Right now, we’re in a market tussle. On one hand, there’s good news of falling inflation in the US and here, which is leading to questions about the end of rate rises. While on the other hand, there’s bad news about a worrying recession coming because the rate rise programs have been too aggressive.

The US is more likely to have a mild recession, while economists think we will endure a slowdown.

“Over the last 50 years, all US recessions have been preceded by inverted yield curves, as is the case now – but the lag can be up to 18 months and it can give false signals,” AMP’s Shane Oliver wrote last week. “At the very least, the plunge in 2-year bond yields below the Fed Funds rate is signalling that the market expects that the Fed has probably done enough to control inflation and that the Fed will cut rates over the next two years.”

By the way, in Australia, the yield curve is now inverted, warning of a rising risk of a recession but its track record in signalling a recession is poor. That said, the money market thinks the RBA has also done enough to KO inflation.

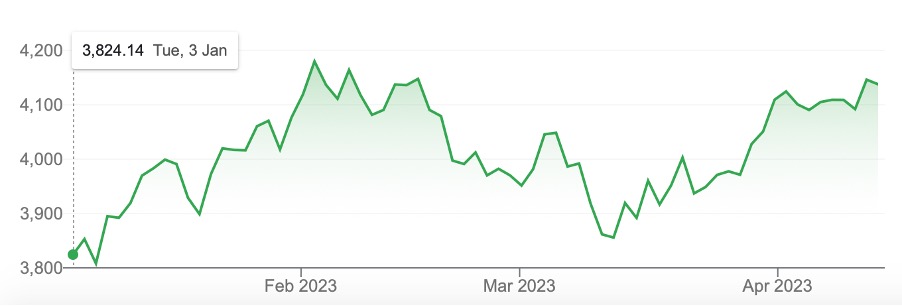

All this talk about either being near the end of rate rises or no more rises, has to be great for stock price rebounds, especially for tech and other growth stocks. It explains why the S&P 500 is up 8.2% year to date and the S&P/ASX 200 has jumped nearly 6% year to date.

S&P 500

And while there are similar stories of falling inflation in both the US and Australia, data last week suggests that the Yanks might see the end of rate rises before us. The reason is data-linked because every statistical release is so important for central bank bosses trying to work out when they should stop these rises.

Until last week we saw our inflation falling faster than the US, but then the March CPI showed inflation in the States fell to 5%, which was a huge plus for the economy and stocks. This was followed by an even bigger inflation surprise, with the Producer Price Index falling by 0.5%, which took the annual PPI growth rate down from 4.9% to 2.7% — that’s the lowest since January 2021. More importantly, it’s close to the last 20 years’ average!

That set the scene for tech stocks to really kick, but then on Friday, US retail sales came in at 1% down when the economists’ guesses were more like 0.5%. This set off recession concerns selling.

In fact, the negativity was so high that the market couldn’t even go higher on better-than-expected bank profit reports from the likes of J.P.Morgan Chase and Wells Fargo. The former saw its share price rise over 7% on the news but the overall market put the focus on a potentially battered US consumer and the Dow dropped 0.42% and the Nasdaq lost 0.23% for the week, though the latter was up 1.24% for the week. Crucially this tech index is up 16.72% for the year-to-date and the end of rate rises has a lot to do with this jump.

That retail result has fuelled recession fears even more, but US Treasury Secretary Janet Yellen told CNN over the weekend that the banking crisis could help the Fed in its inflation battle. That’s a message from her to her Fed replacement, Jerome Powell, that he should be careful with rate rises, given the impact of less lending from banks because of the banking crisis that followed the deaths of Silicon Valley Bank and Credit Suisse.

Of course, this has added weight to those arguing that a significant US recession was now more likely, but Yellen won’t have any of that. “I’m not seeing anything at this time that is dramatic enough or significant enough in my view to significantly change the outlook,” Yellen said. “I think the outlook remains one for moderate growth and a continued strong labor market with inflation coming down.”

Taking all this into consideration, we have a US economy with falling inflation and less likely to be hit by a bad recession. Yellen is comfortable with the US banking system, which is also a good anti-recession story.

“Americans should note that America has a safe, strong banking system,” she said. “Our banking system is well capitalized and liquid, and the problems that a couple of banks faced — this is not a general problem throughout the banking system. We took steps to make sure that depositors feel that their savings are safe, and the tools that we used to do that are ones that we could and would use again if difficulties in a single bank or a couple of banks were to create a risk of contagion to the system.”

These are all good stories for a stocks recovery this year.

Locally, our falls in inflation have been good, but last week’s job numbers must be making Dr Phil Lowe nervous. He doesn’t want to raise rates more than he has to with 10 already in the bag and the unknown effects of the mortgage cliff set to hurt spending and the economy this year.

The jobless rate is stuck around a 50-year low of 3.5% and 53,000 jobs created in March wasn’t good for interest rate worriers and Dr Phil. It makes the next few weeks of economic data crucial for future rate rises.

But I’d argue that all the above is good for stocks.

The US with a better-than-expected inflation story and Yellen at least ruling out a ruinous recession with no banking crisis, has to be good for stock prices. This story was reinforced on CNBC by Paul McCulley, the former chief economist at PIMCO — the world’s biggest bond fund manager.

He knows a thing or two about US interest rates and is teaching a Fed-watching course at Georgetown University. He says rate rises are over and to expect rate cuts this year from the Fed. That will be good for a broader group of US stocks.

But what about us?

Well, the RBA will be watching wage data to make sure the strong labour market doesn’t push up pay packets and inflation. This is how AMP’s Shane Oliver sees it: “In Australia, strong March jobs data adding to the risk of a wages breakout and the upswing in the residential property market (which if sustained would reverse the negative wealth effect from lower home prices) increase the risk of another RBA rate hike in May.

“Our base case is that with the labour market being a lagging indicator and economic growth and inflation likely to continue to slow the RBA will remain on hold at its May meeting. But it’s a close call with upcoming data on inflation to be watched closely.”

I expect our inflation will really fall when the mortgage cliff kicks in and that’s likely to happen as US stocks will be rebounding on the end of rate rises. I’m not sure about McCulley’s rate cut speculation and it would be more likely if a US recession shows up and is worse than expected.

I’m betting on a US Goldilocks story of falling inflation, no more rate rises and a slowdown or mild recession that will power a stock market rebound on Wall Street. And despite our potential slower falling inflation, our stock market would play follow the leader and would do so all the way into 2024, and maybe even beyond.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances