The irrepressible positivity of Americans has again come back to bite stock market players with 263,000 jobs created in September and the unemployment rate falling from a low 3.7% to an even lower 3.5%. This proves the new age adage that post-Covid, in a pro-inflationary world, good news is bad news!

Why? Well, it means that the Federal Reserve is going to be committed to more 0.75% interest rate rises and therefore raises the likelihood that the US could fall into a significant recession. “While the data was about as expected, the drop in the unemployment rate is seemingly what the markets are obsessed with because of what it means for the Fed,” said Bleakley Financial chief investment officer Peter Boockvar to CNBC. “When combined with the low level of initial jobless claims, the pace of firing’s remains muted and this of course gets the Fed all fired up about continuing with its aggressive rate hikes.”

Not surprisingly, bond yields spiked as bond prices fell and, simultaneously, stock market indices headed south so we can expect our market to give up the great gains of this week. The focus for us now goes onto next Friday, when the Yanks get the latest CPI but after this very good jobs number, I can’t be positive about seeing a significant fall in inflation.

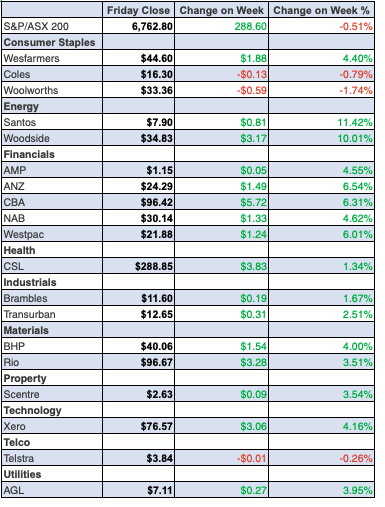

And that’s what we need to see a resumption of the positivity we saw this week for stocks. On that subject, our market had a good one with the S&P/ASX 200 Index rising 4.84% (or 312.5 points), which is a sneak preview of what will happen when US inflation is tamed.

Adding to the positivity for our market was the RBA’s wise 0.25% rise, following the drop in the monthly CPI from 7% to 6.8% in September and the energy sector powered the Index higher as OPEC+ cut production levels, which looks opportunistic.

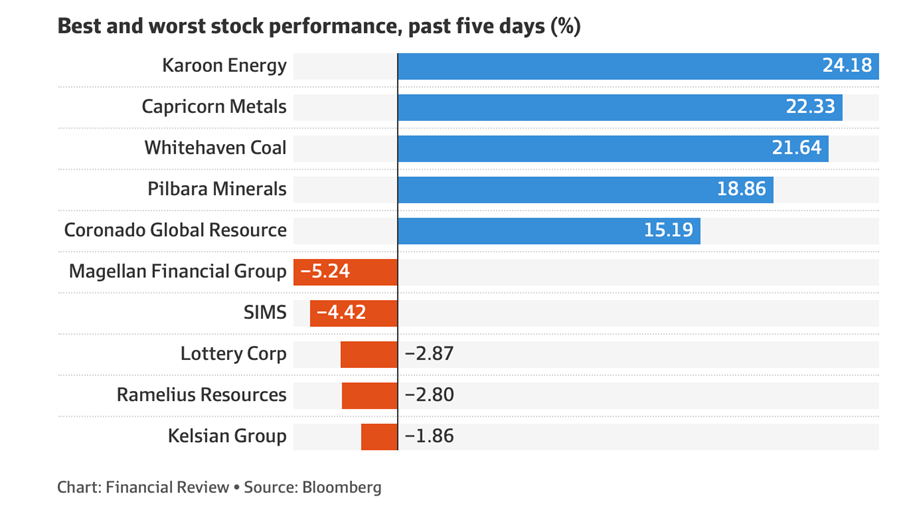

Unsurprisingly, Woodside Energy wacked on 8.44% this week to finish at $34.83. Energy plays had a good week, as the chart of winners and losers shows.

The week in review:

- This week in the Switzer Report, Tony Featherstone’s focus is on financial service stocks. There is enormous pain ahead for consumers as interest rates climb. Heavy falls on the share market this year reflect that. As always, the market is 12-18 months ahead of the real economy. Here are two companies that look interesting at their current valuations. [1]

- To add, some REITs are offering unfranked yields around the 8%–9% range, and while there might not be franking to make this juicier in the hands of the investor, there is attractive scope for total return if the REIT unit/share price can behave as analysts think, over the near term. In that context, James Dunn provides his three top REIT situations. [2]

- In our HOT stock column this week [3], the first “HOT” stock is from Michael Gable, Managing Director of Fairmont Equities, who explains his view on Nufarm (NUF), a crop protection and specialist seeds company. The second “HOT” stock is from Raymond Chan, Head of Asian Desk at Morgans. Raymond explains to you when he thinks Santos (STO) should be added to your portfolio.

- In Buy, Hold, Sell — What the Brokers Say, there have been 3 upgrades and 4 downgrades [4] from the 7 stockbrokers monitored by FNArena so far this week.

- And finally, in Questions of the Week [5], Paul (Rickard) answers your queries about how if interest rates have peaked, should you be buying long-term government bonds? If Aussie Broadband is doing a great job and the broker reports are positive, why does its share price keep sinking? Should you take part in the share purchase plan for Argo Global Listed Infrastructure? What are the super caps this year?

Our videos of the week:

- Can we trust the stock market rebound? Is Jun Bei buying these: A2M, MP1, NXT, TYR & more! | Switzer Investing (Thursday) [6]

- Did Dr. Phil Lowe make the right interest rate decision & are stocks set to surge? | Mad about Money [7]

- Daniel Lai from ArchTIS (AR9) – Switzer Small & Micro Cap Conference September 2022 [8]

- Mick O’Brien from Equity Trustees (EQT) – Switzer Small & Micro Cap Conference September 2022 [9]

- Robert Proulx from Imagion Biosystems (IBX) – Switzer Small & Micro Cap Conference September 2022 [10]

- Reserve Bank shocks us with a quarter percent rise! | SwitzerTV [11]

- Fibre; What exactly is it and why is it so important? | The Check Up [12]

Top Stocks – how they fared:

The Week Ahead:

Food for thought: I always have optimism, but I’m realistic. It was not with the expectation of great success that I started Tesla or SpaceX… It’s just that I thought they were important enough to do anyway – Elon Musk

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

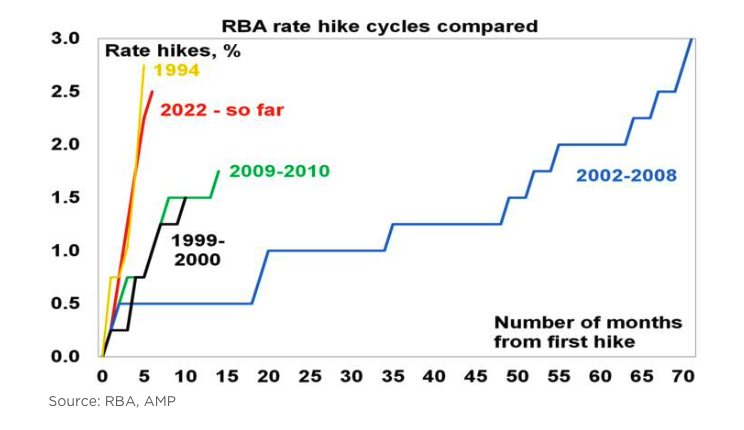

The RBA has increased its cash rate again but slowed the pace to +0.25% which took the cash rate to 2.6%. This was in line with our view and a slowing “at some point” had been flagged by the RBA.

In justifying another hike, the RBA noted inflation is still too high and expected to rise further due to global factors and strong demand and that it’s important that medium term inflation expectations remain “well anchored”. But the 250 basis points in rate hikes over six months is still the fastest series of hikes since 1994, so it made sense to slow the pace down “as it assesses the outlook for inflation and growth”.

Top 5 most clicked:

Two ‘hardship’ stocks I like – Tony Featherstone [1]

Questions of the Week – Paul Rickard [5]

3 high-yielding REITs – James Dunn [2]

Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck [4]

“HOT” stock: Nufarm (NUF) & Santos (STO) – Maureen Jordan [3]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.