For a bit of mischief, I asked ChatGPT to explain why Artificial Intelligence (AI) stocks are rallying. In under a minute, the AI chatbot spat out an impressive list of reasons.

Advances in AI technology topped the list. Increasing adoption of AI, big data and cloud computing, and investor confidence and government support were other factors.

I reckon ChatGPT downplayed investor confidence. In its typical understated tone (with investing), the software said that “positive market sentiment surrounding AI has attracted the attention of investors who see its long-term potential”.

AI hype is a huge factor driving the current rally in global tech stocks. But as I wrote last week in this column, long-term growth investors should have some exposure to AI in their portfolio, including through Exchange Traded Funds (ETFs).

Another option is thinking about technology-service companies that benefit from the AI boom. Sometimes, the best way to play a boom is to own the companies that provide the “picks and shovels”. Returns aren’t as high, but nor are the risks.

I suspect most ASX200 companies are thinking about the potential effect of ChatGPT and other AI technology on their business. How could they use AI to boost employee productivity or replace some, and better understand customers?

Board directors will put many more questions about AI to executive teams this year. What is the company doing about AI? What are its competitors doing? What are the risks if we don’t invest sufficiently in AI and are left behind?

The result will be higher investment in AI technologies by ASX 200 and other large organisations, such as government departments, over the next few years.

That trend is obvious, yet there has been little commentary on how the current AI boom will affect ASX-listed technology-service companies. What happens when lots of organisations need more help with implementing AI-focused tech projects?

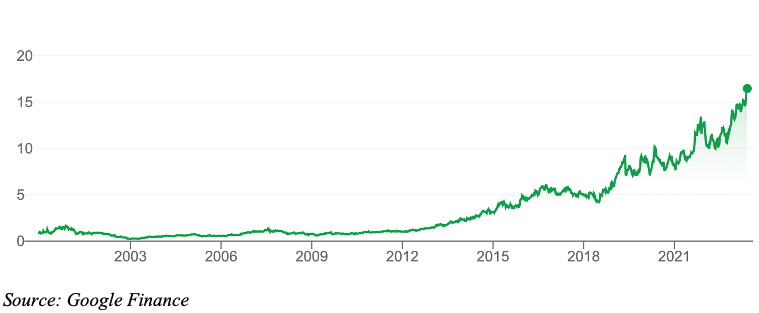

Australia has some terrific tech-service companies. Over the years, I’ve preferred Technology One (ASX: TNE), the star tech-service stock. I recall meeting TNE management about 20 or so years ago when the company listed on ASX.

Chart 1: Technology One

I have also written favourably about Hansen Technologies (ASX: HSN), a utilities-billing software company that has a defensive business model.

Data3 (ASX: DTL) another impressive tech-service stock, was included in my December 2022 column on “small-cap ideas for 2023”. DTL is up almost 8% year-to-date.

To avoid repetition, I won’t cover those stocks again in this column. As an aside, TNE looks fully valued after its recent rally. DTL still appeals and Hansen looks cheap.

Here are two other tech-service companies to consider. Both suit experienced investors who understand the features, benefits and risks of small-cap investing.

- Objective Corporation (ASX: OCL)

The Sydney-based company provides technologies for public-sector organisations and local governments here and overseas. As such, Objective is leveraged to the long-term trend of digitisation of government services for communities.

Objective’s half-year result for FY23 underwhelmed. Revenue grew 4% to $55 million, but EBITDA fell 16% to $12.7 million in 1HY2023,

In a letter (February 16) to shareholders, Objective noted several short-term headwinds. They included greater focus on subscription licences to drive higher annual recurring revenue; initiatives to reduce project costs and delays; and higher travel and wage bills.

Objective founder and CEO Tony Walls wrote: “Following the slow initiation of new projects in 1HY2023, we are buoyed by the increased activity we’re now witnessing in our primary target market – the public sector.”

Walls added: “The outlook for contracting new business for the remainder of FY23 is strong … We expect our long-term revenue growth rate and margin expansion to return to trend from July 2023 … Historically, we have had great periods of growth during softer economic times. This has been a result of being able to hire great people and maintain fiscal discipline.”

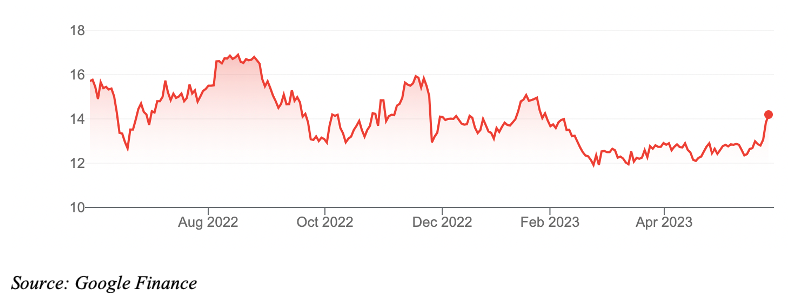

The market was sceptical. Objective fell from $15 in the lead-up to its results to $11.78 soon after. The stock has recovered to $14.13 after strong gains this month.

Objective’s wounds over the past year look largely self-inflicted. The company appears to be playing the long game, innovating its business model, investing in R&D, reconnecting with clients, improving service delivery and becoming more efficient.

But that’s heresy in a market obsessed with short-term results. These days, small-cap industrial shares can be belted on even the slightest whiff of bad news.

Like other tech service companies, Objective will not be immune to the slowdown in economic activity over the next 12 months, potentially lower or slower investment in new tech projects (to save costs), or a tight labour market for IT staff.

Still, recurring revenue from tech services from government organisations is a good place to be. Objective has a good position in this market and is making solid progress strategically. It may take time, but Objective can become a larger business.

Chart 2: Objective Corporation

- Atturra (ASX: ATA)

Formerly known as FTS Group, Atturra listed on the ASX in December 2021 after raising $24.5 million at 50 cents a share through an Initial Public Offering (IPO). The company was valued at $100 million upon listing at the issue price.

Atturra provides a range of technology services across the public and private sectors. It claims to have more than 600 clients and describes itself as one of the largest consulting and defence teams working with Defence and the Federal Government.

Atturra has done well since listing, almost doubling its IPO issue price at one point. The shares now trade at 91 cents, capitalising Atturra at $210 million.

As readers of this column know, I watch small-cap industrial IPOs closely in the 12-24 months after listing. By then, IPO hype has faded, the company has history as a listed entity, is bound by disclosure rules, and escrow provisions have usually lapsed (meaning early investors are free to sell their previously restricted securities).

Atturra’s half-year revenue grew 34% and underlying earnings (EBIT) rose 39% for 1HY2023, compared to the same period a year ago.

About a third of the revenue growth came through acquisitions. The rest was from organic business growth as new clients were added and Atturra’s services expanded.

In November 2022, Atturra raised $25 million to fund three strategic acquisitions. Atturra has a pipeline of potential acquisitions – and the balance sheet to buy several smaller firms.

Atturra reported $55 million of cash at its 1HY2023 result. About a quarter of the company’s market capitalisation is accounted for by its cash holdings.

In April 2023, Atturra announced it had completed the acquisition of The Somerville Group and Hammond Street Developments (both IT service firms).

Following the acquisitions, Atturra upgraded its FY23 revenue guidance to $168.5-$175.5 million, from $160-$167 million previously. Atturra is forecasting underlying EBITDA guidance of over $19 million for FY23.

Atturra is growing quickly through acquisitions – and importantly, organic growth. That’s a good sign. Over the years, I’ve seen too many micro-cap companies come unstuck when their growth was based mostly on rapid debt-fuelled acquisitions.

Atturra looks like it is building a good business. Share-price gains might be slower from here, but Atturra has performed well since listing.

Chart 3: Atturra

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at May 31, 2023.