The toughest month for stocks (September) is here, so let’s start thinking outside the square with the knowledge that the December quarter is the best for stocks. Many years ago, it was explained to me by the man who gave us the idea of “lateral thinking” i.e., Edward de Bono, that successful people think outside the square. I think winning stock players invest outside the square and are often buyers when most investors are selling.

History isn’t always a reliable guide for the future. The same applies to investing in stocks using the past. But as Mark Twain observed: “History doesn’t repeat itself, but it often rhymes”. I think I can see a rhythmic pattern I like for stocks right now.

Over the last 20 years, the S&P 500 has averaged a loss of 0.5% in September, making it the worst stretch for the benchmark. Many commentators say this September is shaping up to be another rough one for the market, as investors weigh the potential for more rate hikes and an economic slowdown in China.

The S&P 500 dropped 1.8% in August, bringing its year-to-date gains down to 17.4%. Meantime, the S&P/ASX 200 dropped by 1.4% over the same time. In fact, it’s still below the high point for the market of 7539, which happened on February 6!

Investors were discouraged in August by commentary from Federal Reserve Chair Jerome Powell at the Jackson Hole Economic Symposium, suggesting more monetary policy tightening may be coming. However, data since has made these pessimistic prognostications look over-the-top, with unemployment rising in August from 3.5% to 3.8%, which surprised most economists.

That said, the consensus view on Wall Street isn’t yet saying that rate rises are done and dusted. Steve Wyett, chief investment strategist at BOK Financial, summed up the current attitude to the Fed and rate rises this way: “It would be a mistake to look at today’s employment report, along with recent data, and say the Fed is done…even though trends in inflation are moving in the right direction and a broader view of the employment market would indicate wage pressures should abate, overall economic growth is above trend and inflation remains well above the Fed’s recently confirmed 2% target”.

On the other hand, I think we’re close to seeing the Fed and the RBA stop raising rates, even if the narratives coming from their leaders will remain cautious about winning the fight against inflation. When the central banks look set for no more rises, stocks will surge.

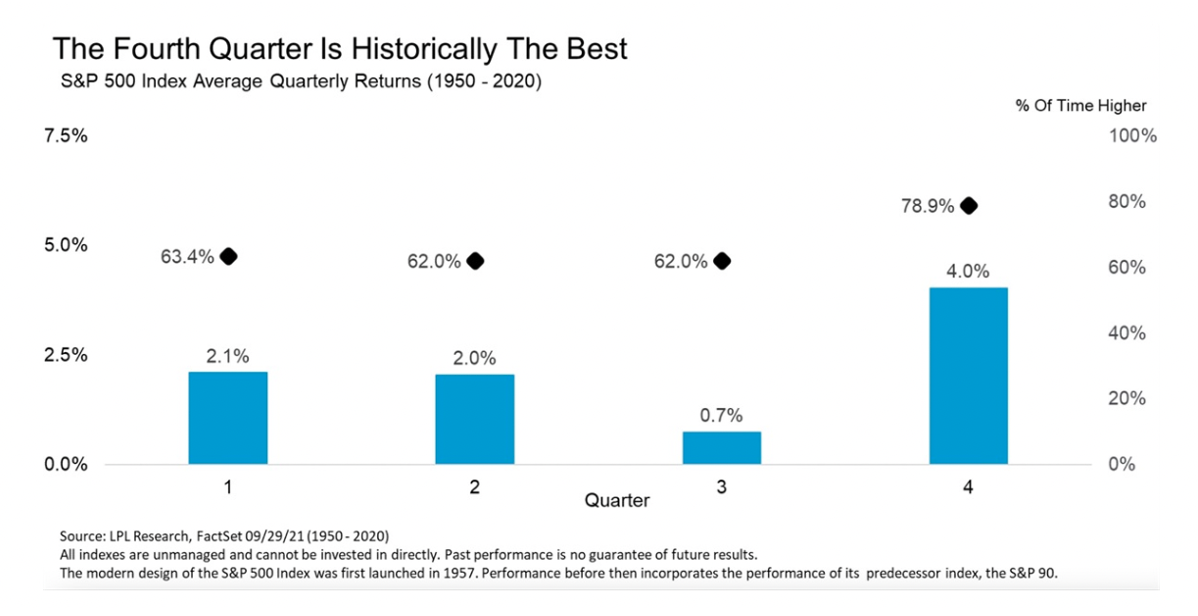

What I’m saying is that after the storm of September, historically the sun shines on stocks in the December or fourth quarter, as the chart below shows.

The chart also shows that the first or March quarter is another good one for stocks. Putting the half year of October to March and you have a pretty rewarding time for stock players. Add this to the fourth year of a US President being the second best for stocks and history is giving optimists a nice leg-up for stocks.

Interestingly, 2022 was one of the oddest years ever, with bonds and stock returns falling together, which seldom happens. The bond market had the worst year ever! And this was a year when an industry standard portfolio of 60% equities/40% fixed income suffered double-digit losses. This hadn’t happened since the early 1930s years of the Great Depression.

Then in 2023, the Dow is up only 5.10% year-to-date, while the ASX 200 is up a small 3.98%. This makes me think the last quarter, if it coincides with an increasing belief that rate rises are nearly over and the next move will be down, could be good news for stocks.

This year has been great for quality tech stocks and other highly profitable growth plays, but I get a sense that others will perform well when rate rises stop and cuts get close.

This is what Wayne Duggan from Forbes reported two days ago: “Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, says each month inflation comes in below expectations, the likelihood the Fed has issued its last rate hike of the current cycle increases.”

And here is his view on rate cuts, which is crucial for stock prices going forward.

“Not only is the Fed unlikely to raise rates at the next meeting, but they are also unlikely to raise rates again this year as long as inflation continues to remain contained.” Zaccarelli says. “Investors still care what the Fed is going to do, but at this point given that they are either done raising rates or very close to being done raising rates, the underlying fundamentals of corporate profits are again the main focus.”

Interestingly, the US bond market is pricing in a 44.4% chance the FOMC will raise rates by at least another 25 basis points by November, which is very different to the view a few months ago. The market is also pricing in a 59.5% chance the FOMC will cut interest rates from their current levels by May 2024.

Given stock markets move ahead of reality, this is another reason to believe that stock buying will start in the December quarter and roll into the March quarter. After that, it might be a ‘sell in May and go away’ year.

Given all this, I’m charged with the advice from Warren Buffett for September, which says “be greedy when others are fearful…”. I want to buy in any sell-offs in scary September.

As I said a few weeks ago, I like GEAR for a high-risk play, which should magnify any local market gains. For US market rises, I like IHVV, which is a hedged ETF for the S&P 500.

Local stocks I like include Macquarie (MQG), CSL, Resmed, Ramsay, MP1 and Pilbara Minerals. Chalice Mining is my big speculator, along with Paladin Energy (PDN), as more and more countries start talking up the need for nuclear to save the planet.

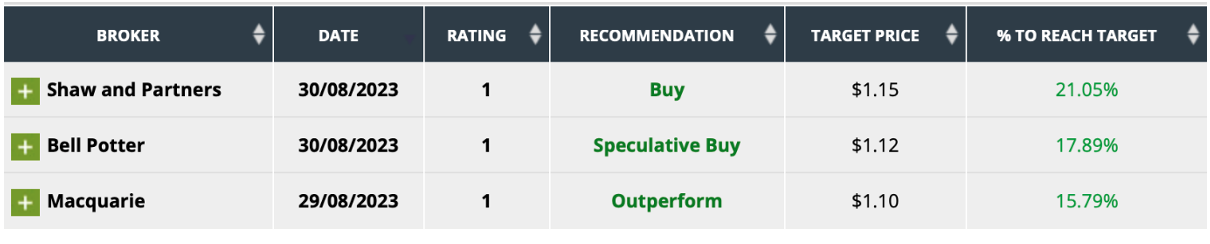

The consensus rise for PDN is 18.2%. This what FNArena shows for individual assessors:

I can assure you, if September gets scary, I will be a fearless buyer!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances