index return of 9.5% pa.

With a prospective full year dividend of 36c per share (Argo paid out 34.5c for FY23), it is trading on a yield of 4.1% (fully franked).

Argo’s discount to NTA at the end of August was 4.8% (NTA of $9.06, ASX share price of $8.63). On Friday, with a closing share price of $8.70, I estimate it had narrowed to a discount of 1.5%. When Argo is trading at a discount, it can be considered as a strong alternative to the major index tracking ETFs (VAS, IOZ, STW or A200).

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.