The bank reporting season kicks off on Thursday when ANZ presents its full-year results. Westpac follows on Monday 1 November, with NAB bringing up the rear on Tuesday 9 November. On Friday, we will hear from Macquarie with their first-half results.

After such a strong rally, shareholders will be looking for confirmation that profits are holding up, dividends getting back towards pre-Covid levels and expenses being tightly managed. They will also be reviewing trends in the net interest margins, and most importantly, growth in lending books relative to peers.

Here is my analysis of what to expect.

Profits and dividends

ANZ reported a first-half cash operating profit of $3bn. This included the benefit of a writeback of some Covid-19 credit provisions. Before one-off and notable items, the profit was $3.8bn. For this half, where credit provisions will start to move back to a more normal position, the market is expecting a cash operating profit before notable items of $3.1bn. This would be on the back of ongoing cost control, a stable NIM environment, marginal volume growth in Australia and a strong performance from New Zealand. ANZ has said to expect notable items of $129m, so this will take the cash profit to just under $3bn.

For the first half, ANZ paid an interim dividend of 70c. It is set to do this again in the second half, maybe pushing up to 72c.

In the first half, Westpac reported a cash operating profit of $3.8bn, and after notable items, $3.5bn. Westpac has announced notable items of $1.3bn after tax for this half, mainly due to a write-down of assets, goodwill and capitalised software in the institutional bank. It will also not have the benefit of a credit impairment writeback, which will bring the cash operating profit down to about $1.9bn. In underlying terms, the market expects a small deterioration (excluding bad debts) in profit.

There is a huge variability with the analysts in terms of predictions for the second half dividend, ranging from 34c to 60c per share. The “pack” is around 58c a share, the same as it paid in the first half.

The market will also be keen to see what progress Westpac has made on its very ambitious plan to cut costs. In May, it announced a plan to slash its cost base from $10.2bn in FY20 to $8bn by FY24.

NAB’s first-half cash profit (there were no notable items) was $3.3bn. Again, it benefitted from a writeback of Covid-19 provisions. NAB also provided the market with a third quarter trading update, detailing a $1.7bn quarterly profit.

The fourth quarter won’t contain the same level of writeback, so the market thinks NAB will report a cash operating profit of $3.3bn. Ord Minnett thinks this will be the “sector leading” result, showing growth in underlying pre-provision profit of 5%.

On the dividend front, the market expects a final dividend of 65c, up from 60c in the first half.

Summarising the dividend expectations: ANZ 70c, Westpac 58c and NAB 65c per share.

Capital returns

ANZ is almost halfway through a $1,500m on-market share buyback that it started in August. Although an increase in size is possible, it is unlikely. Because ANZ doesn’t have surplus franking credits, there is no prospect of an off-market share buyback.

Will Westpac announce an off-market share buyback? It is the only major bank yet to announce any capital plans and has both the capital position and franking credit balance to do so. Some analysts say that a buyback of $4bn to $5bn could be announced next week, while others say that until the “fix” is complete, capital actions aren’t on the agenda. If it is announced, this could be a major catalyst for the share price.

NAB is only 20% through its $2,500m on-market share buyback. It is very unlikely that NAB will rollout any new capital actions.

Home lending volumes

Home lending volumes will be a key watchpoint for ANZ. In the first half, it grew its book by a net $6bn, but this was still below market growth.

Westpac has also been struggling, but in the first half, it turned the corner with net growth of $2.6bn. This came after a couple of years of net outflows. The market will be looking for further positive progress.

NAB’s performance in the first half was underwhelming with volumes largely flat. However, the 2nd quarter showed an improvement on the 1st quarter, and the third-quarter trading update said that housing lending had grown at 2%, outpacing system growth. Expect to see solid growth this half.

What do the brokers say?

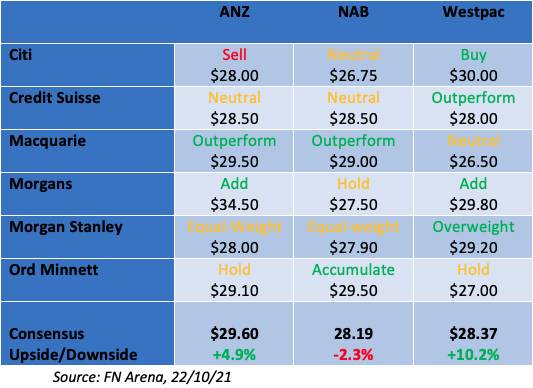

The table below shows the recommendations and target prices from the six major brokers for each bank.

Collectively, they see the most upside with Westpac, with a target price of $28.37 compared to Friday’s close of $25.74, some 10.2% higher. ANZ is viewed as having upside to $29.60, while NAB is trading 2.3% higher than the consensus target of $28.19.

In terms of “top pick”, Citi, Credit Suisse and Morgan Stanley favour Westpac, Morgans goes for ANZ while Ord Minnett and Macquarie opt for NAB.

My pick?

I am sticking with NAB. I agree with the Ord Minnett view that it is most likely to deliver the “sector leading” result, plus it has momentum in terms of volume growth and from the difference CEO Ross McEwan is making. Further, as the bank most exposed to the SME market, a post-lockdown recovery should work in its favour.

Who could surprise? The most obvious candidate is Westpac. Two areas – an off-market share buyback, which could give its share price a real boost, or signs that business momentum is strong and the “fix” is almost complete. If the share price margin between NAB and Westpac widens to $4.00 (currently $3.12), Westpac will start to look attractive.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.