Two weeks ago I looked at the likelihood of a Santa Claus rally, which is often a celebrational pay-off out of Christmas. And while I think it’s nice that we get an end-of-year lift for our portfolios and super funds, I’m more interested in how this lift-off often precedes a great period for stocks from November to April.

This can give way to a “sell in May and go away” play that’s really not as reliable as the Santa Claus rally. But this year’s Christmas rally looks more likely with the economic outlook for 2022 looking great.

Last week the RBA speculated that next year will bring 5% economic growth and I’ve written before that Westpac’s chief economist, Bill Evans, tipped 7% growth for 2022. If he’s right, and he often is, then this has to be good for corporate profits, our big companies and the overall stock market index.

For the cautious player who wants to benefit from the Christmas cheer of the usual Santa Claus rally, simply playing an ETF for the S&P/ASX 200 Index should be a 10% plus for 2022. ETFs such as IOZ, A200 and STW give you access to our top 200 stocks.

The big drivers of the index are the big miners, the big banks, CSL, Telstra, Wesfarmers and a few others. Most of these are given the thumbs up by analysts and our market historically has returned 10% per annum over a decade.

Given most economists expect 2022 to be a good year for the economy, I think making 10% plus dividends on the overall market isn’t a big call. Also, given our market has lagged the US stock market because our vaccination program has been slow off the mark, I expect our overall stock market to outperform Wall Street in 2022.

I’m also expecting commodity prices to do well next year as the economic boom globally kicks in with vaccination rates spiking higher. The world’s trek back to normalcy will be helped by the new Pfizer pill, which we learnt over the weekend will help vulnerable people, reducing by 89% those who might need to be hospitalized or be threatened by death from the virus!

This is a social breakthrough and probably an economic gamechanger, which will buoy confidence, investment, growth, profits and stock prices!

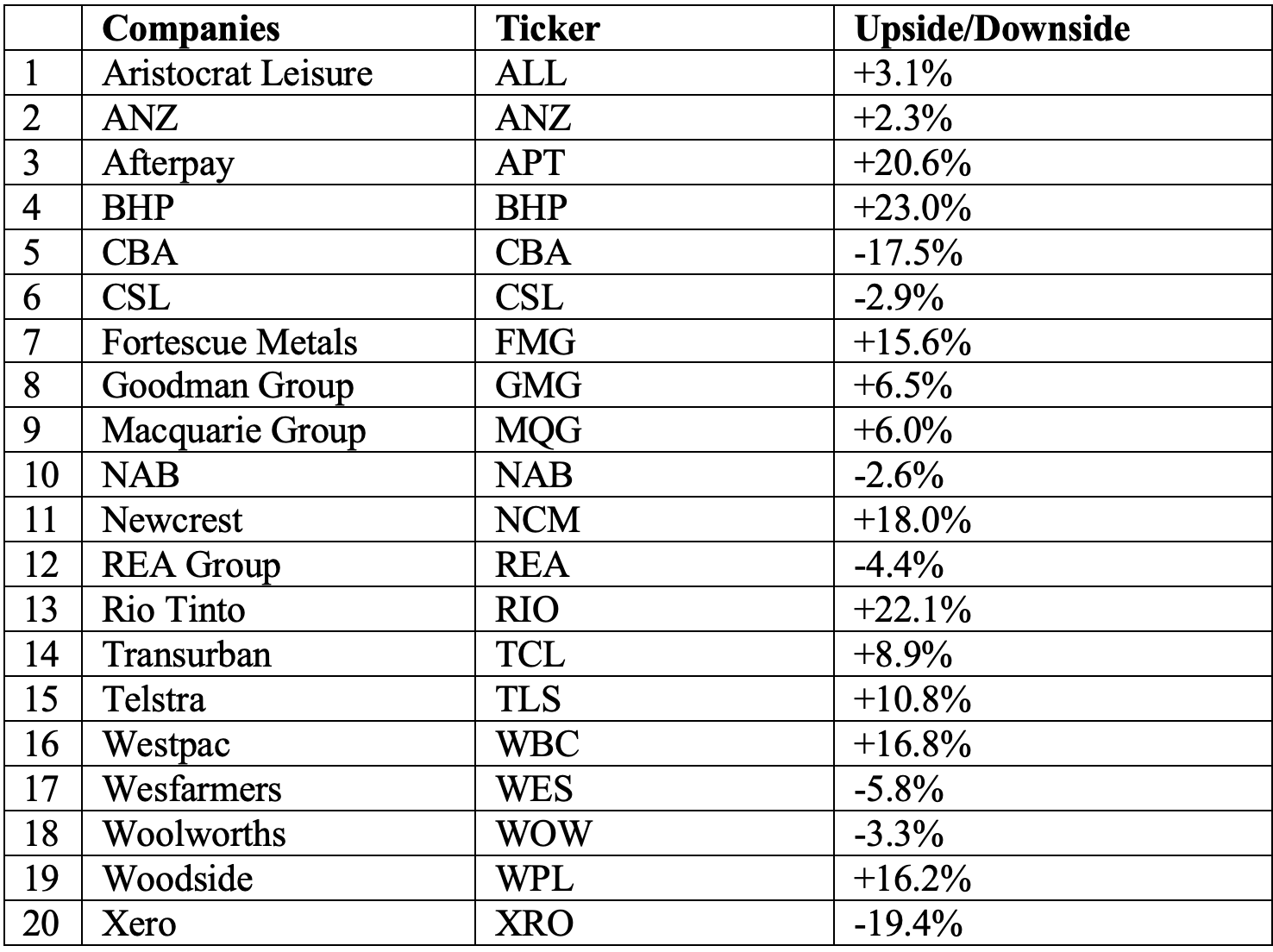

I’ve looked at the biggest driver of our overall stock market — the Top 20 companies — and then looked at what the analysts surveyed by FNArena have tipped for these companies. You can see them below:

Adding all the upsides and deducting the downsides, I came up with an average gain of 5.7% before I added in dividends and franking, which gives me an average gain of close to 11%.

I also believe the calls on the big four banks, apart from Westpac, are too negative as I believe a big boom year with mortgage interest rates likely to rise with out-of-cycle bank-determined increases, which will help bank profits and share prices.

This potentially pushes my 11% gain higher and I wouldn’t be surprised if I pocketed 15% out of an ETF play based on the S&P/ASX 200 Index.

Also, many of these analyst calls are more short term and over the 2022 calendar year, they could easily become more positive.

If you don’t want to play an ETF, the resource stocks all look attractive, if the analysts know what they’re talking about. The average gain from lumping BHP, RIO, FMG, NCM and WPL together would be a prospective return of 19%, which isn’t bad for some of the best mining companies in the world!

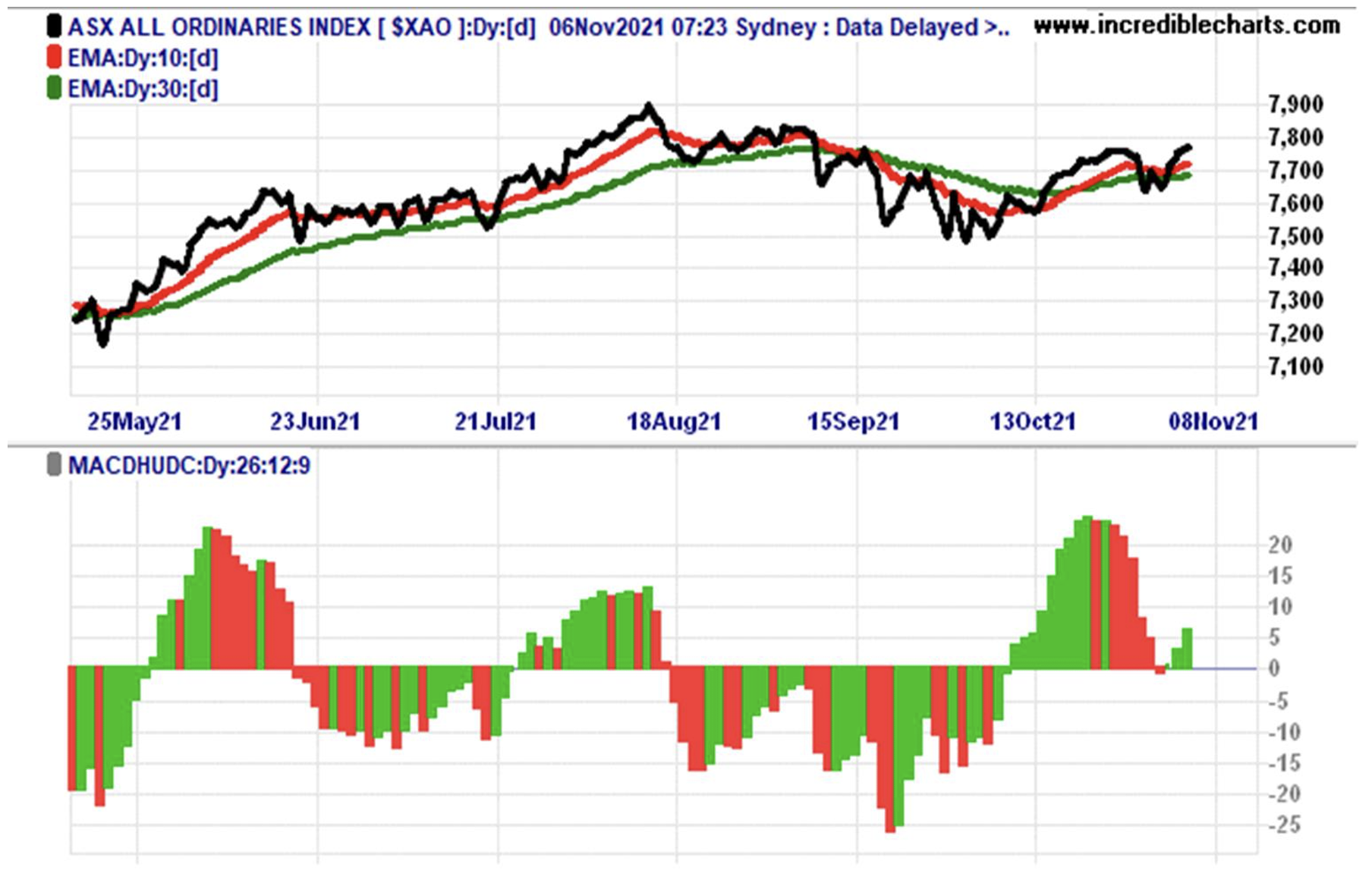

By the way, if you want a Merry Christmas for your stocks portfolio, you might have to do your Christmas shopping early because optimism is on the rise as this from market-timer expert, Percy Allen shows:

As Percy noted over the weekend: “The Australian stock last Wednesday became bullish on short-to-medium-term trend analysis. The All Ords red 10-day trend line is above its green 30-day one and its price momentum, as measured by its MACD oscillator, strengthened in the last three days.

“On medium-to-long term trend analysis, the All-Ords index has been bullish since the 20th of October 2020 because its green 30-day trend line has been above its blue 300-day one. The index is still above its peak before the crash of 2020.”

Putting it all together, it’s not only looking good for stock players over Christmas but more importantly in 2022.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.