Conditions for the residential property sector are pointing up, thanks to low interest rates, good housing affordability and a relatively low rate of home building in recent years that has left rental markets fairly tight.

Importantly for the sector, the Reserve Bank does not share the view of some (mainly foreign) analysts who believe local house prices are wildly overvalued. It’s prepared to support the sector further over the coming year, if need be, with lower interest rates.

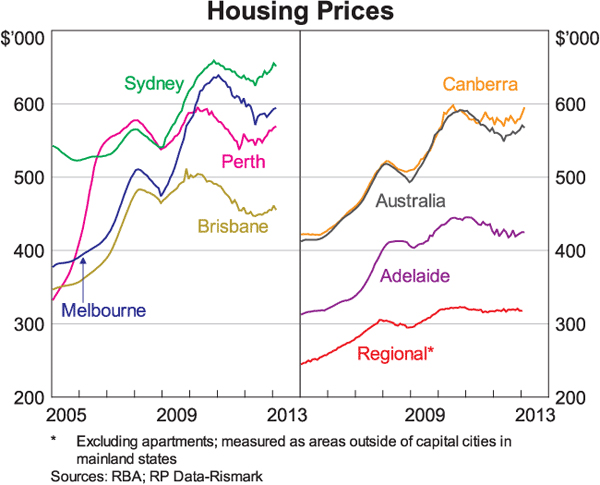

After all, house prices relative to household incomes have moved around a broadly stable trend since the mini-bubble in house prices burst in late 2003.

Australia’s relatively high rate of population growth and high urban density continues to support prices.

Alternative growth source

From a cyclical perspective, the market seems due for improvement. Indeed, with the huge run up in mining investment close to a peak, the RBA wants to see “non-mining” sectors take up some of the economic slack over the next few years.

If the Australian dollar remains relatively high, non-mining trade exposed sectors like manufacturing, education and tourism will be hard pressed to provide this alternate source of growth – meaning more work will be required from the consumer sector and ideally, housing construction.

Both consumer spending and home building will do better in an environment of at least modestly rising house prices – which should be possible without sparking fears of an “asset bubble” due to the current good affordability levels.

According to the recently released Commonwealth Bank/Housing Industry Association home affordability index, the percentage of average household income required to service a loan on the average-priced home in Australia has fallen over the past year to be almost at the levels last seen in 2009. House prices relative to income are below their average of the past decade, and mortgage interest rates are well below average.

Sound underpinnings

Note that back in 2009, very low interest rates and a panicked drop in house prices during the financial crisis created the conditions for a mini-boom in prices over the following year. Underpinning the market today are tight rental markets, with the national vacancy rate still only around 2%.

[2]As reflected in a lift in home loan approvals, demand is starting to stir. Over the past year, the value of home loan approvals (excluding re-financing) rose by 9%, led by solid demand from existing homeowners and investors. Confidence among existing homeowners has lifted, and more see now as a good time to buy a new dwelling. Tight rental markets and relatively flat house prices in recent years have improved rental yields, making investment property also relatively more attractive – especially now in a period of exceptionally low interest rates.

[2]As reflected in a lift in home loan approvals, demand is starting to stir. Over the past year, the value of home loan approvals (excluding re-financing) rose by 9%, led by solid demand from existing homeowners and investors. Confidence among existing homeowners has lifted, and more see now as a good time to buy a new dwelling. Tight rental markets and relatively flat house prices in recent years have improved rental yields, making investment property also relatively more attractive – especially now in a period of exceptionally low interest rates.

Investors to the fore

Unlike in 2009, however, first-home buyers are generally less active – as there are less government incentives. Led by some temporary incentives, first-home buyer demand did spurt higher briefly in mid-2012, but has since waned again. One challenge facing first home buyers is that the lift in prices relative to income in recent years – although countered by a drop in mortgage rates – made the upfront deposit relative to income requirement for those just getting into the market more onerous.

On the supply side, Australia’s housing sector has long faced challenges, which is partly why established house prices have held up so well. Developers continue to bemoan land shortages, heavy infrastructure charges and an often-unfriendly local government approvals process. But despite these supply side constraints, builders have nonetheless found ways of meeting demand in recent years, with a strong upturn in building in 2009 and 2010. Indeed, home building approvals have also lifted since mid-2012, but so far at least the upturn remains muted and led by apartments rather than established homes.

Compared with 2009, the current upturn should be more dominated by investors than first homebuyers. That should see relatively more demand for, and construction of, apartments rather than single-family homes, and some eventual easing in rental market pressures.

This improvement in rental supply should also temper the overall lift in house prices relative to a situation where first homebuyers were driving the market. Longer-term, another huge move higher in house prices is unlikely – as household debt levels are already high. Rather house prices will respond with a lag to the rise and fall in affordability caused by the interest rate cycle.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.