Successful contrarian investors have a knack of buying stocks on bad news. When everybody else is selling – or panicking – contrarians pounce on bargains. True contrarians go against the crowd and back deeply unpopular ideas. They are prepared to invest uncomfortably, at least at the start, and buy stocks the market hates.

I thought about the challenges of contrarian investing – or deep-value investing as some call it – while reading Elders’ (ASX: ELD) half-year FY23 result this week. Investors took a pitchfork to the agribusiness firm after it reported its after-tax profit for HY23 almost halved to $48.8 million and cut its interim dividend by 18%.

Sales rose but the company’s gross margin shrunk in HY23. Falling livestock prices, weakening crop prices and flood events crunched Elders’ performance. Elders noted that livestock and cattle prices declined in line with softening international markets for these products. Subdued demand for sheep was another headwind.

Falling fertiliser prices encouraged farmers to delay fertiliser use. Elders’ chart on key fertiliser prices (on page 11 of its presentation pack) shows the extent of the fall. Moreover, flood events across Australia’s East Coast and North West damaged some summer crops. The result: more crop chemicals kept in storage and delayed sales.

Elders’ other issue is its comparative numbers. The company’s HY23 result is being compared to an unusually strong HY22. Back then, Elders benefited from historically high livestock prices, high real-estate turnover and supply-chain disruptions.

Many of Elders’ customers bought their agribusiness supplies earlier than usual in FY22. But bringing forward that procurement has meant delays in HY23.

Elders’ industry commentary in its result highlighted three main things. First, conditions for many agriculture firms have deteriorated this year.

Second, agriculture stocks are inherently cyclical. Elders has a long history and market position. But like other agricultural suppliers, Elders is hamstrung if falling livestock and crop prices encourage farmers to delay procurement. There’s not much it can do.

Third, the market has a habit of over-reacting to bad news in agriculture stocks.

Elders, of course, has more issues than its latest profit result. The company’s well-regarded CEO, Mark Allison, is due to retire on or before November 2023. Elders’ share price was pummelled in November 2022 when it announced Allison’s planned departure.

Allison’s looming retirement coincides with a period of falling global economic growth, recession fears in key offshore markets and lower soft commodity prices. Elders’ succession risks are magnified given elevated uncertainty in its industry this year.

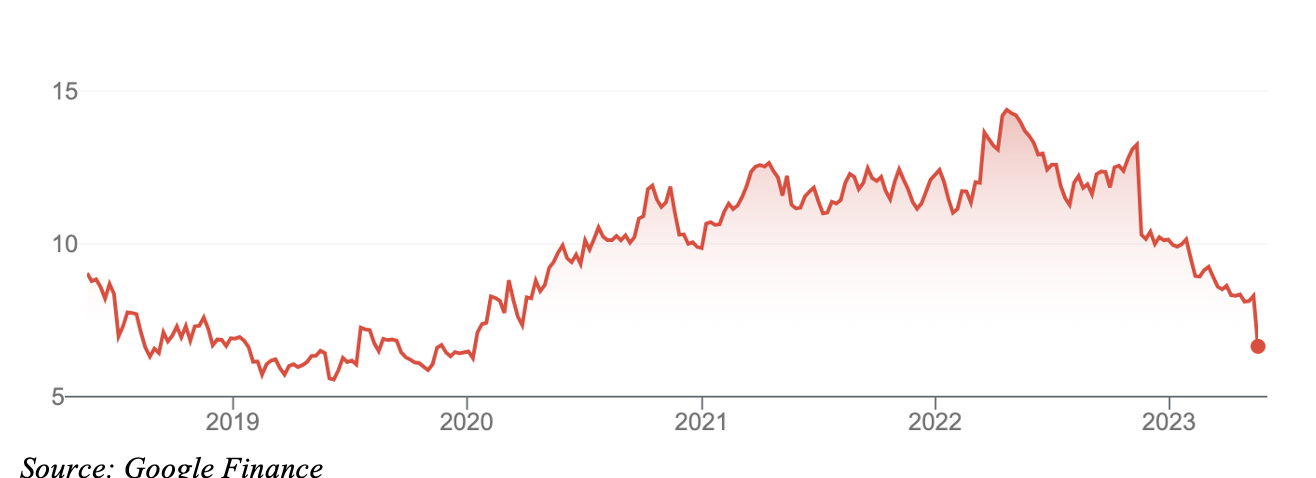

But every stock has its price. Elders fell 13% on Monday after posting its HY23 result. The stock has fallen from almost $15 in May 2022 to $6.64.

In the space of five months, Elders has given back almost three years of share-price gains. The stock last traded at around $6.64 in early 2020. It’s been a brutal fall.

Given current selling momentum, Elders is hurting towards the mid-$6 range. If that happens, technical analysts will watch if Elders holds that level – a point of previous price support on its chart. That could be the time to buy. If Elders breaks that support point, the next stop is $5.50-$5.70.

Judging by consensus estimates, analysts have underestimated the extent of Elders’ problems. Price targets for Elders are considerably higher than the current price but will be revised lower to account for the latest earnings and commentary. Even so, a number of analysts think Elders is worth more than its current valuation.

Elders’ share-price volatility highlights a higher forecasting error with this stock. That’s not surprising given the inherent unpredictability of weather events and soft commodity prices. Things can change quickly for agriculture suppliers.

This volatility creates the opportunity for long-term investors to buy at bottom-quartile valuations when bad news peaks and hold through industry cycles.

Elders’ share price might not have bottomed. But it’s a reasonable bet that the company’s valuation is in the bottom quartile – that is, getting close to bottoming out.

As a small-cap company in a volatile sector, Elders suits experienced investors who understand the risks of deep-value investing. Conservative investors should look elsewhere, preferably to companies that rely less on commodity prices.

Prospective investors should put Elders on their portfolio watchlist. The stock will look seriously interesting if it heads back to that mid-$6 range and holds support.

Chart 1: Elders

Betashares Global Agricultural Companies ETF – Currency Hedged (ASX: FOOD)

In researching this article, I examined several agriculture stocks. Australian Agricultural Co (ASX: AAC), another beaten-up ag stock, looks interesting after heavy falls this year.

AAC has slumped from a 52-week high of $2.40 to $1.40.

Judging by the sell-off this month, investors expect a tough set of numbers and outlook when AAC releases its full-year FY23 result on May 18 (just after this column is written).

I’ll cover AAC in more detail in coming issues, along with Costa Group Holdings and Inghams Group. There’s more value emerging among agriculture stocks.

That said, it’s hard to go past using an Exchange Traded Fund (ETF) for exposure to a basket of global agriculture stocks. Given the cyclical and weather risks of ag stocks, a diversified investment approach to this sector makes sense.

I have covered the Betashares Global Agricultural Companies ETF (FOOD) a few times in this Report in the past couple of years. I like the long-term thematic of rising food demand as the global population grows and Asian middle-class diets are upgraded.

FOOD provides exposure to 60 of the world’s largest agriculture stocks in one trade. ASX has reasonably limited choice for agriculture stocks (many are small-caps), meaning a global approach to investing in this sector is warranted. The ETF’s weighted average market capitalisation is about $40 billion.

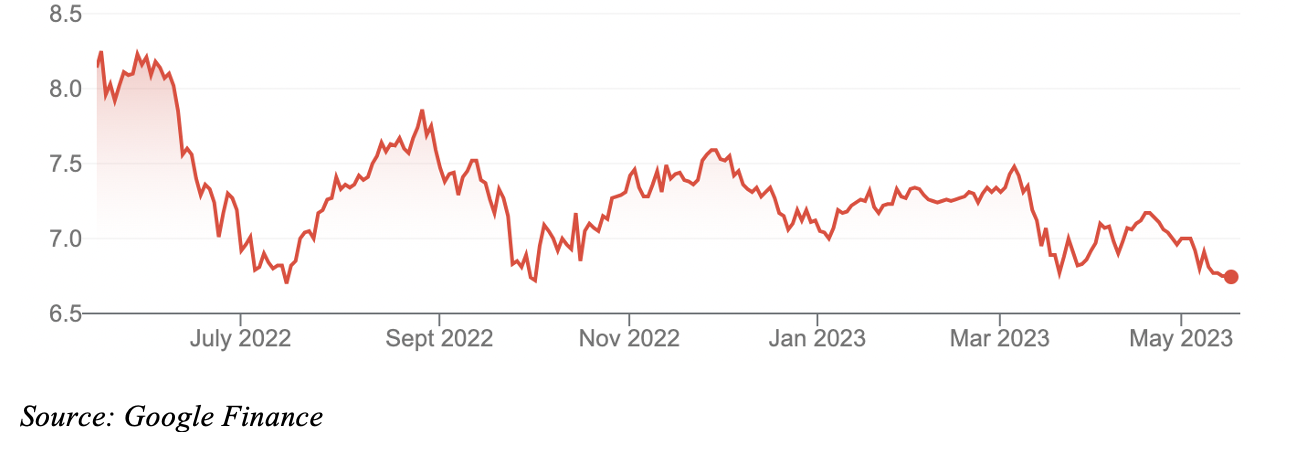

FOOD has returned 17.24% on average over three years to end-April 2023 and 7.54% since inception in August 2016. The ETF is down about 12% this year, (to end-April) in line with broader weakness in global agriculture stocks.

Betashares data shows FOOD is on an average forward Price Earnings (P/E) multiple of 10.74 times and a price-to-book (P/B) ratio of 1.69. That does not seem demanding given the ETF includes many of the world’s great agricultural companies.

FOOD is hedged for currency risk. The annual fee (including expenses) is 0.57%. Like all investment products, ETFs have pros and cons. But FOOD is a convenient tool for investors who want exposure to global ag stocks after a period of price weakness.

Chart 2: BetaShares Global Agricultural Companies ETF – Currency Hedged

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 17 May 2023.