I was asked a throw-away question recently about what risky stocks I like right now. Now I’m very mindful not to say too much because I don’t know much about a person’s individual circumstances and as I’m not a trader, I always allow myself at least a year to be proven right (or wrong).

In fact, I think my investing competitive advantage over my fund manager rivals is that I only have to impress myself and those family members in my super fund, while the pros have to justify their investing decisions quarterly or half-yearly.

For this article today, I wanted to find a quality business that’s currently out of favour with the market but will have fans when we’re vaccinated and borders reopen. And I’m thinking about pubs, restaurants and the entire hotel, hospitality and tourism sector getting back to something like the ‘old normal’.

What business will be a real beneficiary and should expect to be more profitable, which should drive its share price higher? I’ve said before I think Qantas is a natural gainer from us flying again and the 26.7% upside predicted by company analysts makes perfect sense.

But if you want another standout company that fits my view that certain stocks will be key beneficiaries of the reopening and us getting back to going out and celebrating the end of lockdowns, then it has to be Tyro Payments.

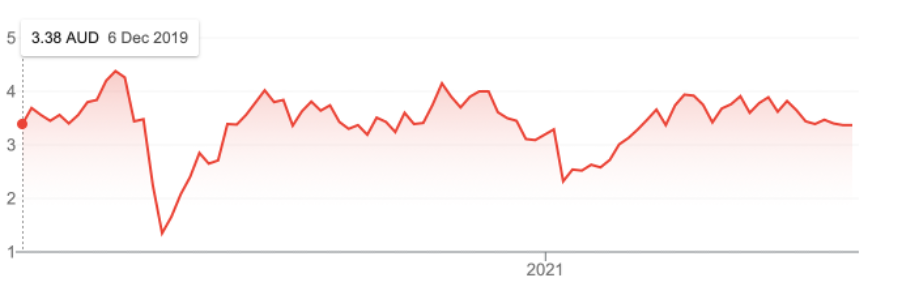

The FNArena survey predicts a 26.2% upside, suggesting Tyro’s current share price of $3.37 goes to $4.25. Ord Minnett tips a $4.50 price target, while Morgan Stanley says $4.60! If these guys are right, we’re talking a 36% gain. This chart below shows it has been a $4.40 stock before the Coronavirus introduced us to lockdown land, which is terrible for a company that has a big chunk of the hospitality businesses as its key customers.

Tyro Payments (TYR)

Its second market challenge/dive was linked to an opportunistic foreign hedge fund report that exaggerated the company’s problems with its credit card devices, which was essentially a problem created by the maker of those little terminals we swipe our credit cards on.

Nonetheless, it caused problems for Tyro’s small business customers, but the Viceroy report (aided and abetted by unquestioning media reporting) really hurt the company’s share price in January this year.

And even though its CEO Robbie Cooke found 10 faults in the Viceroy report, which helped a slight recovery in the company’s share price, Tyro has then had to deal with intermittent and extended lockdowns, which hurt the basis of its income-earning.

So if normalcy brings packed pubs and restaurants etc., its pre-Covid share price could easily reassert itself.

Talking to Motley Fool, a colleague of mine, Ben Clark of TMS, looked at four reasons to buy Tyro a few months ago. This is what he came up with:

- In the first 11 days of last December, he said the company had 29% business growth. This was seen as the end of the lockdown effect and it’s what we should expect after vaccinations change business conditions in 2022.

- He liked the fact the company was going into new verticals creating a more diversified business.

- Its integration hub, TyroConnect, should be good for customer loyalty and attracting new merchants.

- Its lending activity will eventually pick up as the world becomes more normal. Tyro has made good profits out of this activity.

I also like the fact that even though Tyro is known for being a major player in hospitality (pubs, cafes, restaurants, etc,), it’s moving into other business areas such as medical services.

On top of that, its ad campaigns talking about better business banking, shows what it can potentially tap into with its database.

And I like its hook up with Bendigo Adelaide Bank, with the new Bendigo Bank EFTPOS/eCommerce initiative powered by Tyro merchant payment services to assist new and existing business banking customers.

According to Tyro’s website, the new offering provides businesses with a range of new benefits including:

- Simple, secure, and high-speed payment processing.

- Automated surcharging and tipping.

- Seamless cloud-based Point of Sale and Practice Management Software integration including support for the latest POS providers, SplitBills, and Pay@Table

- Improved visibility and insights with a new web portal and mobile app, including e-statements.

- 24/7 local phone support.

- Omni channel eCommerce and EFTPOS. Customers that accept payments in store and online can see their takings in one location and on one statement.

- One statement for all transactions including American Express and Alipay.

- Health businesses can also accept private health insurance claiming and Medicare rebates.

This shows me the kind of potential this business has in order to build its customer base. It gives me reason to think those 30% plus gains are a real chance as 2022 brings a less virus-infected world.

One final speculative plus could be a tie up with Zip Co. This is purely my speculation, but with Afterpay linking up with the US-based Square (which is a rival to Tyro), it could make perfect sense for these two companies to work together with their considerable small business databases to leverage off their already well-established relationships. As I say, this is my speculation, but it looks like sensible speculation! And yes, I am invested in Tyro but I’ve certainly never kept that a secret – check out my ZEET stocks!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.