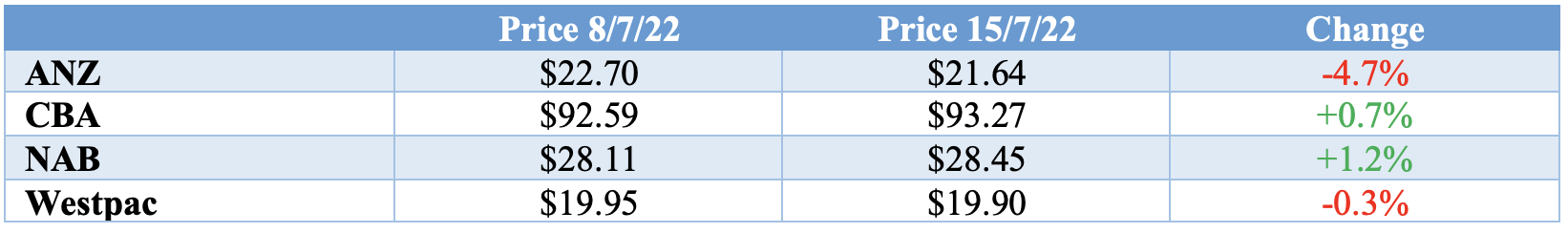

Thank goodness the ANZ has abandoned a plan to buy accounting software provider MYOB. Analysts, investors and commentators were unanimous in saying the acquisition didn’t stack up. Last week’s price action, which saw ANZ lose 4.7% while most of its major bank competitors saw their prices increase, tells the story.

At the most fundamental level, the acquisition looked challenging. Would MYOB’s clients, typically small- to medium-sized businesses, really be comfortable with the ANZ using their data, either to sell them additional products or offer additional insights? Assuming that 85% of MYOB’s clients didn’t bank with the ANZ, how many would readily change their banking relationship to bank with the ANZ, noting the inertia clients have when it comes to change of this nature? And did ANZ have the skills, culture or experience to “manage” an adjacent business such as MYOB, or was MYOB likely to be “crushed”?

The ANZ Board listened to the market’s concerns and killed the deal. To achieve growth, they went “back to type” and today announced the acquisition of Suncorp Bank.

Suncorp Bank brings 1.1 million customers, $47bn of mortgages, $45bn of deposits and $11bn of commercial loans. ANZ’s lending book will tilt towards Queensland (where it was under-represented), with that state’s share rising from 14% to 19%. Overall, ANZ will leapfrog NAB to be the third biggest provider of mortgages in Australia and the third biggest retail deposit bank. At a Group level, it rebalances ANZ towards Australian retail and commercial.

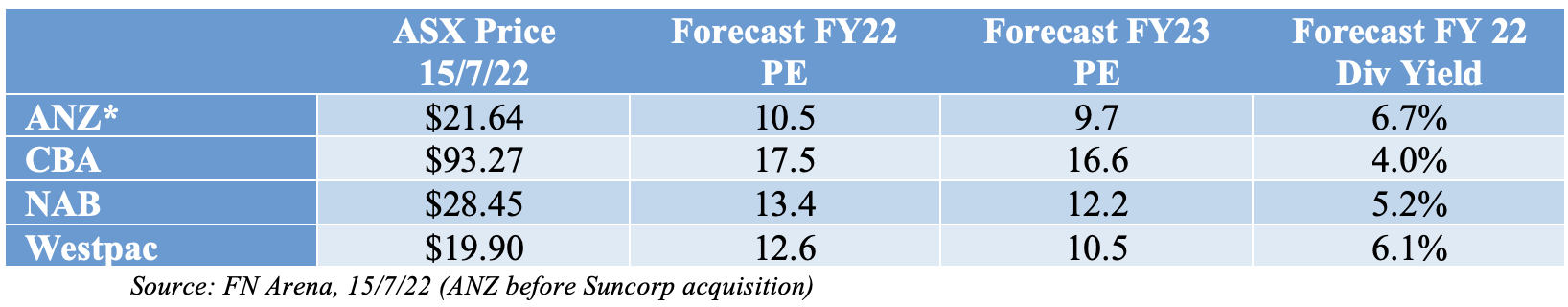

Suncorp comes at a high price. ANZ is paying $4.9bn, which represents a multiple of 13.8x current year Suncorp Bank earnings of $355 million, and compares to the multiple of 10.9x that ANZ is currently trading at (see table below). It is a 30% premium to book value.

To keep Queensland customers and the State Government on side, ANZ has offered several commitments:

- The business will continue to be branded ‘Suncorp’ (which may in any event be the best strategy), with ANZ licensing the ‘Suncorp Bank’ brand for 5 to 7 years.

- No change to the number of Suncorp Bank Queensland branches for at least 3 years post completion;

- No net job losses in Queensland for at least 3 years post completion;

- Lending commitments for businesses, renewable energy and Olympic Games infrastructure; and

- Suncorp Bank will continue to be led by Clive van Horen.

ANZ says that it expects to achieve annual cost synergies of $260 million, representing around 35% of Suncorp’s FY22 cost base, which will lower the acquisition multiple to 9.8x when fully implemented. These are expected to cost about $680 million to implement, but take 6 years to deliver. The transaction won’t be complete for another 12 months, in years 2 to 4, no cost synergies are expected prior to system migration and the continued separate operation of Suncorp Bank, and in years 4 to 6, the synergies will be phased in.

If ANZ can deliver the synergies and maintain the revenue, it says that the transaction is “low single-digit EPS (earnings per share) accretive” and “marginally ROE (return on equity) accretive”.

Capital raising

To fund the acquisition, ANZ is raising $3.5bn through a 1 for 15 renounceable entitlement offer. Following the raising and acquisition, ANZ’s capital ratio on a Pro-forma basis will be 10.7%, comfortably above APRA’s “unquestionably strong” target of 10.5%.

The 1 for 15 entitlement offer is at a price of $18.90 per share. This represents a discount of 12.7% to ANZ’s closing share price last Friday and 12.0% to the theoretical ex-rights price of $21.47.

Fractional entitlements will be rounded up to the next whole number, so if you own 1,000 ANZ shares, you will have 67 entitlements.

The offer is being conducted in two parts. An institutional offer that opened today and closes tomorrow, with entitlement not taken up to be auctioned, and an offer to retail investors which opens on Tuesday week.

Entitlements are tradeable and will be quoted on the ASX under the code ANZR. Investors, therefore, have three choices:

- Take up their entitlements by paying $18.90 for each new ANZ share;

- Sell their entitlements on the ASX; or

- Do nothing, with their entitlements auctioned.

In the “do nothing” scenario, retail entitlements not taken up are auctioned to institutional bidders. In the event that the auction price exceeds the offer price of $18.90, retail shareholders are paid the excess, with that payment made on 23 August.

The timetable for the offer is as follows:

- Results of Institutional Entitlement Offer (Thurs 21 July)

- Trading halt lifted and ANZ shares recommence trading (Thurs 21 July)

- Record date for Retail Entitlements (7.00 pm, Thurs 21 July)

- Retail Entitlements commence trading on the ASX (Thurs 21 July)

- Retail Entitlement Offer opens (Tues 26 July)

- Last day for trading on ASX of Retail entitlements (Mon 8 August)

- Retail Entitlement Offer closes (Mon 15 August)

How will the market view the acquisition?

This is how I expect the market to view the acquisition:

- Firstly, they will be relieved that MYOB has been shelved;

- Strategically, they will say it is sound. ANZ is growing scale in its key franchise – Australian mortgages, deposits and commercial lending – in a geography where it is underrepresented and is growing faster than most other states;

- ANZ has paid “top dollar”;

- The cost savings, while potentially achievable, are in the “never-never”;

- Organisationally, keeping the Suncorp brand and leadership team minimises acquisition risk, but could also impact the opportunity to drive long acquisition benefits.

The market will be encouraged by ANZ’s trading update which was released in conjunction with the acquisition announcement, which showed revenue up 5% in the third quarter due to a higher net interest margin and lending momentum. ANZ grew its home lending book by a net $2bn in the quarter, and also recorded growth in commercial loans, institutional loans and in NZ. Costs look to be broadly on plan, with ANZ saying that “run the bank costs were expected to be broadly flat for the second half despite inflationary pressures”. Bad debts for the quarter were negligible – a total of just $14 million. The ANZ Board also confirmed a final dividend of 72c (not payable till the end of 2022), which will take the full-year payout to 144c per share.

The market will consider ANZ’s pre-acquisition share price and forecast multiples and compare those to its competitors. As the table below of broker forecasts shows, ANZ was trading on a multiple of just 10.5x forecast FY22 earnings. This compares to 12.6x for Westpac and a staggering 16.6 times for CBA.

Broker Forecasts* – Major Banks PE Multiples and Yields

So while there may be misgivings about the purchase price and the delivery of the integration benefits, the overall take will be that Suncorp is a logical acquisition. And because ANZ is now so cheap, the institutional raising will be very well supported.

Investors who have the cash should also participate – take up your entitlements.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.